maybefalse/iStock Unreleased via Getty Images

Alibaba’s (NYSE:BABA) shares have risen 45% from their 52-week lows and investors are now wondering if it can continue rallying. Bulls argue that stock is a great investment as it’s undervalued at current levels, the Chinese government will come in its support and the retail consumption story in China will drive Alibaba’s growth going forward. While these arguments sound credible at the first glance, I beg to differ. In this article, I’ll attempt to explain how each of these arguments has major shortcomings and why Alibaba’s shares may be a value trap. Let’s take a closer look at it all.

Chinese Support

A great deal of emphasis is being laid on how the Chinese government is reportedly finished with its crackdown on their technology sector. Alibaba and its peers have been adversely impacted by regulatory interventions in China, fines, forcing them to change the way they conduct businesses and also how they raise capital from secondary markets. So, the easing of regulatory crackdowns in China would be a big positive and a show of support towards its flailing technology sector. (Read – Alibaba: A Value Trap)

Also, China has a zero COVID-19 policy in place and it had imposed strict lockdowns spanning from March through May in various parts of the country. This had once again created supply-chain issues, fueled unemployment rates and sparked country-wide protests. So, the government was said to be easing the pressure with interest rate cuts. This possibility of a liquidity injection, while the US is raising interest rates, suggested that Alibaba may grow faster than other e-commerce companies that are based in the US.

Besides, the SEC has maintained its stance of potentially delisting Chinese stocks from its bourses, if they don’t open up for audit inspections. Chinese regulators claimed over 2 months ago that they’re opening up to audit inspections in order to comply with listing rules in the US. These reports and/or statements by the Chinese regulatory bodies have created an impression amongst investors that Alibaba will thrive going forward, now that its government is backing it, which has consequently fueled a rally in its shares in recent months.

While these narratives present a bright outlook for Alibaba, that’s not quite the ground reality.

See, the recent reports suggesting that Chinese regulatory bodies are finished with their crackdowns on the technology sector, is not news, it’s mere speculation. It’s something that investors think, might happen going forward. There isn’t any press release or an official statement that would clearly corroborate this change in stance by the Chinese government.

Similarly, Chinese government did not slash interest rates in their meeting last Monday. There’s now speculation that the government is cautious against flooding the market with liquidity and about policy divergence with the west, which suggests that such rate cuts might not happen anytime soon. This quashes the hopes of investors who were expecting Chinese stimulus to boost Alibaba’s financial growth.

Lastly, the Chinese regulators did vow to comply with SEC’s listing requirements 2 months ago, but there hasn’t been any material progress since then. On the contrary, the SEC has published multiple lists of potential delisting candidates (such as here) and also warned investors to be wary of risks associated with investing in Chinese stocks.

The point that I’m trying to make here is that the Chinese government hasn’t shown any tangible progress or declared public support towards aiding the growth of Alibaba or the country’s technology sector in general. So, investors must be mindful of investing Alibaba, especially when most of its recent positives come in the form of speculation and unconfirmed reports.

Consumption Story

We’re also seeing another commonly used bullish argument in investing forums – the rapidly growing Chinese consumption to drive Alibaba’s e-commerce sales in the coming years. But what remains unanswered is, where will this growth come from?

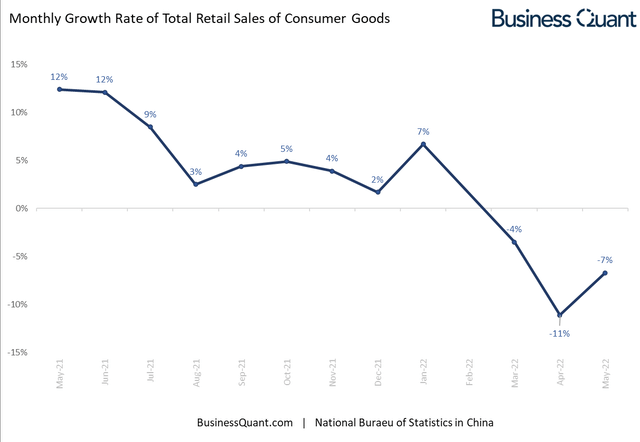

We already know that Chinese regulators kept their interest rates constant and are skeptical about flooding the economy with stimulus. Besides, retail sales in China have plummeted in the last 2 months and there’s no telling when will it start rebounding.

