curraheeshutter/iStock via Getty Images

I believe the coming months could be an ideal time to accumulate shares in Woodside Energy Group (NYSE:WDS) as its recent merger with BHP Group’s (BHP) energy division could create investor turnover. Woodside is one of the world’s largest LNG producers and has one of the highest production exposure to the much sought after commodity.

Introduction to Woodside Energy

Woodside Energy Group is one of the largest independent E&P in Australia. Woodside has over 60 years of operating history and was one of the leaders of the LNG industry in Australia. It’s production portfolio is centered around the production of LNG from conventional offshore projects in Western Australia, as well as oil and gas from other assets.

In terms of development, Woodside is currently expanding the Pluto LNG facility in Western Australia with the Pluto Train 2 expansion, to exploit the dry gas reserves from the offshore Scarborough gas field. Woodside is also developing the Sangomar Oil Field in Senegal. As Australia’s largest LNG operator, Woodside supplies 5% of global LNG supply.

In August of 2021, Woodside Energy proposed a merger with BHP Group’s Petroleum segment.

Who is BHP Petroleum?

While BHP Group Ltd (BHP) has been known in recent years as the world’s largest diversified metals and mining company, BHP was also a leading pioneer in the Australia oil and gas industry with their Bass Strait discovery in 1965.

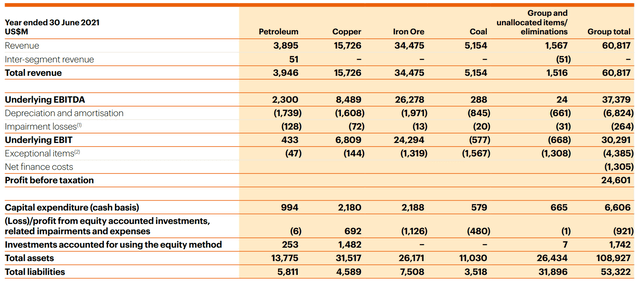

Nowadays, BHP’s oil and gas assets are overshadowed by its metals and mining business. In 2021, the Petroleum segment only accounted for 6.4% of the group’s revenue, and 6.1% of EBITDA (Figure 1).

Figure 1 – BHP Petroleum was a small segment of group’s business. (BHP Group’s 2021 Annual Report)

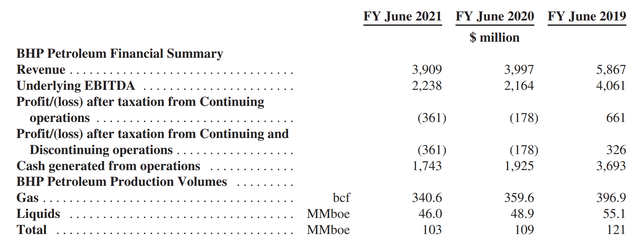

However, this small business segment is still a sizeable oil and gas company in its own right, with production of 103 MMboe in 2021 (Figure).

Figure 2 – financial summary for BHP Petroleum (Woodside Energy F-4 form to SEC)

Rationale for the merger

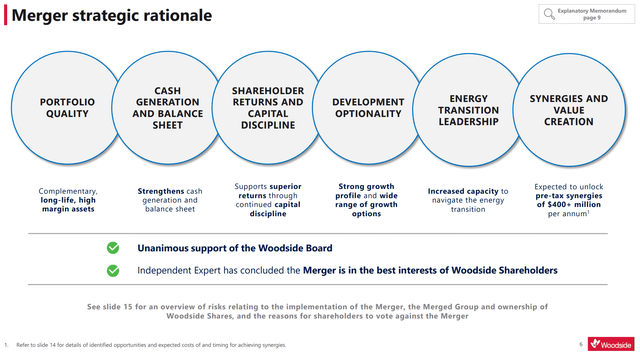

Woodside management highlighted several reasons for the transaction (Figure 3). I believe the most salient ones are complementary assets and strong cash flows.

Figure 3 – Transaction rationale (Woodside and BHP Petroleum merger investor presentation)

Looking through the assets that the two company holds, we find that BHP holds 16.67% interest in Woodside’s cornerstone Northwest Shelf gas project, and 26.5% in the Scarborough gas field that underpins much of Woodside’s near-term Pluto 2 LNG growth opportunity. Hence it makes sense to consolidate and combine the assets.

