pcess609/iStock via Getty Images

Thesis highlight

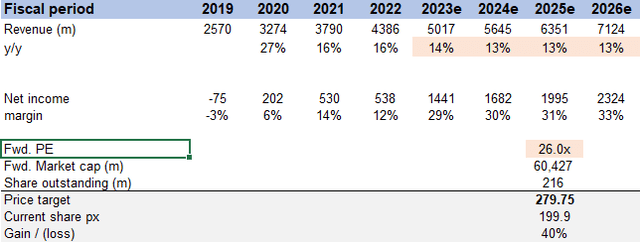

I recommend going long Autodesk (NASDAQ:ADSK) ($199.9 as of this writing). The key reason I favor ADSK is the critical nature of its product. It serves a critical function in its customers’ workflow processes, thereby giving me confidence that ADSK is not a business that can be easily replaced. I believe management’s long-term guidance is attainable as it is supported by several growth drivers and its ability to raise prices. I expect it to make $7.1 billion in revenue and $2.3 billion in earnings in FY26, which, based on a 26x forward earnings multiple, would give it an equity value of $279.75 per share, which is 40% more than it is worth now.

Company overview

ADSK is a software company specializing in products for the building and construction sectors, making construction and maintenance of buildings, roads, and factories more efficient. Its features help customers innovate, save time and money, make better product decisions, increase sustainability, better communicate with stakeholders, and optimize their designs. ADSK serves customers worldwide.

As of FY21, ADSK has 40% revenue in Americas, 39% in EMEA, and 21% in Asia.

Investments merits

Plenty of market opportunity ahead

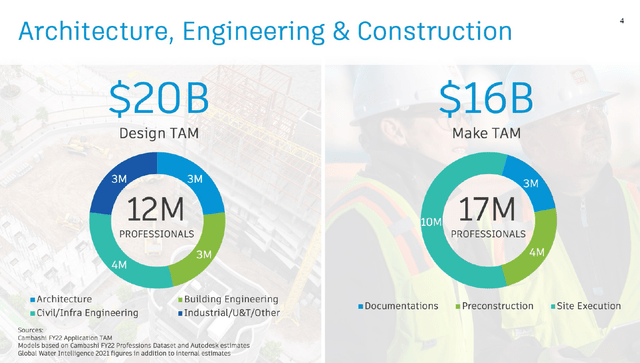

Construction and Manufacturing are the two primary markets that I will concentrate on as they represent the bulk of ADSK’s TAM, collectively $74 billion.

Both of these fields are experiencing a convergence of the design-make process. Designers have traditionally relied on a technique known as the “Design-Feedback Loop,” in which feedback from a user is fed back into the design process as a means of finding ways to make the item better. However, industries and processes are undergoing increasing digital transformation. There’s a pressing need to evolve beyond that approach in the modern era, and the “Design-Make Convergence Loop” does just that by emphasizing adaptable production lines and continuous feedback throughout the manufacturing process to speed up iterations and cut costs.

In the context of a bicycle factory, consider the following: Modern assembly lines can crank out 100,000 bicycles per day despite receiving no input from customers. In contrast, with more adaptable assembly lines, a manufacturer could mass-produce a thousand bicycles outfitted with sensors that provide data on how cyclists use the bikes. Based on the data, engineers could make adjustments. A manufacturer, for instance, could find out which kind of braking system is more popular with its customers by adding sensors to a road bike that can accommodate either rim or disk brakes. With consistent feedback from all of its bikes’ sensors, the manufacturer could make changes more frequently and reduce production runs.

