SweetBunFactory/iStock via Getty Images

Overview

The race for sovereign state semiconductor supremacy rages on. Recent supply concerns have caused widespread worry across several industries, forcing companies to ramp up forecasts to secure chunks of the $555B global chipset market.

Industry by industry, earnings downgrades have been announced with the finger often being pointed to semiconductor supply pandemonium. Supply constraints have provided a natural ceiling on capacity to meet demand, particularly in the consumer discretionary space.

The global Coronavirus pandemic created whipsawing demand, wreaking havoc with global supply chains. Now with increasing technological advancement, semiconductors have seeped into every consumer product out there, driving dependency on secure sources of supply.

Yet the chipset industry is not just like any other industry. Supply imbalances and state sponsored capacity building have sent the industry into a state of flux.

The general performance of the semiconductor sector year-to-date has hardly been anything to get excited about.

As the industry’s strategic importance rises in the development of military applications, so too have export controls, regulations, quotas, and other protectionist measures to bridle foreign players from acquiring technological advantage.

Recent US export bans and licensing requirements for semiconductor manufacturers have sent the price of doing business upwards, while providing natural limits to total addressable markets. All this could be interpreted as a veiled attempt to quell the technological ascent of China as it strives for political, economic and military dominance.

It paints a complex picture. In my previous article about Quantum computing darling, Rigetti (RGTI), I highlighted some industry-wide challenges. The same ones are faced by San Jose-based Magnachip Semiconductor Corporation (NYSE:MX).

The 40-year-old US chipset builder designs, manufactures, and supplies analog and mixed signal semiconductor platforms for a range of applications including automotive, communications, consumer industrial and the Internet of Things.

Its core business revolves around display solutions and power solutions which cover organic light emitting diode (OLED) technology, and display driver integrated circuits for OLED displays.

Like most technology focused firms, the company possesses a bucket load of patents and mentionable research & development spend to boot.

Magnachip Corporate Presentation

Magnachip’s mobile display driver integrated circuits (DDICs) have found their way into a range of smartphones

Display driver integrated circuits (DDICs) which control OLED displays of all types, such as tablets, television sets, monitors, and notebooks, are the other key product marketed by the California based semiconductor player.

Products like this are a staple of consumer durables and often highly discretionary, making them susceptible to rapid market booms and busts like the one observed pre and post pandemic.

In fact, extensive lockdowns during the SARS-Cov2 pandemic drove a consumer durable boom with families decking out their homes with gadgets of all sorts. Without a doubt, this would have created significant sales tailwinds for Magnachip Semiconductor Corporation at the time.

Magnachip Corporate Presentation

Magnachip Semiconductor Manufactures the controllers which manage OLED displays found in an extensive range of products.

Yet the opposite is true today. Items such as televisions, computers, smartphones or even cars make up discretionary one-off spend, unlikely to be renewed on a regular basis. Consumer durables numbers are already starting to roll over, signaling possible headwinds for certain chipset players.

Price action for Magnachip Semiconductor Corporation has broadly matched the Philly Semiconductor Index, with the company losing -49.88% of its market capitalization year to date.

That downwards path has been more volatile than the general industry-leading sector index perhaps representative of where Magnachip Semiconductor finds itself on the technology company size & value spectrum (small capitalization, high value)

Characteristic of high growth technology plays, the firm does not redistribute earnings to shareholders, opting instead for reinvestment, specifically in onerous research and development. ETF ownership is not a big component of underlying equity holdings either, with just 20 different ETFs owning equity. All in, that makes up a paltry $10M in equity held by ETFs on a company weighing in at ~$450M.

