Zerbor

Thesis

Main Street Capital (NYSE:MAIN) is a leading business development company (BDC) that focuses on lower middle market (LMM) companies. It structures debt instruments in addition to taking equity exposure in its portfolio companies to generate a blend of net asset value (NAV) growth and dividend income.

MAIN has also performed well over the past ten years, posting a 10Y total return CAGR of 9.8%. However, its medium-term performance was less impressive, as it delivered a 5Y total return CAGR of 4.67%.

Our analysis suggests that the market has de-rated MAIN, given the coming recession, which could impact its LMM portfolio companies harder. As a result, the projections over its NAV growth have also been revised markedly to reflect these near-term challenges.

Notwithstanding, MAIN’s valuation has found support at the current valuation zones over the past ten years (excluding the COVID pandemic). Therefore, we deduce that significant damage had already been factored into its current valuations. Notwithstanding, we believe the situation remains dynamic as the economic headwinds could worsen. Therefore, the market could de-rate MAIN further if it anticipates significant cuts to its NAV or net investment income (NII) estimates are necessary to de-risk its execution through the cycle.

However, we note that MAIN is likely at a near-term bottom, supported by a relatively attractive valuation. Hence, we expect a relief rally to ensue from here. As such, we rate MAIN as a Buy, with a medium-term price target (PT) of $44 (implying a potential upside of 24%).

MAIN’s Valuation Has Been De-risked

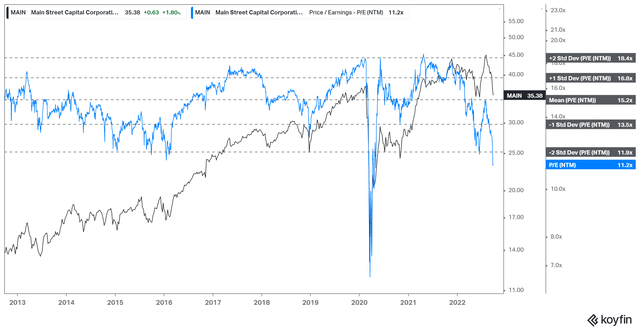

MAIN NTM P/NII valuation trend (koyfin)

MAIN collapsed from its August highs, down nearly 23%, as the market struck fear into investors, given Fed Chair Jerome Powell’s increasingly hawkish pivot. As a result, it sent MAIN down, crashing below the two standard deviation zone under its NTM P/NII 10Y mean.

Notably, that level has supported MAIN’s uptrend over the past ten years, barring the massive sell-off in March 2020. Therefore, we postulate that the market has likely de-risked MAIN’s valuation in anticipation of further headwinds that could impact its NII and NAV.

Therefore, we believe the critical question facing investors is whether Main Street’s forward estimates adequately accounted for recessionary headwinds.

The Street Consensus Remains Cautiously Optimistic

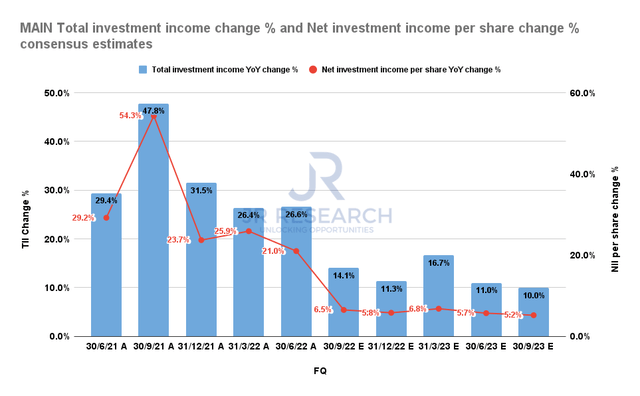

Main Street Total investment income change % and NII change % consensus estimates (S&P Cap IQ)

Our analysis indicates that the consensus estimates (neutral) suggest that Main Street’s total investment income (TII) growth should remain robust through the cycle. It’s also corroborated by management’s commentary at its Q2 earnings call, which didn’t suggest any discernible weakness in the operating performance of its portfolio companies.

However, given the worsening macro headwinds which could lead to a soft or hard landing (depending on which economist you ask), investors need to assess whether the moderation in its projections is reasonable.

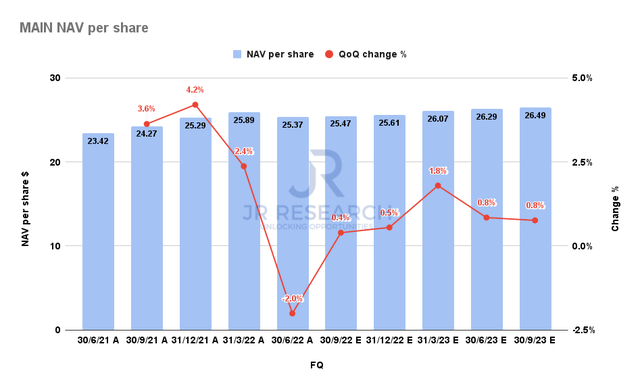

Main Street NAV per share consensus estimates (S&P Cap IQ)

Furthermore, Wall Street expects Main Street’s NAV per share to have bottomed out in Q2’22, suggesting that Wall Street expects a progressive sequential recovery moving ahead.

Our assessment suggests that the market has likely de-rated MAIN markedly to account for the worsening macro headwinds. However, we believe MAIN could see further downside volatility if the market anticipates a significantly worse impact on its underlying performance due to worsening macros.

The consensus estimates seem to have priced in a slowdown or mild recession, but not a hard landing. Hence, we believe the risks of a further markdown remain relevant. As such, investors are encouraged to add exposure over time.

Is MAIN Stock A Buy, Sell, Or Hold?

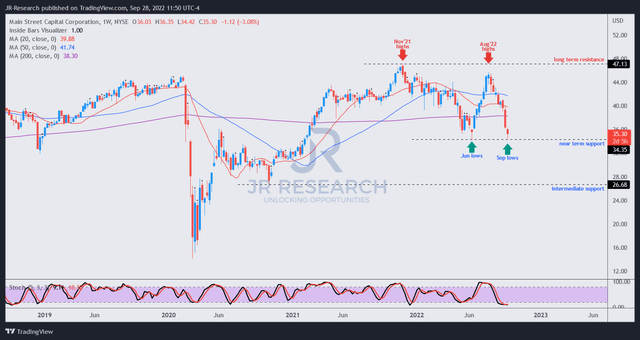

MAIN price chart (weekly) (TradingView)

MAIN’s medium-term chart indicates that it has fallen to its near-term support, which could help stanch further selling downside at the current levels.

However, we must caution investors that MAIN appears to have lost its medium-term bullish bias, given the rejection seen at its August highs.

Therefore, we suggest investors be cautious with their exposure and use appropriate risk management strategies (PT and stop loss management) to manage their exposure accordingly.

Notwithstanding, we believe the price action is constructive for a relief rally from the current levels. Coupled with a reasonably attractive valuation supported by an NTM dividend yield of 7.6%, adding exposure at the current levels seems appropriate.

We rate MAIN as a Buy, with a medium-term PT of $44.

Be the first to comment