Dmytro Skrypnykov/iStock via Getty Images

Sea Limited (NYSE:SE) keeps falling as investors have grown wary of weakness in its video game business and fearful of future weakness in its e-commerce businesses amidst a weakening economic picture. The latest quarter saw SE report typically torrid revenue growth but at the expense of deteriorating profitability. SE remains a higher risk idea due to its high degree of cash burn, but the company has a cash-rich balance sheet and is working towards improving profitability in its core e-commerce markets. The stock is looking highly buyable after an 80% decline from all-time highs – I have initiated a small position and aim to hold for the long term.

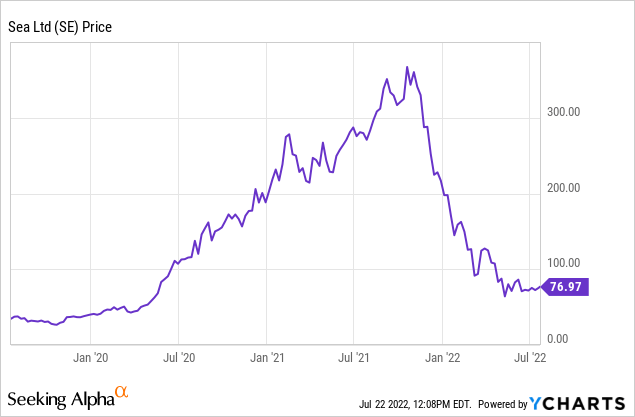

SE Stock Price

After peaking near $373 per share, SE has fallen 80% to trade at around $77 per share.

I last covered SE in March when I rated it a buy on account of the valuation. The stock has since fallen another 30% since then.

SE Stock Key Metrics

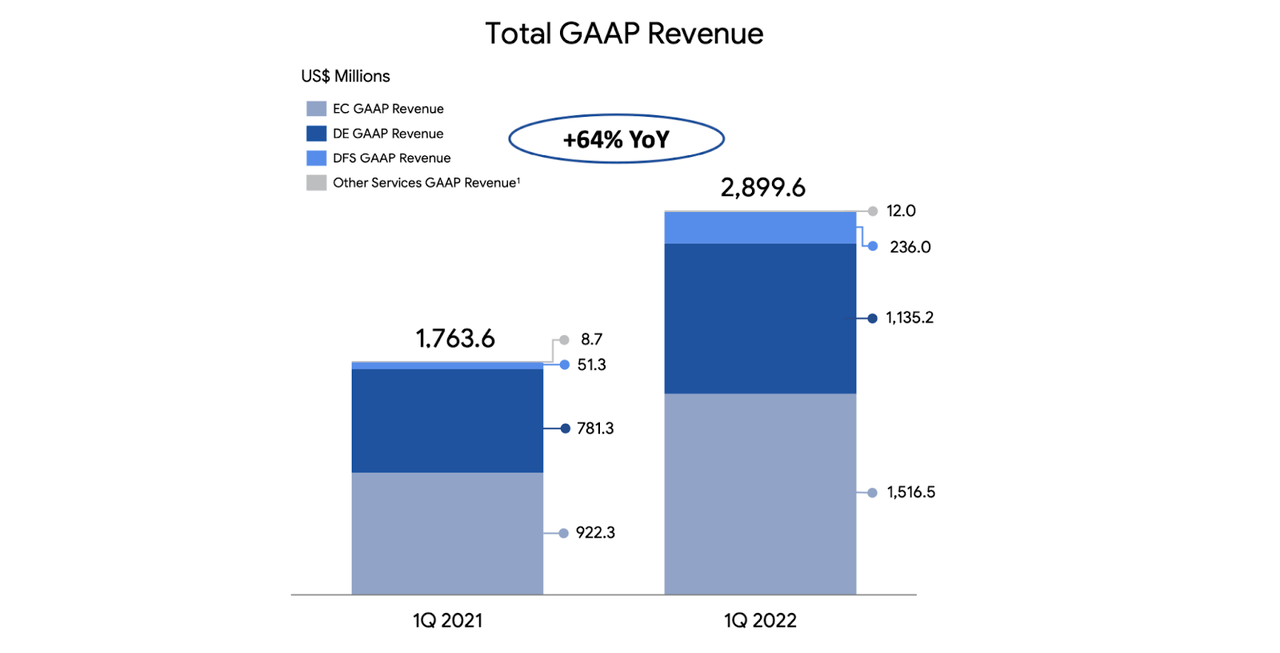

The latest quarter saw SE report 64% year over year revenue growth.

