DarioGaona

Just two months ago, I wrote on MAG Silver (NYSE:MAG), noting that the company was on track to see a significant increase in earnings year-over-year, and with multiple catalysts on deck, any pullbacks below $11.75 would present buying opportunities. Since dipping into this buy zone in late September, MAG Silver is up nearly 40%, helped by precious metals prices firming up and another solid quarter at Juanicipio. This was evidenced by another sequential increase in attributable silver production for MAG Silver, and investors can look forward to much higher throughput next year with the 4,000 tonnes per day Juanicipio Plant set to be commissioned. Let’s take a closer look at the preliminary Q3 results below:

All figures are in United States Dollars unless otherwise noted.

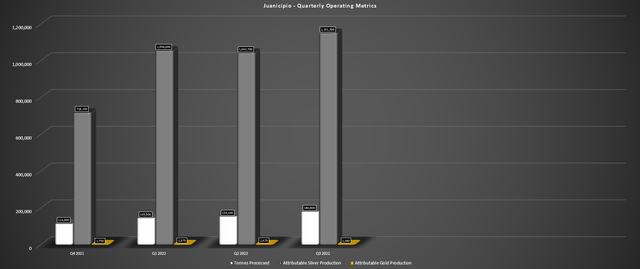

Juanicipio Operations (Company Presentation)

Q3 Production

MAG Silver released its preliminary Q3 results last month, reporting that ~180,800 tonnes of mineralized material was processed in the quarter at an average grade of 513 grams per tonne of silver. This translated to the production of ~2.62 million ounces of silver and ~5,400 ounces of gold on a 100% basis, or ~1.15 million ounces of silver and ~2,400 ounces of gold on an attributable basis given MAG Silver’s 44% interest in the mine. As shown in the chart below, this translated to a record quarter for MAG Silver for attributable silver production, with a nearly 10% increase from the previous record reached in Q1 2022 (~1.06 million ounces of attributable silver production).

Juanicipio Quarterly Operating Metrics (Company Filings, Author’s Chart)

As noted by Fresnillo (OTCPK:FNLPF), material from Juanicipio continues to be fed to its Saucito and Fresnillo plants while both companies await power for final commissioning, which was expected to be reached by the end of October. Assuming this timeline was met, operations were expected to steadily ramp up at the Juanicipio Plant, which is expected to run at 4,000 tonnes per day, translating to double the current throughput rate being utilized at Fresnillo’s two plants and much higher production levels (~364,000 tonnes per quarter vs. ~180,000 tonnes processed in Q3 2022). Additionally, 70% of the material goes through the Saucito plant, providing valuable metallurgical data and better resembles the soon-to-be commissioned Juanicipio Plant.

Unfortunately, this commissioning is behind the previous schedule of up to 90% of nameplate capacity by year-end, but MAG Silver has benefited from Fresnillo making the room available at its two nearby plants. The good news is that these ounces aren’t lost; they’re deferred. Assuming things go as scheduled, MAG Silver could see attributable silver production of more than 8.0 million ounces next year, a significant increase from the estimated production of ~4.6 million ounces of silver this year. To put this in perspective, this would place MAG Silver’s attributable silver production just behind First Majestic (AG) near 11.0 million ounces, but with a single operation and much higher margins (sub $8.50/oz all-in sustaining costs).

To summarize, for investors that have suffered through a less exciting year than planned at Juanicipio, given the delayed tie-in to the electrical grid, the finish line finally looks to be visible, and we should see a significant step-up in production beginning in Q1 2023. This is expected to translate to annual EPS of $0.93 for MAG Silver, a ~160% increase year-over-year from the $0.37 expected to be reported this year. So, with industry-leading earnings growth, commercial production on deck, and a busy drilling season at multiple projects, 2023 should be a catalyst-rich year for investors.

