da-kuk/E+ via Getty Images

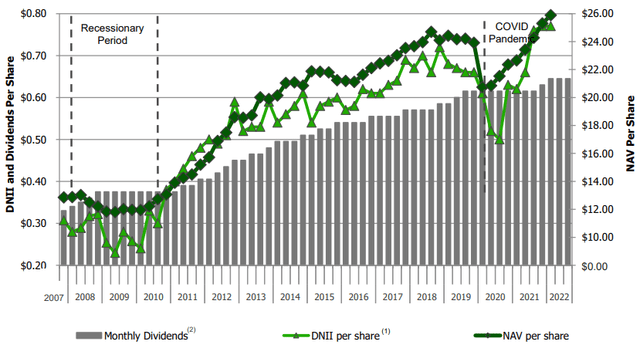

Main Street Capital (NYSE:MAIN) is one of the pre-eminent blue chip business development companies (“BDCs”) (BIZD). It has a phenomenal track record of growing dividends and NAV per share over time by taking a unique – and highly successful – focus on under-served lower middle market firms (those that bring in revenue between $10 million and $150 million with EBITDA between $3 million and $20 million). In fact, these equity investments have driven the company’s 5% CAGR in net asset value since 2007.

MAIN Track Record (MAIN Investor Presentation)

On top of that, MAIN’s practice of paying out monthly dividends attracts a lot of demand from retail investors, combining with its internalized management and efficient operating structure (~1.4% operating expenses as a percentage of total assets relative to a ~2.8% average across the BDC space) to earn a massive premium to NAV (currently 48.9%) that is tops in the BDC space.

Another big reason why investors like MAIN is that it has never cut its monthly dividend despite going through the Great Recession and COVID-19 crash. It has, in fact, grown it quite meaningfully over time despite paying out a large payout. A big reason why MAIN has been able to generate such impressive growth is that it has been able to leverage its massive premium to NAV to regularly issue new equity on an accretive basis and then reinvest the proceeds alongside cheap debt into new investments, continuing the virtuous cycle of growth and wealth creation for investors.

MAIN’s investment grade (S&P BBB- stable) credit rating enables it to take on debt at attractive rates and on favorable terms, making new investments even more accretive.

Meanwhile, MAIN’s underwriting for its debt investments is fairly conservative with a 2.8x EBITDA to senior interest rate coverage and MAIN also spreads its bets pretty well across over 28 industries, with machinery, construction and engineering, and professional services taking the top three spots at 11%, 8%, and 7%, respectively, of its total investments. 99% of its loan portfolio is secured debt and 99% of its loan debt portfolio is first lien term debt.

MAIN is also positioned to weather rising interest rates, as 95% of its debt investments are floating rate, giving it a 575 basis point net cash interest margin vs. its matched floating rate credit facility.

Finally, MAIN also operates as an asset manager of a non-traded BDC, from which it receives a base management fee of 1.75% of total assets and receives 20% of net investment income above a hurdle rate and 20% of net realized capital gains in incentive fees.

MAIN is also well aligned with shareholders as its senior executives and Board of Directors collectively own 3.1 million shares and restricted stock grants represent ~50% of the total compensation for executive management.

Why We Are Not Buying The Dip In MAIN Stock

While MAIN certainly has a lot going for it, we have not been buying the dip in the stock for two main reasons:

First and foremost is the fact that the stock remains quite expensively priced. Trading at a near 50% premium to NAV offsets the ~140 basis point operating efficiency advantage relative to BDC sector averages, insider alignment, and track record provided by MAIN.

While it is true that the presence of the asset management business means that the intrinsic value of MAIN is understated to some degree, it is only contributing net investment income at a ~$20 million annualized pace. Even assigning a 15x multiple to the business puts it at just $300 million. The business currently commands a $2.81 billion market cap, so that would put the BDC portion of the business at a $2.5 billion market cap, putting the premium to NAV at a still whopping ~32%.

The next highest premium to NAV in the space is 24.21% found at Hercules Capital (HTGC). This hefty premium is also problematic because – in addition to reducing the margin of safety and providing greater downside risk – it also reduces forward total returns for shareholders by reducing the dividend yield and all but removing the multiple expansion factor from the equation. As a result, it puts a very large burden on management to deliver truly market-crushing underlying returns and growth in order to generate outperformance for investors.

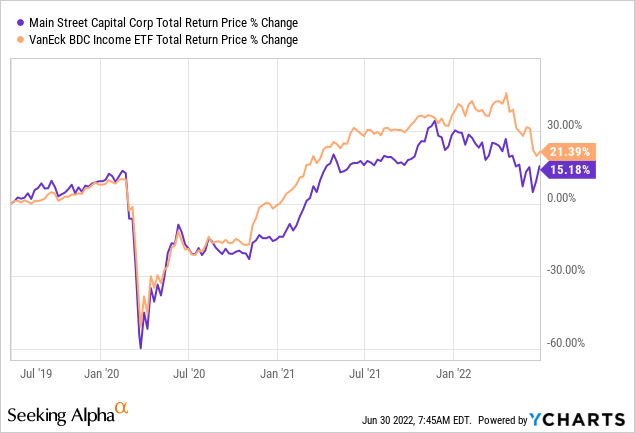

When looking back over the past three years, we see that this has simply not been the case:

The second reason why we have been refraining from buying MAIN at this time is because much of its outperformance has been driven during a massive bull market and period of economic prosperity. While this has obviously applied to all of its peers as well, it has especially benefited MAIN due to its uniquely overweight equity investment position. Similarly to how stocks tend to outperform bonds and leveraged funds tend to outperform unleveraged funds during expansions, MAIN has outperformed peers.

While we certainly do not take anything away from MAIN’s well-deserved reputation and have already pointed out the key structural advantages to its business model that have also contributed to its outperformance, we also believe that MAIN’s quality as a BDC has been overstated due to it benefiting from operating in a highly favorable macro environment for so long.

Moving forward, if we indeed end up in a recession, MAIN will likely experience steep underperformance due to a combination of its equity investments struggling (thereby reducing cash flow) and losing value (thereby reducing NAV per share at a more rapid pace than MAIN’s more loan-heavy peers). These two forces will likely also result in MAIN losing some of its massive valuation premium, further compounding losses for MAIN shareholders. This, in turn, will have the negative impact of reducing growth rates by reducing the accretive effect of issuing new equity that they have enjoyed for so long.

Investor Takeaway

While MAIN has delivered great returns for shareholders over the past 15 years, we believe that – should we truly be facing a recession in the coming years – it is poised to deliver very disappointing total returns for shareholders relative to peer investment grade BDCs for the foreseeable future.

As a result, we are steering clear of it for now and are investing elsewhere at High Yield Investor, including in several deeply undervalued recession-resistant high yield stocks and much more conservatively positioned investment grade BDCs like Ares Capital Corp (ARCC) and Oaktree Specialty Lending (OCSL).

Be the first to comment