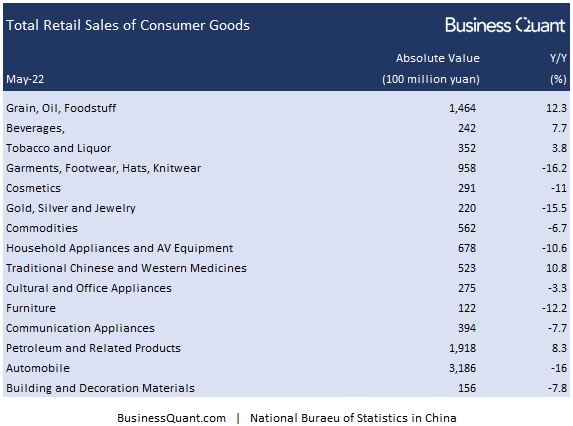

Digging deeper into this retail sales growth data presents us with an interesting insight. As it turns out, only petroleum, foodstuff, medicines, beverages and tobacco/liquor saw their sales grow during the month of May. Otherwise, 10 out of the 15 constituting product categories saw their sales decline last month.

BusinessQuant.com

I contend that due to the tough comparables from last year and without government stimulus, overall retail sales growth in China will remain in the red or stay muted until 2023 at least. Plunging oil prices, although arguably unrelated to Alibaba, might drag petroleum sales lower and exacerbate the overall sales plunge in the country. Overall, this leads me to believe that Alibaba will be revenue challenged in the next few quarters and its management may lower their guidance on the next analyst call. This does not paint an encouraging picture for investors looking to go long on the name.

Valuation Talk

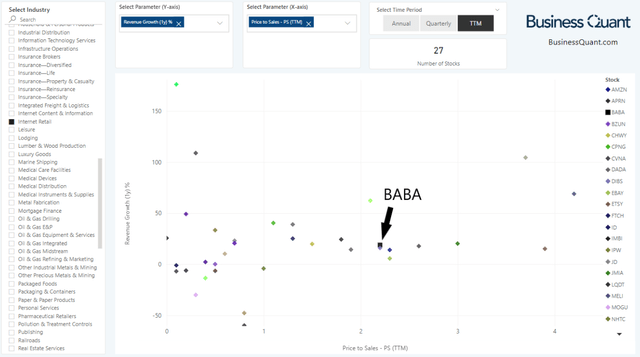

Lastly, Alibaba’s shares are trading at just 2.2-times their trailing twelve-month sales which is seemingly low and attracting the attention of investors. But there’s a catch.

Let’s look at the chart below to put things in perspective. The X-axis highlights the Price-to-Sales (or P/S) multiples for 27 companies that are classified under the internet retail industry. Note how Alibaba is horizontally positioned towards the right, indicating that its shares are trading at a relatively higher P/S multiples compared to a broad swath of its peers.

Now, let’s shift attention to the Y-axis which plots the revenue growth rates for the same set of companies. Note how Alibaba is vertically positioned right in the middle, which indicates that its revenue growth rate is in-line with the average industry levels.

The collective takeaway from both the axes here is that Alibaba has a mediocre revenue growth rate but its shares are trading at a relative premium anyway. This presents more downside potential for the stock, than upside potential, from the current levels.

Final Thoughts

The takeaway here is that Alibaba is surrounded by several risk factors. Maybe the Chinese government will come in full force to support its technology sector, or maybe it’ll continue on with its crackdown. There’s also no telling when Alibaba’s revenue growth will pick up to justify its price premium compared to other internet retail stocks. It’s due to this heightened uncertainty, that risk averse investors may want to avoid the stock for the time being at least. Contrarian investors, on the other hand, may want to wait for potential price corrections before initiating long positions in the name. Alibaba seems to have ample downside potential and can fall further from current levels. Good Luck!

Be the first to comment