chapin31/iStock via Getty Images

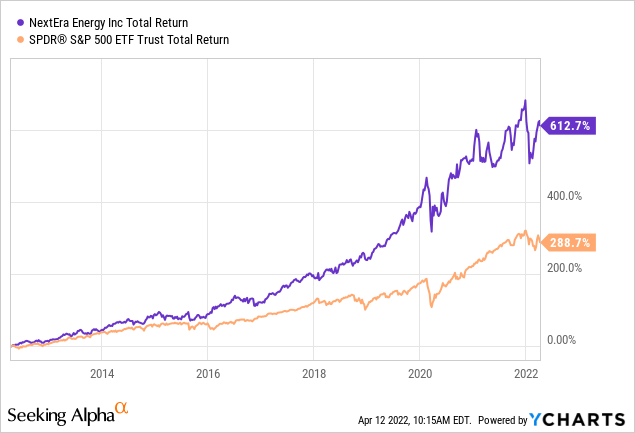

As I mentioned in the bullets, NextEra Energy (NYSE:NEE) used solar and wind technology to go from a relatively unknown entity to become the largest utility company – by far – in the United States (current market-cap = $169 billion). The company’s total returns over the past decade have blown away the S&P500 (see chart below) and the future looks bright despite the current narrative that somehow the world needs to make a hard pivot back to fossil fuels. The truth is: the world currently needs both fossil fuels (especially natural gas) and renewables. But no doubt capital will continue to flow and to, and the transition to clean energy will continue, both in the US and globally. That being the case, NextEra – with its vast experience and project management skills in renewables, will continue to be a leader for many years to come.

Investment Thesis

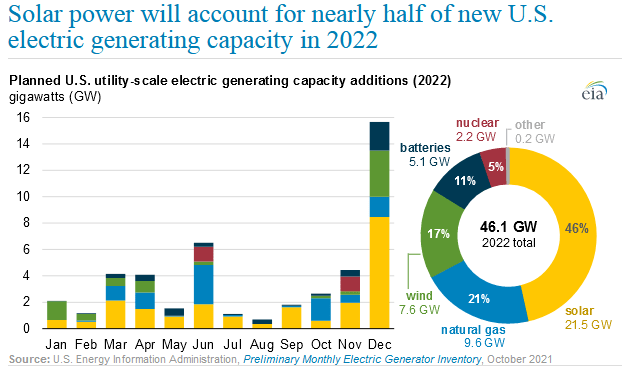

As the graphic below shows, renewable solar and wind technology will continue the growth trend of the last few years and in aggregate represent the vast majority (63%) of estimated U.S. incremental power generation additions in 2022:

US Renewable Energy (EIA)

Indeed, as coal plant after coal plant got shutdown over the past decade, renewable energy has become the #2 component of electrical generation power in the U.S. – trailing only natural gas, which in and of itself is much cleaner than coal (50% less CO2 emissions, 100% less toxic particulate emissions as compared to coal, cheaper too).

This demonstrates excellent progress on the clean green energy front and the prospects for renewable energy becoming the #1 power source in the U.S. will likely come faster than most investors realize: note that the EIA also predicts:

By 2030, renewables will collectively surpass natural gas to be the predominant source of generation in the United States. Solar electric generation (which includes photovoltaic (“PV”) and thermal technologies and both small-scale and utility-scale installations) will surpass wind energy by 2040 as the largest source of renewable generation in the United States.

Meantime, on an anecdotal basis, where I live it currently costs ~$10 to recharge a 300 mile range EV, while filling up a 20 mpg ICE-based car for the equivalent range cost ~$60, or ~6x the cost of the EV. My point being that many consumers who otherwise might not even consider an EV are likely going to be doing so this year. And as they say, once you have driven an EV and enjoy the quiet and very powerful acceleration of an electric motor driven vehicle (both cars and trucks), it’s hard not to come away with a favorable impression. Also note that despite the narrative that EVs are overly expensive (likely based only on consideration of the upper-end Tesla (TSLA) market), Bloomberg reports that when taking into consideration Federal subsidies, Ford’s (F) F-150 “Lightning” EV will actually cost 17% less than the ICE-based F-150. This is very significant considering the F-150 is a $40 billion brand – second only to Apple’s (AAPL) iPhone.