2022 Q1 Presentation

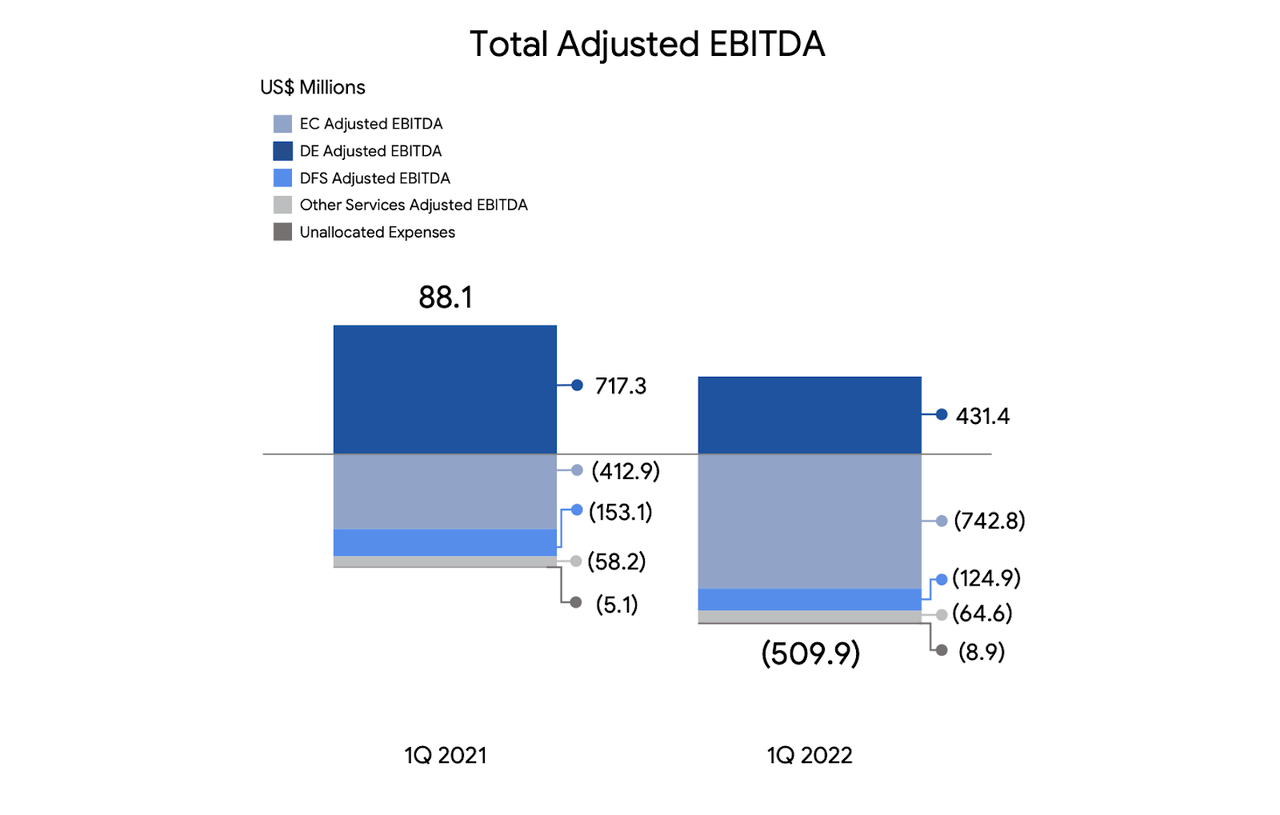

We can see below that it was able to offset weakness in its digital entertainment business (‘DE’ – the video game business) with strength in its e-commerce (‘EC’) and fintech (‘DFS’) businesses.