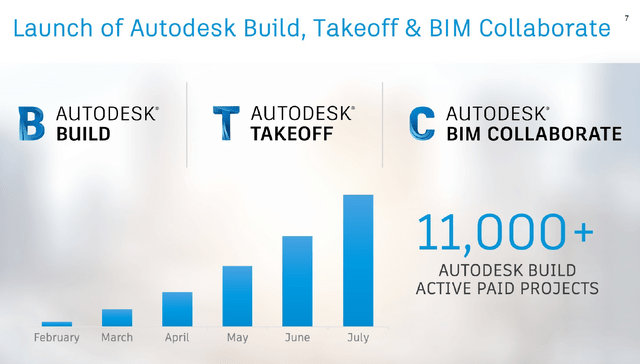

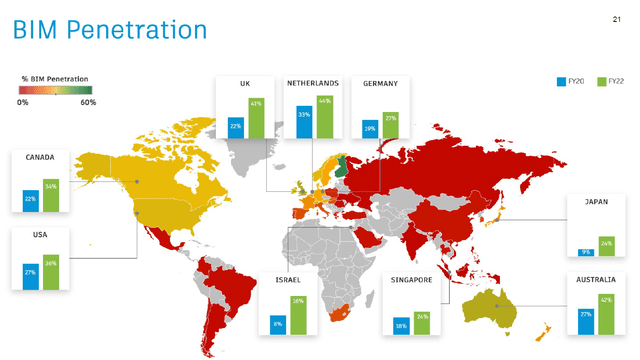

The total TAM for Construction is $36 billion, with $20 billion in Design and $16 billion in Make. I believe ADSK would win this battle because of its strong product offering, which addresses three major customer pain points: disconnected data, teams, and workflows. Autodesk Docs, which improves team collaboration and data handover, Autodesk Building Information Modeling [BIM] Collaborate, which reduces errors and rework while enabling better complexity management, and Autodesk BIM Collaborate PRO, which helps business growth by improving win rate and project forecasting; are among ADSK’s new cloud collaboration offerings. I anticipate that ADSK’s new product will continue to improve and gain customer adoption around the world. I’m confident in this new product because of how quickly it has been adopted since it came out. For example, ADSK has more than 11,000 active paid projects just six months after it came out, and the rate of BIM adoption around the world has gone up sharply.

