da-kuk

For lack of a better term, Lytus Technologies (NASDAQ:LYT) is odd.

The company is odd. Lytus is targeting streaming and telemedicine end markets in India (and elsewhere), but the company at the moment consists of three businesses. Two of those businesses don’t really exist yet, while a third is mostly operated by a third party.

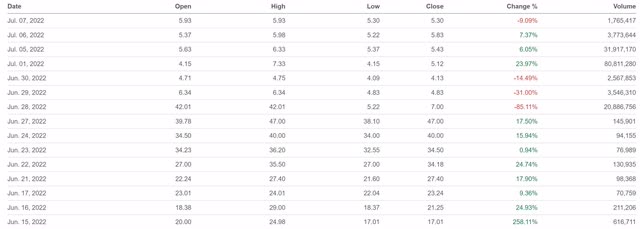

The stock certainly has been odd. Lytus went public last month at $4.75 per share. In its first day of trading, LYT stock soared 258%. In less than two weeks, in total it rallied almost 900%. Shares promptly gave back all of their gains, and then some, in three trading sessions.

The initial public offering prospectus too was odd. Even by the standards of SEC filing language, it’s rather confusing. More importantly, it contains a so-called “going concern” warning, something I don’t ever recall seeing in a pre-IPO document.

To be sure, the fact that Lytus is well, odd, doesn’t make Lytus stock a sell. But it does contribute to the sense here that there’s not that much to the stock — and yet it still, even with the sharp recent pullback, has a fully-diluted market capitalization above $180 million. With traders apparently moving on, at the least it’s going to take some time before there’s a strong, coherent case for investors to own the stock.

Lytus Technologies At A Glance

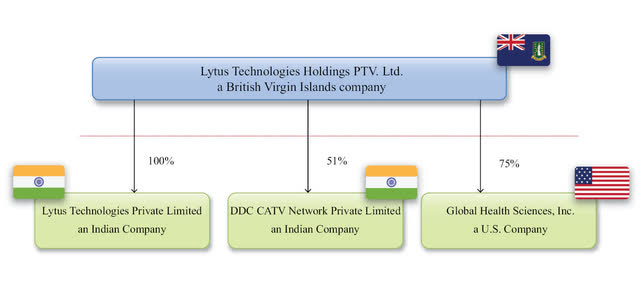

The publicly traded Lytus Technologies is a holding company with three subsidiaries:

The main business at the moment is DDC, a cable television operator in New Delhi. Global Health Sciences was acquired in 2020 to enter the U.S. telemedicine market. Lytus India offers streaming and telemedicine services in India, to existing DDC customers.

That description, however, doesn’t quite capture exactly what this business is at the moment.

Delhi Distribution Co.

DDC (Delhi Distribution Co.), of which Lytus owns 51%, at first glance appears to be a cable and internet provider of the type familiar to consumers worldwide.

But the telecast services offered by DDC are in fact delivered by a third-party, Reachnet. For total consideration of about $59 million, DDC acquired 1.8 million customers; for a fee totaling 61% of telecast revenue, Reachnet provides those services to DDC’s customers.

Somewhat oddly, the deal hasn’t actually been consummated, despite the agreement being signed back in June 2019. The prospectus attributes the delay to lockdowns driven by the Covid-19 pandemic, which probably is true to some extent; that said, Lytus also does not appear to actually have the cash on hand.

The IPO proceeds (see p. 35 of the prospectus) are supposed to pay for the 51% ownership of DDC (at a cost of just $265,000) and contribute to the $59 million owed to Reachnet. The bulk of that payment will be funded by debentures under an agreement signed on Dec. 30, 2020. Those debentures, if paid after 12 months, have an effective interest rate of 43.75% (yes, forty-three point seventy-five percent); if extended out four years, the effective annual interest rate (including both actual interest and a redemption price well above the capital raise) still comes in above 20%.

The sky-high interest rates (Lytus also borrowed $1 million last year at an effective interest rate of about 35%) are a bit more palatable when considering that it does seem DDC is getting a reasonably good deal. The company’s profit from the Reachnet deal is about $14-$15 million annually. (Owing to accounting vagaries, that profit is booked as “other income”; the intangible asset created by the acquisition then is amortized as an expense.)

