_laurent

Author’s Note: This article was published on iREIT on Alpha/Dividend Kings in October of 2022

Dear Readers/Subscribers,

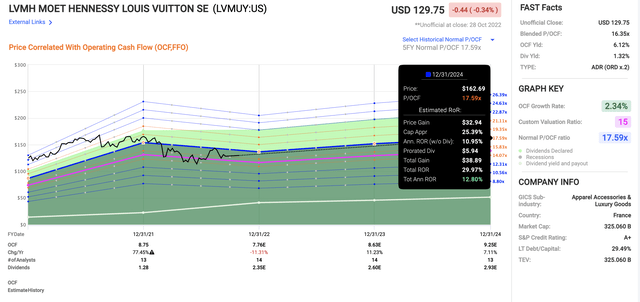

LVMH (OTCPK:LVMUY) likely won’t make you rich as an investment. At least not in the short term. Triple-digit RoR in the short term usually isn’t in the cards for an investment such as this. What it can do, despite the current volatility, is safeguard capital and provide protection through incredibly safe assets, yield, and a decent upside.

With recent price drops, we now have a realistic 30% RoR until 2024E for the company – and this, to me, is important enough to highlight.

Why?

Let me show you.

LVMH – Luxury provides protection

LVMH isn’t your standard simple company. It’s an international conglomerate specializing in luxury goods. Some of its brands go back around 700 years in history, which predates all but a few European nations in their current configuration.

The idea for LVMH was one by French multi-billionaire, art collector, investor, and businessman Bernard Jean Étienne Arnault. Its foray here was a resounding success, and the business magnate remains the major shareholder in the company, which this time is A+ rated.

As before, going through all of the brands (or “Maisons”) the company manages would be too much for a simple article, but some of the major ones you may be familiar with include:

- Christian Dior

- Louis Vuitton

- Fendi

- Marc Jacobs

- Kenzo

- TAG Heuer

- Bulgari

- Dom Perignon

- Zenith

- Sephora

LVMH is by far the world’s leading luxury producer. The company has a current market cap of over €350B and manages between €40-€55B in annual sales revenues, with a gross margin of between 65-68% typically, and a pre-tax operating profit margin of around 18-22%, and EBITDA margins of around 35%. Those are some incredible margins to keep in mind when you consider what it is they sell.

Almost 50% of sales is in fashion, but the company is working to balance this out through products such as Wines/Spirits, Perfumes, Watches/Jewelry, as well as profits from selective retailing. Note as well that while LVMH does own some appealing watch brands, it does not own watch brands that play “in its league” when compared to Fashion. It doesn’t own Rolex, Patek or Vacheron Constantin, or even a Niche luxury brand like F.P Journe (one of my own dream watches). TAG Heuer is nice, but it’s hardly up there with those brands. So there is a bit of a mix to the portfolio.

As before, when investing in a company such as this, it pays to know a bit about luxury. Which I do.

I use them personally, and often.

As mentioned in my first article, I do have a few TAG pieces, as well as one Zenith in my watch collection. The Zenith is a nice “beater” semi-luxury watch for great value, as opposed to always wearing my Rolex. I’ve owned several bottles from Maison Francis Kurkdjian, and the Gentle Fluidity Silver EDP is probably my all-time favorite male (and several of my dates) fragrances since its release in 2019.

I believe it to be important for someone to actually be somewhat familiar with the company’s brand products, and with the mentality of someone shopping for these things, because usually, you will be spending a disproportionate (compared to more standard shopping) amount of disposable income on their products.

My shopping of these products also hasn’t been particularly influenced by the current state of the economy – and in that, I’m very similar to other buyers of LVMH products.

Why do I say this?

Because company sales are, generally speaking, up.