Autodesk 2021 Investor Day Autodesk 2021 Investor Day Autodesk 2021 Investor Day

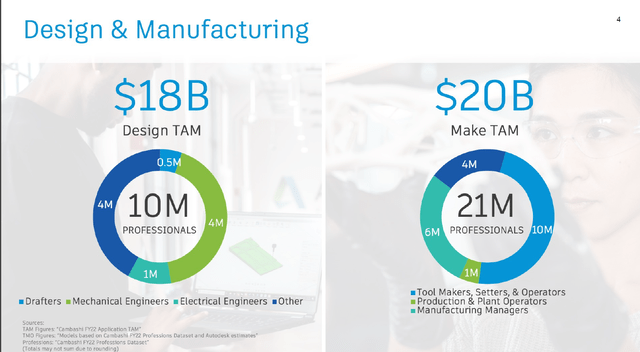

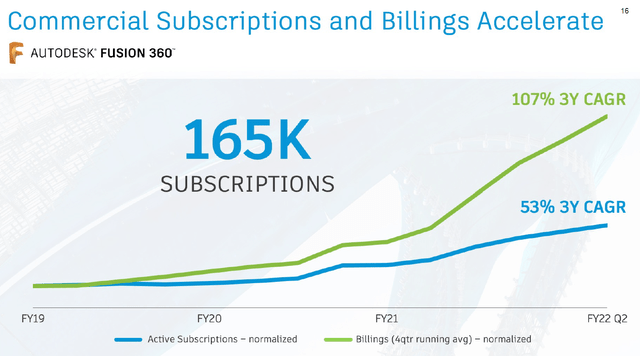

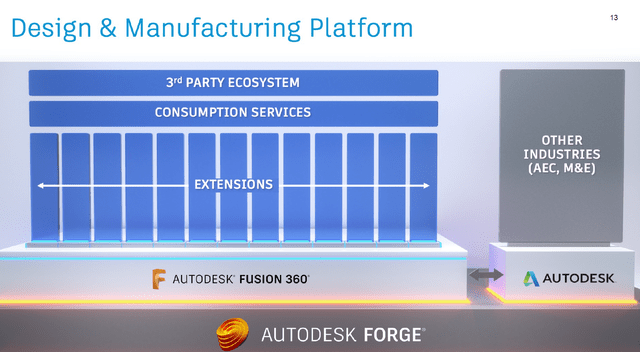

The TAM for the manufacturing industry is $38 billion, of which $18 billion goes toward the design phase and $20 billion goes toward production. ADSK has a new product, Autodesk Fusion 360, and I think it will dominate this market. The purpose of this new product is to streamline the workflow by combining a number of separate point solutions and platforms into one. Since CAD, CAM (manufacturing side), CAE (simulation), PDM (data management), and PLM (information management system) are all different platforms, customers must send file-based information somewhere for a change in the current process. This problem is addressed by Autodesk Fusion 360, which unifies all platforms into a single workspace where modifications made on one platform are automatically reflected on all others. Consider collaborating on multiple spreadsheet versions prior to the availability of cloud storage and Google Sheets. When there are different versions out there, it’s hard to work together.

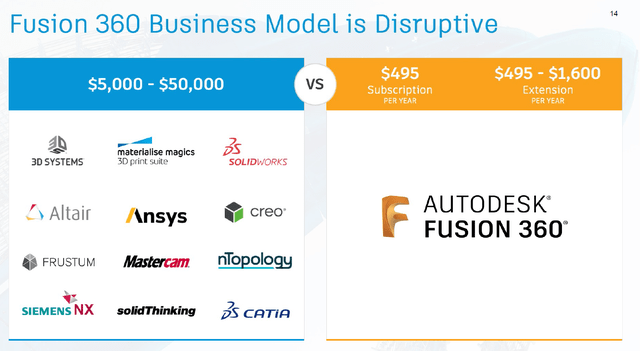

The Fusion 360 platform is a key aspect of ADSK’s manufacturing strategy given its differentiated and disruptive business model. Autodesk Fusion 360’s cost-effectiveness is a further incentive for its use. It is possible for a user to replicate Fusion 360’s offerings, but doing so would be prohibitively expensive because he would have to subscribe to multiple point solutions from different providers. This would result in inefficient data integration between systems and would drive up the price by a factor of ten. A basic Fusion 360 platform subscription costs $495 per year and has mass market capabilities in the design and manufacturing spaces. To avoid overserving the entire business, ADSK adds on to the standard set of features. Since its release, Fusion 360 has grown quickly, which shows that people like it. I expect this growth to continue as ADSK takes market share from other solution providers.

Autodesk 2021 Investor Day Autodesk 2021 Investor Day

Sticky product gives ADSK strong pricing power

ADSK is the most widely used CAD (computer-aided design) software. Its products play an essential role in the customer’s process and are often incorporated into collaborative workflows involving the customer, vendor, owner, and other key players in the design and service ecosystem. Products from ADSK, like other software suites with such deep customer workflow integration, have significant pricing power. They’re a negligible cost that has to be spread out over the entire budget (few thousand dollars of subscription a year vs an entire construction project that could be worth millions). While I recognize that the implied ROI varies by sector and project, I feel that ADSK is selling their product at a significant discount compared to the value it actually delivers to customers. The majority of the staff have been trained to use the program since they were graduate students. Switching to a new vendor is a major hassle, even if you’re willing to learn new software and get your existing processes synchronized.

