Editor’s note: Seeking Alpha is proud to welcome Jay Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

pjohnson1

Yum China (NYSE:NYSE:YUMC) is currently undervalued by 20%. I believe that as the company continues to execute and grow, the market will eventually recognize its intrinsic value. The current valuation provides investors with an opportunity to capitalize on this mispricing.

Business description

YUMC is China’s largest QSR (quick service restaurant) operator. YUMC owns the intellectual property rights to Little Sheep, Huang Ji Huang, and COFFii & JOY, as well as the exclusive right to operate and sublicense KFC, Pizza Hut, and Taco Bell in mainland China.

YUMC currently runs primarily on a self-operated model (86% of units as of Q2 2022). KFC and Pizza Hut are the two most important brands, accounting for 95% of YUMC’s revenue:

- KFC entered China in 1987, and YUMC currently has 8,510 stores as of Q2 2022.

- Pizza Hut entered China in 1990, and YUMC currently has 2,711 stores as of Q2 2022.

Significant room is available for KFC to continue growing

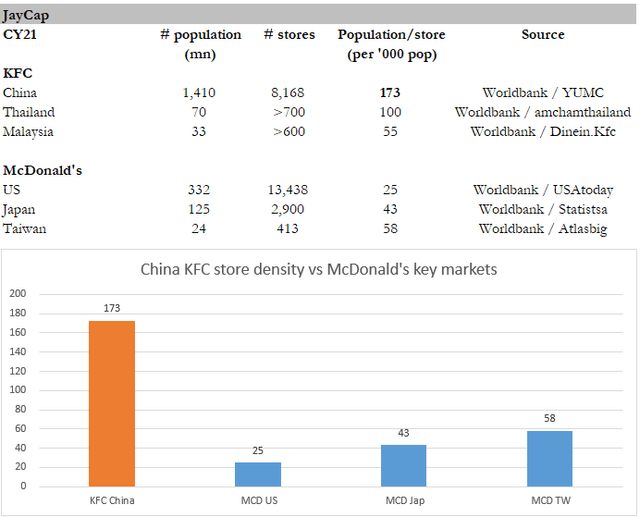

KFC has a lot of room to grow in China. As of CY21, there were 8.1k KFC locations in China, serving 173k customers per location and 1.4 billion Chinese. There is a significant difference between this and McDonald’s (MCD) in the United States, where MCD serves 25k customers per location.

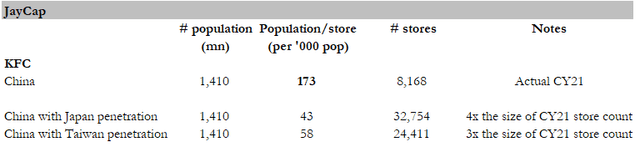

In the future, YUMC intends to operate 20,000 restaurant units. Based on my bottom-up analysis (only of KFC), benchmarking with the largest fast food chain’s (i.e., MCD) penetration in other mature Asian markets and the Chinese population, I estimate there is room for more than 20,000 KFC locations. As a result, the 20,000 figure outlined by management appears reasonable. While this analysis is not exact, it does provide a clear indication that China has plenty of room to grow.

The competitive environment in China’s QSR industry is also ripe for consolidation, which benefits the largest player as it scales (this will be explained further below). YUMC is the market leader, accounting for 4.9% of total revenue. This indicates that there is no clear leader and that YUMC has enough opportunities to compete with other independent businesses and gain market share.

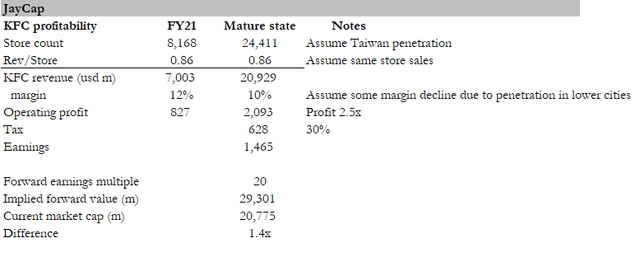

To further contextualize this, I conducted a financial impact analysis. If KFC China achieves the same level of penetration as in Taiwan, operating profit in China could increase by $2.1 billion, or 2.5x from FY21 levels. To put things into perspective, assuming a long-term forward earnings ratio of 20x to 1.5 billion (after 30% tax) equates to 1.4x the entire current market cap of YUMC. KFC’s status as China’s most well-known QSR brand provides further evidence that YUMC can continue expanding.

