We Are

Investment thesis

Back in September on the company’s Analyst Day Elastic (NYSE:ESTC) outlined the details for its ambitious goals to re-accelerate top line growth and reach revenues of at least $2 billion in FY25. Only two months later after posting Q2 FY23 earnings it turned out that laying out such aspiring goals in the current fragile economic environment was probably a bit premature.

Just like on the Analyst Day management was very detailed in describing the trends shaping the business on the Q2 earnings call, shedding light on important details regarding current macroeconomic headwinds. I think this wasn’t just important information for Elastic shareholders, but for investors in similar growth names as well, because demand patterns used to be quite similar for these companies.

All in all, Elastic is still a company present in several transformational segments of the IT market with 30%+ revenue growth trading at unusually low valuations. Even if the company has fallen out of the Rule of 40 elite recently, I think they have the potential to get back there, which could lead to significant multiple expansion in the future.

Short Intro

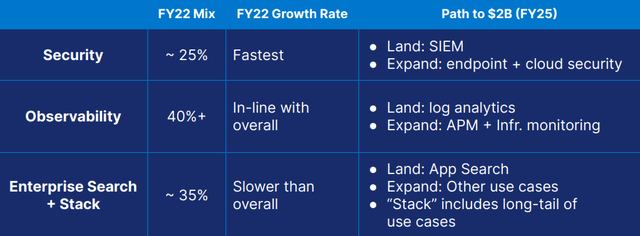

For those investors, who are not already familiar with Elastic I suggest reading my previous piece on the company, where I’ve covered the company’s business model more extensively. In short, Elastic began as an enterprise search company and extended their scope to observability and security, two quite hot segments in today’s IT market. There is a good summary slide in the Analyst Day presentation (very informative presentation of 187 slides, don’t miss it!) on this topic:

Elastic Analyst Day presentation

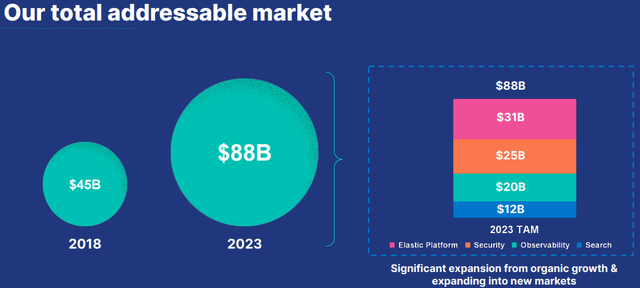

With this expansion Elastic has grown its total addressable market substantially:

Elastic Analyst Day presentation

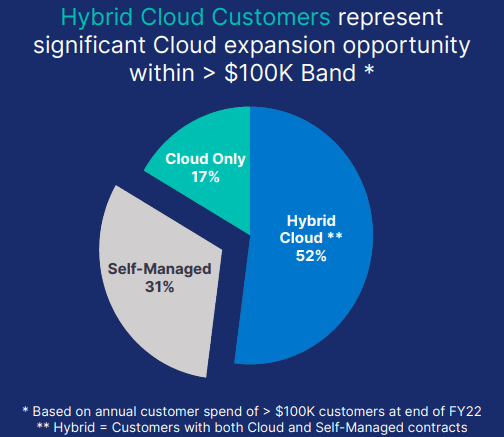

The company mainly tries to focus on customers having an annual contract value (ACV) of greater $100,000, which cohort has an impressive net expansion rate (NER) of more than 135%. These customers make up 69% of total spend on the platform and have a significant cloud expansion opportunity:

