imaginima

Thesis

Magellan Midstream Partners (NYSE:NYSE:MMP) is a leading midstream company focusing mainly on refined petroleum products. Through its extensive pipeline system (longest in the US), it has delivered tremendous visibility to investors with its largely fee-based operating model, with escalators/tariffs to cope with higher costs.

As a result, it gives the company strong confidence in delivering its continued growth in dividends with a disciplined CapEx framework, supporting the growth of its distributable cash flow (DCF).

Magellan has also benefited from the heightened commodity pricing environment in 2022, as MMP posted a YTD total return (including dividends) of 16.2%, well above its 10Y total return CAGR of 8%.

Notwithstanding, management sees less potential upside to its guidance in H2’22, as commodity prices moderated markedly through Q2. Furthermore, underlying commodity prices have remained relatively tepid through September as the market continues to be concerned about demand destruction.

Despite that, management accentuated that its business model is relatively inelastic to the movement in underlying prices and, therefore, has kept its guidance for FY22.

We gleaned that MMP has continued to trade at levels well below its 10Y valuation mean. However, we also noted that the market had not re-rated MMP despite its low valuations. Therefore, with less potential for upside surprises through Q4 and even through Q1’23, MMP could continue to trade in a tight range.

We believe the near-term downside risks for MMP due to underlying market volatility could offer investors another opportunity to add at more reasonable levels.

Hence, we now rate MMP as a Hold and urge investors to await a better entry point.

Magellan’s Commodity Pricing Tailwinds Could Level Off

Magellan’s ability to maintain its guidance demonstrated the resilience of its business model and relative inelasticity to the recent commodity price movements.

Despite that, management’s commentary suggests that investors should expect less potential for further upside surprises that could lift the momentum of MMP in the near term. Coupled with an expected cost increase, it could further hamper its near-term upside.

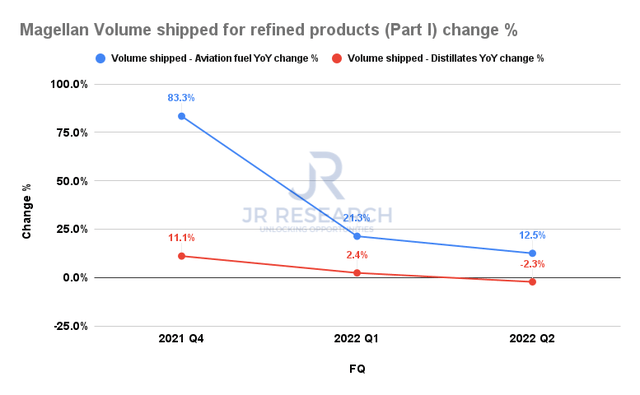

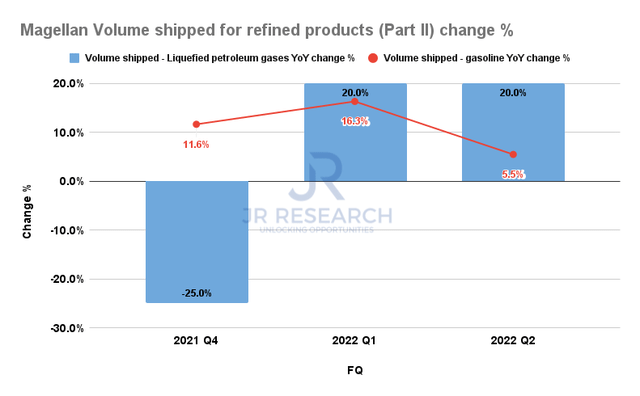

Magellan Volume shipped for refined products (Part I) change % (Company filings) Magellan Volume shipped for refined products (Part II) change % (Company filings)

Also, we gleaned that more challenging comps for Magellan could impact the growth in its volume shipped for refined products moving ahead. As seen above, volume shipped growth across its products has continued to moderate through FQ2’22, even though liquefied petroleum gas and aviation fuel remain strong.

Therefore, it remains to be seen how the weakness in forward commodity prices could worsen the growth cadence given the growth deceleration in its volume shipped.

Robust Distributable Cash Flow Should Still Underpin Buying Sentiments

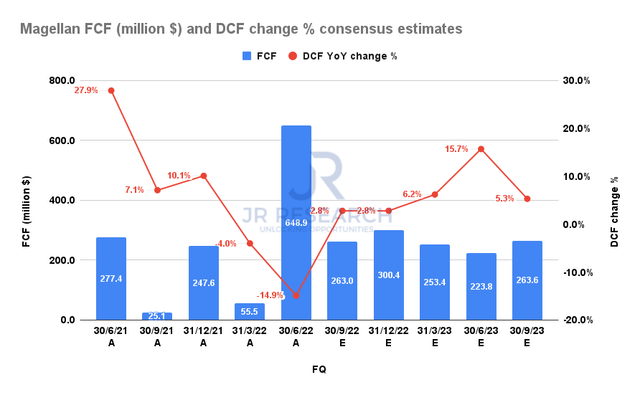

Magellan FCF and DCF change % consensus estimates (S&P Cap IQ)

Notwithstanding, the consensus estimates (neutral) suggest that Magellan’s strong free cash flow (FCF) generation should continue to underpin its distributable cash flow (DCF) through FY23.

