akurtz

Thesis: Pent-Up Demand From Millennials Is Waiting To Be Released

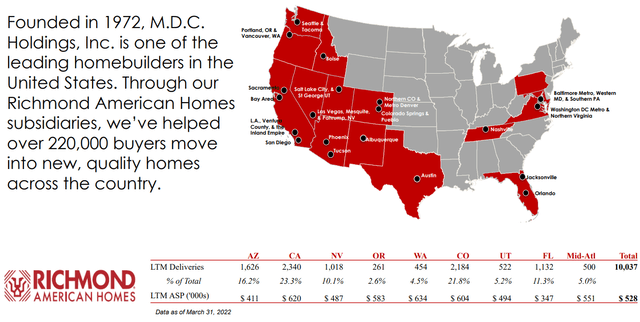

M.D.C. Holdings (NYSE:MDC) is a midsized homebuilder that operates through its wholly owned subsidiary, Richmond American Homes.

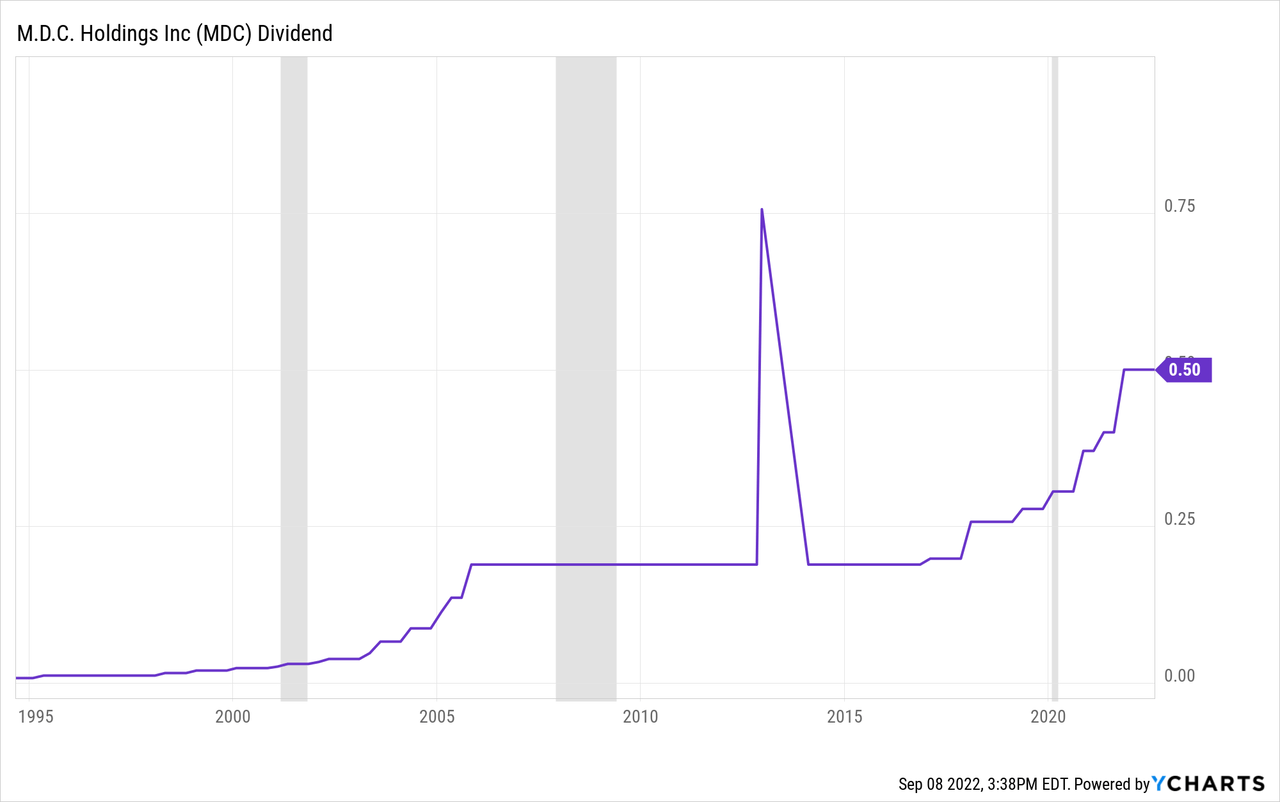

Among homebuilders, MDC is by far the most shareholder-friendly when it comes to dividends. Not only does the company pay a 6.6% dividend yield, but MDC has never cut or reduced its quarterly payout since initiating it in 1994. This is really saying something, since MDC operates in such a cyclical industry.

