skynesher

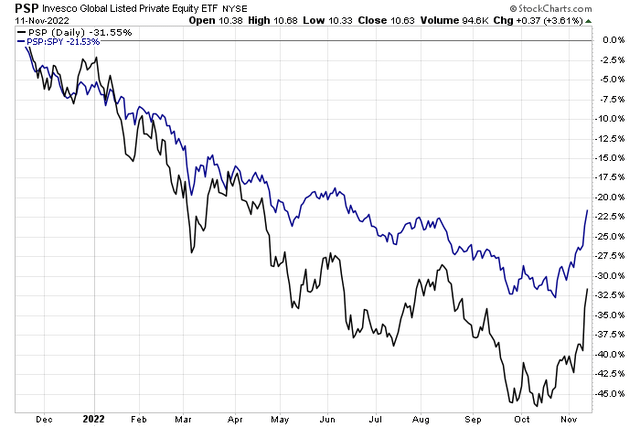

Private equity stocks and companies involved in the capital markets have suffered as fewer deals have been sought and secured in 2022. I notice, however, that the Invesco Global Listed Private Equity ETF (PSP) has rallied to its best level in five months. The move has also outperformed the latest jump in the S&P 500 ETF (SPY).

One of the fund’s holdings reported a strong quarter last week, but the stock traded lower. Is Carlyle (NASDAQ:CG) a value here?

Private Equity Stocks Turning The Corner?

According to Bank of America Global Research, Carlyle is one of the largest alternative asset managers in the world, and its business spans three segments – global private equity, global credit, and global investment solutions. Carlyle has offices worldwide, was founded in 1987, and was publicly listed on the NYSE in May 2012.

The Washington, D.C.-based $11 billion market cap Capital Markets industry company within the Financials sector trades at a low 6.3 trailing 12-month GAAP price-to-earnings ratio and pays a high 4.3% dividend yield, according to The Wall Street Journal.

Fundraising could be pressured in the next several quarters, with the capital markets continuing to experience tough times. The hope is that the economy troughs and interest rates stabilize at some point in 2023. Until then, and perhaps even into 2024, though, assets under management and fee-related earnings may be weak. The fact that the company earns 70% of its revenues from its big private equity platforms could pose a risk.

Upside potential comes from more than $80 billion in dry powder and increasing earnings quality. There could also be better acquisition candidates in the year ahead as market valuations drop.

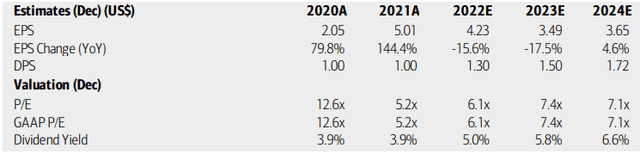

On valuation, analysts at BofA see earnings falling materially this year and next before a normalization in 2024. Dividends are expected to grow at an impressive pace through 2024 while the company’s operating and GAAP P/Es continue to look attractive. Finally, CG’s yield looks solid so long as the payout holds up through next year. Overall, while EPS growth is poor in the coming four quarters, the stock appears cheap, and Seeking Alpha rates it with a B- valuation.

Carlyle: Earnings, Valuation, Dividend Forecasts

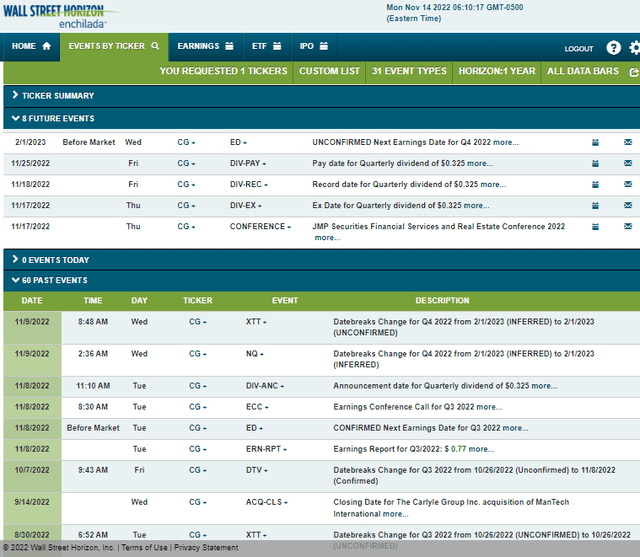

Looking ahead, corporate event data provided by Wall Street Horizon shows an upcoming speaking engagement. Carlyle Group’s management team is slated to present at the JMP Securities Financial Services and Real Estate Conference (virtual) on Thursday, November 17. That’s also when the stock goes ex-div. Finally, CG has an unconfirmed Q4 2022 earnings date of Wednesday, February 1, 2023, before market open.

Corporate Event Calendar

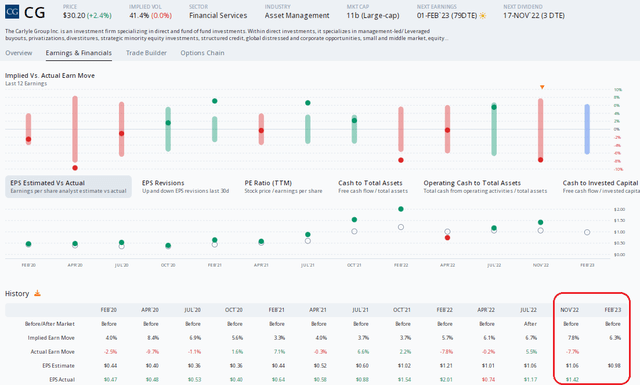

The Options Angle

Carlyle reported Q3 results last week and declared a $0.325 dividend. The company reported $1.42 of per-share profits versus a consensus forecast of just $1.06, according to Option Research & Technology Services (ORATS). The stock traded sharply lower post-earnings, but the drop was in line with what the options pricing suggested.

For the February quarter, analysts see EPS of $0.98 and there have been 11 recent upward EPS revisions, per ORATS. The options market implies a 6.3% move following the next quarterly report.

CG: Shares Slide Despite an EPS Beat

The Technical Take

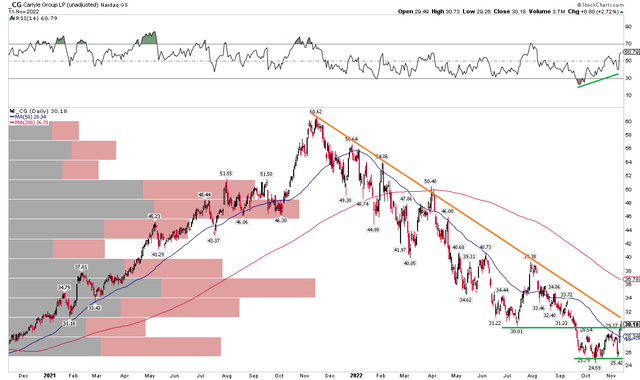

CG is attempting to stabilize in the mid-$20s after a dreadful year that has seen shares drop by more than half. What’s encouraging for the bulls is that the stock has rallied to nearly two-month highs on rising momentum. Notice the RSI indicator at the top of the chart – it shows the highest reading in almost three months, confirming the small breakout in price. The overall trend remains lower, though. We need to see CG climb above $32, but even then, the falling 200-day moving average could prove problematic in the mid-$30s.

Overall, the technical picture looks better, but there are still issues.

CG: A Downtrend Showing Signs of Breaking

The Bottom Line

I like Carlyle’s valuation and dividend yield here, but there are macro risks. Moreover, the technical picture still shows a downtrend. I am a hold on the stock amid these mixed signals.

Be the first to comment