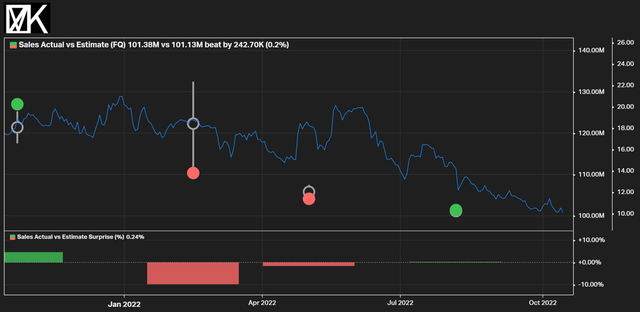

Over the course of this year, the company has had a spate of earnings misses, putting further pressure on an already declining stock price. Problems related to industry wide wafer supply shortages has put a natural cap on the firm’s ability to get product effectively out the door.

A particularly big sales miss at the start of the year has kicked off what essentially was a spate of misses and continued downwards pressure on the equity.

Simplified Income Statement

While Magnachip’s income statement does show signs of declining revenues, it also highlights a degree of capital prudence, particularly in the management of selling, general & administrative expenses along with research and development.

Since Q2 FY 2021 ($113.9M sales), the firm’s revenue has declined, Q2 FY 2022 ($101.4M sales) underscoring competitive pressures in both the display solutions and power solutions markets.

Declining demand for China and Korean flagship smartphones has impacted sales. Supply shortages of wafers figure front and center as part of the firm’s revenue generating woes.

Simplified Balance Sheet

The firm presently holds ~$273M in cash and cash equivalents on its balance sheet as part of its commitment to maintain at least $100M of cash readily available. Additionally, the firm has committed to using some of the cash available to repurchase $37.5M of stock.

Consequently, the stock price will be supported in a tax effective way for equity holders as capital gains are often taxed at a lower rate than distributions. The firm holds little in the way of debt which is a net positive given skyrocketing costs of capital.

Surprisingly for what is typically a very capital/ technology intensive sector, Magnachip solely has ~$100M in net plant, property & equipment, perhaps suggesting a heavily outsourced production model.

Simplified Cash Flow Statement

The company generated $12.1M in cash flow from operations in 2Q FY 2022 with a large part of this attributable to other operating activities and a cash collection exercise culminating in a sizable reduction in accounts receivable (-$11.2M).

Other standouts on the cash flow statement include little to no new investments whatsoever. On the cash flow from financing side, some minor repurchases of common stock took place ($1.0M) with the $37.5M likely to be tabled into 4Q this year, as had occurred the year earlier.

In any case the firm is self-financing, has negligible debt and enough cash on hand to finance both capital expenditure and stock buybacks as required.

Risks

Any investment in risk capital presently comes with a bagful of price action peril. In a semiconductors space facing extensive component shortages, export controls, increased regulation, and break-neck speeds for technological change, nothing could be truer.

For Magnachip, some positives remain – the firm has cash on hand, little to no debt, and a degree of diversification in its marketing mix.

Yet that may not be enough. The company has already guided significantly lower next quarter (sales in the range of $70M to $75M) with continued wafer shortages handicapping a robust sale drive.

Its key markets all remain heavily discretionary and, as the US economy slides into recession, are likely the first markets to bear the brunt of tightened consumer purse strings. Televisions, cars, and computers are often one-off spends – a lot of which was perchance carried out during the pandemic.

Given the current outlook for risk capital in general, and particularly the semi-conductor space, more opportunity for downside is likely.

Key Takeaways

- Magnachip Semiconductor Corporation is a California based semiconductor specialist with markets for OLED control systems and power systems that find themselves in an array of industries – cars, smartphones, and computers to name a few.

- The firm, like the entire semiconductor industry, is reeling from component supply disruption borne out of the global health pandemic several years ago.

- Semiconductors also have increasing geopolitical importance. As a result, US export bans and increased regulation has put an anchor on total addressable markets and revenues.

- Capital allocation has been a corporate strength – it has maintained cash on its books, taken a disciplined approach to R&D spend, avoided recourse to onerous debt and plans to return capital to shareholders via buybacks.

- However, macro-economic clouds abound for a sector that finds itself heavily discretionary and subject to consumer appetite for more stuff. Consumer hunger for new stuff may abate as the US economy tips into a challenging, drawn-out recession.

Be the first to comment