Furthermore, the addition of BHP’s producing Gulf of Mexico (GOM) assets should provide much needed cash flows to help fund the development of the Scarborough gas field and Pluto Train 2 projects.

On BHP’s side, it is no secret that in recent years, global investors have been super focused on ESG initiatives and had been advocating for BHP to divest their energy assets. This transaction is a convenient platform for BHP to surface value for its energy assets while simultaneously divesting those assets to shareholders to do with as they please.

BHP Petroleum Merger Brings Woodside To America

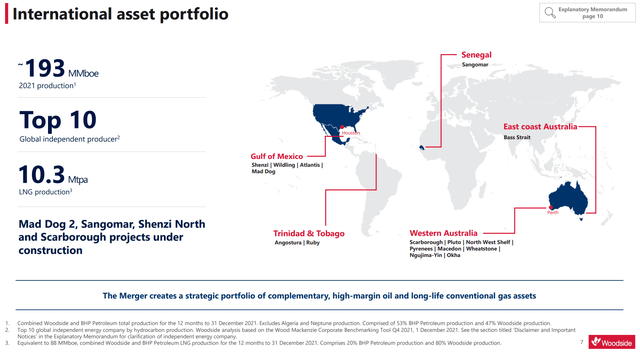

Recently on June 2, Woodside Energy completed the all-stock merger with BHP Petroleum, with Woodside issuing 915 million shares to BHP, giving BHP 48% control of the resulting company. The combined entity now ranks as one of the top 10 global independent energy companies with close to 200 MMboe of production (Figure 4). As part of the transaction, BHP transferred the Woodside shares directly to BHP shareholders.

Figure 4 – Summary asset portfolio for Woodside / BHP Petroleum (Woodside and BHP Petroleum merger investor presentation)

Share Dividend Could Cause Investor Turnover

As we mentioned above, BHP is primarily known as the world’s largest diversified metals and mining company. Many investors and investment funds hold BHP for its metals and mining exposure. When BHP transferred Woodside shares directly to its shareholders, it may have caused a conflict with some investors’ investment mandate (as many funds have strict mandates, particularly against holding fossil fuel companies) and thereby cause the investors to liquidate their Woodside shares over the coming months.

I believe long-term investors should take advantage of this potential turnover event to accumulate shares in Woodside Energy and capture the upside in the LNG story.

LNG Market Opportunity

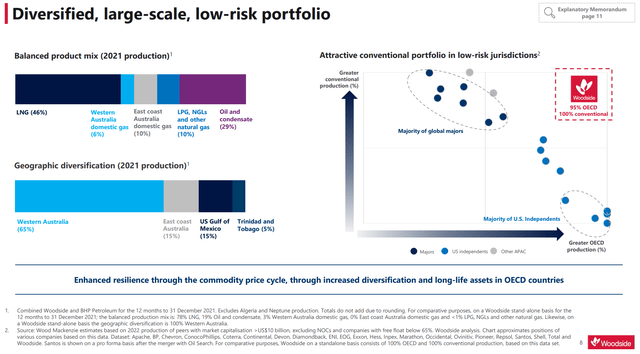

The main reason I like Woodside Energy is its large LNG exposure. As can be seen from Figure 5, almost 50% of Woodside’s production comes from LNG. Furthermore, more than 95% of Woodside’s production comes from OECD countries, an important distinction as the world grapples with energy security.

Figure 5 – Combined Woodside / BHP production exposures (Woodside and BHP Petroleum merger investor presentation)