Recent Developments

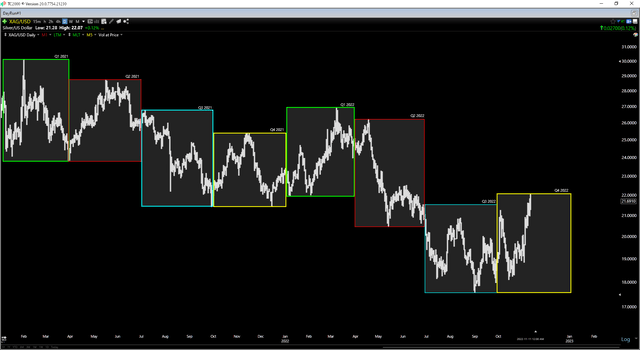

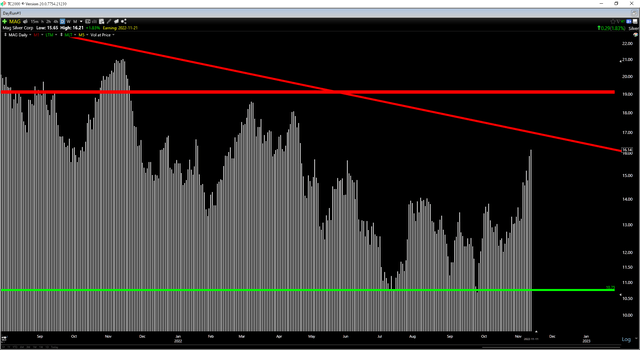

In terms of recent developments, there haven’t been many, but the major one is the recent movement in metals prices. While the silver price looked like it was going to average less than $20.25/oz in Q4 2022, down from an average realized price of $21.32/oz in Q2 2022, the silver price has since recovered sharply. This pushed the quarter-to-date average price to $19.80/oz vs. $19.20/oz a couple of weeks ago. Assuming the strength persists for the remainder through December, it looks like silver could average nearly $21.00/oz for Q4, translating to a sequential improvement from Q3 (estimated at $19.70/oz) and similar levels to Q2.

Silver Futures Price (TC2000.com)

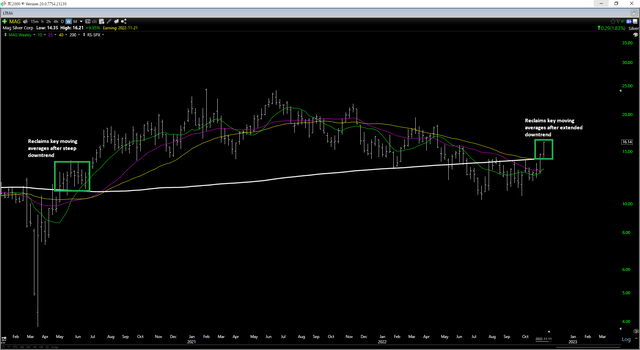

This rebound in silver prices is obviously a positive development for MAG Silver and the sector, given that many silver producers were struggling to generate positive all-in cost margins at sub $20.00/oz prices. So, with sentiment potentially improving, this rising tide could lift all boats, shifting the previous trend of sharp rallies in silver miners being sold immediately towards sharp pullbacks being bought up immediately. Given that, I see MAG Silver as a top-5 name in the silver space, it should benefit from this change in trend, and importantly, it’s now back above a rising 200-day moving average, which is when it tends to perform its best (Q1 2020 to Q1 2021).

MAG Weekly Chart (TC2000.com)

Valuation

Based on ~101 million fully diluted shares and a share price of $16.15, MAG Silver trades at a market cap of ~$1.63 billion. If we compare this figure to an estimated net asset value of $1.19 billion, MAG Silver is trading at 1.37x P/NAV, which is a premium valuation relative to sector-wide multiples. In fact, much more diversified producers like Barrick Gold (GOLD) and Agnico Eagle (AEM) are trading at closer to 1.0x P/NAV with multiple mines across multiple jurisdictions and significant exposure to Tier-1 jurisdictions (Canada, United States, Australia).

That said, silver producers typically command a premium multiple to gold producers due to their leverage. It’s also worth noting that MAG Silver has a unique business model with a minority interest in one of the richest silver projects in North America, where Fresnillo is the operator. This makes MAG Silver somewhat similar to a royalty company vs. a producer, given minimal capital expenditures (no cash calls since Q4 2021) and very high margins. The major difference, of course, is that royalty/streaming companies command premium valuations due to their high-margin business models and diversification across dozens of paying assets, which MAG Silver lacks due to having an interest in only one project generating cash flow.

Still, given this very attractive business model, I see MAG Silver as one of the lowest-risk ways to get exposure to silver in a sector where there is a lack of high-quality companies, and many mines have razor-thin margins on an all-in cost basis. Hence, I believe MAG Silver can justify a multiple of 1.50x P/NAV (above the precious metals producers’ peer group) and could trade closer to 2.0x P/NAV if positive sentiment returns to the sector. Given that I prefer to be conservative, I believe it’s best to use the low end of this multiple (1.50x vs. 2.0x) to derive fair value, translating to a fair value of $1,785 million or US$17.70 per share.