2022 Q1 Presentation

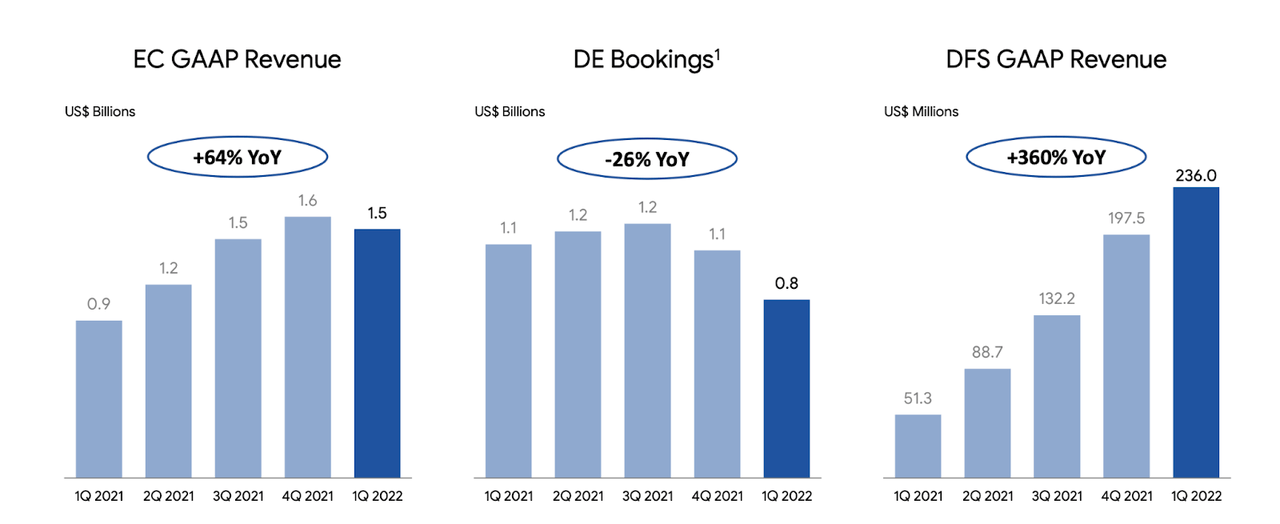

Its digital entertainment business, led by its hit game Garena Free Fire, continues to see declines in its user base.

2022 Q1 Presentation

That decline led to digital entertainment adjusted EBITDA dropping by 40% to $431 million, which in turn sent overall adjusted EBITDA from positive $88.1 million to negative $509.9 million.

