Gerald G Gantar

Thank you to all readers of our Marketplace Contributors Earnings Preview Roundtable series in July. Your comments and engagement were appreciated by all contributors involved.

With 2023 beginning, we thought now would be a good time to give you insight into what our contributors and services are focused on. For this week we start with the macro angle.

Our contributors were asked the following open ended questions:

What are you expecting and/or looking for in your area of focus for 2023?

What is one of your top ideas for 2023 and why?

Enjoy reading! Please share your comments below. We always love hearing your thoughts. Links to author profile and service are included. All services have either a two-week free trial or a limited one-month money-back guarantee. For a full list of Marketplace services, you can go here.

*Note for non-Premium readers: If the author provides a link to an article, we have included a dollar symbol ‘($)’ to indicate it is behind the paywall. Articles from this account, SA Marketplace, are not paywalled.

Elazar Advisors, LLC of Fed Trader: The market should hold up and go up in 2023. The Fed is, as we speak, about 400 basis points too aggressive based on the month print of CPI and PCE. Like they do everything, too late and too much, they’ll have to reverse all that tightening… again probably too late and too much. If they don’t they’ll be looking at -.1 and -.2 CPI prints. Deflation.

And if you ask… there’s going to be a recession? For a recession you’d need negative GDP prints, terrible jobs and jumping delinquencies. Uh, I don’t see any of that. So I think everybody is wrong.

Idea: Probably Bitcoin. My subscribers know I’ve been ahead of this both ways. I have recently turned from bear to bull. Everybody can say it’s here to change humanity, but for me it’s simply a macro trading instrument on steroids. And since most people trading it never heard of the Fed it makes it more worthwhile to pay attention to the Fed and their moves. I think the Fed flips hard in 2023 and that will squeeze all the new Bitcoin bears.

Disclosure: N/A

Eric Basmajian of EPB Macro Research: 2023 will start with recessionary conditions intensifying. Based on the sequence of leading indicators that we track at EPB Macro Research, there’s a high-risk window that the US economy descends into recession in the first half of the year.

The housing market will continue to weaken and the downturn will spread through manufacturing and finally hit the labor market by the spring.

The Federal Reserve will stop monetary tightening (pause) by March 2023 and will likely begin to lower interest rates slowly by the end of the summer. Stock prices may not benefit from these lower interest rates as the reason for the easier monetary policy will be recessionary conditions.

Idea: I think Treasury bonds across the curve will be strong performers in 2023 after sharp weakness throughout 2022. In 2022, Treasury bonds suffered greatly under the pressure of many historic rate hikes but will benefit in 2023 as rate hikes turn to rate cuts under recessionary pressures.

Lower risk options are the belly of the Treasury curve (SHY) (IEI). Two-year and five-year Treasury bonds offer more than 4% yields currently with little risk of price declines. Intermediate-term Treasury bonds (IEF) offer almost 3.9% yield currently and have the potential for larger gains should interest rates decline in 2023.

Long-term Treasury bonds (TLT) (EDV) are higher risk/speculative options. These bonds offer roughly 3.9% yields but have the potential for 20%-30% gains if interest rates decline sharply. There’s risk of price declines with long-term Treasury bonds as well.

Disclosure: Long IEI, TLT, EDV

ANG Traders of Away From the Herd: We’re expecting an increase in fiscal impulse from the federal government compared to 2022. We expect the Treasury to net-spend (transfer to the economy) $2-$3 trillion in 2023. This will increase liquidity and prevent the widely-expected recession which, in turn, will seed a new bull market.

A more complete argument can be found here: A New Bull Market Is Likely To Start In 2023.

Idea: Buy infrastructure, green energy (including nuclear), and disruptive technology – AI.

Disclosure: N/A

Steven Bavaria of Inside the Income Factory: 2023 may repeat themes we are already familiar with: Political, economic, and financial volatility, inflation, recession, etc. But most companies will survive and pay their debts, even if their stock tanks. That’s why I focus on credit investments, rather than equity, and I’m happy to collect 10% yields while waiting for the recovery.

My goal is to earn an equity return of 9%-10%, but not to be a hero doing so. That’s why I prefer credit bets to equity bets at a time when markets are so spooked they are paying me 10% and 11% yields to take risks that only paid 7% or 8% a year or so ago. Credit is an easier bet to win than equity, since all an issuer has to do is stay alive and pay its debts. Of course, for equity investments to pay off the company not only must stay alive, but also grow its earnings and ultimately its stock price.

Credit markets are currently overcompensating investors for perceived risks (Link), so there are lots of opportunities to earn “equity returns without equity.” That’s the essence of our Income Factory® strategy, which has proven itself in 2022.

Idea: There are lots of good credit investments, but I prefer closed-end funds in the corporate loan sector. One of my favorites is Invesco Senior Income Trust (VVR). VVR yields 10% and recently increased its payout. Between their top-of-the-capital-structure security position and floating interest rates, loans are an excellent investment vehicle to ride out whatever storms lie ahead, as they did in the crash of 2008/2009. Both VVR and the underlying loans themselves are selling at discounts, which offers further protection as well as some upside when markets recover.

As mentioned before, credit is an easier “bet” to win than equity. All issuers have to do is stay alive and pay their debts. With all the challenges facing our country and economy, a bet on corporate America to essentially “muddle through” seems like the way to go, especially if it pays us a yield of over 10%, which is essentially an equity-level return.