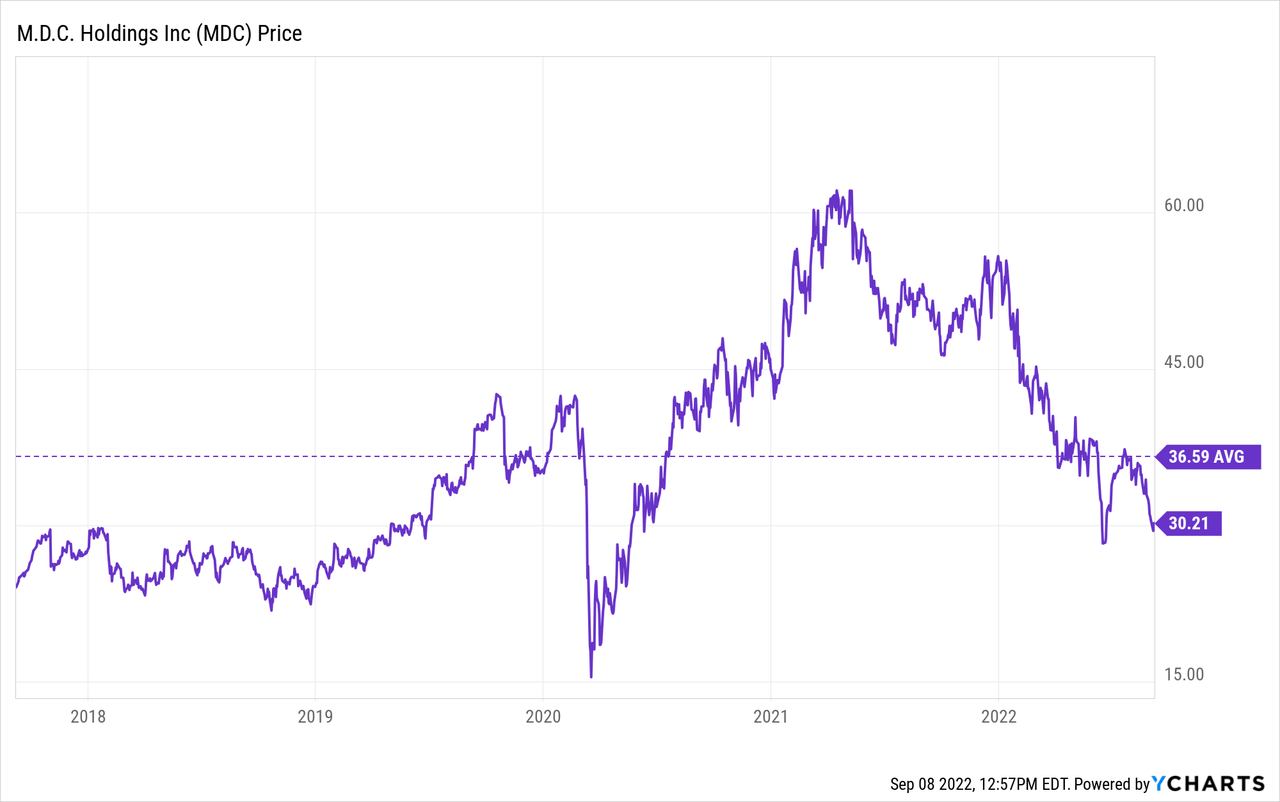

As we wade into the back half of the year amid rising mortgage rates and increasing new home inventory, the headwinds appear to be amply priced into MDC’s stock price, which has dropped 45% year-to-date. What aren’t adequately priced in, as I see it, are the long-term tailwinds MDC enjoys.

Company founder and CEO Larry Mizel gave three major supporting forces for housing in its particular markets on the Q2 2022 conference call (emphasis mine):

Despite these near-term challenges, we remain confident in the long-term outlook for industry and our company. We believe the demand drivers that propel our industry over the last few years continue to exist, including a large population of Millennials entering their prime home buying years, baby boomers relocating to adjust their lifestyles, and migration trends from high to low cost areas of the country.

Of these three major tailwinds for the housing market, I think Millennials wanting to buy their first home is the most important. Baby boomers are more likely to already own a home, so their relocating primarily affects the existing home market. And while migration trends do benefit MDC, the same holds true: Most people migrating to another area of the country and buying a home there already owned a home in their previous city.