Growth estimates suggest YUMC can more than double its store base

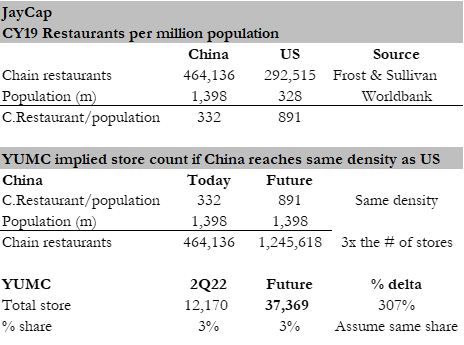

According to Frost & Sullivan, the Chinese restaurant chain market will reach Rmb321 billion by 2024, with a CAGR of 9.1% between 2019 and 2024. In terms of numbers, China had 332 chain restaurants per million people in 2019, compared to 891 in the United States. Given rising consumer demand for fast food, services, and reputable brands, I believe chain restaurants have enormous potential in China.

YUMC is benefiting from this tailwind, and if it maintains its market share, it could potentially triple its store count (as analyzed below). In fact, given that its competitive advantages (logistical network and brand marketing power) scale as it grows, YUMC could easily more than triple its store count.

Author’s estimates

Unit growth is supported in several ways

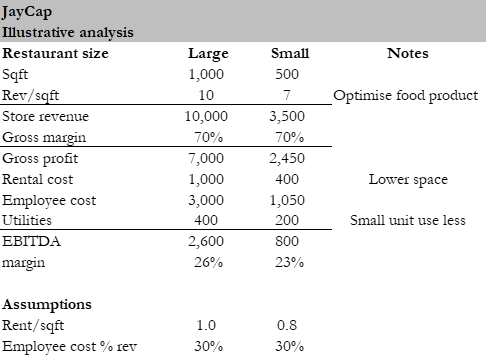

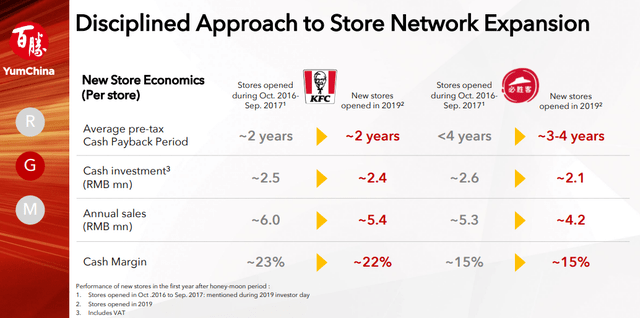

I expect stores to be opened at a faster pace through store size rationalization and penetrating non-prime regions. Underlying the goal of opening an additional 10,000 units is YUMC’s constant reinvention of store designs, which allows it to rapidly develop stores while maintaining a high return on investment. This strategy will aid in further penetration of lower-tier cities and expansion into non-prime areas within higher-tier cities by shrinking store size and employing other cost-cutting strategies. The illustration below shows how a smaller store can still produce attractive margins despite lower sales.

Author’s estimates

Aside from store size rationalization, a franchise model could accelerate the pace of store openings and lift working capital burdens. As previously stated, YUMC operates primarily on a self-operated model (86% of units are self-operated), and franchise shops are primarily developed in remote locations.

While this model provides YUMC with greater assurance of product quality, it limits growth because YUMC only has so many employees and capital. It would alleviate the strain on operations and capital by awarding master franchise agreements or direct franchise rights to other operations, thereby accelerating the pace of store openings.

Product localization and innovation

There are numerous examples of Western companies (e.g., PayPal (PYPL), Amazon (AMZN), and others) entering China without localizing their products, all of which have met the same fate: exiting the country. Localization is especially crucial when it comes to mass-market food, and YUMC’s management has demonstrated that they know what they are doing.

YUMC’s long history in China has provided the company with a wealth of information about the types of services most valued by the Chinese people. This data is a huge competitive advantage for YUMC because it allows it to consistently provide the market with the right demand at the right time. Management intends to use this data to create new recipes on a regular basis to meet the diverse needs of its customers across all geographies. Successful examples of new product launches and promotional campaigns include the following:

- The tagline “Based in China, integrated into life” made its debut in 2004.

- In 2008, the slogan was changed to “Create new fast food, change for China.”

- The company has rolled out traditional Chinese morning foods, such as porridge and fritters, catering to the tastes of local consumers.

Yum China Innovation Center, a 2,500-square-meter building with research and development capabilities, opened in Shanghai in January 2019 to help the company scale up its ability to innovate. This is another example of a competitive advantage that only a scaled player can afford.

Management has demonstrated their expertise in operating QSRs in China

The total number of YUMC stores has grown at a staggering pace from 7,563 in 2016 to 11,788 in FY21. In FY21, YUMC opened 1,806 new stores, which is equivalent to 1 new store every 5 hours. The important thing to note here is that the growth comes with attractive profit margins and payback periods, which indicates two things:

- Management is not growing the number of stores for the sake of expanding, but rather to grow profitably and sensibly.

- The return on investment is still significantly higher than the cost of capital, implying that YUMC has plenty of room to continue investing aggressively.

