imaginima

Magellan Midstream Partners, L.P. (NYSE:MMP) is one of the largest and most well-known midstream partnerships in the energy industry. We have long liked midstream partnerships for our energy income portfolios due to their general stability and high yields. Magellan Midstream Partners certainly has a high yield, which sits at 8.35% as of the time of writing. However, it does not enjoy the same cash flow stability as some of its peers for reasons that we will discuss in this article.

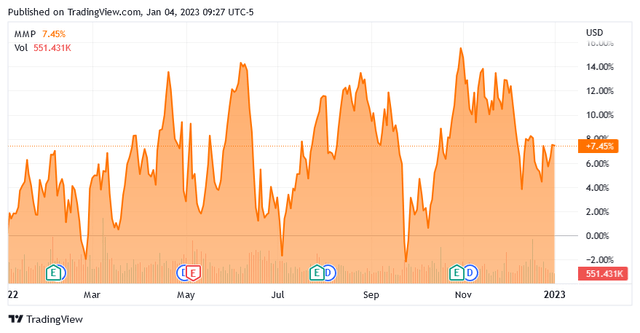

The company could still earn a place in your portfolio, though, due to its enormous size and balance sheet strength providing it with a number of advantages over smaller and weaker midstream partnerships. The company certainly has earned some of the respect that many investors give it, as its common units were among the few equities that actually delivered a positive return over the past year. The company’s growth prospects are unfortunately somewhat limited, but its 8.35% current yield can mostly make up for that. Therefore, let us investigate and see if Magellan Midstream Partners could be a good addition to your portfolio today.

About Magellan Midstream Partners

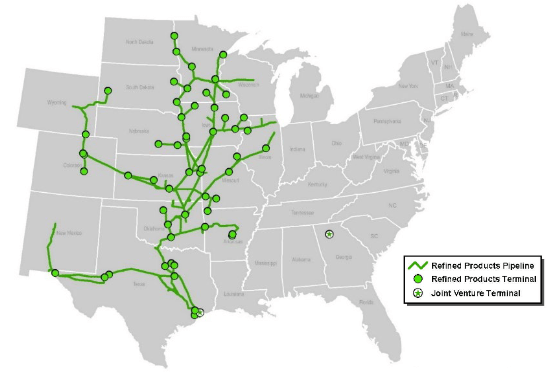

As stated in the introduction, Magellan Midstream Partners is one of the largest and most well-known midstream master limited partnerships in the United States. The company is primarily known for its extensive network of refined product pipelines, which stretch across most of the central part of the country:

Magellan Midstream Partners

Magellan Midstream Partners owns approximately 9,800 miles of refined products pipelines, 47 million barrels of refined products storage, and 54 refined product terminals. This gives the company the largest refined products midstream infrastructure network in the United States. There may be some readers that point out that it does not extend to the East Coast or out to California, which is somewhat disappointing because the heavily-populated coasts are major consumers of refined products. However, many of the nation’s refineries are actually located in the central part of the country, and Magellan Midstream’s network connects to about 50% of the nation’s entire refining capacity. This provides the company with a very solid supply of refined products to transport.

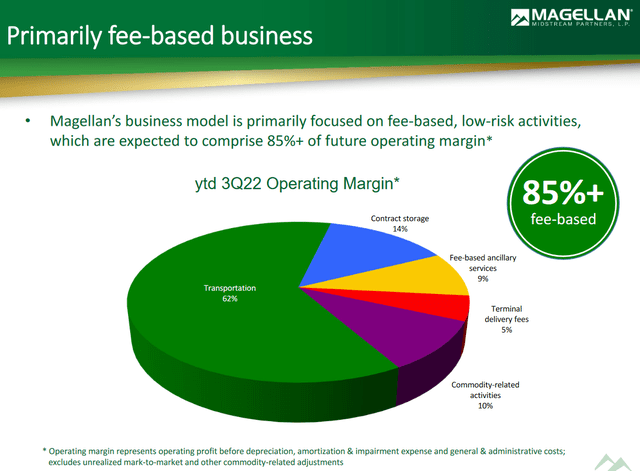

The fact that the company has access to a large supply of refined products is important because of the business model that the company uses. As is the case with most midstream companies, Magellan Midstream Partners enters into long-term contracts with its customers for the transportation of refined products. In exchange for the company’s transportation and storage services, the company’s customers compensate it based on the volume of resources that they send through the company’s infrastructure and not on the value of these resources. In fact, about 85% of the company’s operating margin (a proxy for operating profit before accounting for depreciation and amortization) comes from these volume-based fees:

