AsiaVision/E+ via Getty Images

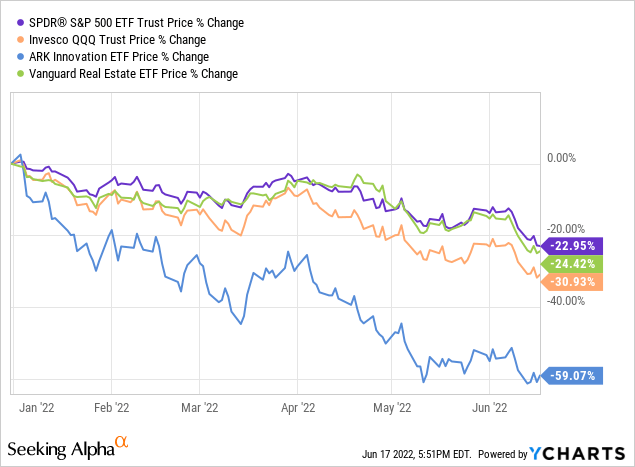

Stocks are crashing right now as historically high valuation multiples, soaring interest rates, raging inflation, and rapidly increasing expectations of a recession are combining to form the perfect storm for public markets. The S&P 500 (SPY) is firmly in bear market territory, as are REITs (VNQ). The Nasdaq (QQQ) is getting hit even harder and high growth technology (ARKK) has gotten absolutely slaughtered:

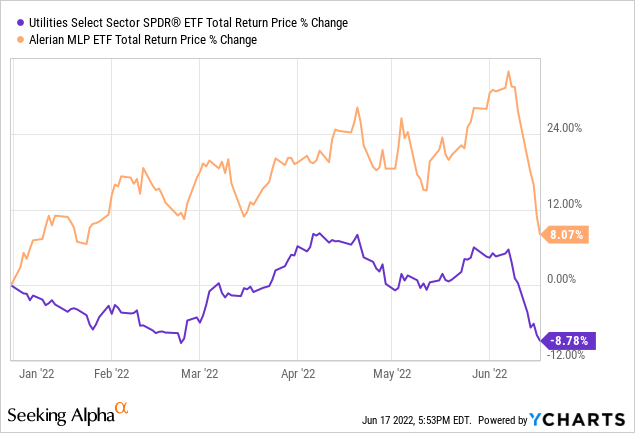

Even highly defensive utilities (XLU) are getting hit due to rising interest rates eroding the value of what have typically been considered bond proxies. Only midstream (AMLP) has managed to keep its head above water thus far this year thanks to a combination of trading at historically cheap valuations, improving sector balance sheets and free cash flow generation, and a spike in energy prices:

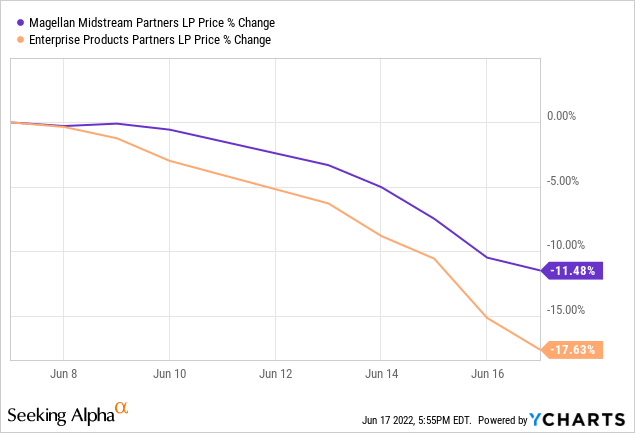

However, despite these positive impacts, over the past ten days midstream has taken it on the chin, sending even blue chips with impressive multi-decade distribution growth streaks like Magellan Midstream (NYSE:MMP) and Enterprise Products (NYSE:EPD) plummeting:

In this article, we will discuss these two businesses and share why we think the dip is a great time to add these low-risk high yielders to your portfolio to help you keep calm and collect dividends.

MMP: Sky-High Yielding Inflation Hedge

MMP is without a doubt one of the most boring midstream businesses on the market today. Its growth capital expenditure budget is definitely one of the lowest relative to its size today, despite being one of the smaller investment grade midstream businesses with a $10.73 billion market cap. Management stated on its latest earnings call:

We now expect to spend approximately $70 million in 2022 on expansion capital

Though this amount could increase a little if they identify additional growth projects. Either way, growth spending is likely to be less than 1% of its current market cap and possibly even less than 0.5% relative to its enterprise value this year. No matter how you look at it, that is a very small capital budget.

However, management’s long-term returns on invested capital have been the best in the industry, so its ultra-conservative approach to investing in new projects is commendable, and it has proven to be very generous with returning excess cash flow to unitholders.

At a recent investor conference, management stated that it plans to continue that practice moving forward:

We’ve increased our annual dividend for 20 consecutive years. Obviously, some years are higher and some years we’re lower. We already announced that we expect to have distribution growth, similar in 2022 to what we did in 2021. We haven’t announced the timing or how that’s going to work. But to give investors a sense, it’s probably going to look about the same.

