pixelfit

Thesis

LVMH Moët Hennessy – Louis Vuitton, Société Européenne (OTCPK:LVMUY, OTCPK:LVMHF), or commonly known as LVMH, faces numerous short-term headwinds as a result of the various changes in the macroeconomy. In this article, we will assess some of these risks, and analyze the company’s past and future financial performance. Overall, we recommend a “HOLD” rating, as the future of LVMUY seems unclear at the current moment.

Company Overview

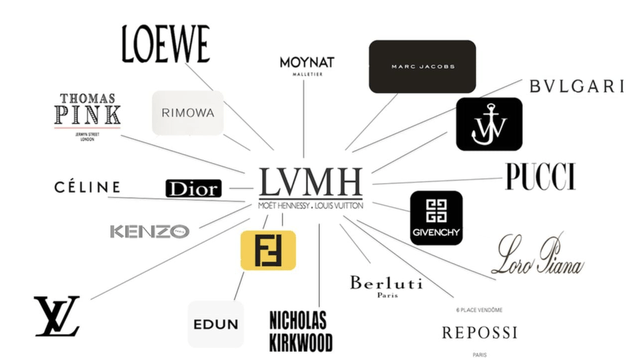

LVMH is a global fashion powerhouse with major fashion houses under its umbrella. The company produces and distributes luxury goods, operating in six segments: fashion and leather goods, its largest and oldest; watches and jewelry; wines and spirits; perfumes and cosmetics; selective retailing (including Sephora and airport duty-free retailer DFS); and other business segments. LVMH owns renowned fashion brands like Dior, Louis Vuitton, BVLGARI, Berluti, and famous spirits like Dom Perignon, Moet & Chandon, Veuve Clicquot. These brands are historic, with extremely high value, and are widely known internationally.

Recent Stock Performance

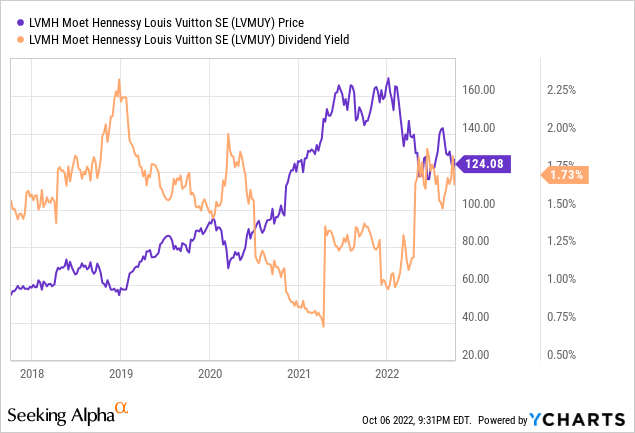

LVMH has rewarded shareholders well in the last 5 years, returning 117% in total return. The 5-year total return is nearly triple the total return of the S&P 500, showing outsized outperformance. LVMH’s 16.8% 5-Year CAGR is impressive for such large company valued at nearly $300 billion, and shows investors that the business strategy works despite skepticism over the size and diversity of their brands. In addition to capital gains, investors of LVMH has also seen decent dividend yield, ranging from 0.75% to 2.25% in the last 5 years. Though the yield itself is not stellar on its own, we believe the near 20 years of consistent dividend payouts should be a positive for investors as it demonstrates the company’s resilient performance in numerous economic cycles.

Macroeconomic Headwinds

However, in the near-term, we see numerous headwinds that will affect profitability of LVMH with no certainty as to the resolution. First and foremost, we believe the luxury market will be heavily impacted by the predicted recession as a result of interest rate hikes and high inflation. Such impact will be felt broadly by all of LVMH’s brands, as consumers in major markets limit their spending on luxury products.

In addition, there are numerous uncertainties that are facing key markets in the developed world, with Europe facing high energy prices before the onset of the winter, weakening currencies in Asia, and the outcome and impact of the U.S.’s mid-term elections. At the very least, the economic difficulties will impact the ability of the middle class to afford and/or justify a purchase of luxury goods, and we are beginning to see that data already. In all, it is our belief that luxury markets thrive the most during a time of peace and economic prosperity as we saw in 2021, but the various market and political conditions of today make environment unlikely for the time being.

