akrassel/iStock via Getty Images

For those who can afford it, boating is an excellent experience. If you want to feel at ease, you can always go slow and enjoy the waves and the wind. But if you want something exciting, you can always crank up the speed for a real joy ride. Although current economic conditions bring into question just how viable the boat industry is in the near term, one company with an attractive track record over the past few years is Malibu Boats (NASDAQ:MBUU). Given the current trajectory of its fundamentals, shares do look very cheap on an absolute basis. Compared to similar firms, using 2021 results, the stock does look more or less fairly valued or slightly pricey. But even in the event that fundamental performance pulls back some, shares are not priced at such a level that would warrant significant downside. Of course, this could change if economic conditions deteriorate significantly. But absent that, the company seems to offer investors a favorable risk-to-reward opportunity at this time, leading me to rate it a soft ‘buy’.

Taking a cruise with Malibu Boats

According to the management team at Malibu Boats, the company designs, produces, and sells a range of recreational power boats. These products include sport boats, sterndrive and outboard boats, and related offerings. It sells these products through eight brand names: Malibu, Axis, Pursuit, Maverick, Cobia, Pathfinder, Hewes, and Cobalt. Some of these brands, such as Malibu and Axis, are industry leaders. Combined, these two brands grant the company the number one leading market share in the US performance sport boat category. Meanwhile, the Cobalt brand gramps the company the largest market share in the country when it comes to the 24-foot to 29-foot segment of the sterndrive category of boats.

It’s worth noting that the management team at Malibu Boats is incredibly dedicated to the idea of continuously innovating. Most recently, on August 11th, the company announced the introduction of the all-new A225 and T235 models under the Axis brand name. The first of these, the A225, management says has been inspired by the first-ever Axis boat, while the T235 is particularly geared toward surf crews. If you look at the company’s investor relations page, you will see press releases discussing no fewer than five other new boat models over the past year. If these are anything like the company’s prior releases, they should be incredibly successful for the firm. After all, the company’s products have won a variety of awards, such as the WakeWorld 2020 Riders Choice Award for Wakesurfing and Wakeboarding Boat of the Year, and the WakeWorld 2019 Innovation of the Year award.

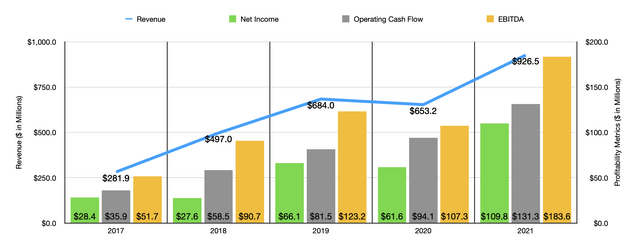

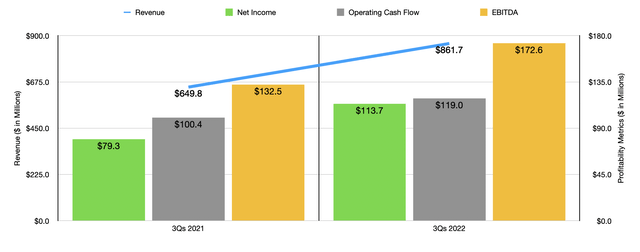

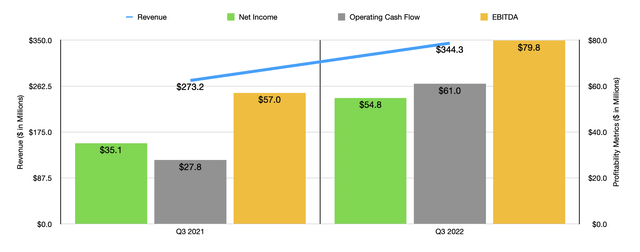

This quality has had a very positive impact on sales in recent years. Between 2017 and 2021, revenue for the company grew tremendously, rising from $281.9 million to $926.5 million. That growth has continued into the current fiscal year. Revenue in the first three quarters of 2022 came in at $861.7 million. That represents an increase of 32.6% over the $649.8 million generated the same time last year. Growth for the company has been particularly strong for its Saltwater Fishing segment, which comprises everything outside of the Malibu and Cobalt brands. Total unit sales here jumped by 74.4%, climbing from 863 to 1,505. By comparison, the Malibu segment saw an increase of just 5.1%, while the Cobalt segment grew unit sales by just 0.6%. For the Saltwater Fishing segment, much of the sales increase was driven by the company’s acquisition of Maverick Boat Group back in late 2020. Besides that, much of the company’s sales increase came from higher pricing, with net sales per unit climbing 16.1% from $111,438 to $129,399.