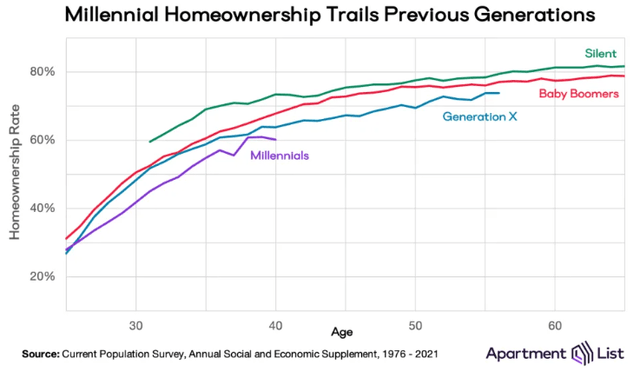

Would-be first-time Millennial homebuyers represent a giant well of pent-up demand. Due overwhelmingly to affordability issues, Millennials all the way up to age 40 have homeownership rates lower than any of the three generations that preceded them.

Apartment List

It is not as if home ownership is no longer a feature of the American Dream. It is. Millennials just can’t afford the American Dream.

(This is particularly depressing for me as one of those Millennial renters who would like to buy a home sometime in the next few years, if affordability permits.)

Right now, that is largely a function of how high mortgage rates have jumped in comparison to rising home prices. But, in my estimation, this problem will be solved in the next year or two by a combination of falling mortgage rates and (probably) home values falling to some degree.

While I foresee home values falling in the next year, I do not see them dropping back down to where they were pre-COVID. Thus, I do not think MDC deserves to trade at the same level it was in mid-2019, before home prices surged some 40%.

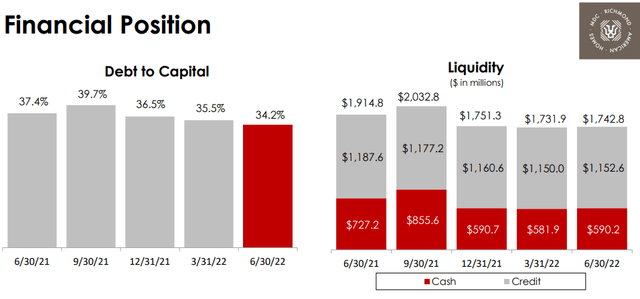

Don’t get me wrong. Troubling times are ahead for the housing market and homebuilders. But MDC appears to be adequately prepared. The company ended Q2 with $590 million in cash and $1.14 billion of availability on the credit facility for total liquidity of $1.74 billion.