This is nice because it means that Magellan Midstream Partners is somewhat insulated from commodity price fluctuations. Refined products typically trade somewhat in line with crude oil prices and as we saw over the past two years, crude oil prices can sometimes vary significantly. The fact that Magellan Midstream charges its customers based on volumes provides a certain amount of stability to the company’s cash flow that would not exist if it billed based on refined product prices.

With that said, Magellan Midstream Partners’ cash flows are not as stable as those of some other midstream companies. The biggest reason for this is that the demand for refined products can decline during economic slowdowns. We saw this in a very big way during 2022 as the lockdowns encouraged most people to stay at home and avoid driving, which drastically reduced the demand for refined products. The volume of refined products that is transported by the company’s pipelines depends directly on the demand for such products. Thus, its volume will decline when the demand for these products goes down, which has a direct effect on the company’s cash flows. There are a growing number of predictions that the United States will enter into a recession during 2023, which could be a concern as recessions usually cause the demand for refined products to decline. Thus, Magellan Midstream Partners could see a cash flow decline over the next few months, although it will likely not be as severe as the 19.50% decline that the company experienced back in 2020:

|

FY 2021 |

FY 2020 |

FY 2019 |

|

|

Distributable Cash Flow |

$1,118.0 |

$1,044.5 |

$1,297.5 |

(All figures in millions of U.S. dollars.)

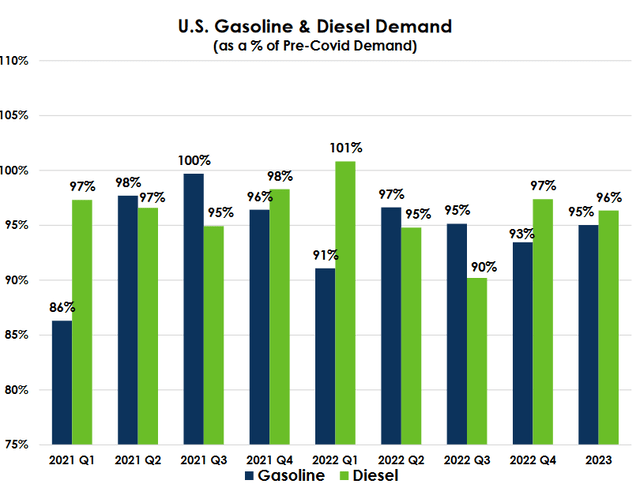

We can clearly see that the company’s 2020 decline was a one-time event but unfortunately it did not fully recover to its full-year 2019 levels in 2021. This is partly because of the lingering effects of the pandemic. Although we did see many economies, both in the United States and abroad, begin to reopen following the disastrous effect of the lockdowns, there were many people that still remained in fear and so spent more time at home than they would have prior to the pandemic. In addition, we have seen an enormous surge in remote work that persists to this day. A person that works at home will naturally not need to travel to work every day, as they would in the absence of the ability to perform their job functions remotely. That reduces the demand for refined products, such as gasoline and diesel fuel. As we can see here, the demand for these products still remains below pre-pandemic levels:

NuStar Energy/Data from U.S. Energy Information Administration

Unfortunately, the company’s cash flows in 2022 have been quite disappointing:

|

Q3 2022 |

Q2 2022 |

Q1 2022 |

|

|

Distributable Cash Flow |

$290.1 |

$228.0 |

$265.4 |

(All figures in millions of U.S. dollars.)