Elastic Analyst Day presentation

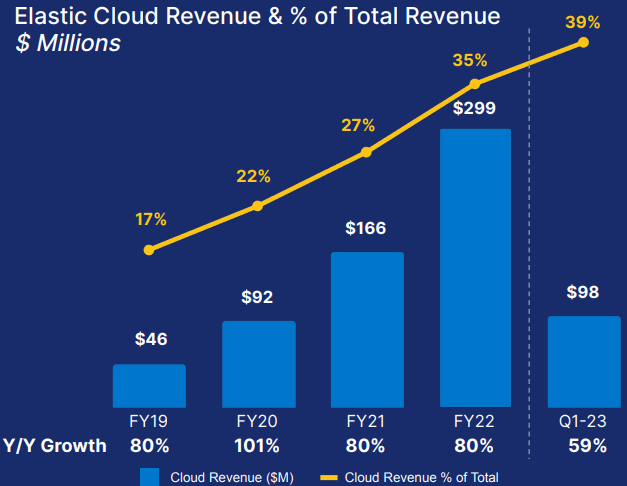

Elastic Cloud is already growing nicely and will be the main growth driver of the business in the upcoming years as it already accounts for most of new customer additions. In Q1 FY23 39% of total revenues were generated by Elastic Cloud showing almost doubling from a few years ago:

Elastic Analyst Day presentation

Management expects that Elastic Cloud revenues will reach at least 50% of total revenues by the end of FY24, which could be the main driver behind the possible re-acceleration of top line growth. Currently, Elastic Cloud grows at a ~50% YoY rate.

Finally, a few words on pricing and contracts Elastic offers. Comparing to the SaaS spectrum of companies Elastic has quite a flexible pricing model providing usage-based contracts for most of its use cases. There is a sum usually billed annually in advance for a committed capacity, but companies can flexibly modify consumption if needed. On the top of annual contracts Elastic also introduced month-to-month contracts, which is a good tool for addressing new customers, especially SMBs. These very flexible contracts make up currently 16% of total revenues.

A new reality: September Analyst Day vs Q2 results

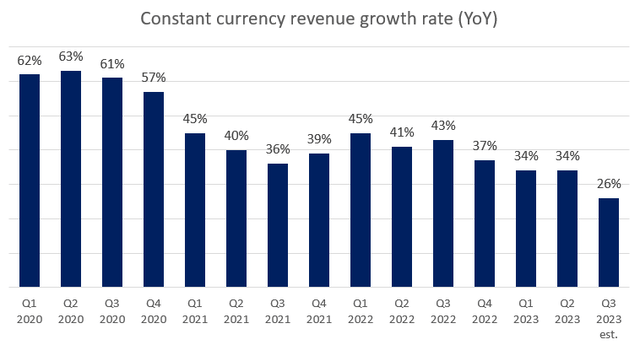

As mentioned in the beginning paragraph Elastic held an Analyst Day in the second half of September and laid out a framework to reach revenues of at least $2 billion for FY 2025. This would have required a compounded annual revenue growth rate of 36% from the $1,083 billion expected for FY 2023 at that time. As constant currency (CC) revenue growth tracked at ~34% YoY in the preceding Q1 quarter this was already an ambitious goal in my opinion, which was partly fueled by the increased shift of revenues to the cloud. At this time management communicated that they didn’t see any meaningful impact from a possible macroeconomic backdrop on the business.

After the publication of Q2 FY23 earnings and the earnings call that followed it turned out that this backdrop was already on the corner:

“In the month of October, we began to see belt tightening and consumption slowing down in the SMB segment. We also saw increased scrutiny on deals overall, particularly in countries where the strengthening U.S. dollar has created adverse conditions.” – Ash Kulkarni, CEO on Q2 earnings call

The Q2 quarter ended on the 31st of October, so based on management comments it could have consisted of two good and one mediocre quarter. Revenues came in at $264.4 million growing 34% YoY in cc barely exceeding the company’s and analysts’ ~$261 million estimate:

Based on my experience and historical data Elastic (just like many other growth names) tries to guide for a 5% beat on the top line, which means that October revenues could have fallen short by around $10 million as this month was solely responsible for the “softer” revenue figure. Management prudently decided to incorporate this weakness into its second half guidance leading to a 26% cc YoY growth rate for the Q3 quarter:

Created by author based on company filings

When I add the 5% safety-margin I have mentioned above the 26% cc YoY growth rate would increase to ~32%. So, even if we suppose that the weakness experienced in October persists topline growth would not decelerate meaningfully from current levels. However, in the light that management talked about revenue re-acceleration not long ago this is obviously a disappointment, which made shares fall ~9% on an otherwise uneventful trading day.

