martin-dm

Upstart Holdings, Inc. (NASDAQ:UPST) reported a troubling double-miss on sales and earnings this week, and the fintech’s stock has suffered as a result.

The artificial lending start-up is going through a period of slowing sales growth and loan originations, which resulted in a severe deterioration of Upstart Holdings’ financial metrics. The fourth-quarter forecast is nothing short of disastrous.

If the investment case for Upstart Holdings didn’t die before the third-quarter earnings report, it certainly did now.

Huge Double-Miss On Sales And Earnings

Upstart Holdings missed earnings by a wide margin in the second quarter of this year due to a slowdown in its core business of personal loan origination.

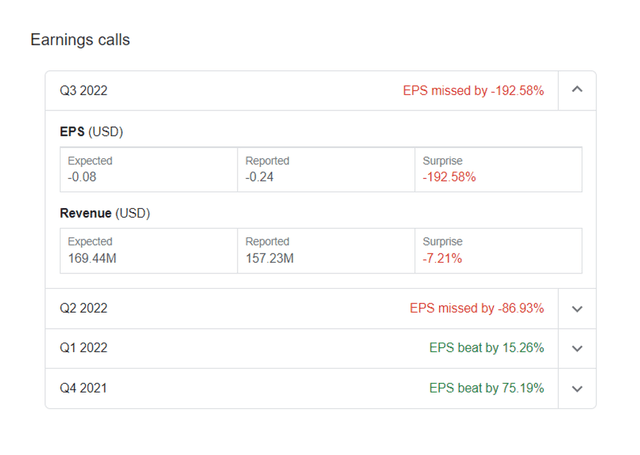

This week, the fintech released its Q3’22 results, and Upstart Holdings missed on sales and earnings by even greater margins than in the previous quarter. The AI-powered lending startup reported a 24-cent loss per share, which was significantly higher than the 8-cent loss per share predicted by analysts.

Upstart Holdings also disappointed investors by reporting third-quarter sales of only $157.2 million, when the market expected $169.4 million.

Earnings Calls (Upstart Holdings Inc)

The double-miss highlighted that the fintech’s business model is undergoing a painful transition period, which has resulted in a decline in all of Upstart Holdings’ profit metrics. The transition is primarily marked by a significant slowdown in the fintech’s loan originations, which has resulted in significantly slower sales growth.

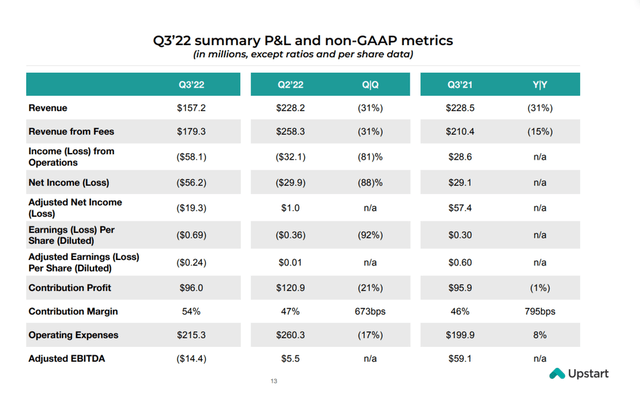

Sales at the AI lending company fell 31% YoY in Q3’22 as the environment for personal loan originations deteriorated throughout the quarter. In Q3’22, Upstart Holdings generated only $157.2 million in sales, well below its guidance of $170 million.

Upstart Holdings also reported significantly lower profit figures across the board, from operating income to adjusted earnings per share. One of the most compelling reasons to invest in Upstart Holdings in the past was the fintech’s ability to generate profitable growth. Unfortunately, with losses increasing in Q3’22, this reason can no longer be used to justify purchasing the fintech’s stock.