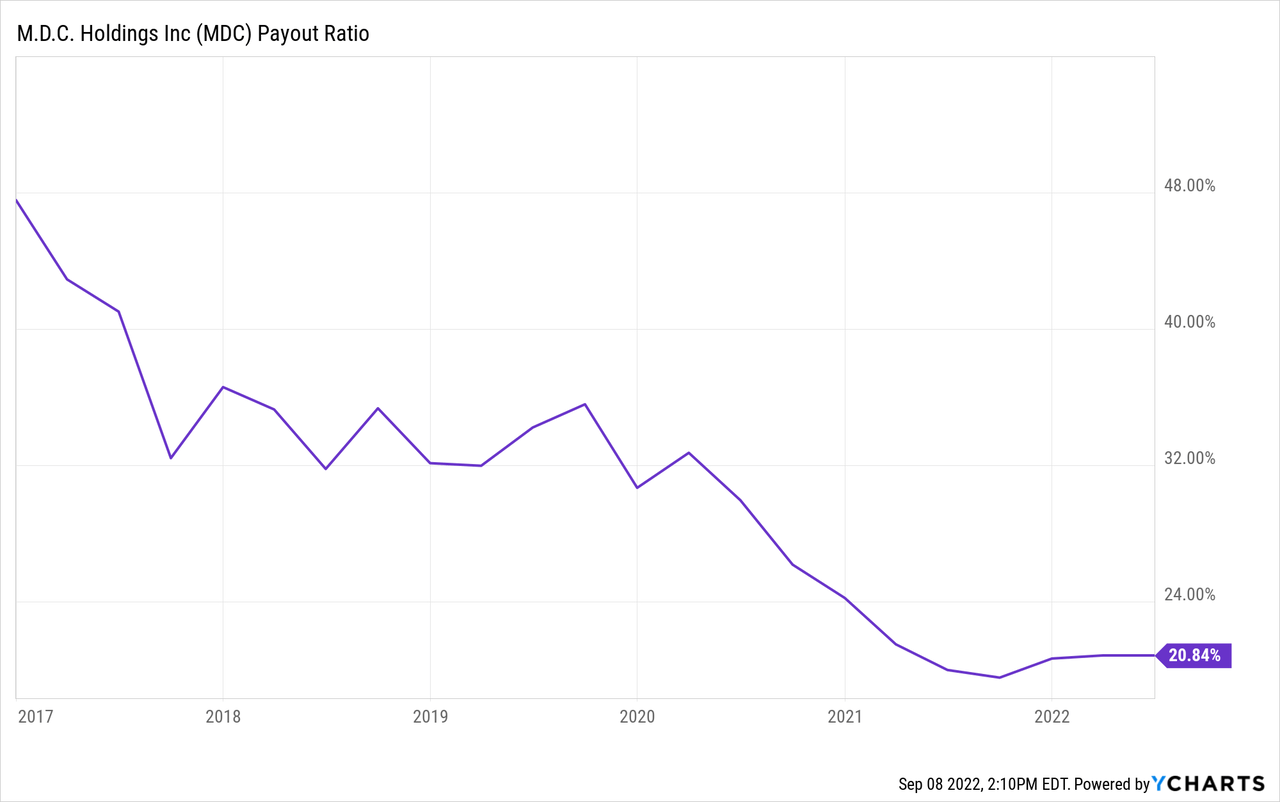

And with a 6.6% dividend yield based on a payout accounting for a mere ~20% of earnings, I think MDC is an interesting opportunity for patient dividend investors with some tolerance for stock price volatility.

Overview of MDC

MDC’s focus is primarily on the Western third of the United States but also has significant developments in Central Florida, Nashville, Washington DC, and Baltimore.

MDC Q1 Presentation

As you can see above, in the last twelve months, California was MDC’s largest state for deliveries at 23.3%, followed by Colorado at 21.8%, Arizona at 16.2%, Florida at 11.3%, and Nevada at 10.1%.

The company tries to maintain a 2-3 year supply of land for future building. This mitigates some risk in both the case of a hot housing market and a housing market trough. It provides opportunity without leveraging MDC too heavily on the success of its near-future developments.

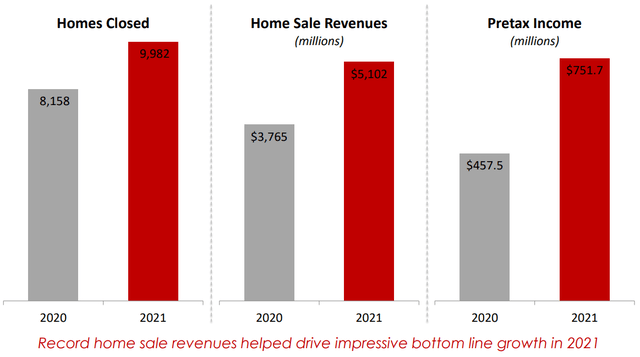

Last year was unsurprisingly a blowout year for MDC, as it was for homebuilders generally.

MDC Q1 Presentation

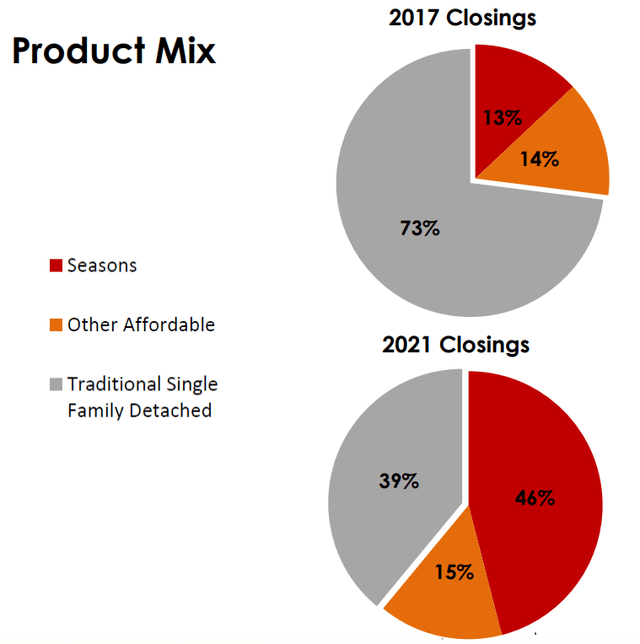

Over the last five years, MDC has shifted its mix of new home developments to its affordable home brands like “Seasons,” largely in response to demand for high-quality starter homes from Millennials.