As I have mentioned earlier based on the Q2 call the main area of weakness was the SMB segment on the one hand, and international markets (comprising 40% of revenues) on the other. Some more color on topic from the CEO follows:

“And through all of Q2, what we saw was in October things started to change and act differently than what we had seen prior to that. Specifically in SMB, we saw a lot of belt tightening, and we are seeing this in a couple of places, very obviously. First is in monthly cloud. Monthly cloud tends to be – a lot of it tends to be SMB. We saw consumption construction there. We also saw fewer SMB customers signing on to the platform. So that was one. The second thing that we saw in October, which is sort of the last month of our quarter, as you know, in certain international geographies where we had seen the dollar tightening having the dollar increase having a significant impact on just the way customers are thinking about things, we saw customers going through more approval processes. And these were deals where we continue to compete very well. Some of these deals slipped out from Q2 into Q3. Some of them have even closed since then. But we see that, that pattern of more approvals, and we expect that to continue going forward. So the assumptions that we’re making effectively are that SMB, what we saw in October is going to continue for some time. The pattern of deal inspection is going to continue for some time, but having said that, our competitive position remains very strong. We continue to do well in competitive environments. In terms of our win rates, they stayed healthy as they have been.” – Ash Kulkarni, CEO on Q2 earnings call

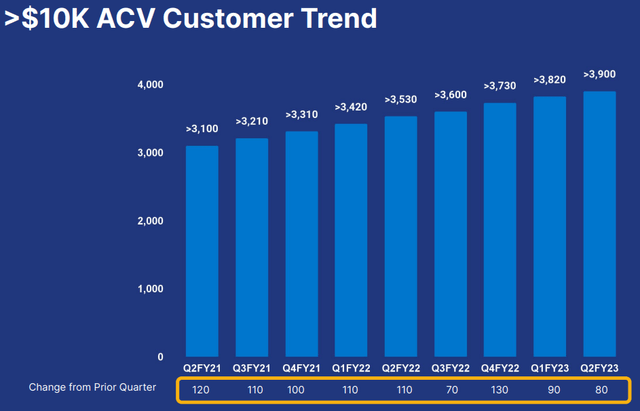

This confirms what some other SaaS companies experienced that the current macro weakness is more pronounced in the SMB segment. This can be also seen when looking at monthly cloud revenues, which are more SMB heavy and have decreased 1%-point in terms of total revenues to 16% in Q2. Furthermore, new customer additions reached “only” ~400 during the quarter compared to ~700 in the prior quarter, which was also mainly due to the weakness in the SMB segment. However, if we look at larger customers with an ACV of greater than $10,000 the deceleration is much more moderated:

Elastic Analyst Day presentation

The picture pointed so far shows that no meaningful deceleration is to be expected on the top line, although the expected re-acceleration of revenues seems to be delayed. A key question around the close future is, whether things have gotten worse since October?

Luckily, management was very informative on the Q2 earnings call and told important details in that regard:

“November has been steady so far. We have continued to see business play out as we expected. We’ve not seen any meaningful change in terms of customer tone in the month of November. So I think that we’ve reflected that obviously in the outlook here for the back half. So we feel pretty good about the number that we’ve called for the back half, and we’ve tried to incorporate all of these trends specifically into the guidance and suitably derisk the guidance for the back half to accommodate for these. So we feel good about the outlook for the back half and based on what we’ve seen in November so far.” – Janesh Moorjani, CFO and COO on Q2 earnings call

I believe the CFO’s comments were welcoming news for investors, and not just for the ones who are shareholders of Elastic. As the call was held on the 30th of November, we can conclude that one out of three quarters have been passed at least as expected so far from Q3. This shows that perhaps the weakness in October was not the beginning of a larger trend, but rather some caution from companies in an uncertain economic environment. However, I must add that I don’t want to make foregone conclusions, so I’ll keep monitoring these areas of weakness at other SaaS companies as well.

