joebelanger

Like many gold and silver miners, MAG Silver Corp. (NYSE:MAG) has fallen precipitously in the last few months, falling by over 45% from March highs of $19.58 to recent lows of $10.32. For reference, the VanEck Gold Miners ETF (GDX) has fallen by a similar amount, from over $41 to below $25.

I believe MAG Silver could be near a tradeable bottom, with significant catalysts on the horizon. I would encourage investors to use this deep pullback to accumulate shares, as MAG is trading at a significant discount to peers, assuming the mine is ramped up by 2023.

Introduction To MAG Silver

MAG Silver is a Canadian silver developer focused on advancing the Juanicipio Project, which is being developed with Fresnillo Plc (OTCPK:FNLPF). MAG Silver owns 44% of the project, and Fresnillo owns 56%, and is the operator.

MAG Silver Is A 20 Year Mining Journey

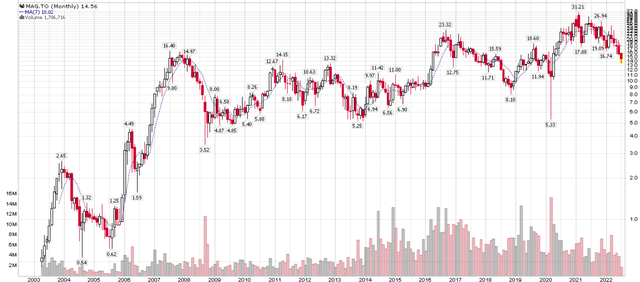

MAG Silver is one of those rare mining companies that is able to take a mining project from initial drilling all the way to production. As my mentor Mr. W taught me many years ago, approximately 1 in 10 mining ‘projects’ get advanced to a resource, while 1 in 10 resources are ‘economic’. Finally, 1 in 10 economic resources gets developed into a mine. So MAG Silver is basically a 1 in 1,000 success story that took 20 years to play out. Figure 1 shows a 20 year chart of MAG Silver on the Canadian exchanges.

Figure 1 – MAG Silver 20 year stock price (Author created with price data from stockcharts.com)

The Juanicipio property and its potential were first recognized in the late 1990’s by a mining consultant. Subsequently MAG Silver raised capital through an IPO in 2003 (at C$0.50 / shr) to acquire the property and begin exploration drilling.

Significant intercepts of silver and gold were encountered in the early stages of drilling and in 2005, MAG Silver was approached by Peñoles, the predecessor of Fresnillo Plc., to earn into the project. Through $5 million of exploration spending, Fresnillo was able to earn a 56% interest in the property by 2007.

In 2008, near the depths of the financial crisis, Fresnillo tried to take over MAG Silver with US$4.54 hostile takeover bid. However, as Fresnillo was a 19.8% shareholder of MAG Silver at the time, and was unwilling/unable to provide information to MAG Silver so that the board can make an independent valuation assessment of the takeover proposal, MAG Silver sued Fresnillo in the International Court of Arbitration of the International Chamber of Commerce (“ICC”) to prevent the hostile takeover. Ultimately, in 2011, the court unanimously sided with MAG Silver and upheld the shareholder standstill provision that protects MAG Silver from further opportunistic takeover bids from Fresnillo.

After the failed takeover attempt, MAG Silver and Fresnillo mended their relationship and continued to explore and develop Juanicipio under their joint venture agreement.

This culminated in the 2019 formal approval of the Juanicipio mine development plan finalizing Fresnillo as the project’s Engineering, Procurement, Construction Management (“EPCM”) developer and mine operator on behalf of the JV.

Juanicipio Is A Silver Giant

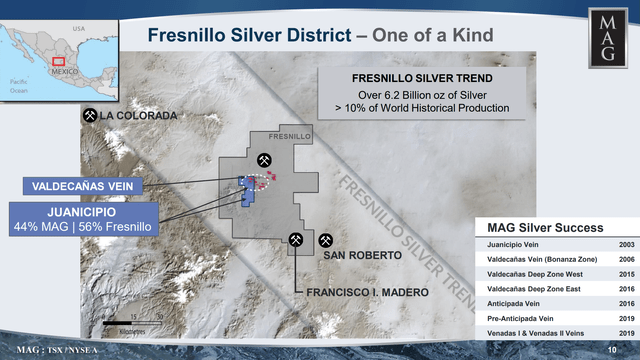

The Juanicipio project is located right next to the Fresnillo mine (Mina Proaño), owned and operated by Fresnillo Plc. (Figure 2). The Fresnillo mine is widely regarded as one of the most profitable silver mines in the world due to its exceptionally high grade, with average reserve grade of 265 g/t silver and 0.76 g/t gold. Silver mining has been conducted in the Fresnillo mine region since the 1550s and has produced over 3.3 billion cumulative ounces of silver.