The company’s distributable cash flow in all but the third quarter was still lower than in the comparable quarter of 2021 but it is still generally performing better than what it saw in 2020. The company has yet to release its fourth quarter 2022 results but it has guided for a distributable cash flow of $1.1 billion, which would be a decline over 2021 levels but still represents a recovery from what we saw in 2020. As we can see above, the demand for gasoline and diesel fuel is expected to be pretty similar to 2022 levels in 2023 and below that of the best quarters of 2021. Thus, we can assume that Magellan Midstream Partners’ 2023 distributable cash flow will be right about the same level that we are seeing so far this year. Thus, we will probably not see a significant appreciation in the company’s unit price and investors should expect the distribution to make up nearly all of the return that we will see over the next twelve months. This is far from unprecedented as the company’s unit price was only up a moderate 7.45% over the trailing twelve months:

This is nowhere close to the return that a few of the company’s peers have delivered over the same period:

|

Company |

TTM Return |

|

Magellan Midstream Partners |

7.45% |

|

MPLX (MPLX) |

8.85% |

|

Kinder Morgan (KMI) |

10.15% |

|

The Williams Companies (WMB) |

21.32% |

|

DCP Midstream (DCP) |

36.52% |

This is certainly discouraging from an investment perspective, but it is important to keep in mind that none of these peers have the refined products infrastructure that Magellan Midstream Partners owns. As such, including Magellan Midstream Partners in a portfolio that also contains some of these other companies can help achieve diversification across the various types of midstream companies.

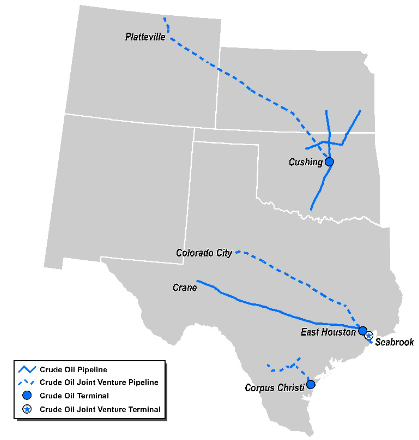

Magellan Midstream Partners is more than just a refined products midstream company, although that is by far its biggest unit. The company also owns and operates a fairly sizable amount of crude oil midstream infrastructure.

Magellan Midstream Partners

In total, Magellan Midstream Partners owns 2,200 miles of crude oil pipelines and 39 million barrels of crude oil storage capacity. This infrastructure uses a very similar overall business model to the company’s refined products network but it does have a bit more stability. This is because the contracts that Magellan Midstream Partners has with its customers include minimum volume commitments. These contractual clauses specify a certain number of resources that the customer must send through Magellan Midstream Partners’ infrastructure or pay for anyway. This adds a certain amount of cash flow stability because it protects the company’s cash flow against a decline in oil production that frequently accompanies lower crude oil prices. Thus, this unit is somewhat more protected against issues in the broader economy than the refined products business and provides the company with a certain baseline level of cash flow that can help to support the distribution. This adds somewhat to Magellan Midstream Partners’ appeal as an income investment, despite the fact that this business unit is substantially smaller than the firm’s refined products segment.

Financial Considerations

It is always important to analyze the way that a company is financing itself before we make an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid. As this is usually accomplished by issuing new debt to repay the existing debt, a company may see its interest expenses increase following the rollover depending on the conditions in the market. In addition, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a decline in cash flows could push a company into financial distress. Midstream companies usually have remarkably stable cash flows but as we have already seen, Magellan Midstream’s cash flows are not as stable as some of its peers so this is a risk that we should be aware of as part of our investment analysis.

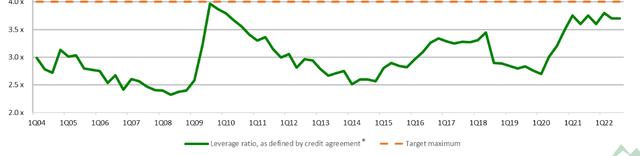

One metric that we can use to analyze a midstream company’s debt load is its leverage ratio. This ratio, which is also known as the net debt-to-adjusted EBITDA ratio, essentially tells us how many years it would take a company to completely pay off its debt if it were to devote all of its pre-tax cash flow to that task. As of September 30, 2022, Magellan Midstream Partners had a leverage ratio of 3.7x based on its trailing twelve-month adjusted EBITDA. This is quite a bit higher than the sub-3.0x ratio that it had back in early 2020:

With that said, analysts usually consider anything below 5.0x to be a reasonable ratio. Magellan Midstream Partners is clearly well below that requirement. As I have pointed out in many previous articles though, I usually like to see this ratio below 4.0x in order to add a margin of safety to the investment. That is also the level that most of the best-financed companies in the industry maintain. Magellan Midstream Partners clearly fulfills that requirement as well. Thus, it does not appear that we have too much to worry about here in terms of the company’s debt load, as the company should be able to carry its debt even if its cash flow does decline temporarily, such as what might happen if we enter into a recession in 2023.