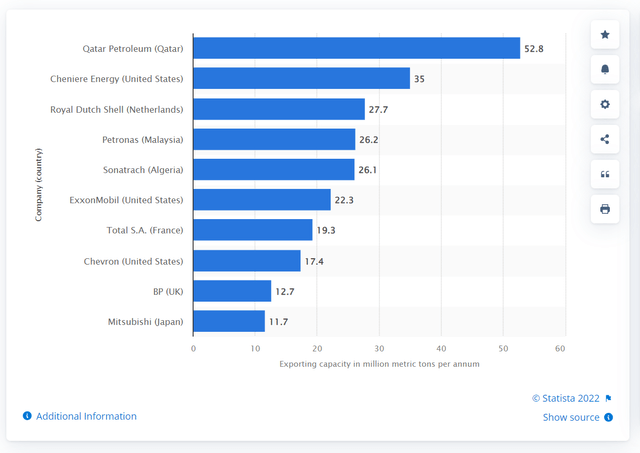

In fact, Woodside’s 10.3Mtpa LNG production makes it one of the largest producers globally, just outside of the top 10 (Figure 6), not far from the supermajors such as Shell (SHEL), Exxon Mobil (XOM), and Chevron (CVX).

Figure 6 – Top 10 global LNG producers (Statista)

Historically, Australian LNG (what Woodside produces) are mostly sold on into the Asia Pacific markets under long-term contracts (from 5 to 25 years) indexed to crude prices. However, in recent years, a wholesale “spot” market where cargoes go to the highest bidder has developed due to increased liquidity in the global LNG market.

LNG Prices Surging on Recovering Demand and Supply Disruptions

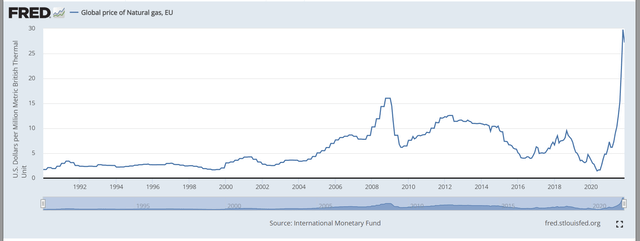

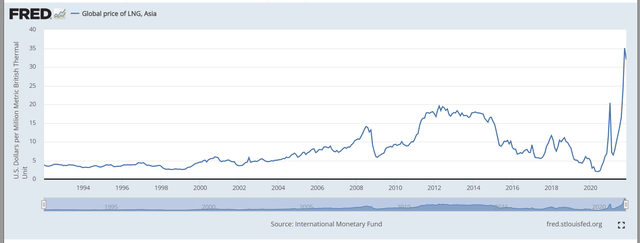

Global LNG prices have recovery has accelerated in recent months due to strong demand recovery from post COVID-19 pandemic restrictions and tensions and supply disruptions caused by the Russia/Ukraine war. Figure 7 shows European natural gas prices, which are currently at multi-decade highs. A similar price pattern can be seen in Asian LNG prices (Figure 8).

Figure 7 – European natural gas prices at all-time highs (St. Louis Fed) Figure 8 – Asian LNG prices at all-time highs (St. Louis Fed)

According to Wood Mackenzie (a global research firm specializing in energy), global LNG demand is expected to more than double in volume between 2021 and 2050 (quote from Woodside Energy’s F4). With domestic production declines in Europe and Asia, LNG imports are expected to become the preferred supply type.

The 2020 COVID-19 pandemic and low oil and gas prices in 2020 resulted in many LNG projects getting delayed. In 2020, only 1 LNG project was sanctioned, while 2021 saw a few, including Woodside Energy’s Scarborough-Pluto Train 2 project. However, many of the longer-termed projects were dependent on Russian gas supply.

With the uncertainty in Russia’s role in global energy markets, it appears LNG markets are primed to remain tight in the coming years, which should be a boon for Woodside Energy as its Pluto 2 project comes online in 2026.

Valuation

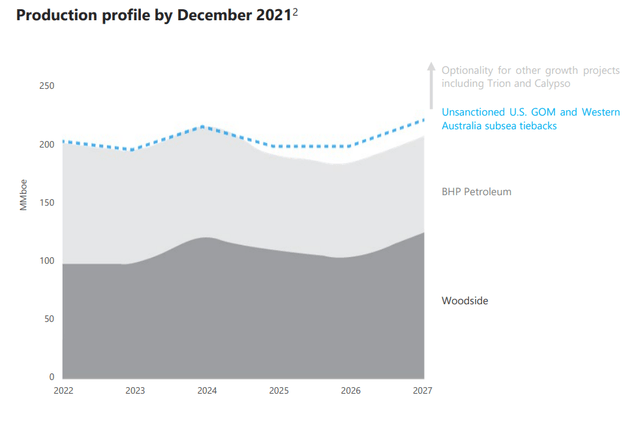

With long-life assets, Woodside Energy’s production profile is forecasted to remain stable around 200MMboe for the next few years with potential growth from unsanctioned projects in the Gulf of Mexico (Figure 9).