MDC Q1 Presentation

Though MDC’s average nationwide home sale price was $572k in Q2 2022, that is largely because building in some more expensive areas like California and Washington raises the average. In Florida, MDC’s new home offerings are listed in the high $200k to low $400k range. And just outside of my own city of Austin, TX, MDC has homes starting in the low $400k area.

Here’s how CEO Mizel describes the affordable home segment:

These homes are in well located areas of the market, and features some of the quality and craftsmanship that Richmond American Homes are known for, but at a scaled down footprint and price point.

Another attribute of MDC that I like as a long-term buy-and-hold investor is the company’s general defensiveness through the entirety of the housing cycle. Here’s Mizel again:

We’ve always run our company to be successful through the entirety of a housing cycle, not just in the good times. This means we stay disciplined in our acquisition of new land deals, adhere to our built to order business model and limit the amount of speculative inventory in our communities.

While this discipline may curtail some of the upside during the market peaks, it limits our exposure during the market troughs.

With fewer speculative homes in its inventory and a smaller bank of optioned land, MDC isn’t quite as leveraged to the continued ability to sell homes at an elevated price as many of its homebuilder peers.

2022 Midyear Update

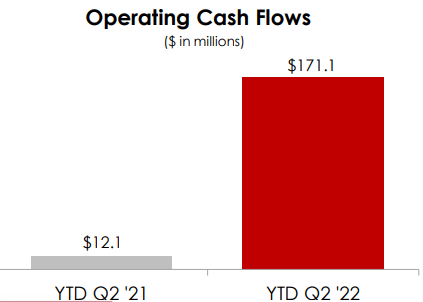

For the first half of 2022, MDC enjoyed a continuation of the strength that characterized 2021. Operating cash flow, for instance, soared year-over-year:

MDC Q2 Presentation

However, starting around May, the housing slowdown began. More and more deals fell through as buyers backed out due to rising mortgage rates or failed to qualify for financing.

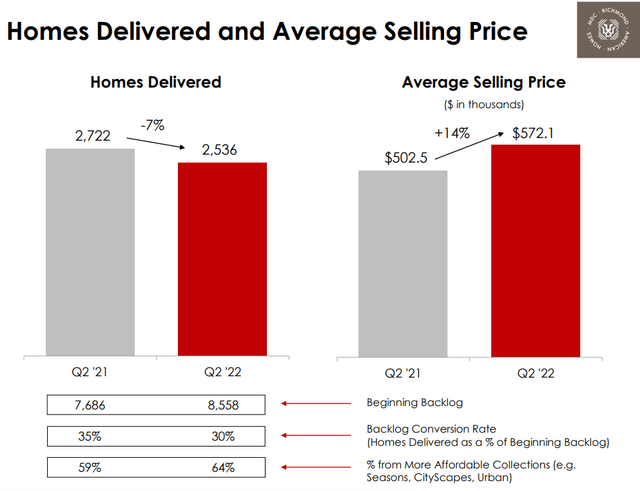

As such, though the number of homes delivered and sold in Q2 2022 fell YoY, home sales revenue still rose because of the rise in home prices.

MDC Q2 Presentation

Moreover, notice in the above image that the percentage of homes from MDC’s “affordable” brands continue to rise as a share of the total sold, from 59% last year to 64% in Q2 of this year.

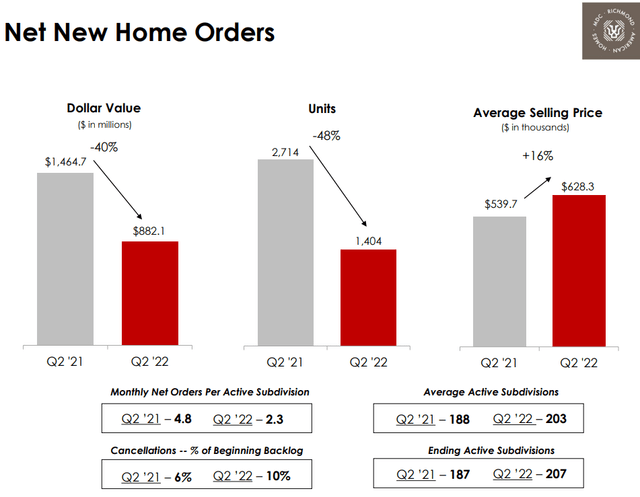

The following illustration, however, demonstrates that the good times have largely come to an end for the time being. The total dollar value of new home orders from buyers has dropped 40% YoY, while the number of individual homes ordered dropped 48% YoY.

