Sanjog Mhatre/iStock via Getty Images

Investment Thesis: MakeMyTrip could see further upside from here on the basis of further assumed growth in gross bookings across the Air Ticketing segment.

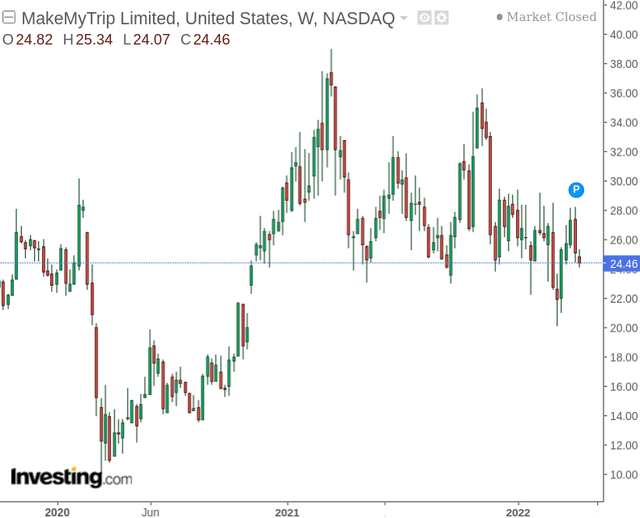

In a previous article, I made the argument that MakeMyTrip (NASDAQ:MMYT) could see further upside on the basis that gross bookings have been seeing a slow but steady recovery as well as a strong cash position in spite of the pressures caused by the pandemic.

In spite of this, we have seen the stock see a slight decline from the highs seen in March 2021:

The purpose of this article is to assess whether we could see growth in stock price from here, as well as assess the company’s prospects in light of continued global inflation as well as the effect of the ongoing geopolitical situation between Russia and Ukraine on the broader travel industry.

Performance

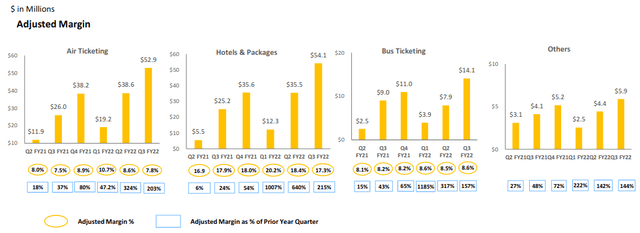

When looking at the recovery of MakeMyTrip’s business segments in terms of adjusted margin, we can see that both Hotels & Packages and Air Ticketing have seen a strong recovery over the past year:

MakeMyTrip Limited Investor Presentation: February 2022

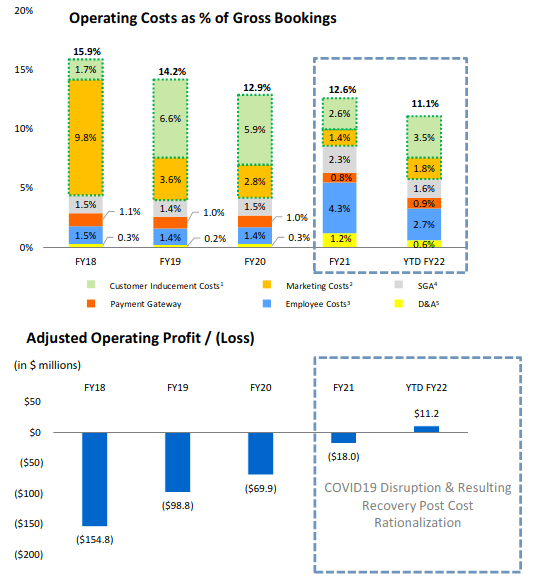

Moreover, as the company has grown, MakeMyTrip appears to be achieving significant economies of scale in that marketing costs as a percentage of gross bookings (along with overall costs) have significantly declined:

MakeMyTrip Limited Investor Presentation: February 2022

Additionally, given that a significant motivation of usage of online travel agents is to save on travel costs – the acquisition of a majority stake in BookMyForex by TripMoney (one of India’s leading online foreign exchange providers) may attract further booking interest as customers seek to minimize foreign exchange costs – particularly as international travel has started to return to a degree of normality once again.

As I pointed out previously, one of the major advantages of the Indian travel market is the propensity for domestic travel. With a sizeable domestic market – India has been able to capitalize on a rebound for domestic travel demand whereas up until now – travel demand across Europe has been largely dependent on travel rules between different countries.

However, it is also worth considering how the recent geopolitical situation between Russia and Ukraine stands to affect the market for international travel between India and the West.

Looking Forward

One of the consequences of the geopolitical situation between Russia and Ukraine has been the closure of Russian airspace to Western airlines, and vice versa. This has significantly impacted international travel to and from India, as it means that Western carriers must now take longer routes to the south to reach their destination. This can add several hours of flight time and thus increase the cost of making the trip – which is then passed to customers in the form of higher prices.

However, Indian carriers are still able to use Russian airspace, and over time may prove to be more price competitive on routes between Europe and India as compared to its Western counterparts. For this reason, we may see a boost to MakeMyTrip’s Air Ticketing segment if this proves to be the case – as consumers seek lower prices and to minimize flight time. It is reported that Air India and Vistara are the only two carriers in India that are able to fly non-stop to the United States, while several North American carriers have had to suspend flights from Canada and the U.S. to India as a result of the routes becoming non-viable.

Of course, Indian carriers will also be affected by the rise in fuel prices and face the same challenges in higher costs on that front. However, Indian carriers are at a significant advantage to their Western counterparts in facilitating international travel to Europe and North America both in terms of price and flying time, and anticipated higher demand for such carriers is also expected to benefit MakeMyTrip, as a larger number of customers seek to book travel through the platform.

One of the potential risks for MakeMyTrip is saturation for domestic travel demand as international travel picks up once again, i.e. while we may see growth in demand for international flight tickets, we may also see a drop in demand for domestic hotel bookings. However, overall gross booking demand looks to continue a solid growth trajectory based on the results of previous quarters.

Conclusion

To conclude, MakeMyTrip still faces some challenges post-pandemic given higher fuel costs and potential growth saturation for domestic travel in the short to medium-term. However, as international travel starts to open up, Indian carriers are well-positioned to attract more customers across routes to Europe and North America and I anticipate that this will also benefit booking demand for MakeMyTrip across the Air Ticketing segment.

Be the first to comment