Figure 2 – Juanicipio location (MAG Silver investor presentation)

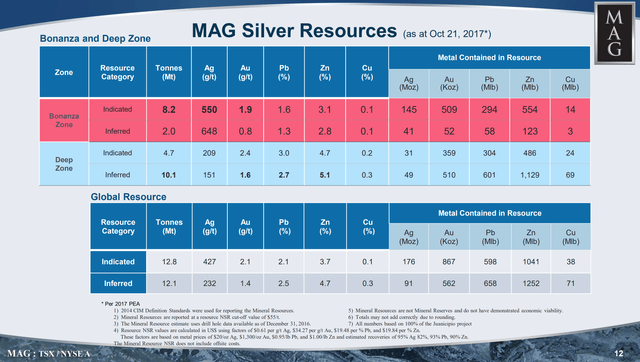

According to MAG Silver’s 2017 Preliminary Economic Assessment (“PEA”) report, the Juanicipio project has a global resource of 267 million oz of silver and 1.4 million oz of gold, with significant amounts of lead, zinc, and copper as well (Figure 3). What is special about Juanicipio is that the majority of the resource is located in the Bonanza Zone, where grades run as high as 560 g/t silver and 1.9 g/t gold, indicated. That is potentially $350 /t revenue rock (using $19 per oz silver), just on the silver value alone!

Figure 3 – Juanicipio global resource (MAG Silver investor presentation)

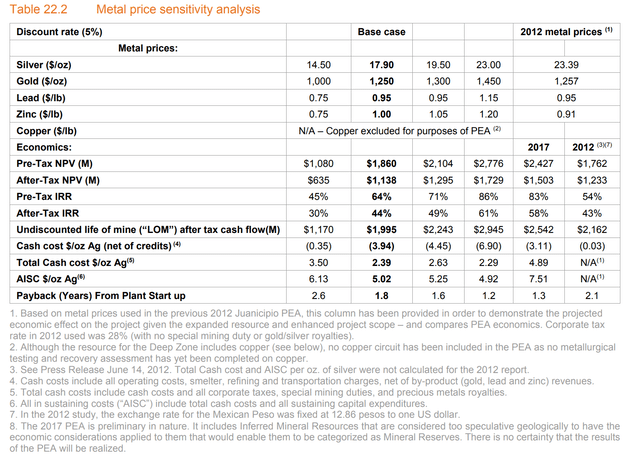

Juanicipio’s exceptionally high grade led to some eye popping economics in the PEA report, as summarized in Figure 4. Using a base case silver price of $17.90 and gold price of $1,250, the 2017 PEA envisions the project having an after-tax IRR of 44% and NPV of $1.1 billion and an All-in Sustaining Cost (“AISC”) of $5.02 /oz silver. At current prices for gold and silver ($1700 and $19 respectively), one would expect the NPV to be significantly higher.

Figure 4 – Juanicipio economics summary (MAG Silver 2017 PEA assessment of Juanicipio)

Mine Development Nearing Completion

MAG Silver and Fresnillo is currently developing Juanicipio as an underground mine with a 4,000 tpd processing plant. Although the 2017 PEA envisioned Juanicipio producing 9.6 million oz of silver and 39k oz of gold per annum for the 19 year mine life, Fresnillo, the operator, is developing Juanicipio to deliver 11.7 million oz of silver and 44k oz of gold per annum.

Construction of the plant was completed in December 2021, however, commissioning of the plant was delayed due to the Mexican state-owned electrical company ‘Comisión Federal de Electricidad’ (“CFE“) not having the manpower to oversee the existing installation, supervise the physical connection, and approve the required blackout prevention devices.

This pushed out the commissioning schedule by approximately 6 months, with MAG Silver now expecting commissioning to occur mid-2022 and ramping up to 85-90% nameplate capacity by December (Figure 5). The upcoming Q2 earnings release from MAG Silver will be critical to see whether there is a further slip in the commissioning schedule.

Figure 5 – Updated Juanicipio schedule (MAG Silver investor presentation)

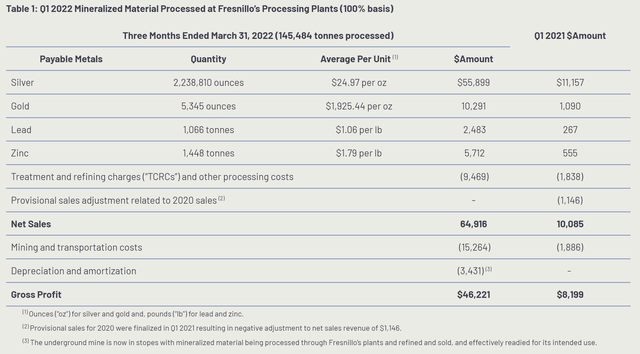

Despite the delay in commissioning, underground mining of development and initial stope materials has been in operation since Q3/2020. In the latest quarter, Fresnillo processed 145k tons of ‘pre-production waste’ from Juanicipio that was worth $65 million (Figure 6).