Indeed, while Lytus owes Reachnet $59 million, Reachnet as of Dec. 31 already owed Lytus $40.4 million (p. F-109). Presumably, once that obligation is retired, cash flow from DDC can repay the debentures, and Lytus will be free and clear. From there, Lytus can use DDC subscribers to drive growth in OTT (over-the-top, i.e., streaming) and telemedicine revenues, which the company will own 100%.

A key word there, to be honest, is “presumably.” There’s some guesswork involved here to understand the reasoning behind the Reachnet deal and the strategy going forward. It’s not clear why the pandemic has so dramatically slowed the Reachnet agreement and the debenture issuance — or why Lytus was trying to go public last year before the uncertainties surrounding those deals were resolved.

There’s little ability to ask for color: there’s no apparent direct contact for IR or anyone else at Lytus. (I’ve tried to make contact, and will update this piece if any response comes in.) But based on the prospectus, the cash flow from DDC, and the 1.8 million subscribers (encompassing an estimated 8 million users, based on the average size of an Indian household), will provide the base for growth going forward.

Lytus India and Global Health Sciences

If the strategy works, that growth will come from Lytus India and Global Health Sciences. Lytus India plans to offer both an over-the-top service in India as well as telemedicine service. The catch is that neither is all that developed at this point.

For the first nine months of FY22 (fiscal years end in March), Lytus Group generated revenue of just $1.1 million. ~$900K came from the cable business (beyond the services provided by Reachnet); ~$200K from telemedicine. Both figures declined year-over-year against the 9M FY21 period.

To be fair, it’s still early for both revenue streams. The OTT business will require upgraded set-top boxes and other efforts; Lytus has developed an app, which appears to drive the revenue generated to this point.

The telemedicine business has different models for different markets. In India, Lytus contemplates Local Health Centers, staffed by nurses for ECGs, blood and urine tests, ultrasounds, and the like. Doctors, treating remotely, will be on call. This model should be of particular use in the countryside, where access to healthcare remains limited.

In the U.S., the model is based on a “proprietary platform” already in use in several states by roughly 125 physicians, for managing data transmitted from medical devices. Revenue from the GHSI business is currently “not significant,” but Lytus writes in the prospectus (p. 73) that “the additional rollout of devices will generate significant revenue for the company.” Further geographic expansion is planned.

When Was Lytus Technologies’ IPO?

All told, this is a bit of a strange business for a U.S. IPO, which might explain why that IPO was delayed. As noted above, Lytus has been trying to go public for some time: an original filing more than a year ago contemplated the issuance of 2.7 million shares at a range of $10 to $12.

In March, Lytus revised its filing to plan an offering of units that included both stock and warrants at a range of $4.75 to $6.75. The warrants were removed in May, and the IPO finally priced at the bottom of that range last month.

Lytus sold a bit over 2.6 million shares, with the underwriters’ option adding another 391,000. Net of expenses, Lytus raised a little over $13 million, which will be used to grow its business going forward. Shares began trading on June 15.

Who Was Interested In Buying Lytus Technologies Stock?

As noted, the IPO priced at $4.75. On the first day of trading, LYT stock opened at $20.

At the risk of being repetitive, it’s not at all clear why. Lytus was not a typically “hot IPO.” Few investors had ever even heard of the company, and the fact that the offering was delayed, downsized, and cut in price shows that there was hardly an established pool of demand.

And it’s not as if volume was high, either. On the first day, a little over 600,000 shares traded, less than one-quarter of the float.

Yet the stock kept going — still on relatively normal-ish volume. On June 27, LYT’s eighth session of trading, it closed at $47. Total volume to that point was just 1.45 million shares — just under half the total shares available (presumably about 3 million between the IPO and the underwriters’ option).

To further complete the odd picture, LYT then reversed — as volume absolutely soared:

On June 28, the average share of Lytus stock changed hands seven times. The stock fell 85%. A bounce a few days later saw two-day volume total 112 million shares — more than thirty-seven times the number of shares available to trade.

This trading looks like something from January 2021 — only if meme stocks had collapsed instead of soared.

Again, it’s not at all clear why this happened. Skeptics might argue for manipulation as a possible theory, and low-float IPOs are a tempting target. Yet we have zero evidence for that claim, and it still doesn’t explain why volume was so high during trading on June 28, when the stock was in absolute freefall. A nefarious actor wouldn’t need that kind of volume — or anywhere close — to exit a position.

Rather, it simply seems like LYT, so like so many stocks over the past few years, became a retail trader’s plaything. And, with volume quickly retreating, many of those traders have moved on. That leaves the fundamentals.