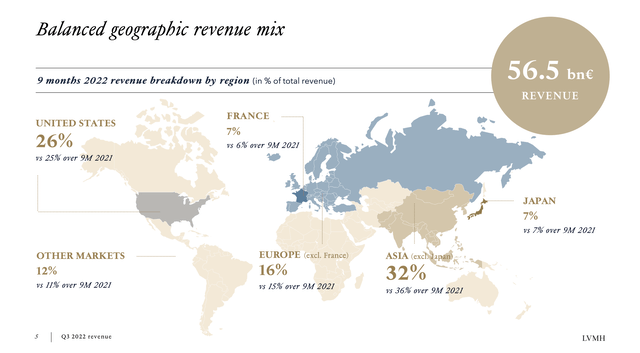

The people that buy luxury have it in their budget so they usually don’t adjust their spending habits for a downturn like the one we’re seeing. Sales for the latest quarter, 3Q22, are up 28% versus YoY, of which 20% is organic.

The remaining 8% is FX. We also can’t particularly see any weakness in any one geographical area, except maybe Asia due to China and other factors. I personally consider this a positive, as I want the company to focus less on the Asian market, not more (ex-Japan).

Specific trends include very strong sales in Europe, despite overall Russia and Ukraine issues as well as the economy. This might surprise some – but I say again, it’s historically established through several recessions that this isn’t a company that sees a massive negative impact from this sort of potential downturn.

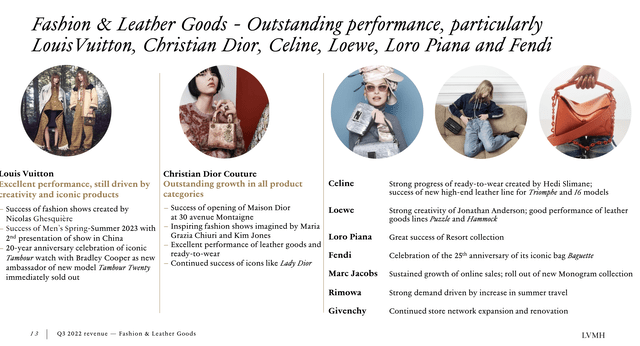

Sector/Segment-wise, the performance was excellent in Wines/Spirits due to high champagne sales (32% up) and solid growth in Cognac/Spirits (16%). Fashion, which you might have expected to take a hit from Russia, actually grew by more than 30% YoY, of which 24% was organic. So that argument is laid to rest – leather goods are fine without the traffic from Russia.

The same is true in Perfumes & Cosmetics. LVMH focuses on selective distribution. It’s my view that once you’ve experienced one of the company’s products, and your economic situation remains roughly the same, you will not adjust your habits in this segment to make up for the current economic situation. One of my Guerlain scents was used up in the last 3 months – I didn’t go to any other, less expensive brands, but went straight to my local retailer and bought a new bottle. Expensive – yes. Worth it? Again, also yes.

One of the typical arguments is that companies like these do not do well in downturns because people need to adjust their “belts”. While I am sure that this exists, it’s my stance that this is false generally speaking. Sales during problematic periods remain roughly stable or even go up. If there was to be any sort of massive negative impact, I believe that it would have been at least beginning now – but it has not.

Even Watches/Jewelry, which is otherwise somewhat more volatile, is up 23% YoY. LVMH’s selective retailing segment is growing like gangbusters as well, up 30% YoY with 20% organic. Sephora is doing very well, despite impacts from Hong Kong, Macao, and other centers.

The company’s outlook is that a combination of current growth and growing luxury leadership will lend itself to significant earnings stability and through-cyclic safety.

I do not fault the company for this view, as I agree with it.

LVMH is one of the most skilfully-managed luxury companies on earth. I would say it’s “the” most. While LVMH does not give you millionaire growth, it provides you with billionaire safety. That is the point for me of investing in the company. I’ve been slowly adding shares to my growing position, and I intend to continue doing so. Eventually, I mean to purchase an LVMH product from the annual dividend from my LVMH shares.

Risks then?

They do exist.

The 40%+ share of sales revenue from Asian markets, especially from a growing interest in luxury goods from Chinese consumers can be considered worrying.

This is due to the political situation in China, where it no longer seems unlikely that the CCP may declare such consumption to be “contrary” to state goals or ambitions.

