First off, the crude oil market, unlike every other commodity in America, is virtually unregulated. ~ Peter DeFazio

After missing earnings estimates for Q4 2019, Macquarie Infrastructure Corporation (MIC) is now staring at uncertainty in 2020. Going forward, two of the three business divisions of the company may get impacted because of the COVID-19 outbreak. This is a stock to avoid and I have assigned a neutral rating to it. Here are my reasons.

MIC’s Business Model

Image Source: MIC site

Ninety percent of MIC’s business is made up of (A) handling and storage of bulk liquid petroleum and (B) running Fixed Base Operations (FBO) for the aviation industry. The remaining 10% of the revenues come from its gas utility business in Hawaii.

The main business divisions can face disruptions in 2020, and here’s an analysis of all the three business divisions:

(A) The Petroleum Storage & Handling Business

IMTT, MIC’s subsidiary, has been in the news recently. It has signed a contract with a 20-year take-or-pay contract with a joint venture of Valero Energy to provide storage and handling services. It will have to invest in constructing two pipelines and expand rail and marine infrastructure to fulfill this contract. Revenues will start flowing in from 2021-end.

IMTT will also expand its facility at Geismar to provide additional services to an existing customer.

About $150 million is expected to be invested in this business in 2020 and MIC expects an incremental EBITDA of $39 million annually – of which $6 million will start rolling in from 2020, $ 21 million by 2021, and the rest by 2022. Capacity utilization is pegged at around 85%.

COVID-19 has thrown a spanner in the works though. China is the world’s largest importer of oil and its demand has plummeted. Oil cargos have been stranded off the country’s coast and China has cut its own output by 1.5 million barrels per day. Energy analysts expect a sharp fall in demand.

Crude stocks have piled up and this can be a positive factor because IMTT’s storage facilities would be fully utilized. However, the COVID-19 outbreak is likely to hit consumer spending and reduce demand for commodities. The full impact of the pandemic is yet unknown.

It is uncertain whether crude demand and prices will climb back to their highs – and, therefore, it is reasonable to assume that the outlook for this business unit is bullish in the near-term but uncertain in the medium-term.

(B) The Atlantic Aviation Business

Though jet fuel prices have crashed, people are canceling trips as countries continue issuing travel advisories for inbound and outbound travel. Analysts reckon that it will take a year for the aviation industry to return to normal.

MIC’s aviation business subsidiary generates revenues from hangar rentals, fueling, aircraft rental, maintenance, flight instruction, etc.

Forty percent of the gross profit of the aviation business comes from hangar rentals and this part should do well if aircraft remain idle. The rest of the business should witness a dip. On the net level, the gains and losses of this division may even out in 2020.

(C.PK) Hawaii Gas Utility

Ten percent of MIC’s revenues are from its Hawaii gas business and it’s too inconsequential to make a difference. It will be business as usual in 2020 for this division.

Overall business prospects of MIC are unclear as I write this post (on Feb 28, 2020). Growth in both the aviation and crude storage businesses cannot be forecasted because there are many ifs and buts around its 2020 outlook.

Key Financials and Peer Comparison

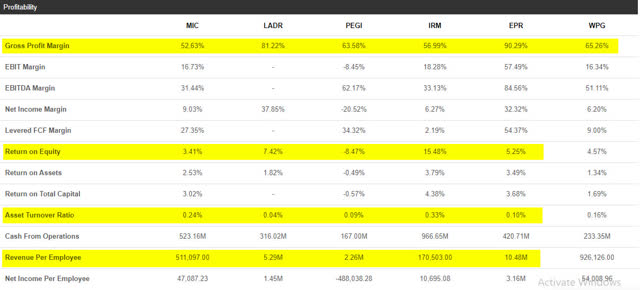

Per Seeking Alpha, MIC’s peers include Ladder Capital (LADR), Pattern Energy Group (PEGI), Iron Mountain (IRM), EPR Properties (EPR), and Washington Prime Group (WPG).

Image Source: Seeking Alpha

MIC has reported the lowest gross profit margins (52.63%) compared to its peers. Its asset turnover ratio is extremely low at 0.24% (for every $1 of assets, the company generates $0.24 in sales). MIC’s return on equity (3.41%) is very poor – it beats the inflation rate by less than 1%.

The revenue per employee at $511,097 is the worst amongst its peers, and it implies that either the company is overstaffed or is not utilizing its workforce effectively.

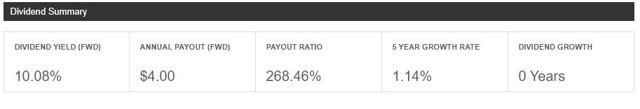

MIC’s dividend yield works out to about 10.1%. It does look tempting but when you take into account the fact that the stock price has done nothing in the past 12 months, the dividend yield does not look so hot.

Image Source: Seeking Alpha

Summing Up

MIC was quoting about $43 at the beginning of 2020. It touched a high of $45.62 and is quoting $39.69 as of Feb 27, 2020. The company estimates that it will generate an EBITDA between $575 million and $600 million in 2020 – as compared to $640 million EBITDA generated in 2019. This implies that the management team expects the company to underperform slightly in 2020.

There also is no clarity on how the current COVID-19 situation will unfold.

Given the uncertainty, past underperformance and muted guidance, I would avoid investing in MIC. My rating for it is neutral.

*Like this article? Don’t forget to hit the Follow button above!

How To Avoid the Most Common Trading Mistakes

How To Avoid the Most Common Trading Mistakes

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Be the first to comment