Troubles in Asia

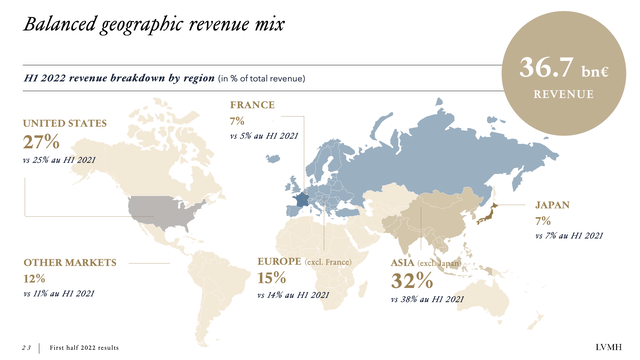

Asia is a key segment for LVMH, comprising 39% of revenue when including the Asia (Excl. Japan) segment with Japan in 1H 2022. The revenue contribution from Asia is much larger than the U.S. markets combined with France, which shows the sheer importance of the markets in the Pacific. However, Asia has seen economic turbulence, notably in China with the struggling Chinese real-estate market and high inflation in major Asian developed economics, such as South Korea, Taiwan, and Japan.

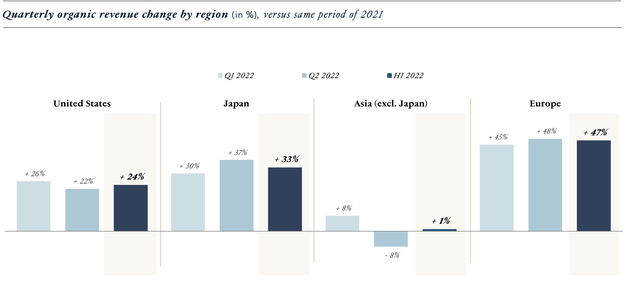

Even as of recent earnings announcement, we are already seeing a decrease in the revenue contribution from the Asia markets, which has long been part of LVMH’s growth strategy. The current 39% market share is nearly ~15% down from the 45% market share that LVMH had the same period last year. In addition to market share, we found it worrying to see a quarterly decline in revenue on a YoY comparison. In Q1 2022, Asia segment excluding Japan saw a modest 8% YoY growth (still far below the growth rates of U.S., Japan, and Europe. However, in Q2 2022, we saw a -8% YoY growth, which should be worrying to investors who believe in the importance of the Asia segment.

The fundamentals in Asia seem to look worse than the previous quarter in Q2 as well, as the Asian currencies have depreciated significantly, which should increase prices of LVMH products for the local markets and reduce discretionary spend as budgets decrease. We believe that it is likely that Asia continues to struggle, and severely drag down top line growth for the conglomerate.

Reasonable Valuation

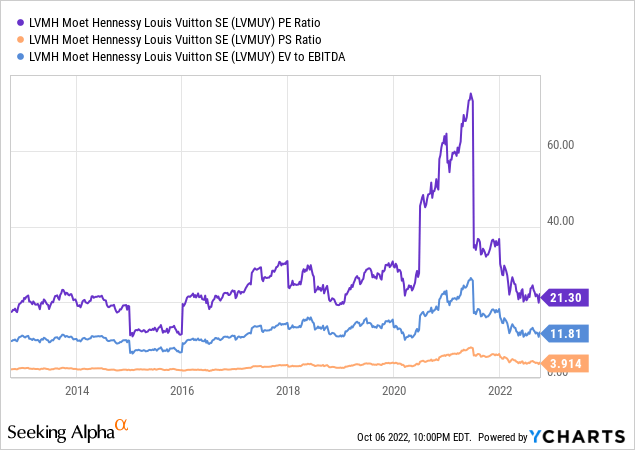

We believe LVMH’s valuation remains justifiable given that various valuation metrics are near long-term averages. And so far, the company has been able to deliver robust top line growth across business segments, and has not yet worried investors of a pending shortfall in financial performance. With continued high luxury spend by higher-income consumers, we believe that as of right now, LVMH will be able to maintain its business trajectory for the time being.

However, if market conditions were to worsen more than expected or some of these macroeconomic and geopolitical risks are realized, we believe that the market will be swift in compressing the company’s valuation and discount for tougher earnings seasons ahead.

Conclusion

We are recommending a “HOLD” rating on LVMH, as we believe that there are just way too many headwinds and uncertainties facing the conglomerate. We would like to wait and see the next few earnings results to determine the trajectory and resilience of the company’s business model, and we believe a lot of the uncertainties discussed in the article will be resolved in that same frame.

Be the first to comment