If this were a horse race, a credit bet would be like betting on horses to merely “finish the race,” a pretty simple bet to win. Equity is like betting on a few specific horses to finish ahead of the pack (“win, place or show”), a much harder bet to win.

Disclosure: VVR long.

The Macro Teller of Macro Trading Factory: Statistics are what bulls are touting.

Following a down year, there’s an 85% probability for the S&P 500 to rise.

Following a double-digit down year, the average return over the subsequent year is 18%.

The third year of a presidential term is the best one for stocks. We don’t dismiss or underestimate any of this.

Nonetheless, we never (solely) focus on history, statistics, or potential returns. Instead, we always (predominantly) focus on risks and risk management. And when we look into 2023 right now (regardless of potential return) we still see a lot of uncertainty.

High degree of uncertainty = high level of risk = low level of (market) exposure. It was as simple as that in 2022 and it’s as simple as that now.

This, of course, might change over time – we’re always open and flexible to change course – but for now, we still operate under a “risk off” mode, even if the first week (even month) of the year might prove itself to be (particularly) bullish. It’s not only about (absolute) return and it’s not only about (absolute) risk but about the ratio (relative value).

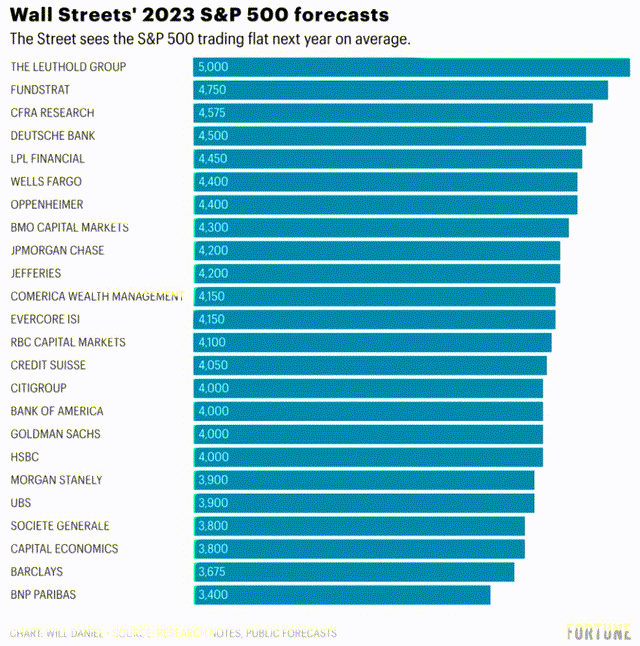

Fortune

Idea: Wall Street, like Wall Street, is always bullish.

Even Morgan Stanley (the most bearish big house on the street) expects 2023 to be positive (albeit slightly), but keep in mind that the level at the end of the year doesn’t reflect what necessarily is going to happen along the year.

Take Deutsche Bank for example. In spite of its 4500 target for year-end, the German bank sees the S&P 500 climbing to 4500, then tanking 25% (~3375, in-line with the level we indicated ($)), just to climb back to 4500.

More than anything, it’s important to remember the main guidance that you already read/heard us saying hundreds of times: It’s not only about (absolute) return and it’s not only about (absolute) risk but about the ratio (relative value).

Risk can be high and yet tolerable if the potential return is high enough (overcoming even a high risk). Potential return can be high and yet rejected if the risk is too high (overcoming the potential reward).

Even if stocks might deliver decent returns in 2023, it seems to us (at the moment) that bonds are positioned to deliver a better risk-adjusted return (relative value), and perhaps even a greater simple (non-risk-adjusted) return (absolute value).

Disclosure: N/A

Michael Roat of Tri-Macro Research: I’m expecting a persistent risk-off and strong USD dollar environment with global growth and inflation decelerating, deterioration in emerging markets and a Fed continuing to tighten until US inflation is firmly back at target. I would not expect a big flood back into US Treasuries despite the CPI coming back down and the reason is: Breakeven inflation expectations that are a component into a 10Y UST rate for example and are currently around 2.30% even though the CPI is around 7%. This means over the term of the security – inflation is priced to average 2.30% and therefore come back down, so I don’t think falling oil prices or decelerating actual inflation is going to drastically provide a bid for US bonds as a lower inflation rate (lenders want to receive at the least the inflation rate when extending credit) is already priced into the US bond market and this is reflected in a nominal yield below 4% and breakeven inflation expectations at 2.30% with a CPI above 7%. Inversely – if the CPI does not fall back to target soon, nominal yields and break evens would spike on a “catching-up” to the CPI scenario though I lean toward the former.

Idea: Based on the above I like shorting gold prices through GLL, a leveraged and inverse gold price ETF. The reason is I feel a major deprecation in the US dollar is unlikely given the extensive figure of global USD denominated debt, which is comparatively much higher than the euro, yen among other currencies. I think even in a risk-off environment, nominal US yields are still likely to rise particularly due to the fact described above and shown in the image, that is, the CPI is much higher than inflation expectations or nominal yields so even if the CPI comes down, it should have a very minimal if any positive effect on bond prices and rates falling. In my view, rates (real and nominal) still rise while the CPI comes down, and this therefore reduces gold’s appeal as an inflation hedge and also its competitiveness with higher-yielding securities since gold pays no interest.

Disclosure: Long call option position on GLL.

Be the first to comment