Figure 9 – Combined Woodside / BHP production profile (Woodside and BHP Petroleum merger investor presentation)

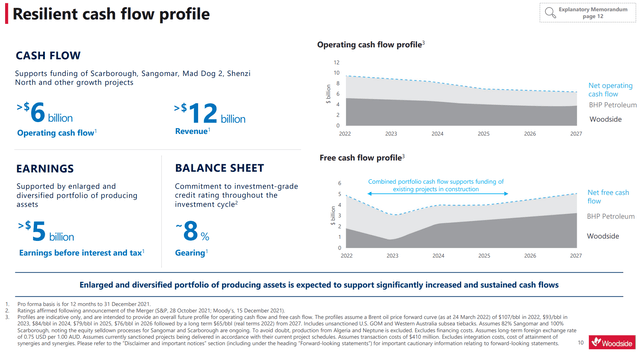

This steady production profile drives strong operating cash flows of over $6 billion in 2021 and pro-forma $9 billion in 2022 (Figure 10). Note that the cash flow profiles in Figure 10 are based on conservative price assumptions of Brent $107 in 2022, $93 in 2023, $84 in 2024, $79 in 2025, $76 in 2026 and $65 from 2027 onwards. With a market cap of approximately $42 billion, this translates into a Price-to-cashflow multiple of 4.6x for 2022.

Figure 10 – Cash flow profile (Woodside and BHP Petroleum merger investor presentation)

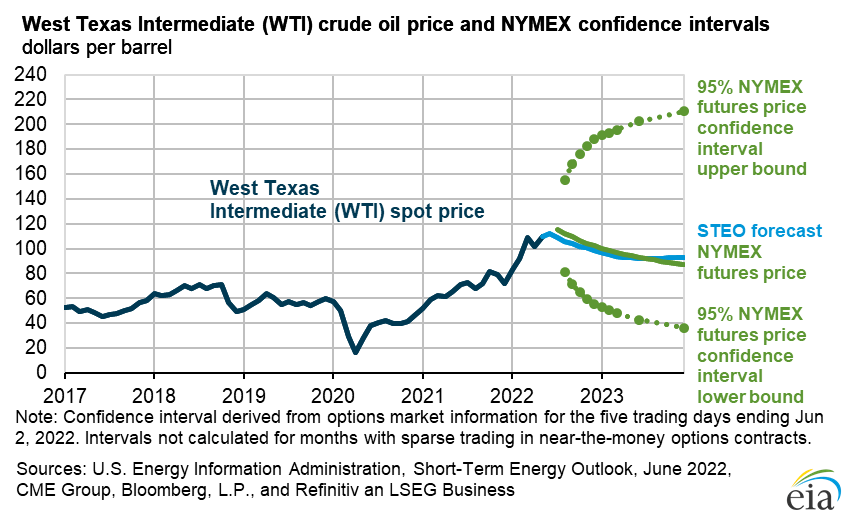

Based on the tightness in the global oil markets and supply disruptions from Russia, it is very possible that oil prices will remain over $100 for the next few years, offering bonanza cashflows for energy producers like Woodside.

In fact, the EIA, it its latest short-term energy outlook, forecast Brent prices of $107 and $97 for 2022 and 2023, with a wide confidence band for future WTI oil prices due to the supply uncertainty (Figure 11).

Figure 11 – EIA Short-Term Energy Outlook (EIA Short-Term Energy Outlook, June 2022)

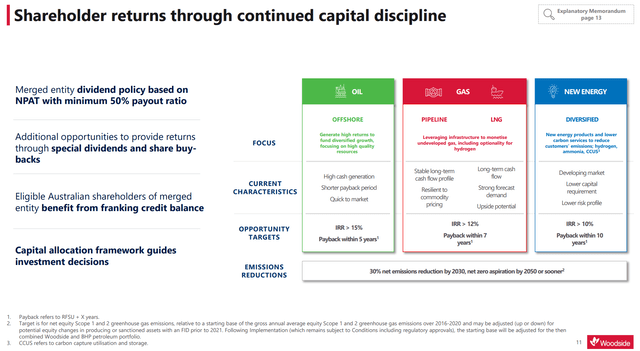

Strong shareholder returns Expected

With the BHP merger, Woodside has also committed to return a minimum of 50% of Net Profits after Tax through dividends (Figure 12) with upside from special dividends and share buybacks.