Scale gives YUMC a supply chain advantage

YUMC’s size enables it to affordably maintain a complex supply chain network. The logistics network promotes countrywide growth by facilitating the distribution of inventory to retailers without incurring large third-party logistics costs. This is a considerable edge over smaller competitors, since YUMC’s customized warehouse management system can trace items from beginning to finish. It can also monitor the position of vehicles and the temperature of food in real time, assuring the quality and safety of the goods.

The current logistics network of the company consists of 26 logistics centers and 7 distribution centers, which can support the company’s expansion into 1,200 additional locations, as well as over 2,200 outsourced refrigerated vehicles with cold chain storage and transportation capacity. YUMC plans to invest $1 billion in logistics centers, supply chain digitization, and critical upstream suppliers over the next few years. As these investments are implemented, 45 to 50 logistics and distribution hubs are expected to be operational to support growth and additional efficiency benefits.

Aggressive efforts to improve usage of technology in both front and back ends

YUMC is a pioneer in the use of technology to modernize and improve business operations in China’s QSR sector. The ultimate goal of management is to improve technology-driven services, provide clients with unique and fulfilling dining experiences, and increase overall operational efficiency. In my opinion, the most important aspects of its digital ecosystem are the loyalty program and the back-end infrastructure.

Loyalty program

Since their inception, YUMC’s loyalty programs have successfully increased order frequency and strengthened consumer loyalty. As YUMC increases its loyalty program spending, this trend is likely to continue. The opportunity to acquire granular consumer data is significant given its large customer base. This data allows YUMC to conduct targeted marketing by categorizing its members into different groups based on their habits, location, order history, and so on.

Back-end infrastructure

The strength of YUMC’s digital investment can be found not only in the front-end infrastructure that interacts with customers to increase customer engagement and loyalty, but also in the back-end infrastructure that increases operational effectiveness. Contactless delivery and takeaway options, as well as a digital ordering and payment interface and in-store digital technology, all contribute to cost savings, including increased staff scheduling and productivity.

Forecast

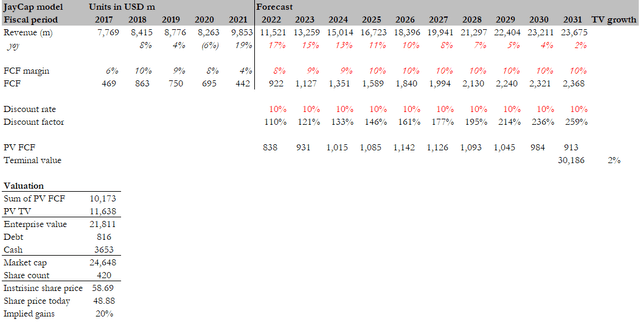

Based on my investment thesis, I expect YUMC to continue growing by capitalizing on multiple tailwinds and successfully executing its growth strategies. My DCF model is separated into two periods:

- First period: FY22 to FY26, when growth slows from current levels to 10% in FY26 (slightly higher than the 9% expected by the industry).

- Second period: FY27 to FY31, when I expect growth to slow to the long-term inflation level.

To be conservative, I expect YUMC to recover to a 10% FCF margin (as of FY18) with no significant inflection in the FCF margin (which is entirely possible given the reduction in capex moving forward as growth slows). In terms of the discount rate, given the current market environment and rising IR, I would require a 10% discount rate before considering investing in YUMC.

Assuming the aforementioned assumptions and a 2% terminal growth rate, I calculated an intrinsic value of $59, or a ~20% upside over the current share price ($49).

Red flags

The Chinese economy poses a macro risk to YUMC. This is especially an issue in today’s environment as the Chinese government is aggressively shutting down cities and states to contain the spread of COVID-19, regardless of what might happen to the economy in the short term. The saving grace here is that YUMC’s product offerings are largely affordable and can be delivered easily (cushioning the impact of lockdowns).

To increase their user bases and significantly broaden and subsidize consumer choice, delivery platforms might provide considerable discounts to customers, thereby capturing market share from YUMC. This has occurred before when Alibaba (BABA) and Meituan (OTCPK:MPNGF) were vying for market share, but it has subsided recently due to the desire to make money (due to pressure from shareholders).

Historically, YUMC has been able to pass inflation along to customers through pricing, but if chicken costs rise dramatically, this might be difficult. This is an ongoing problem, and if should it worsen, it would impact gross margins.

Conclusion

YUMC gives investors direct access to the expanding China QSR market, which is supported by consumers’ increasing demand for fast food and Western cuisine. It is led by a strong management team that has a proven track record of increasing store counts and innovating with locally sourced products. I believe YUMC can continue to grow and scale, which strengthens its competitive advantage and creates a flywheel effect that feeds on itself, allowing it to grow faster and more efficiently.

Be the first to comment