2022 Q1 Presentation

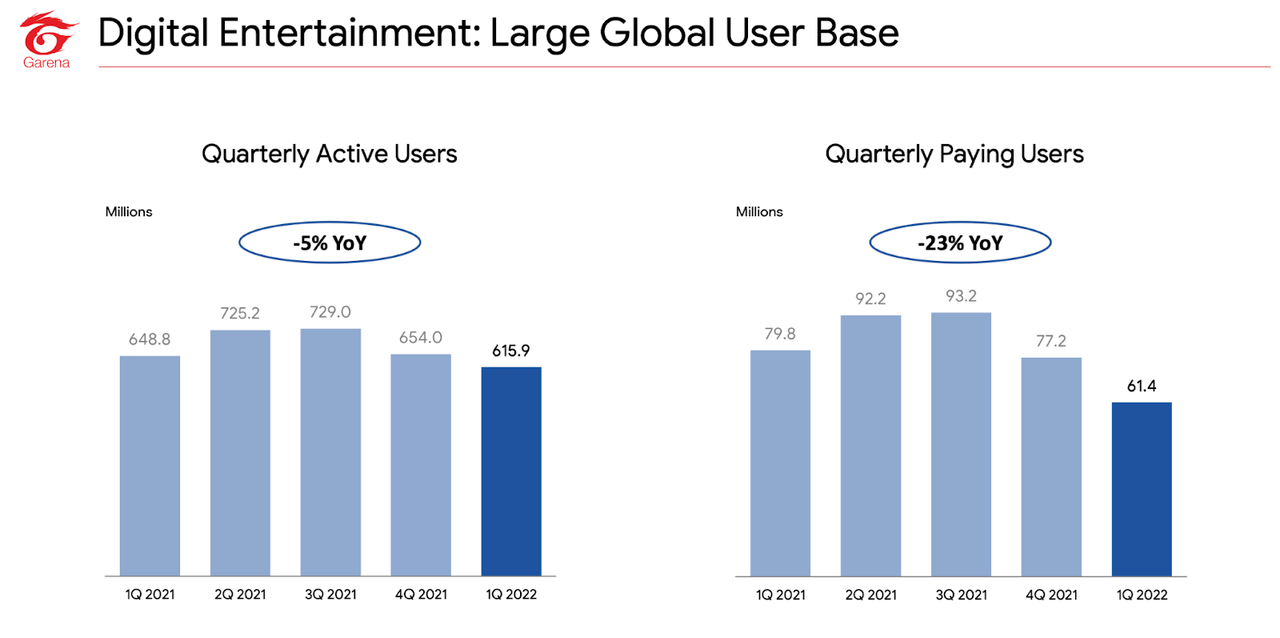

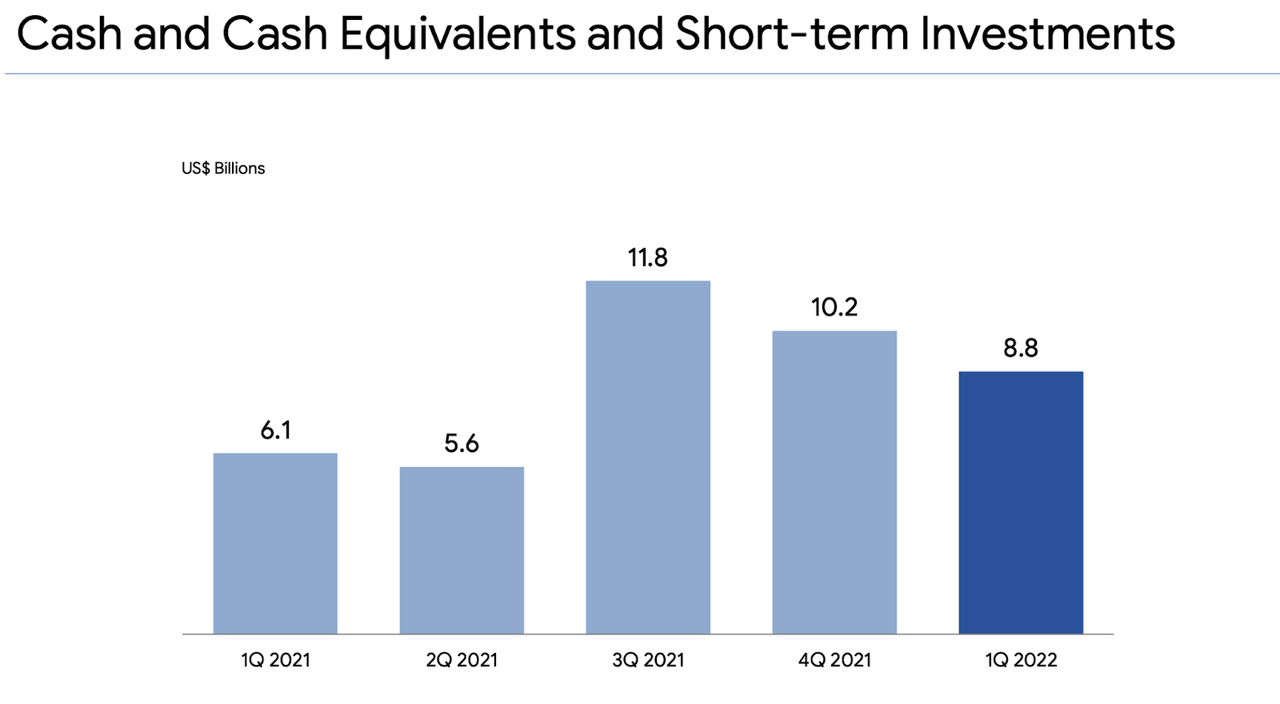

SE continues to guide for positive adjusted EBITDA per order in Southeast Asia and Taiwan before HQ costs by this year, and similar profitability but after HQ costs by the end of next year. Overall, its adjusted EBITDA loss per order stood at $0.40 – slightly higher than the $0.38 per order last year due to aggressive investments in new markets such as Brazil. I suspect that improvements in e-commerce profitability will not be able to fully make up for the declining profitability in its digital entertainment business. Even so, SE has entered this storm with a strong balance sheet carrying nearly $9 billion of cash and short-term investments.

