Massimo Giachetti/iStock Editorial via Getty Images

Investment thesis

Bank of America’s (NYSE:BAC) high asset sensitivity positions it well to benefit from the rising interest rate cycle. The company also has strong loan growth prospects as its loan growth has lagged deposit growth since Covid and there is a good chance to catch up. There is a short-term headwind as the company is planning to discontinue its overdraft charges which will result in a $1 billion hit for the topline. But I believe, in the long term, it will make the company more competitive and thus attract more consumers. Further, its impact will be much lower compared to the impact of investments that some of its global banking peers like JPMorgan Chase & Co. (JPM) are making, and BAC should see a swift recovery in EPS in FY23 and beyond. The stock is trading at 13.32x FY22 EPS estimate and 11.41x FY23 EPS estimate and I believe it is a good buy at the current level given its strong long-term growth prospects.

Last Quarter Earnings

Earlier this year, Bank of America Corporation reported fourth-quarter results for the period ending Dec 31, 2021, with total revenue, net of interest expense rising 10% year over year from $20 billion to $22.1 billion, owing to an increase in both net interest income and non-interest income. Strong deposit growth and investment of excess liquidity boosted net interest income (NII) by 11% year over year from $10.25 billion to $11.41 billion. Non-interest income increased by 8% year over year due to an increase in asset management fees and investment banking revenue. Better asset quality and macroeconomic improvements helped in releasing $489 million in the provision of credit losses. Non-interest expenses increased 6% to $14.7 billion because of higher revenue-related incentive compensation partially offset by lower Covid-19 related costs. Diluted EPS per common share increased by 39% year over year from $0.59 to $0.82 (beating the consensus estimate of $0.76).

BAC Stock Key Metrics

Segments

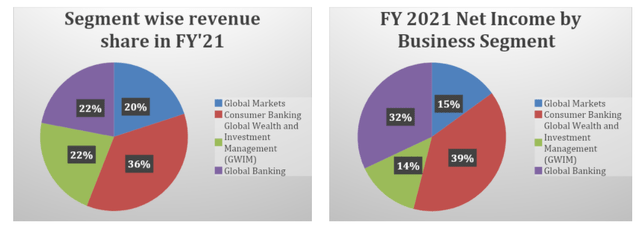

Bank of America reports its business in four segments: Consumer Banking, Global Banking, Global Wealth and Investment Management (GWIM), and Global Markets. In FY21, BAC’s Consumer Banking segment accounted for nearly 36% of total revenue, followed by GWIM (22%), Global Banking (22%), and Global Markets (20%). The Consumer segment accounted for 39% of the total $32 billion in net income in FY’21, while Global Markets and GWIM contributed 15% and 14%, respectively. Despite the fact that global banking accounts for only 22% of total revenue, it generated 32% of total net income.

Bank of America Segment Revenues and Net Income (% of total) (Company Data, GS Analytics Research)

Improving Net Interest Income

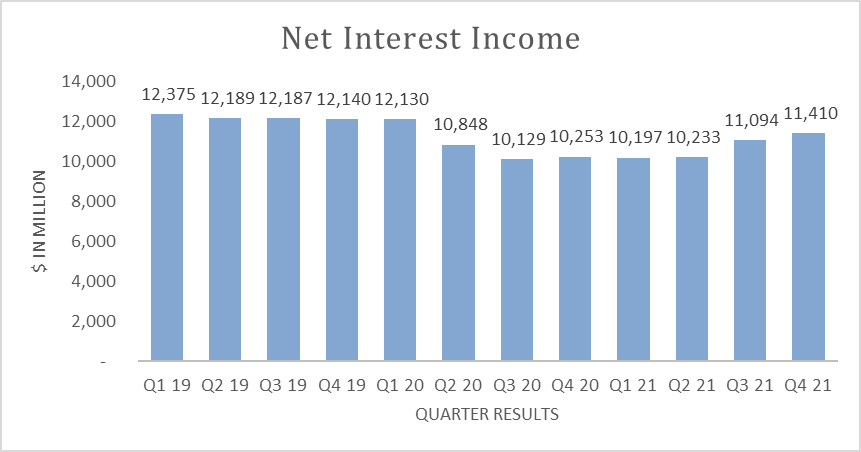

Bank of America Net Interest Income (Company Data, GS Analytics Research)

BAC’s net interest income was impacted during the Covid pandemic as interest rates declined. With the Covid-19 pandemic fading and inflation rising globally, the interest rate cycle has reversed. The US Federal Reserve began raising interest rates in March and consensus estimates are around seven 25bps rate hikes this year. Bank of America has a high asset sensitivity and according to management, the company’s NII can increase $6.5 billion for every 100 bps increase in interest rates. So, we believe BAC is a good way to play the rising interest rate theme.

