David McNew

Thesis

The market environment is looking ultra-bullish for Exxon Mobil (NYSE:XOM) and the stock is up approximately 40% YTD vs -20% for the S&P 500. Exxon’s bull run was driven by a global energy shortage that pushed the benchmark WTI significantly to >$100/barrel. While the main driver for the price appreciation was likely a multiple-year underinvestment in the oil & gas industry, the Russian invasion of Ukraine certainly added to the shortage. But given the bullish market sentiment, Exxon stock is trading at an attractive valuation. In my opinion there is certainly downside risk for the oil price, as I believe the global economy is highly likely to slip into a recession. And in past recession, the oil price has always traded down significantly. Thus, in my opinion, investors should use the opportunity and sell the optimism—as long as it lasts.

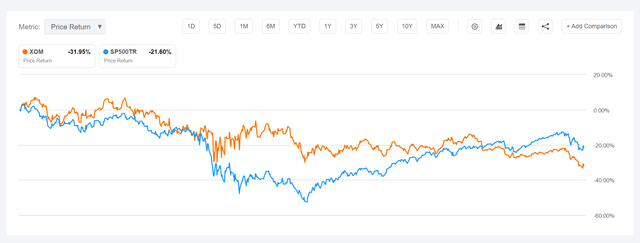

Notably, for the past recessions XOM always depreciated in value.

Dot-Com Crash induced recession (March 2000 – mid/late 2002)

-12% for XOM vs. -33% for SPX.

Seeking Alpha

Financial Crisis (December 2007 – May 2010)

-31% for XOM vs. -21% for the SPX.

Seeking Alpha

Peak Cycle Financials

Given the rapid rise in energy prices, Exxon Mobil has enjoyed a very strong financial performance. (And the same arguments could be made for Chevron (CVX), ConocoPhillips (COP) and Occidental (OXY)).For the trailing 12 month, Exxon generated revenues of $306.87 billion, implying a 70% increase year-over-year. Net-income jumped to $28.84 billion versus a loss of $2.05 billion in 2020. Even more notable, cash from operations for the trailing 12 month was $81.8 billion, almost x3 the same metric for 2019, and more than x5 times the same metric for 2020. In any case, Exxon’s profit windfall is likely to continue for the foreseeable future and Q2 2022 is widely expected to be a blowout quarter for Exxon. With a dividend-break-even price of approximately $35 per barrel, I estimate that Exxon could generate between $15 billion – $20 billion of free cash flow in excess of dividend payments this year. Thus, Exxon Mobil may comfortably achieve the $2 billion debt repayment target and $10 billion of share-buybacks—implying total shareholder distributions of about 8%! That said, the market is surely pricing in a lot of optimism.

Is the profitability sustainable?

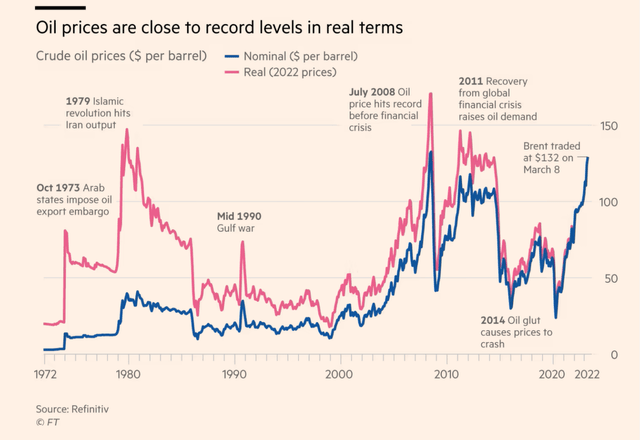

But how sustainable is Exxon’s profit windfall? The thesis for investing in oil & gas companies is deeply anchored on the oil price. And the oil-price is skewed to the downside, in my opinion, given the looming prospects of a sharp recession. This week Edward Morse, the global head of commodities strategy at Citi with half a century of experience shared the view that oil (WTI benchmark) could fall to $60 per barrel, if the global economy were to slip into a recession.

But how likely is a recession? Given rising interest rates, high inflation, falling asset prices and a challenging economy in China, it is difficult to argue that the global economy will not see a recession in the second half of 2022/early 2023. However, the recessionary impact on oil demand and prices is a little more difficult to forecast—but the risk/reward is clearly skewed to the downside. For example, before the financial crisis oil stood at $140 per barrel (July 2008), only to crash to as low as $40 per barrel by the end of the year.

Financial Times

That said, I believe the oil price—and thus Exxon Mobil stock—doesn’t have a lot of upside at the moment, given that so much optimism is priced in. The downside, however, is pronounced given the recessionary risk, which the oil price has not yet fully discounted. Moreover, investors should not disregard that the oil and gas industry is in a secular downturn. Governments and institutions worldwide are working hard to phase out Exxon’s legacy and cash-flow generating business, a commitment that has only been strengthened by the current oil shock.

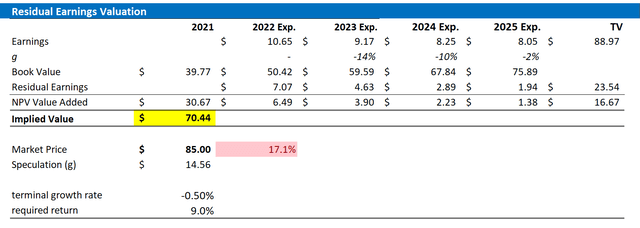

Residual Earnings Valuation

Let us now look at the valuation. What could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise. That said, EPS for 2022, 2023, 2024 and 2025 are estimated at $10.65, $9.17, $8.25 and $8.05

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 05, 2022. My calculation indicates a fair required return of 9%.

- To derive XOM’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply -0.5 percentage points to reflect a secular decline for oil and gas as an energy source.

Based on the above assumptions, my calculation returns a base-case target price for XOM of $70.44/share, implying material downside of about 17%.

Analyst Consensus EPS; Author’s Calculation

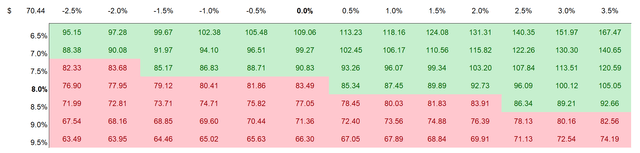

I understand that investors might have different assumptions with regard to XOM’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS; Author’s Calculation

Arguments for a continuation of the bull case

My thesis is anchored on the believe that the global economy will enter a recession in the second half 2022/first half 2023. That said, if the economy turns out stronger than expected, energy demand and the oil price might stay at elevated levels—which would invalidate my bearish outlook on Exxon Mobil. Furthermore, the oil price is significantly correlated to the Russian war in the Ukraine. JPMorgan published research that argues oil could jump as high as $190 per barrel—and to a “stratospheric” $380 per barrel as a worst case scenario. JPMorgan’s thesis is anchored on the assumption that price penalties on Russian oil is retaliated by Russia with output/export cuts. At the same time, however, the situation could also surprise to the upside which would be supportive for my thesis.

Conclusion

I absolutely do not recommend short-selling Exxon Mobil stock. For such a trade the company’s current financial profitability is way too strong and the oil market—including the Russia vs Ukraine situation—far too unpredictable. My Sell recommendation is directed towards shareholders, who I believe are well advised to take advantage of elevated optimism and take profits on XOM. I see $70.44/share as a fair value, which I anchor on a residual earnings valuation based on analyst consensus estimates.

Be the first to comment