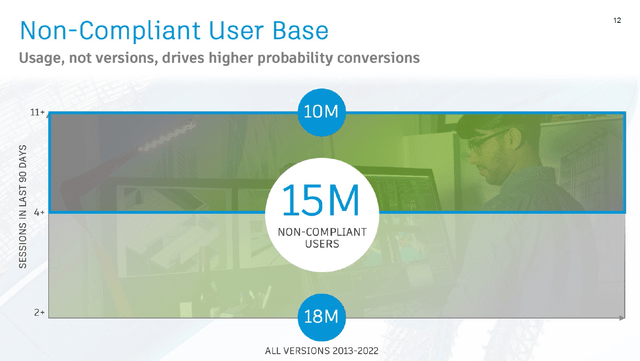

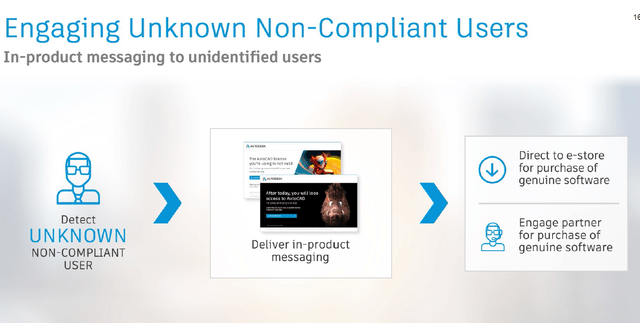

Active policing of non-compliant users drives conversion to subscription

In the past, ADSK applications were sold on CD and installed on a user’s computer via a one-time payment for lifetime access. Reverse engineering, also known as “cracking,” allows for the illegal “replication” of desktop solutions. There are about 15 million non-compliant users, only about 2 million of whom are paying customers, and the company is working to alert them that they are using pirated or otherwise invalid copies of the software. In my opinion, management is doing the right thing by “bumping” non-valid users into becoming paying subscribers instead of immediately disconnecting them, which would cause a major disruption to the workflow.

There are numerous advantages for users to switch to subscription, including reduced malware risk and a more personalized experience now that ADSK has transitioned from serial numbers to named users. During COVID, when remote working was mandatory in many industries, the transition to named users was critical (users could log in from any device in any location). So, even though companies have to pay, I think that the value that users get from an ADSK subscription is much higher than the fees.

Autodesk 2021 Investor Day Autodesk 2021 Investor Day Autodesk 2021 Investor Day

Valuation

Price target

My model suggests a price target of ~$280 or ~40% upside from today’s share price of $199.9. This is on the basis of mid-teens revenue growth from FY22 to FY26 and a forward PE multiple of 26 in FY25.

Image created by author using data from ADSK’s filings and own estimates

ADSK is a well-covered stock, and its growth strategies are well-known by consensus. Hence, I believe consensus estimates are a good guide to future earnings potential, given they are largely anchored around management’s estimates. I believe revenue moving forward should be able to continue growing at a mid-teens level, supported by TAM penetration, conversion of non-complaint users, and pricing. I expect margins to increase as well, given the higher mix of subscription revenue, lower need to spend on sales and marketing and upselling of units (high incremental margins). I assume no change in the current valuation multiple of 26x moving forward.

Risks

Mixed-execution

Management has a lot of growth strategies planned out, which is good, but this also means higher execution risks. In the current market, where investors are very risk-averse because interest rates are going up, mistakes in execution could lead to more unjustified sell-offs.

FY23 target might not hit due to slower conversion of subs

Management could fall short of its FY23 guidance in the event of an economic downturn. Customer industries may experience lower overall employment levels, which could cause a slower conversion rate for current non-compliant users to switch.

Stock-based compensation is a headwind to shareholders’ return

Stock-based compensation is a significant expense, averaging in the low teens over the last six years. If this figure continues to rise, it could result in significant dilution for shareholders.

Conclusion

To conclude, I believe ADSK is worth ~40% more than its value today ($199.9 as of writing). While there is a possibility of a deep recession that could impact ADSK’s near-term growth, I believe the long-term growth should stay intact as ADSK’s product serves a critical function for its users and the industry it serves. I don’t think there should be any problem with ADSK growing at about the same rate as it has in the past, and margins should grow naturally as the business grows.

Be the first to comment