MDC Q2 Presentation

This is mitigated partly by the fact that MDC’s average home sale price of new orders continued to climb in the second quarter by 16% YoY.

Moreover, in the second quarter, project abandonment expenses leaped massively YoY, from $1.1 million in Q2 last year to $15.5 million in Q2 of this year.

Plus, cancellations as a percentage of MDC’s backlog increased four percentage points from 5.7% in Q2 2021 to 9.7% in Q2 2022. Surely these numbers have only continued to get worse in the third quarter.

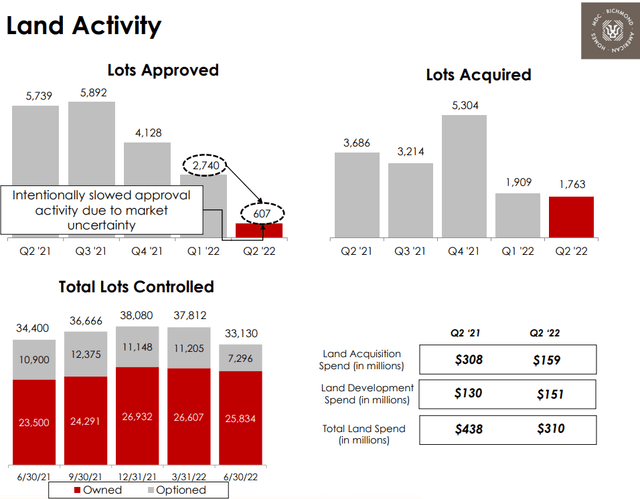

In response to these signs of demand slowdown, MDC has significantly lowered its land acquisitions and approvals as well as shrinking its land bank to a lower level than anytime in the last few years. This came mainly from lowering the number of lots MDC controls via option contract.

MDC Q2 Presentation

Land acquisition spending roughly halved YoY, which shows that MDC is battening down the hatches in preparation for the winter season of the housing market cycle.

Balance Sheet

In some ostensible ways, MDC seems to have a slightly weaker balance sheet than most of its homebuilder peers. For instance, MDC’s BBB-/Ba1 credit ratings are generally lower than the BBB or BBB+ ratings of the majority of public homebuilders.

