Kong Ding Chek/E+ via Getty Images

August slump creates a new opportunity

In August 2022, Sanofi’s price (NASDAQ:SNY) per share collapsed by 17.44%, a rather surprising result for a company that historically has always had very low volatility. Within this article I will highlight the negative aspects that led to a collapse of such a magnitude and especially why I am not concerned. Rather than a rout I consider this collapse an opportunity.

ZANTAC’s legal concerns

The main reason behind the collapse is related to ZANTAC’s legal concerns. To understand the nature and severity of this phenomenon, it is necessary for me to briefly summarize the history from its origins.

ZANTAC was a drug created by GSK (GSK) in the 1980s sold as a prescription and over-the-counter (‘OTC’) product and was intended to treat heartburn. In 2017, Sanofi purchased the OTC rights to this medication after it had been on the market for more than 35 years. The problem related to this matter is that after a little more than 2 years that Sanofi bought the rights, on September 13, 2019, the FDA issued a statement where it declared that ranitidine-based medicines, such as OTC ZANTAC, found an excessive amount of NDMA in the samples analyzed. This statement provoked a multitude of lawsuits against Sanofi in U.S. courts in the following days, in which financial compensation was sought for damages received, going so far as to claim that ZANTAC had been the cause of several cancers. After this claim, Sanofi decided to voluntarily withdraw the drug from the market in the U.S. and Canada and then carried out further testing.

One reason why this issue that arose in 2019 is now affecting Sanofi’s stock market performance is related to a note that Morgan Stanley (MS) analysts delivered to their clients in August 2022.

There is considerable uncertainty at this stage surrounding the potential total financial impact of the ZANTAC litigation.

According to their expectations, the damages from the litigation could be between $10.50 billion and $45 billion. The moment the market learned of these figures, it decided to punish all the companies that marketed the drug, primarily GSK and Sanofi. Looking at the sharp collapse these companies have achieved, I think the market is already discounting the worst possible scenario.

Why I’m not worried

Although this is a rather uncomfortable issue, overall I do not consider a scenario in which Sanofi would have to compensate billions of dollars to be likely. Sanofi’s response on this issue was not long in coming, and the response was impeccable. Here are the main points:

- Since 2019, scientific communities have been extensively studying the consequences of the active ingredient ranitidine in ZANTAC, and no evidence of harm to consumers has been found.

- The presence of NDMA is now a constant in our lives being present in drinking water, soil and common foods. People are already exposed on a daily basis to this toxin, albeit at minimal levels. The samples analyzed may have been an exception.

- Sanofi is not the only defendant company; in fact, several pharmaceutical companies marketed ZANTAC OTC. Moreover, Sanofi had purchased the rights to the OTC drug only 2 years before the FDA announcement, after it had already been on the market for 35 years.

Overall, the company seems very calm and placid about the whole affair, as the science does not support the claims of the whistleblowers, in my opinion. Currently, barring unforeseen events, there is no reason to think that the company will lose the litigation and shell out billions of dollars. The first trial involving Sanofi as a defendant is scheduled for February 2023.

I will end this paragraph with a statement made by Laura Sutcliffe, an analyst at UBS, as I think it best sums up the whole situation in a few lines:

We do not have a view on the likelihood or magnitude of a potentially negative outcome for Sanofi at this stage, but we do think that even not knowing will be enough to deter some investors.

So, just waiting for the first trial is already a reason for some investors to sell their shares. This impulsive behavior, I think, is excessive, and one must take advantage of this moment of fear to buy a solid company like Sanofi at a discount.

Investing in Sanofi

Investing in Sanofi means investing in one of the best European companies in the pharmaceutical field and one that currently capitalizes at €100 billion. The recent turmoil related to the drug ZANTAC is only a minor irrelevant parenthesis compared to the history of this company.

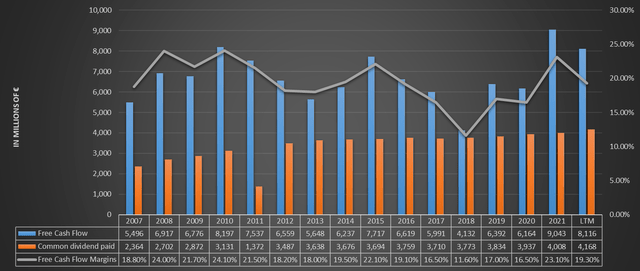

Since 2007, Sanofi has consistently generated free cash flow that amply remunerates its shareholders, sometimes with a dividend yield even above 5% (currently it is 4.13%). Over the long term, free cash flow has increased, with a margin over revenues usually around 20%. This is not a company that can guarantee double-digit returns every year, but it is a solid company that gives stability to the portfolio if bought at the right price.

