Tempura

I wrote several articles on Seeking Alpha about the importance of the inventory cycle to recognize the trend of the economy and its impact on the stock market and the relative strength of its sectors.

The main idea is business must increase inventories when sales are strong. Inventories, on the other hand, must be cut when sales slow down. The inventory management decisions impact the growth of the economy, the stock market and its various sectors, commodities, and interest rates.

Let me explain. Recent data from the Bureau of Labor Statistics provide new important information on the position of the inventory cycle.

PROFITING IN BULL OR BEAR MARKETS

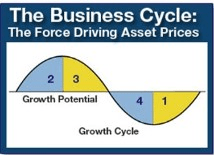

The above graph shows the pattern of the business cycle. The inventory cycle is a crucial part of it.

Economic growth rises from a below average pace in Phase 1 to an above average pace in Phase 2. In Phase 1 business experiences low inventories and stronger demand. Increasing production implies rising demand for raw materials and employment, and increased borrowing to improve and expand capacity.

Consumers’ optimism also rises as income after inflation improves thanks to declining inflation and interest rates. Business responds to increased sales by raising production and building up inventories. The outcome is commodities and interest rates bottom, and employment increases.

In Phase 2 the economy is expanding with growth above potential and business raises production to increase inventories due to strong sales. The increased pace of production places upward pressure on raw materials and wages. Inflation moves higher forcing interest rates to rise.

These developments have a negative impact on consumers’ purchasing power. Spending slows down and business recognizes they must reduce production. This is the time the business cycle enters Phase 3.

As consumers further cut spending, business reduces aggressively production to lower inventories. To do so they must cut prices, reduce purchases of raw materials, employment, and borrowing needed to expand and improve capacity. Profitability of the enterprise becomes a priority. We are now in Phase 4.

This is the time when all excesses created in the previous phases are brought under control. Commodities will continue to decline. Inflation and interest rates must move down to levels needed to improve consumers’ purchasing power. This is the most important phase for investors because of the risk of large drawdowns in equity prices. This is the time of full-scale bear markets.

At the end of Phase 4 inventories are at low levels consistent with existing demand. Interest rates and inflation are low enough to increase consumers’ purchasing power.

This is the time business recognizes inventories are too low. Production is increased. The increase in the purchases of raw materials, in employment, and in borrowing to finance capacity improvements and expansions causes the economy to grow. Phase 1 is now underway again.

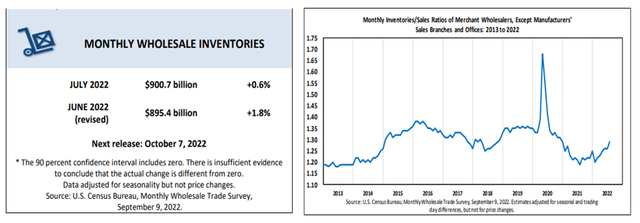

The above graph shows the wholesalers’ inventory-to-sales ratio as of July 2022 (published 9/9/2022 by the Bureau of Labor Statistics). The ratio has been rising sharply, reflecting inventories growing much more rapidly than sales.

There are many reasons to believe the I/S trend will continue to head higher.

As of this writing, for instance, wholesalers’ inventories are soaring at a +16.2% y/y pace after inflation well above the historical average of about 3%-6%. Retail sales after inflation, meanwhile, have declined -0.6% y/y, and personal income is down -3.9% y/y after inflation (see above chart).

Consumers are making less money because of the inflation caused by the surge in liquidity started in 2020 due to government programs and the printing press of the Fed. Growth in liquidity soared to 25% y/y when historical non-inflationary growth has been in the 3%-6% range. Business responded to the surge in demand by accumulating inventories as fast as they could. Hence the supply chain disruptions.

Retail sales after inflation have been flat in the past twelve months. Businesses are beginning to recognize inventories have grown too rapidly relative to income and sales. The outcome is sharply rising I/S ratio (see I/S chart above).

S&P GLOBAL

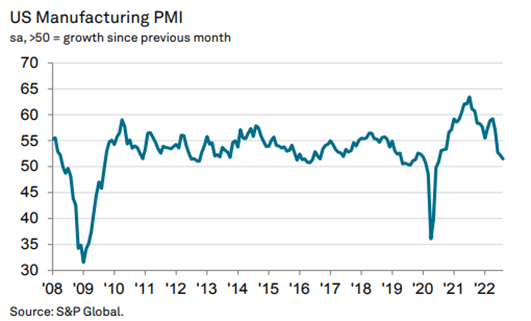

According to S&P Global the manufacturing PMI survey (see above chart) shows manufacturing is already trying to control inventories by slowing down production. However, much more must be done to bring inventories to grow close to the pace of the economy – now about 1.5%.

THE PETER DAG PORTFOLIO STRATEGY AND MANAGEMENT

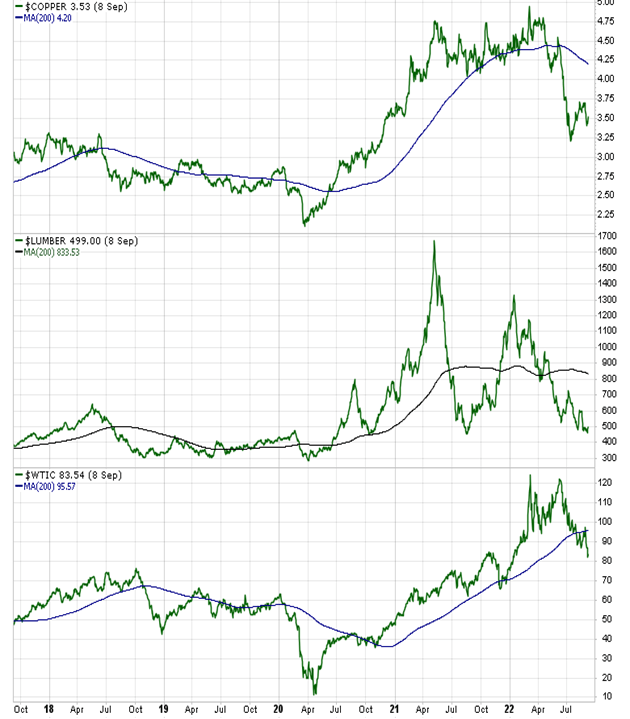

The slowdown in production to reduce inventories is causing a decline in the purchase of raw materials. Commodities are already responding, confirming the weakness of the PMI manufacturing survey (see above chart).

Eventually the economic weakness and the decline in commodities will cause inflation and bond yields to decline.

Key takeaways

- The rise of the I/S ratio reflects slower economic growth. The investment strategy emphasizing defensive sectors such as utilities, healthcare, and staples is likely to outperform the market.

- A declining I/S ratio indicates a strengthening economy. Growth sectors such as industrials, financials, and commodity-sensitive sectors are likely to outperform the market.

- The business cycle is in Phase 4. Inventory growth remains excessive, and it must be scaled down to about 3% after inflation.

- The inventory slowdown will be accompanied by slower business activity, lower earnings, stock prices (SPY), commodities, inflation, and bond yields.

- This process is likely to bring the recession well into 2023 as discussed in a previous article here.

- The economic weakness will continue until inflation and interest rates decline in a convincing way, enough to improve consumers’ optimism. This is the time business has brought inventories under control, consumers’ purchasing power has increased, and the business cycle moves into Phase 1 from Phase 4. The new bull market will finally be underway.

Be the first to comment