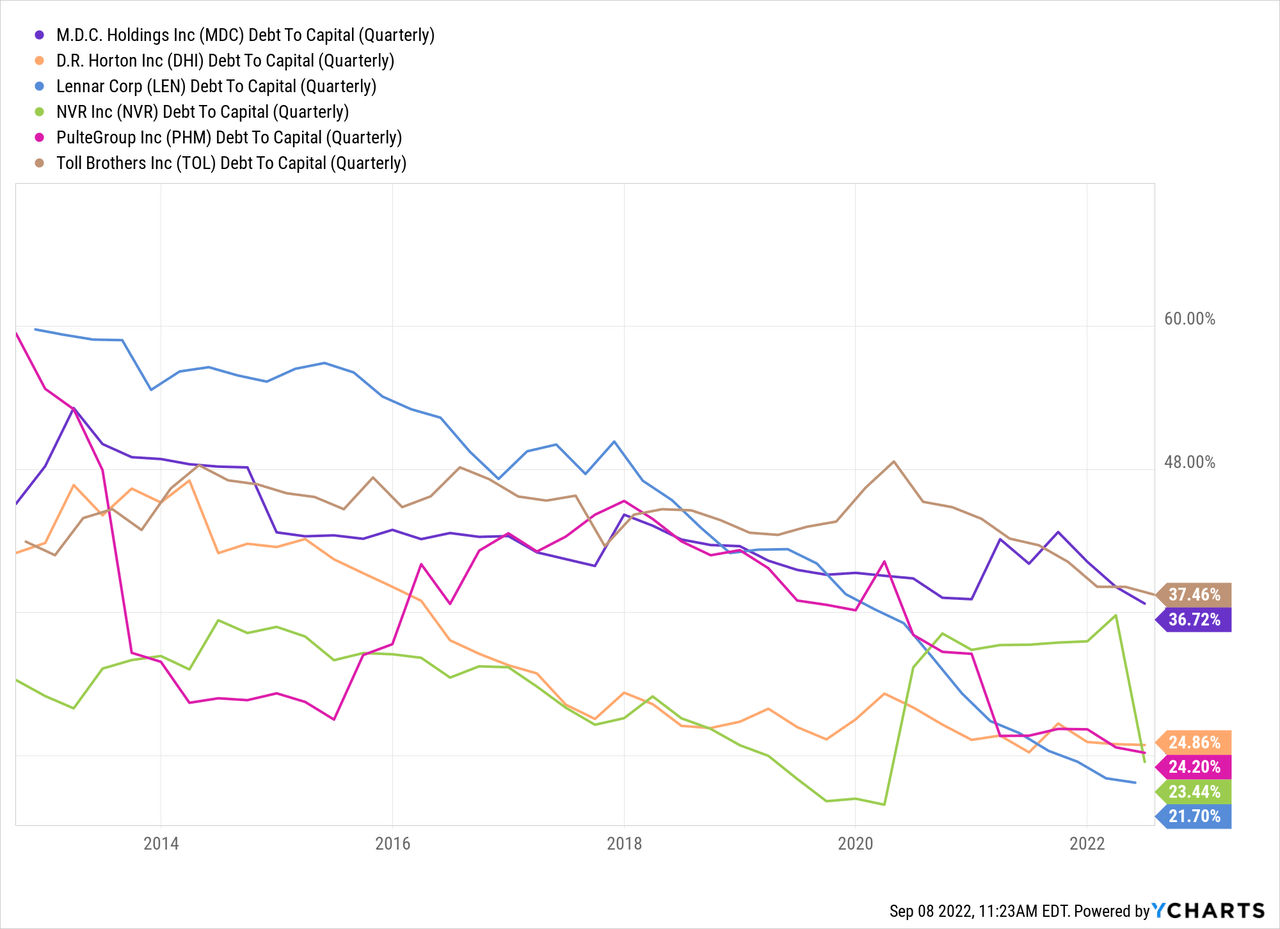

What’s more, MDC’s debt to capital is higher than that of each of its larger peers except Toll Brothers (TOL), although it has been trending down in the last five years.

However, recall that MDC has $590 million in cash ($8.10 per share), which is tantamount to 27% of its market cap. Compare that to peers’ cash as a percentage of market cap:

- D.R. Horton (DHI): 6.6%

- Lennar (LEN): 6.7%

- NVR (NVR): 10.9%

- PulteGroup (PHM): 7.0%

- Toll Brothers (TOL): 6.3%

And MDC’s large cash position is not a new development. It’s a longtime feature of the company, a risk mitigation measure that MDC has practiced for many years. Net debt to capital, which takes into account this cash position, is a mere 24% for MDC.

MDC Q2 Presentation

Moreover, MDC’s balance sheet is remarkable in that it has no senior debt maturing until January 2030, and the credit revolver does not expire until December 2025.

Total debt to TTM EBITDA was 1.63x in the second quarter. Although debt to pre-COVID annual EBITDA of around $300 million comes to nearly 5x.

Bottom Line

If you believe, as I do, that mortgage rates will not continue to rise forever and that, instead, they will reverse course and head lower sometime in the next year or two, then buying MDC now may prove to be a prescient move. If and when mortgage rates drop again, I believe millions of Millennials such as myself will be eager to go house shopping.

Though homebuilders are typically far too cyclical for my taste as a long-term, buy-and-hold dividend growth investor, I am impressed by MDC’s ability to defensively navigate the volatility of the housing market while maintaining its generous dividend payout.

That dividend has not been cut or reduced once since 1994, although there have been stretches of slow or no growth, especially during and after the Great Financial Crisis.

Despite doubling its quarterly payout in the last five years, MDC’s payout ratio has also more than halved during that time due to strong earnings growth.

Today, though the housing market is undoubtedly in for some serious pain ahead, MDC once again looks well-prepared to navigate the stormy seas.

Though I am probably too early in my bullish call, I am buying MDC as a long-term dividend payer and (sometimes) grower for its attractive 6.6% yield that appears to be safe despite the challenges ahead.

Be the first to comment