As a result, we believe it should help underpin buying sentiments in MMP, spurring investors’ confidence in delivering management’s strategic focus on distribution.

We believe the estimates seem credible, given management’s confidence in maintaining its guidance, despite recent weakness in commodities pricing.

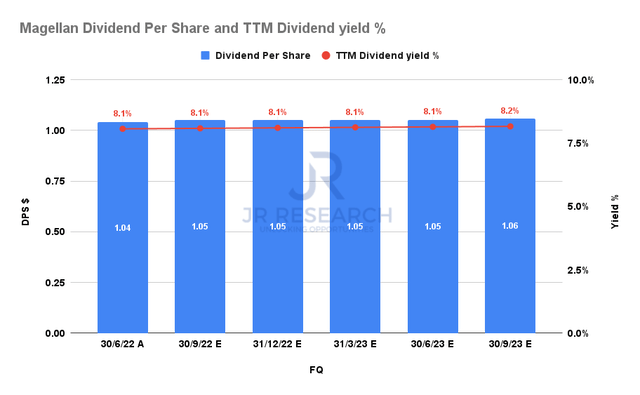

Magellan Dividend per share and TTM dividend yield % consensus estimates (S&P Cap IQ)

Therefore, we are confident that Magellan’s dividend per share (DPS) estimates are credible. As a result, its robust dividend yield exceeding 8% through FY23 should provide strong downside resilience in MMP, even though there could be near-term downside volatility.

Is MMP Stock A Buy, Sell, Or Hold?

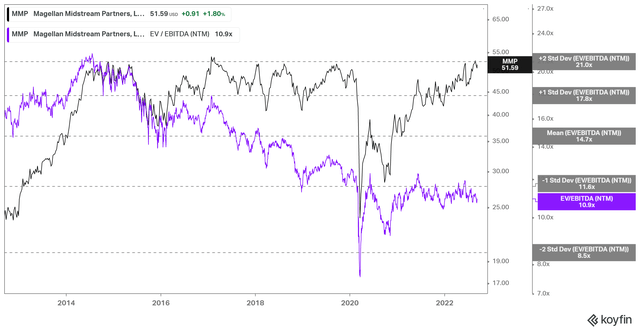

MMP NTM EBITDA multiples valuation trend (koyfin)

We gleaned that MMP has been materially de-rated despite reporting solid operating performance in H1. MMP’s valuation has been unable to break above the one standard deviation zone below its 10Y mean. Notwithstanding, it appears to be moving within a tight range, corroborating our thesis of robust near-term support.

Furthermore, management has continued to implement its stock buyback program, as it posted a TTM buyback yield of 6.3%, with slightly under $500M left in its authorization through 2024. Therefore, we deduce the company’s war chest should continue to boost investors’ confidence if a dislocation occurs for management to intervene with stock buybacks aggressively.

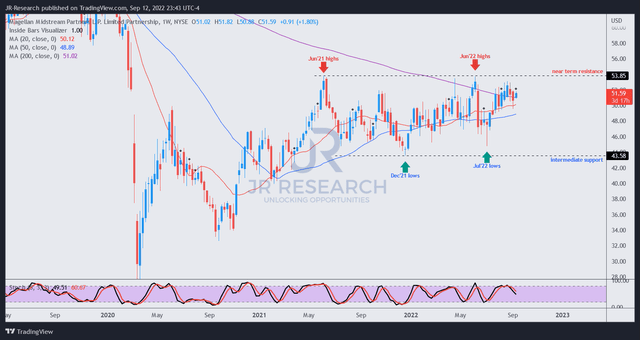

MMP price chart (weekly) (TradingView)

However, we observed that MMP’s price action seems to have stalled close to its near-term resistance. Despite that, it appears to have robust buying support at its intermediate support, close to its July lows.

Therefore, we deduce that MMP could still face near-term downside volatility if the prices in the underlying markets weaken further. It could impact MMP’s total return despite its robust capital allocation policies to mitigate the potential downside risks.

Notwithstanding, we see more potential downside risk in MMP’s price action at the current levels. Therefore, we believe it’s appropriate to maintain a prudent stance and await a better entry point.

Accordingly, we rate MMP as a Hold for now.

Be the first to comment