2022 Q1 Presentation

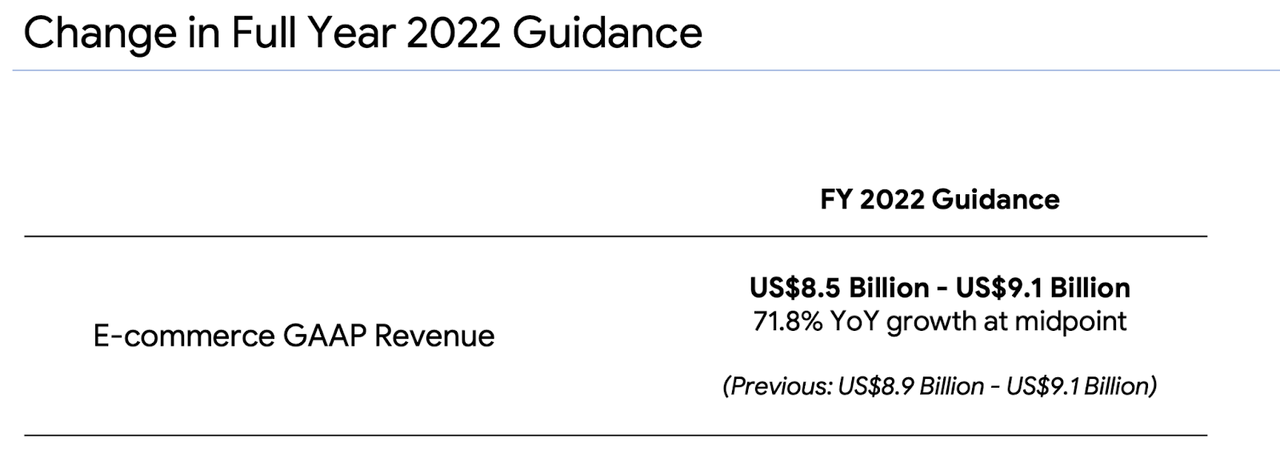

Including long term investments and debt, SE had $6 billion of net cash as of the end of the quarter – down from $7.7 billion in the sequential quarter. Due to the economic uncertainty, SE increased the range of its guidance for e-commerce revenue to $8.5 billion at the low end.

2022 Q1 Presentation

Is SE Stock Undervalued?

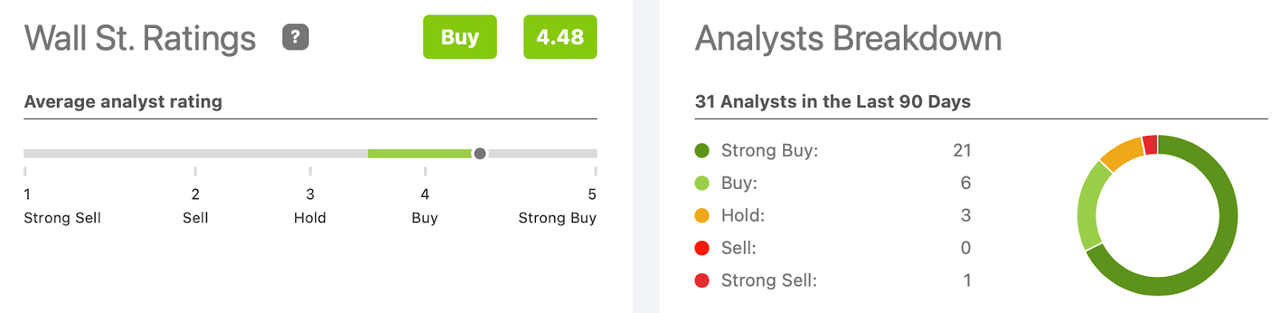

Wall Street analysts remain bullish on the stock, with an average 4.48 out of 5 buy rating.