Now, obviously NextEra isn’t an EV-maker. But it is an electric utility company and the world’s largest producer of wind & solar energy. So the point is this: EV adoption in the United States has lagged that of China and the EU. So, considering NEE’s returns over the past decade were so outstanding during that time, imagine what they will be like as EV adoption in the US takes off (as well the growth in corresponding electricity demand).

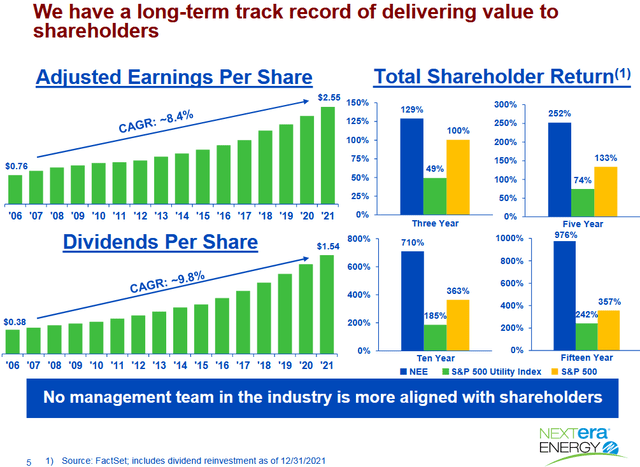

Earnings And Shareholder Returns

In January, NEE posted Q4 quarterly EPS of $0.41/share, a slight beat to consensus estimates of $0.40/share. For full-year fiscal 2021, NEE reported GAAP net income of $1.81/share compared to $1.48/share in FY20. On an adjusted Non-GAAP basis, FY21 earnings were $2.55/share (+10.4% yoy).

A month later NEE declared a 10% increase in the quarterly dividend to $0.425/share. This continues an excellent long-term track record of dividend growth for NEE:

Going Forward

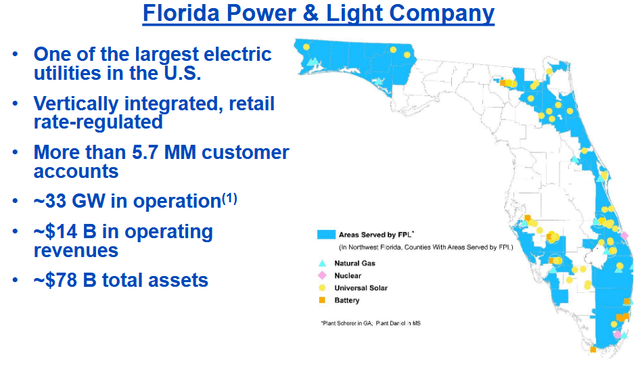

NextEra continues to leverage its Florida Power & Light (“FP&L”) and NextEra Energy Partners (NEP) MLP vehicles to organically grow its renewable solar and wind and natural gas energy businesses. FP&L is one of the largest and fastest growing utility companies in America, and NEE has peppered the state with low cost solar power arrays, many with battery back-up:

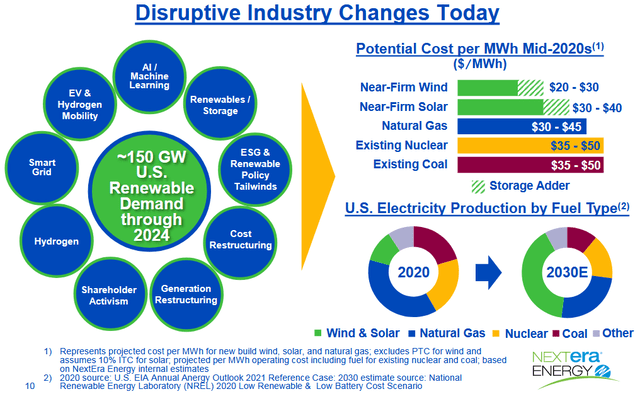

In addition, the company continues its long-term record of dropping down low cost-of-supply wind and solar assets to its MLP. Note that NEE’s cost-of-supply estimates put wind and solar below even that of natural gas, and significantly below that of both coal and nuclear:

This is the secret sauce that NEE has used to disrupt the domestic utility industry and become the largest utility company in the US while proving the disastrous consequences of those utility companies that made big strategic mistakes by focusing on “coal” and “clean coal” (an oxymoron if there ever was one). Consider reading my Seeking Alpha article on that subject (Trump’s First Policy Blunder: “Clean Coal”) and note the negative impact Southern Company’s (SO) Kemper supposedly “clean coal” project had on its shareholders.