Sanofi’s future seems to be in line with the past: the company continues to invest in research and is in the process of commercializing new drugs. In Q1 2022 CEO Paul Hudson expressed his positivity especially about the immunology-related portfolio.

We’re off to a good start in 2022 thanks to a strong commitment to our strategy. We’re proud of the progress made in Immunology, with a broad pipeline of 13 potential new treatments in development.

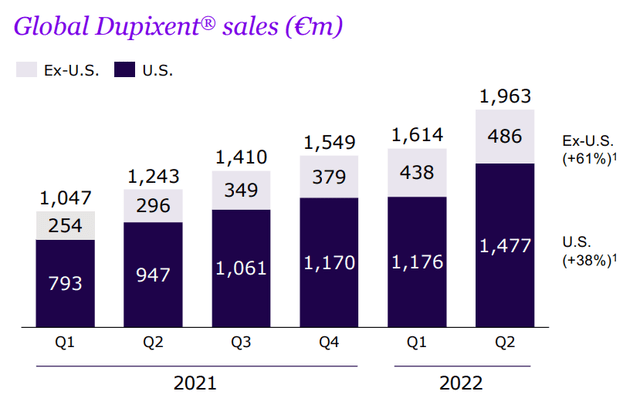

If immunology represents Sanofi’s future, Dupixent® represents the present. This is a drug on which Sanofi has a patent until October 2029 and which has been experiencing very strong growth in recent years. This drug is used for allergic diseases such as eczema, nasal polyps and asthma.

As can be seen, sales growth has increased by €720 million compared to Q2 2021, or 43% growth worldwide. This drug is the most important for Sanofi, as it alone generates 19.40% of total revenues. It will be very important to be able to cover the losses from Dupixent® patent expiration in 2029, especially if its growth continues and exceeds 19.40% of total revenues.

How much is Sanofi worth?

To understand what Sanofi is worth I will use a discounted cash flow. This model will be constructed as follows:

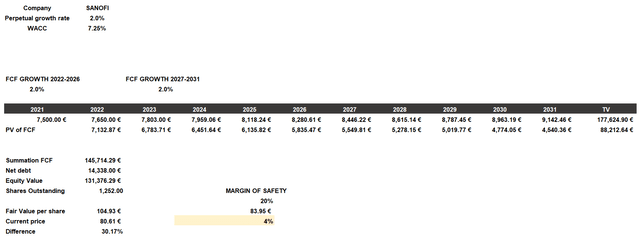

- The cost of equity will be 7.25% and includes a beta of 0.36, a risk-free rate of 3.50%, country market risk premium 4.70% and additional risks of 2.50%. I wanted to include such high additional risks to discount any issues related to ZANTAC’s legal dispute. The after-tax cost of debt will be 3.83%.

- Given a capital structure composed of 85% equity and 15% debt, the resulting WACC will be 7.25%.

- Outstanding shares and net debt are taken from TIKR Terminal

- The fair value will be compared to the stock listed on the Paris Stock Exchange. For that listed on the NASDAQ the reasoning is virtually the same.

- The growth rate of free cash flow will be 2% per year. Sanofi has shown very slow growth, so I would be surprised if it exceeds this threshold. The growth rate entered will be calculated from FY2021, but it does not represent the true FY2021 free cash flow. The reason for this is to keep expectations as conservative as possible: in FY2021 Sanofi generated €9 billion in free cash flow but in previous years it hardly exceeded €7 billion. This was a particularly good year that should not be regarded as ordinary. If I had calculated the growth rate from €9 billion the fair value would have been distorted.

According to my expectations, Sanofi’s fair value is around €105 per share, when it is currently trading at €80. This is a rather marked undervaluation for such a company and was mainly due to the legal dispute. Should the matter be resolved, I would not be surprised if Sanofi returns to €100 per share again. According to my expectations, the company will have no problem defending itself and will continue to develop new drugs and generate cash flow as it has done over the past decades. I see this collapse as an opportunity to buy and not to be scared. Of course, this is just my opinion and I could be wrong.

Be the first to comment