Distribution Analysis

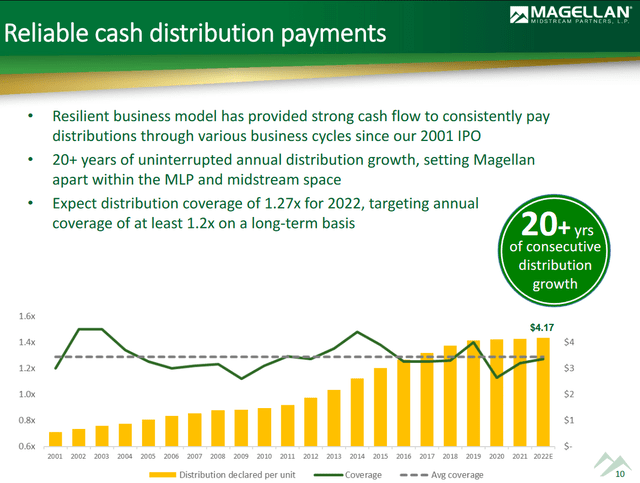

As mentioned in the introduction, one of the biggest reasons that we invest in midstream companies like Magellan Midstream Partners is because of the high yield that it pays out. In fact, that is one of the only reasons to invest in the company since its growth prospects are limited, as we already discussed. Fortunately, the company certainly does not disappoint in this area as Magellan Midstream Partners boasts an 8.35% yield at the current price. This yield is sufficient to ensure a reasonable total return even if the company’s unit price remains flat in the market. Magellan Midstream Partners has a better track record than many of its peers in this area as it has raised its distribution annually for more than twenty years:

This is something that is nice to see given the high level of inflation that has been dominating our economy for the past year. This is because inflation is constantly reducing the number of goods and services that we can purchase with the distribution that the company pays us. This can make it feel as if we are getting poorer and poorer with time. The fact that the company increases the amount of money that it pays us every year helps to offset this effect and maintain the purchasing power of the distribution.

As is always the case though, it is critical to ensure that Magellan Midstream Partners, L.P. can actually afford the distribution that it pays out. After all, we do not want it to be forced to reverse course and reduce the distribution. That would obviously decrease our incomes and would almost certainly cause the company’s unit price to decline.

The usual way that we determine a company’s ability to pay its distribution is by looking at its distributable cash flow. This is a non-GAAP measure that theoretically tells us the amount of cash that was generated by a company’s ordinary operations that is available to be distributed to the common unitholders. In the third quarter of 2022, Magellan Midstream Partners reported a distributable cash flow of $290.1 million but paid out $215.2 million during the quarter. This gives the company a distribution coverage ratio of 1.35x for the quarter. This is a reasonable ratio that is well above the 1.20x that analysts typically consider reasonable and sustainable. I, however, am more conservative and like to see this ratio above 1.30x in order to add a margin of safety to the investment. Magellan Midstream Partners did satisfy my stricter requirement during the third quarter but management has stated that it expects the distribution coverage ratio to be 1.27x for the full-year 2022 period. That is still acceptable but it is well below the 1.50x or higher ratios that we see among many of the other companies that we discuss here at Energy Profits in Dividends. Thus, Magellan Midstream Partners is merely acceptable here and I would certainly prefer to see a higher coverage ratio to reduce the risks of trouble down the line.

Conclusion

In conclusion, Magellan Midstream Partners may deserve a place in your portfolio as a diversifier. The company offers one of the only ways to get dedicated exposure to refined product infrastructure, which has very different fundamentals from the natural gas-focused companies that we normally cover. The company suffers from a lack of significant growth prospects but its distribution yield is sufficient to make up for that. The company boasts a strong balance sheet that also adds a certain amount of comfort to a long-term position.

Perhaps the only real concern that I have here is that the distribution coverage is tighter than I really want to see, but Magellan Midstream Partners, L.P. can probably avoid any forward distribution cuts. Overall, this one is worth considering adding to our portfolios.

Be the first to comment