Figure 6 – Even Juanicipio waste is valuable (MAG Silver website)

Juanicipio About To Hit Lassonde Inflection Point

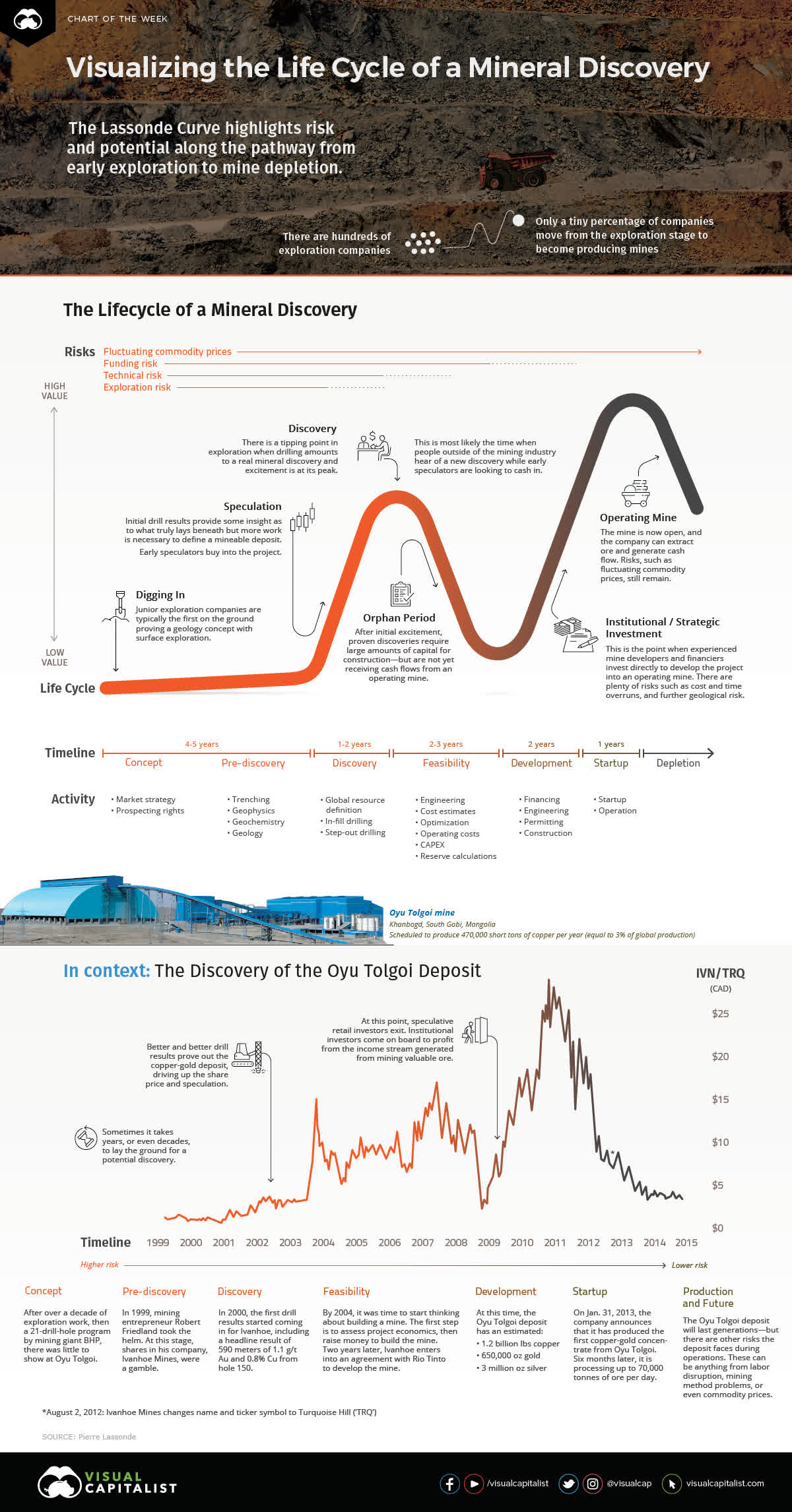

The main reason I am bullish on MAG Silver is because Juanicipio is about to hit an inflection point in its Lassonde Curve. As highlighted in Figure 7, there is a general life cycle to mineral discoveries.