Loan Growth Prospects

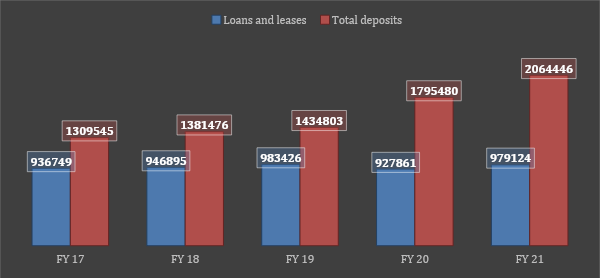

Bank of America Corporation’s loan growth has lagged its deposit growth meaningfully during the pandemic. Following a drop in the asset base of loans and leases from $983.43 billion to $927.86 billion in FY’20, loans and leases increased by 6% in FY’21 to $979 billion. On the other hand, after increasing by 25% in FY’20, the deposit base increased by another 15% closing at $2.06 trillion.

Bank of America Loan and Leases Growth vs Total Deposit Growth (Source: Company Data, GS Analytics Research)

With economies reopening and businesses recovering, we believe loan growth should catch up with deposit growth and BAC will be able to deploy more funds at a higher interest rate. This loan book growth will further add to the company’s net interest income.

Net charge offs as a percentage of average loans and leases is also at multiyear lows indicating improved asset quality and favourable market conditions (Source: Company Data, GS Analytics Research).

|

Year-end Dec 31 |

FY 16 |

FY 17 |

FY18 |

FY19 |

FY20 |

FY21 |

|

Net charge offs as % of average loans and leases outstanding |

0.43% |

0.44% |

0.41% |

0.38% |

0.42% |

0.25% |

Some Headwinds for Non-Interest Revenues and Expenses

On the non-interest revenue side, management has recently announced sweeping changes to overdraft services in 2022, including eliminating non-fund fees and a reduction in overdraft charges from $35 to $10. Fees from overdraft services totalled around $1 billion in 2021, which were recorded in consumer banking as service charges in the consolidated income statement. We should see a ~75% reduction in these fees in the current year and further reduction over the coming years. While a short term hit, we believe this reduction will make the company more competitive in the long run and thus help attract more consumers.

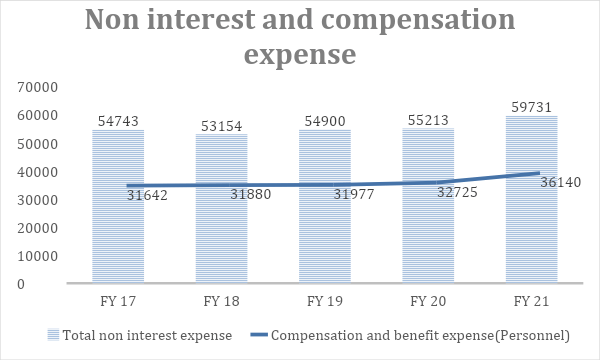

On the expense side, the company is getting impacted by high wage inflation which has resulted in a higher than normal increase in compensation expense in FY ’21 and the same is expected in FY22. However, in the long run, we expect year-over-year wage growth to normalize to the pre-Covid range in FY23 to beyond.

Bank of America’s Total Non Interest Expenses, and Compensation Expense (Company Data, GS Analytics Research)

Is Bank Of America Stock Overvalued?

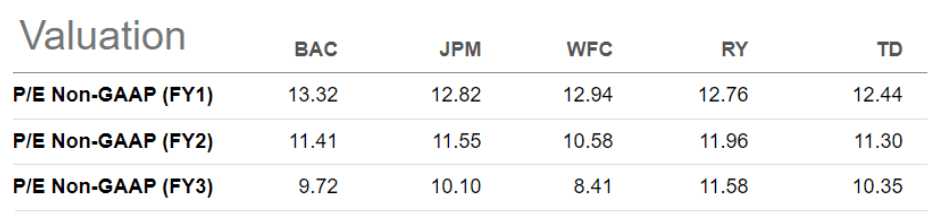

If we compare Bank of America (BAC) with a peer group consisting of JPMorgan Chase & Co, Wells Fargo (WFC), Royal Bank of Canada (RY) and The Toronto-Dominion Bank (TD), its FY22 adjusted P/E is highest in the group. But due to its higher EPS growth rate compared to peers, its FY23 and FY24 adjusted P/E are towards the mid or lower side.

Bank of America P/E Ratio vs Peers (Seeking Alpha)

We don’t think BAC is overvalued if we take into account the company’s better than peers EPS growth prospects for FY2023 and beyond. It also has a decent dividend yield of ~1.93%.