Strong commitment to profitability with workforce reduction

Although it seems that the $2 billion revenue goal for FY25 is in jeopardy Elastic tries to compensate this with significantly strengthening its bottom line. One important step toward this direction was the announcement to reduce total workforce by 13%. Only a few SaaS companies did this until now underlining the fact that the company is truly elastic.

Besides the workforce reduction Elastic decided to streamline its investments in the SMB segment and across other functions expecting further efficiencies. Taking all these together the company announced a 10% non-GAAP operating margin target for FY24. I believe this has been quite a positive surprise as the communication on margins just one quarter ago has been the following:

“…we continue to expect to expand operating margin by several percentage points each year in fiscal 2024 and fiscal 2025.” – Janesh Moorjani, CFO and COO on Q1 earnings call

Well, as the previous guide for FY23 non-GAAP operating margin was for 0.5% I think now one hoped for 10% already in FY24 based on these comments. This shows that there’s plenty of operating leverage in the business, which is a crucial factor for investors these times.

FCF margin should follow approximately the same path in FY24 (from ~0% to ~10%), which means that if the company manages to keep its topline growth above 30% it would return to the Rule of 40 elite league.

Finally, a last though on stock-based compensation (SBC). On the company’s Analyst Day back in September Elastic emphasized that they goal is to keep the dilution resulting from SBC below 5% although it reached only 0.9% in FY21 and 2.6% in FY22. The average annual dilution for large-cap SaaS companies lies around 7%, which makes seem Elastic conservative. Based on the company’s most recent 10-Q filing Elastic had 95,605,341 ordinary shares outstanding at the end of November together with 21,640,240 in equity awards to grant. In H1 of FY23 net grants have been 716,711 leading to a dilution of 0.6% in H1, which is only symbolic. However, most awards are granted usually in H2, so it’s worth to keep an eye on that in the upcoming two quarters. Nonetheless, Elastic seems to be a conservative SaaS company from this point of view.

Valuation: Rock bottom?

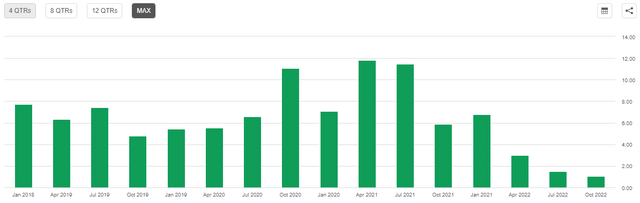

The valuation of shares hit a new low in November when the EV/TTM Sales multiple dropped below 5 for the first time since the company went public in October of 2018:

To put the company’s valuation into context I’ll refer to an extensive collection of SaaS company data as of Q3 2022, which shows that the median SaaS company grew revenues by 21% YoY in the past twelve months and traded at an EV/TTM Sales ratio of 5.68. As Elastic grew revenues well above 30% in the past year and trades at an EV/TTM Sales multiple of ~5 I think it is fair to say that shares are undervalued compared to the broad sector. Moreover, if we consider that a significant improvement is expected in FY24 on the bottom line, while revenue growth could possibly re-accelerate on the back of the strong cloud business, I think shares provide an excellent risk/reward entry point at current levels.

Conclusion

Although Elastic fundamentals suffered a set-back resulting from general macro headwinds in October, the long-term growth story remains still in-tact. In the top of that, profitability is expected to significantly improve in the coming year coupled with the possibility of re-accelerating revenue growth. As management hinted on no further deterioration of business conditions in November, I believe now is a good risk/reward buying opportunity for long-term investors.

Be the first to comment