Q3’22 P&L Summary (upstart Holdings Inc)

Very Disappointing Guidance

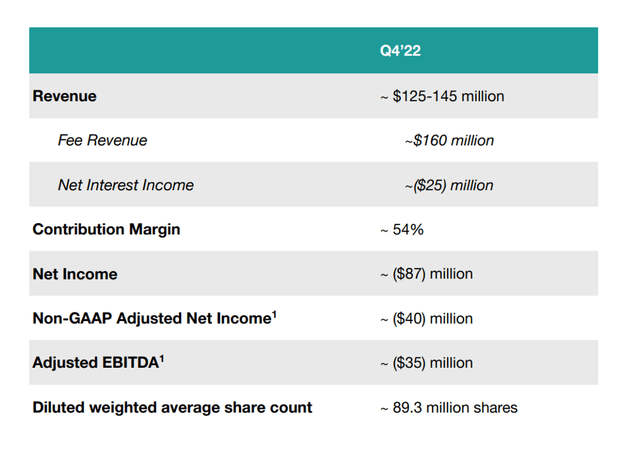

The worst part of Upstart Holdings’ Q3’22 earnings presentation was the forecast for the fourth quarter, which predicts even lower sales.

The fintech anticipates sales of $125-145 million, representing a QoQ decline of at least 8% due to a slowing economy and softer investor demand for loans.

Upstart Holdings’ fourth-quarter guidance implies a 56% YoY decrease in sales compared to the previous quarter. Furthermore, Upstart Holdings anticipates a $40 million loss in adjusted net income in the fourth quarter.

Q4’22 Guidance (Upstart Holdings Inc)

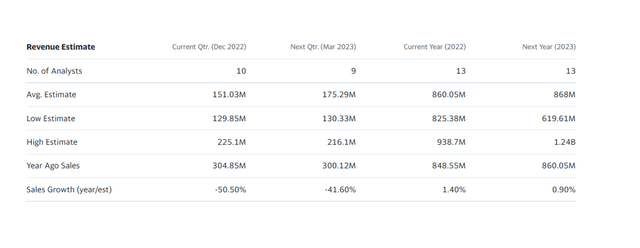

Sales Estimates May Still Be Too High

The market anticipates $860.1 million in sales this year and less than 1% YoY sales growth next year. As a result, sales growth has essentially ceased, and the fintech no longer provides investors with profitable growth.

Furthermore, if interest rates rise and investment demand for personal loans remains weak, those estimates may still be too high.

Revenue Estimate (Yahoo Finance)

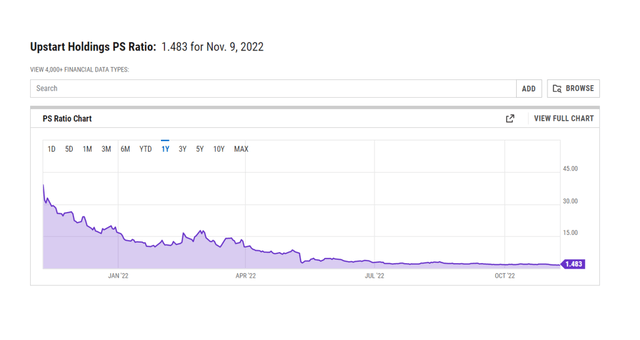

Upstart Holdings trades at 1.5 times sales, but the fintech is no longer profitable and continues to lose money, which is unlikely to change in the near term. The sales trajectory is also deeply concerning, which is why UPST is likely to set new lows in the coming weeks.

Why Upstart Holdings Could See A Higher Valuation

Higher interest rate costs have slowed demand and originations for personal loans at Upstart Holdings. To tip the scales in favor of the fintech, the central bank would need to slow its rate hikes and reduce interest rate uncertainty.

There is little hope for Upstart Holdings to grow into a higher valuation as long as loan originations do not recover. Furthermore, as interest rates rise, there is a greater likelihood that loan defaults will rise, making it even more difficult for Upstart Holdings to find investors for its loans.

My Conclusion

Upstart Holdings’ Q3’22 earnings presentation, in particular the outlook for Q4’22, was a disaster. Clearly, the fintech sees no short-term improvement in its business trajectory, which unfortunately points to origination weakness and valuation losses in the future.

The forecast for Q4’22 implies an 8% QoQ drop in sales, and Upstart Holdings no longer checks the box for profitable growth. Because the valuation multiple remains high, investors have few reasons to invest here.

Be the first to comment