On top of that, MMP has proven to be quite aggressive with unit repurchases and has said that in 2022 they expect any excess cash flow to go towards additional unit repurchases.

Meanwhile, the business model is quite defensive, with the vast majority of cash flows (85%+) stemming from fee-based commodity price resistant contracts. This means that MMP’s cash flow profile is remarkably stable. When combined with the rock-solid balance sheet that enjoys an industry-best BBB+ credit rating, MMP provides investors with a low risk profile.

MMP is also remarkably well positioned to benefit from inflation, and even recently received upgrades from both J.P. Morgan (JPM) and Goldman Sachs (GS) analysts for this very reason.

MMP enjoys tariff changes that are related to the Producer Price Index as well as market factors, leading to an expected average tariff increase of 6% next month. GS analyst Michael Lapides also pointed out that with the PPI index at ~14% year-to-date, MMP is poised to see a major tariff hike in 2023 as well.

Management also pointed out at the aforementioned recent investor conference the durable competitive advantage that it possesses in the refined products’ industry that should enable it to enjoy strong tariff increases for years to come:

There’s a big difference between the crude oil industry and the refined products industry. I think we have to start there to understand why our refined products business is different from and in some cases, has more sort of franchise value to it, overall. And that is on the refined products side, it is a demand pull system. If you look at the areas of the country we serve from Houston, as far north, as Fargo, North Dakota, technically as far west as El Paso, and basically everywhere in between, if you look at those areas of the country, the demand for refined products is the demand for refined products.

So, whether it’s 1 million barrels, 8 million barrels, whatever the demand is, we’re the cheapest, safest, cleanest way to get those fuels into those markets. So, that demand pull creates a stability or a franchise value to our refined products business. Combine that with the fact that we’re connected to 50% of the refining capacity in United States. So, if you take that breadth of supply that we have and you look at that network of the pipeline we have, it’s not a point A to point B pipeline. You can put barrels in Tulsa, Oklahoma, and 20 minutes later, pull out barrels in Florida, and Fargo, North Dakota…

When you put all that together, what it really means is it has a lot of value to our customers in terms of optionality what they can do with our system… A competitor may come in and want to build a pipe from point A to point B. But if they’re really going to try and take volume off of our system, they have to be able to get to point A, B, C, D, E, and F, because that’s what we’re offering. We’re offering all of that, not just point A to point B.

So, it’s just a higher barrier to entry we have. We’re much more differentiated. We think that differentiator essentially translates into the ability, so long as we’re providing value to our customers to increase prices, as or should declines in product happen through time, which I don’t know if any of you all saw the Analyst Day, we think is a lot longer in the future than what most people probably think. But should that happen and we get into that secular decline mode, we don’t think it moves into a knife fight, because we’re differentiated. As long as we stay focused on the value to our customers, which I think is still quite high, we should be able to raise our prices with inflation and be able to offset that volume decline such that our financial performance is really stable, and potentially getting better.

This all combines with the 8.8% distribution yield that is well covered by distributable cash flow to offer a compelling combination of very attractive current yield, conservative business model and balance sheet, and strong inflation protection.

EPD: The Complete Package

EPD – similar to MMP – has a stellar BBB+ credit rating that jointly leads the sector along with Enbridge (ENB). It also has a terrific distribution growth track record that will soon put it in the Aristocrat category.

However, while it certainly enjoys a similarly low-risk balance sheet profile with MMP, EPD has even more to offer investors.

First and foremost, its business model is more diversified, with meaningful exposure to NGLs and natural gas and even some initial exploration into renewable fuels and other renewable energy technologies. On top of that, EPD is retaining considerably more cash flow than MMP is and has more opportunities to deploy it into opportunistic growth projects. As a result, its current distribution yield is ~90 basis points lower (7.9%) and it is buying back far fewer units on a percentage basis of its market cap than MMP is.

However, it recently acquired Navitas Midstream in a deal that is expected to be accretive to cash flow per unit and generate double-digit returns on invested capital, with considerable follow-up growth investment opportunities. Furthermore, EPD just announced a new $5 billion steam cracker in Texas that should also fuel further growth.

On top of that, EPD is also quite inexpensively priced and has proven to weather economic storms extremely well. Its EV/EBITDA multiple is only 9.29x at present, well below its five-year average of 11.01x. When combined with its expected 4.7% distributable cash flow per unit growth rate through 2026 and 7.9% current distribution yield, EPD offers investors compelling value. Meanwhile, its EBITDA only declined by 0.8% in 2020, reflecting just how resilient its business model is to extremely adverse macroeconomic conditions.

Investor Takeaway

MMP and EPD both offer investors extremely high current income that is very safe from the threat of a cut. As a result, income investors looking for a lucrative source of dependable income would be hard-pressed to find better investments at present.

On top of that, both investments are good inflation hedges – particularly MMP – and EPD offers investors strong growth potential via investments in attractive growth projects. EPD – with its more diversified business model – is also better positioned to weather economic storms and energy transition threats to the industry. Overall, we favor EPD here, but think there is certainly a place for MMP in a conservative-oriented income investor’s portfolio as well.

Be the first to comment