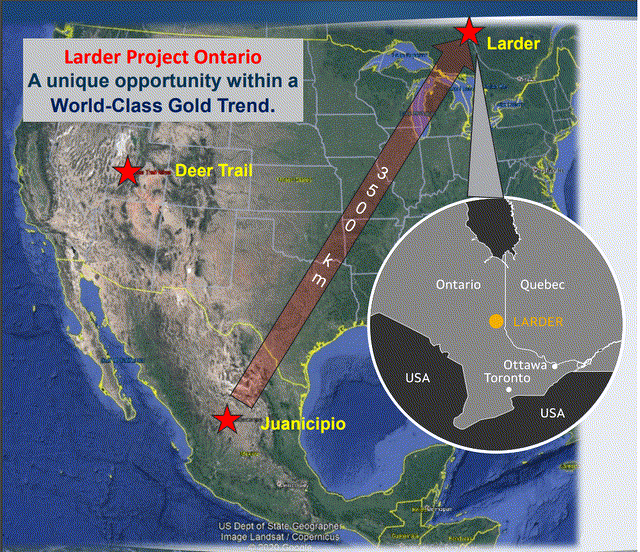

MAG Silver Projects/Mines (Company Presentation)

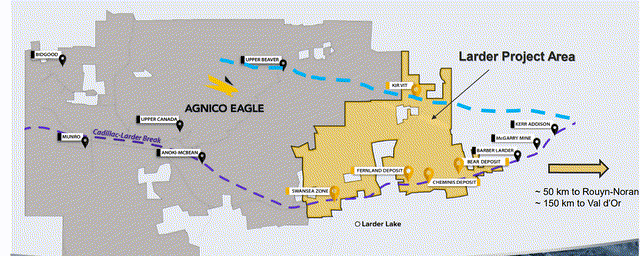

While this only points to a 10% upside from current levels, it is worth noting that I have assigned only $140 million in exploration upside to Juanicipio (44% basis to MAG Silver) and a combined $100 million to its two other projects, Deer Trail and Larder. One of these is a CRD Project in Utah with neighboring mines, including the highest-grade gold mine by mined grade currently (Tintic) and the world’s largest open-pit mine, Bingham Canyon. The other covers seven kilometers of the prolific Cadillac-Larger Break, which hosts multiple world-class mines (Macassa, LaRonde, Malartic), and is just east of Agnico Macassa Mine. Hence, I would argue that a $100 million combined valuation for these assets is quite conservative.

Larder Project Location (Company Presentation)

To summarize, while I don’t see much upside in MAG Silver from current levels in a base case assumption (no mill expansion at Juanicipio, only moderate exploration success at its other two projects), MAG Silver has considerable if it is highly successful drilling out these projects. Investors should get a better idea of this upside next year, with Phase 2 drilling at Deer Lake planned to follow up on exceptional intercepts in its Phase 1 program (1.90 meters at 952 grams per tonne silver, 38 grams per tonne gold, 9.2% lead/zinc), and Phase 1 drilling at Larder.

Technical Picture & Summary

Looking at the technical picture, we can see that MAG has soared to within 5% of its primary downtrend line and is now more than 50% above major support at $10.75 at a share price of $16.15. Generally, I prefer a minimum reward/risk ratio of 5.0 to 1.0 to justify starting new positions in small-cap miners with just $3.00 in potential upside to resistance ($19.15) and $5.40 in potential downside to support, MAG’s reward/risk ratio has moved from over 7.0 to 1.0 at its July lows to just 0.56 to 1.0 currently. This doesn’t mean that the stock can’t head higher, but I don’t see this as anywhere near a low-risk buying opportunity.

MAG 1-Year Chart (TC2000.com)

In a group (silver producers) where it’s hard to find quality except for a few names like SilverCrest Metals (SILV) and Hecla (HL), MAG Silver is another name that stands out. This is because it has one of the more attractive business models due to its industry-leading margins and minority interest at Juanicipio, and upside from two Tier-1 exploration projects. With a catalyst-rich year on deck with drilling results from three projects and nearing the finish line towards declaring commercial production, it certainly makes for one of the better buy-the-dip candidates industry-wide. However, if I were looking to buy the stock, the low-risk buy zone comes in below US$12.80.

Be the first to comment