Typically, the value / stock price of a mineral discovery runs up during the discovery phase, as speculators bet on ‘how big can it get’. Once the size of the project is determined and the project enters the feasibility and development phases, the stock price goes ‘fallow’, as this is usually where economic reality, permit delays and cost overruns occur. Finally, as the mine starts producing, the stock price takes off, as cashflows begin to flow. MAG Silver and the Juanicipio mine is on the cusp of entering the production phase, where the stock re-rates into a producer status.

Figure 7 – Lassonde Curve (Visual Capitalist)

Valuing The Production

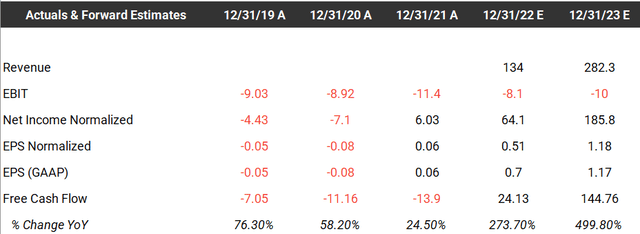

Assuming Juanicipio reaches nameplate capacity by 2023, Wall Street and Bay Street analysts are expecting the company to deliver revenues of $280 million and EPS of $1.17 (Figure 8). At a recent stock price of $11, this is less than 10x Fwd P/E.

Figure 8 – Analyst estimates for MAG Silver (tikr.com)

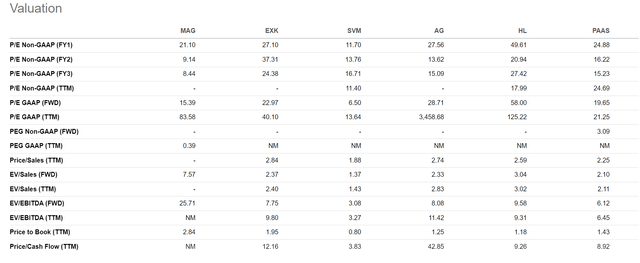

In fact, MAG Silver compares well to silver mining peers which trade at 13 to 37x 2023 Non-GAAP P/E respectively (Figure 9). Based on 2024 Non-GAAP P/E, MAG is a screaming buy, trading at 8.4x P/E versus peers ranging from 15 to 27x.

Figure 9 – MAG screens cheap against peers (Seeking Alpha)

Silver Seasonality Coming Into Focus

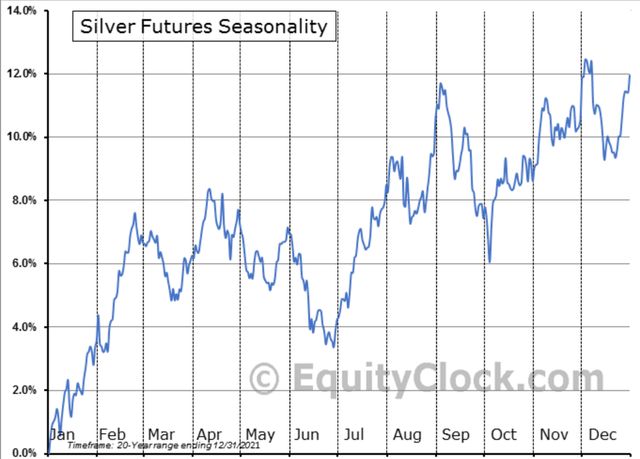

Another upcoming catalyst is the strong seasonality to investing in precious metals. Silver tends to have a very pronounced seasonal bottom in July (Figure 10).

Figure 10 – Silver seasonality (equityclock.com)

I believe the upcoming FOMC meeting on July 26-27 could be an important catalyst. Given oil and gasoline prices have weakened considerably since June, there is a high probability that the Federal Reserve will only increase interest rates by 75 bps at the July meeting. In addition, if inflation has indeed peaked, there may be less pressure for the Federal Reserve to keep raising interest rates at a fast pace.

Risks To MAG Silver

The biggest risk to MAG Silver is further commissioning delay for the Juanicipio mine. As we outlined in Figure 5, commissioning was expected to begin in Q2/2022, and it should have been a significant event worth a press release. Given no news from the company, one must assume that there has been some slippage in the timing.

In addition, gold and silver prices are obvious risks to commodity producers. However, MAG Silver is protected somewhat given the extremely high grade of Juanicipio ore. At an estimated AISC of $5 / oz silver, even if silver prices were to fall precipitously, other producers will have to shut down production long before it impacts MAG, which should provide a floor to silver pricing.

Conclusion

In conclusion, I believe investors should use this deep pullback in MAG Silver as a buying opportunity for the upcoming producer re-rate. It’s only a matter of when, not if, MAG Silver becomes a significant silver producer.

Be the first to comment