Is Lytus Technologies Profitable?

But the fundamentals aren’t terribly easy to understand. Lytus Technologies is profitable at the moment, and there presumably will be a spike in those profits down the line.

On a GAAP basis, CY21 net income (Lytus has not disclosed results for Q4 FY22, which is Q1 CY22) was a bit under $1.4 million. Free cash flow has been essentially breakeven (though modestly in the black). But the profit and loss statement includes amortization of the $59 million paid to acquire customers; that should come off the books in calendar 2024. Free cash flow is impacted both by the lack of cash coming in from Reachnet and the fact that Lytus itself hasn’t made required payments under the customer acquisition agreement.

So, yes, Lytus is modestly profitable now — but that’s not really what matters. Once the cash does come in from Reachnet, the cash flow statement will improve and the balance sheet will be strengthened. (Only ~$29 million of the payment due Reachnet is marked as current, so presumably Lytus will get a net infusion of roughly $11 million along with the $13M-plus raised in the IPO.) And once the amortization runs off, earnings here will look strong (though remember that Lytus will only book 51% of the profit stream from DDC).

But there’s another factor to consider: the newer businesses. Lytus’ spending outside of DDC is incredibly modest. Total cost of revenue plus operating expenses over the past four quarters has been in the range of $2 million.

That has to change significantly for the plans in telemedicine and OTT to have any hope of succeeding. The US business will require working capital as well, since GHSI plans to purchase the devices upfront.

Broadly speaking, then, if the strategy here actually is executed there will be a big spike in profits and cash flow from DDC — and a big spike in losses and cash burn from the newer efforts. To what extent those two cancel each other out is obviously key for LYT stock — and also incredibly difficult to tell.

Was Lytus Technologies’ Initial Valuation Fair?

Qualitatively and quantitatively, there is simply a massive amount of guesswork here. And that in turn makes it difficult to convincingly assess whether the current ~$185 million market cap — marginally above that implied by the $4.75 IPO price — is attractive or not.

But the initial impression is: probably not. Given a pro forma enterprise value about equal to the market cap (the net deficit owed to Reachnet is ~$19 million; net cash post-IPO $13 million), investors need to see at least $200 million of value here to get excited. That’s a tough case to make.

DDC was built on a $59 million acquisition. Perhaps that was a good deal, but it no doubt wasn’t that good. If it were, one imagines Lytus management (which has a decent amount of corporate experience) could find a better way to fund it than via debentures yielding 20%-plus. And again, Lytus only owns ~half of the business; even assuming DDC is worth $100 million, that still leaves ~$150 million in required value from the newer initiatives.

And, again, there’s not much there. Neither Lytus India nor GHSI has a notably disruptive business model. Both are going against more established, better-funded competitors; as it did across the world, the pandemic spurred investment in and adoption of telemedicine in India. Netflix (NFLX) and Disney (DIS), among others, already operate their streaming services in that country.

To be fair, GHSI was founded by a telemedicine pioneer, James Tuchi, who still is part of the company. But managing remote devices is not an innovative business model in the U.S., and as with Lytus India there’s no expressed reason to see the company as having a real edge. These are exceptionally speculative, early-stage businesses — neither of which suggests a valuation in the eight figures, let alone $150 million-plus combined.

Is LYT Stock A Buy, Sell or Hold?

The broad sense from LYT stock is that it’s a 2021 stock in a 2022 market. The crazy early trading had echoes of the similarly frenzied runs that dotted last year’s bull market. The “streaming and telemedicine in India” business model sounds like a perfect fit for a small SPAC (special purpose acquisition company). The vague claims of growth opportunities without an accompanying detailed strategy are reminiscent of some of the small-cap companies that soared in late 2020 and early 2021.

To be sure, that doesn’t mean that this won’t work. There’s value in DDC. We’ll presumably get more information on Lytus India and GHSI over time, and that information might provide some color as to how those businesses aim to succeed. This is clearly a speculative stock, but not a financially questionable one.

The near-term problem, however, is precisely that this is a 2022 market, and vague promises aren’t flying anymore. As much excitement as the post-IPO trading created, beyond those promises there simply isn’t that much here. There’s a low-growth cash flow stream from DDC and hopes for success elsewhere. Last year, that could have driven some interest from not just traders, but investors. This year, it’s almost certainly not enough.

Be the first to comment