The Mountain Valley Pipeline, of which NEE is a shareholder, recently won FERC approval to change its construction methods, allowing the development by boring under 180 streams and wetlands it must cross to complete the natural gas pipeline. The 300-mile MVP project is more than 90% complete but has faced environmental opposition that led to a federal court to reject its permit to cross the Jefferson National Forest. NEE recently filed an 8-K disclosing it had taken an $800 million impairment charge related to MVP. Completion of the 2 Bcf/d MVP would be a pleasant and unexpected upside catalyst.

Valuation

NEE currently trades at a forward P/E of 30x, a premium to the market and to the utility group as a whole – a premium that has been built into the stock over years of outperforming its utility peers (and the market) and its track record of strong dividend growth.

The current annual dividend ($1.70/share) equates to a 2.0% yield at the current stock price of $84.39. However, NEE has never really traded on the basis of current dividend yield – it trades more based on expectations of strong dividend growth and capital appreciation.

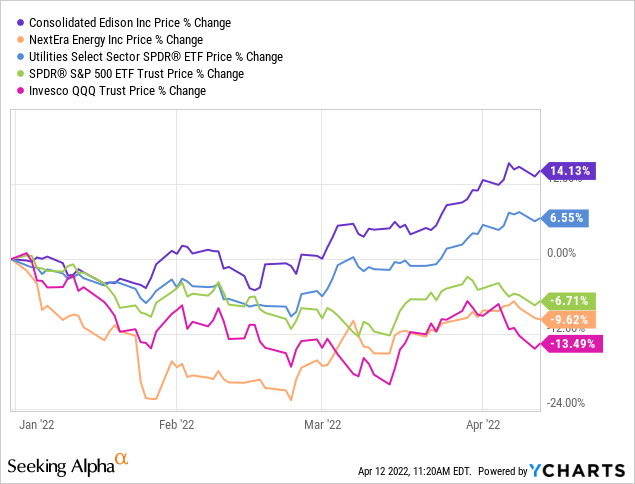

That said, note the utility sector as a whole, as measured by the Utilities Sector SPDR ETF (XLU), currently yields 2.65%. That is a wide disconnect in my opinion. Meantime, as I noted in my recent Seeking Alpha article on ConEd (ED), the recent rally in utilities is somewhat surprising given the current rising interest rate environment:

As can be seen in the graphic, YTD ConEd and the XLU ETF have significantly outperformed the S&P500, while NEE has significantly lagged all three. That is likely because NEE is viewed as more of a “growth” stock while it has also likely faced pressure due to the current narrative that fossil fuels are “in” and renewables are “out”. That is a very unwise and short-term perspective given global government support for renewables and global warming that just keeps getting worse and worse every year.

My gut tells me that investors are searching for safe havens given current market volatility. Investors should use market volatility and try to scale into NEE over time, buying on market dips.

Risks

All the typical risks apply to NEE: rising inflation, rising interest rates, massive geopolitical risks as a result of Putin’s horrific war-of-choice in Ukraine – all of which could lead to slowing global economic growth or even recession, either of which would likely cause a reduction in electricity demand.

Note also that NEE’s stock took a hit when CEO Jim Robo recently announced his unexpected retirement. However, incoming CEO Jim Ketchum has 18+ years of experience at NEE and the company has a deep-bench of experienced executives. I believe NEE’s long-term story remains 100% intact and that the market’s reaction to a change in the CEO position was quite overblown.

Summary And Conclusion

NEE has grown from practically nothing to become the biggest U.S. utility (by far). Its FP&L subsidiary is one of the largest, fastest growing, and most efficient utility companies in the US. Meantime, the clean green MLP drop-down strategy has blown most all (all?) of the O&G MLPs out of the water when it comes to total returns to shareholders. I can see why income oriented investors may not be impressed by NEE’s relatively low dividend yield of 2.0% (ED currently yields 3.3%). In that case, those investors might consider the NEP MLP as the better option. NEP currently yields 3.6%. That said, the investment opportunity for NEE investors is not yield: it is dividend growth and capital appreciation (i.e. total returns).

NEE is a BUY (on market dips) and a long-term HOLD.

Be the first to comment