Profitability for the company has also been on the rise. Net income rose from $28.4 million in 2017 to $109.8 million last year. Operating cash flow followed suit, climbing from $35.9 million to $131.3 million. Meanwhile, EBITDA for the company also increased, rising from $51.7 million to $183.6 million. That strength and bottom line performance has so far continued into 2022. For the first three quarters of 2022, net income totaled $113.7 million. That compares favorably to the $79.3 million reported one year earlier. Operating cash flow grew from $100.4 million to $119 million. And EBITDA increased from $132.5 million to $172.6 million.

When it comes to the 2022 fiscal year, management believes that sales should climb by between 28% and 29%. At the midpoint, that would imply revenue of $1.19 billion. The only guidance the company gave when it came to profitability involves EBITDA. The current expectation is for the EBITDA margin to be around 20.5%. This would translate to EBITDA of $244.1 million. If we apply that same year-over-year change to other profitability metrics, we should anticipate net income of $146 million and operating cash flow of $174.6 million.

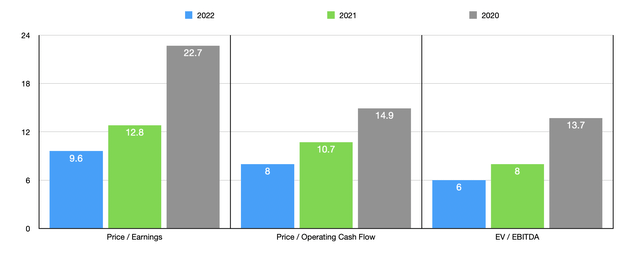

Using these metrics, we can easily value the firm. On a forward basis, the company is trading at a price-to-earnings multiple of 9.6. This compares to the 12.8 reading that we get using 2021 results. The price to operating cash flow multiple should be 8, while the 2021 figures would give us a reading of 10.7. Meanwhile, the EV to EBITDA multiple should be around 6. By comparison, the 2021 figures would give us a reading of 8. Given current industry conditions and tremendous uncertainty about the future, investors would be wise to approach the future cautiously. Although the company has made important strategic moves like acquisitions that will permanently increase sales, keeping all else the same, this favorable pricing environment is not guaranteed to stay. But even if financial performance reverts back to 2020 levels, shares don’t look to offer significant downside. Yes, the price-to-earnings multiple would be rather lofty at 22.7. But the price to operating cash flow multiple would be a more reasonable 14.9, while the EV to EBITDA multiple would come in at 13.7.

To put the pricing of the company into perspective, I compared it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 4.8 to a high of 64.6. Using our 2021 results instead of forecasted 2022 figures, we find that four of the five companies are cheaper than Malibu Boats. Using the price to operating cash flow approach, only four of the five companies had positive results, with their multiples ranging between 5.3 and 34.8. In this case, two of the four were cheaper than our prospect. And when it comes to the EV to EBITDA approach, the four companies with positive results ranged between 3.1 and 7.6. In this case, our prospect was the most expensive of the group. But if we were to use the 2022 forecasted figures, we find that only two of the firms are cheaper.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Malibu Boats | 12.8 | 10.7 | 8.0 |

| Marine Products Corporation (MPX) | 12.5 | 34.8 | 7.6 |

| Brunswick Corporation (BC) | 10.6 | 16.6 | 7.7 |

| MarineMax (HZO) | 4.8 | 5.3 | 3.1 |

| MasterCraft Boat Holdings (MCFT) | 7.8 | 9.5 | 5.1 |

| Twin Vee Powercats Co (VEEE) | 64.6 | N/A | N/A |

Takeaway

Based on the data provided, I believe that Malibu Boats is in a fairly favorable position at this time. Yes, there is concern about what current economic conditions will do to this space. But management has done well over a long timeframe and shares look to offer a favorable risk to reward payoff even in the event that the market takes a step back. Although the company might be fairly priced or slightly pricey compared to some other firms, the whole space looks to be fairly affordable. Overall, this has led me to rate the company a soft ‘buy’ at this time.

Be the first to comment