Seeking Alpha

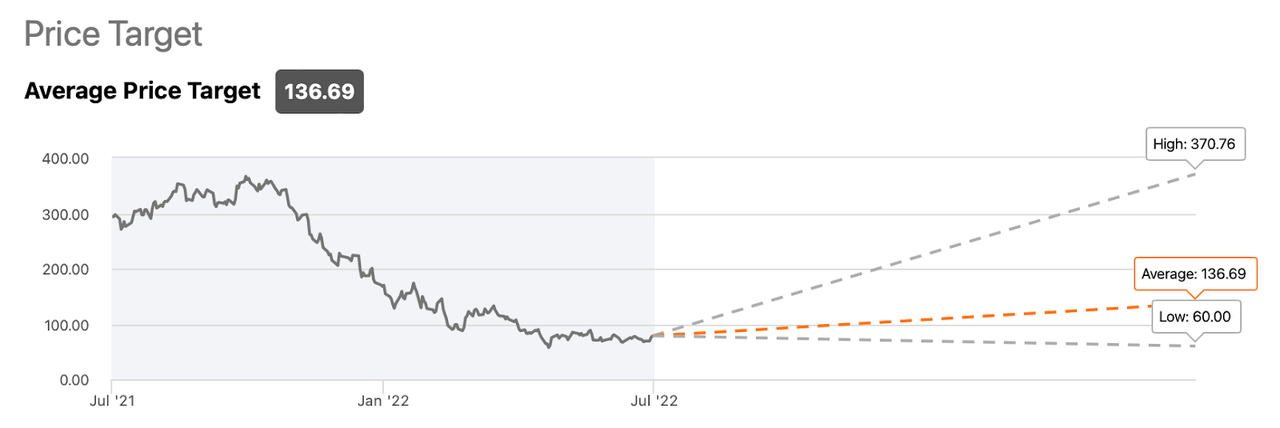

We can see below that the average price target of $139.69 per share represents a significant decline from the previous price targets in excess of $300 per share less than a year ago.

Seeking Alpha

Is SE Stock A Buy, Sell, Or Hold?

There have been grumblings that the current market is only suitable for stocks which are generating positive GAAP income. I continue to detract from that sentiment though acknowledge the likelihood of economic weakness in the near term. SE’s strong balance sheet should be enough to weather the storm – I note that even if digital entertainment adjusted EBITDA is completely wiped out, SE should still be able to fund around 2 years of losses with net cash on hand. SE remains a dominant e-commerce leader in Southeast Asia and is aggressively winning market share in new markets like Brazil – albeit at large loss rates. I once again value SE based on a sum of the parts process. I previously projected $1.8 billion in adjusted EBITDA for the video game business. I now adjust my estimate to $1 billion – representing a steep decline from the $2.8 billion produced in 2021. Again applying a 5x EBITDA multiple, we arrive at a $5 billion valuation for that business segment. For the e-commerce business SE is guiding for $8.9 billion in revenues at the midpoint. I assume the company only hits $8 billion and over the long term achieves 10% net margins. Assuming a 1x PEG ratio and 40% growth in 2023, the e-commerce business might be worth $32 billion. SE is projecting $1.3 billion in revenues for the digital financial services business. Assuming 30% long term margins, a 1x PEG ratio, and 40% growth in 2023 for the digital financial services, I can assign a $15.6 billion valuation. In total we arrive at a $52.6 billion valuation. The stock is currently trading at a $42 billion valuation, suggesting 25% potential upside. I note that this is in spite of reducing my estimates and applying a conservative 1x PEG ratio. In reality, I could see SE eventually garnering a 1.5x to 2.0x PEG ratio, implying another 50% to 100% additional upside from multiple expansion alone. Moreover, SE may be able to sustain its high growth rates for longer than expected. The key risk here remains that of the high cash burn. SE is arguably stuck between a rock and a hard place. If it continues to press on with aggressive growth, it may burn its cash balance to dangerous levels. If it instead aims to preserve cash, then its growth engine may slow down. In spite of the 80% decline since all-time highs, I expect the stock to remain very volatile. While I can see the stock earning a lower risk profile and higher PEG ratio as it improves its profit margins, that may still be many years away. I continue to rate SE a buy but caution that it remains a high-risk story as the path to profitability is less clear here. I have purchased a small position as part of my Tech Stock Crash Basket provided for subscribers.

Be the first to comment