Using management’s assumption for $107 Brent crude for 2022 (which corresponds with EIA’s forecast), we can see from figure 10 above that Woodside should generate approximately $9 billion in operating cash flow. This level of cashflow could translate into a very meaningful dividend. While I am reluctant to hazard a guess at the dividend rate until management updates their guidance in an upcoming earnings release, for comparison’s sake, in 2021, Woodside Energy paid US$1.35 in dividends, which would translate to a 6% dividend yield at current stock prices. With higher energy prices in 2022, I would expect a higher dividend as well.

Figure 12 – Woodside to return 50% of NPAT as dividends (Woodside and BHP Petroleum merger investor presentation)

Risks In The Woodside Story

Global Economic Slowdown

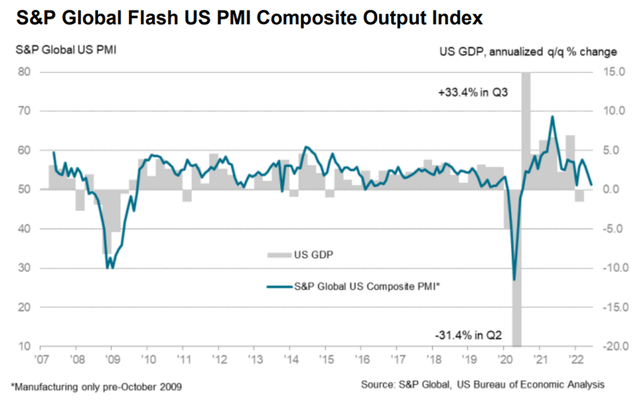

The biggest risk in my opinion is that high energy prices is too much of a good thing and the global central banks’ fight to tame soaring inflation ultimately backfires and pushes the global economy into recession. Already, we are seeing dramatic slowing in economic indicators such as PMI

Figure 13 – US Flash PMI latest reading is 51.2 (S&P Global)

As energy prices are highly correlated to global growth, if economic growth slows or goes into contraction, energy prices could see outsized drawdowns.

Russia / Ukraine Wildcard

On the other hand, there is a certain base level of energy consumption that is inelastic, for example, gas needed to heat homes. An escalation of the Russia/Ukraine war or western sanctions against Russia could put further pressure on key energy commodities like natural gas, and actually drive up energy prices, even as it puts the rest of the economy into recession.

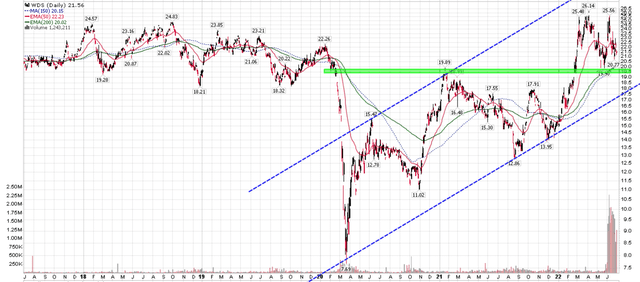

Technical Analysis and Recent Price Action

Woodside has recovered from its COVID-19 pandemic lows in a wide up-channel, hitting multi-year highs of $26 before easing to $21. There is fairly strong breakout support around $19 to 20 dollars that also coincides with rising moving averages (Figure 14).

Figure 14 – WDS in wide uptrend (author created with price chart from stockcharts.com)

Conclusion

The coming months could be an ideal time to accumulate shares in Woodside as its recent merger with BHP Group’s energy division could create investor turnover. I like Woodside’s large LNG exposure, as I believe LNG is one of the key commodities in the coming years. Trading at just 4.6x Price-to-2022 Cashflows with potential upside to spiking LNG prices, I would recommend investors accumulate shares.

Be the first to comment