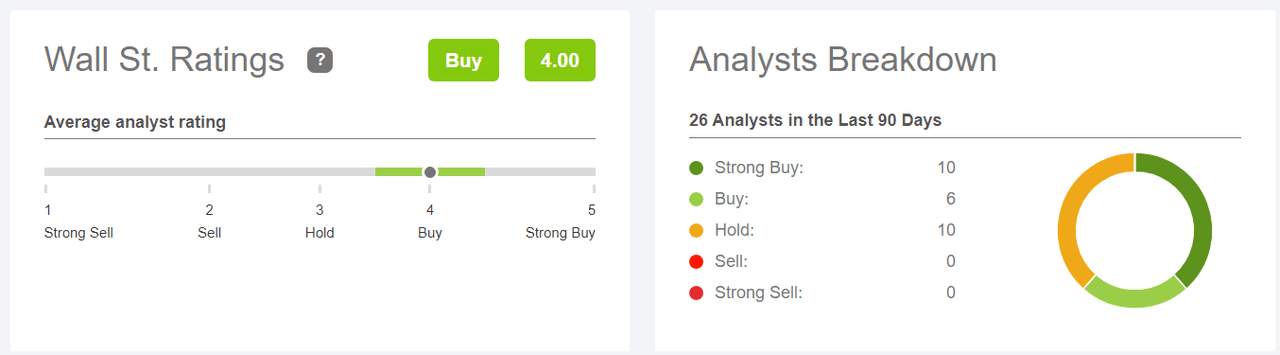

Is BAC Stock Expected To Go Up?

I believe Bank of America’s stock should go up with its business benefiting from the interest rate cycle as well as a potential pick up in loan growth. Sell-side analysts are also warming up to the story and the only bearish analyst – Morgan Stanley’s Betsy Graseck – recently upgraded the stock from underweight to overweight. Overall, Wall Street is bullish on Bank of America with 10 analysts having a strong buy rating, six analysts having a buy rating and 10 analysts having a hold rating. None of the analysts currently has a sell rating on the stock.

Wall Street Ratings for Bank of America Stock (Seeking Alpha)

Is Bank Of America A Good Long-Term Investment?

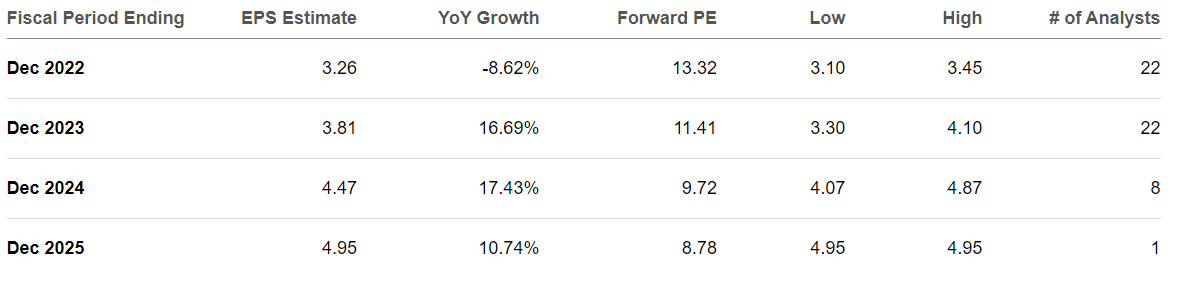

I believe Bank of America is a good long-term investment. The stock is available at a reasonable valuation, has a decent dividend yield of ~1.93% and its long term EPS growth potential is attractive. Even Warren Buffett, one of the world’s most revered long-term investors, has BAC as the second-largest position in Berkshire Hathaway’s (BRK.A) (BRK.B) portfolio. While the company’s EPS is expected to decline slightly this year, sell-side consensus expects EPS to grow in the mid to high teen range for FY2023 and FY2024. I believe the strong loan book growth potential will continue to power the company’s topline and earnings growth for the next three to four years as it catches up with the growth in deposits.

Bank of America Consensus EPS Estimates (Seeking Alpha)

Is BAC Stock A Buy, Sell, or Hold Now?

BAC is a good buy at the current level given its low valuation, decent dividend yield, tailwinds from the rising interest rate environment, and good loan book growth prospects as it catches up with the deposit growth. The company should post a good NII growth over the coming years due to its high asset sensitivity and as it deploys its funds at higher interest rates.

We have earlier covered one of its peers, JPMorgan Chase & Co., where we had a neutral rating as the company was doing excessive investments with a good deal of uncertainty about the payback period. Bank of America is comparatively much more measured in its approach. Compared to JPMorgan whose earnings were expected to decline ~28% in the current year (consensus estimates), Bank of America’s EPS is expected to decline only ~8.62% in the current year and will post a sharp recovery in FY23. Hence, we believe BAC offers a better risk-reward in the long term.

Be the first to comment