LVMH is currently highly dependent on a small number of well-performing brands for large shares of its revenue. Louis Vuitton is a good example of this. The company’s ambition has been to lessen this dependence through diversification and the acquisition of further brands, but this is not yet fully done. Aside from diversification risks and perhaps some valuation risks, there isn’t much to mention here.

Oh, there is one more that’s worth mentioning in context.

LVMH also has “growth caps” on certain segments. This is a luxury thing.

Any capacity constraints the company does have in key segments, such as wines, spirits cognacs, or even clothing, cannot be easily overcome. Nor does the company have the desire to overcome it. What the company sells is “scarcity.” The price is part of the argument. Once the products, such as Hennessy, are sold, there is no more to be had. LVMH does not compromise or tries not to compromise on quality.

This means growth is, as one could say, “Capped”.

Let’s look at valuation.

LVMH Valuation

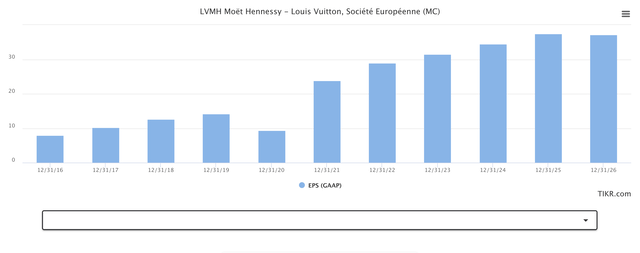

There’s a forecast divergence here. For the ADR, analysts are forecasting a drop in EPS.

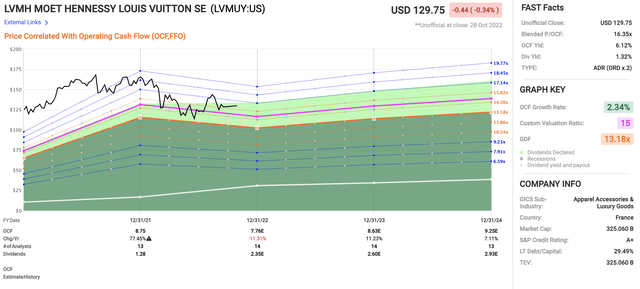

LVMH valuation/Forecast (F.A.S.T graphs)

I do not view this forecast as accurate, relevant, or lining up with my own estimates. It also does not line up with anyone forecasting the native ticker of MC.

LVMH Forecasts (S&P Global/TIKR.com)

My own growth forecasts are calling for the company to not only grow its earnings in accordance with more or less the numbers above but a significant increase in its dividend that reflects the underlying earnings and growth momentum. Dividend growth has been historically impressive, for LVMH has grown the dividend, except in 2020, with double digits every year for years.

EBIT, EBT, Net income, and EBITDA margins have not worsened as a result of the current environment. They’re also not expected to grow worse. LVMH has successfully defended its market position through price increases and growth and will continue to do so.

Generally speaking, it’s very difficult to evaluate LVMH – because unlike certain growth companies I need not mention here, this company’s value isn’t found in intangible/hard-to-measure software. It’s in things such as luxury goods.

LVMH is one of the companies in the entire market where in my valuation I allow for a significant premium to peers and the market. LVMH is profitably generating vast amounts of cash flows. I expect an EBITDA growth rate of around 8%, down from 9% to impair for the environment, with a high, 34-38% EBITDA margin range, due to the company’s pricing power.

For the terminal period, I stick to my growth rate of around 2-2.5%, allowing for the above-GDP growth rate for its native geography. Based on a WACC of 9%, flat EBITDA margins of 35% and a relatively flat CapEx/sales of around 5% as well as the aforementioned high double-digit sales increases, my current models range between a DCF of around €680-€760/share.

The company’s competition comes in the form of luxury peers. These are exclusive, for the purposes of this article, found in Europe, and include brands such as Hermes International, Kering, Richemont (OTCPK:CFRUY), Pernod Ricard (OTCPK:PRNDY), Remy Cointreau (OTCPK:REMYY), Swatch (OTCPK:SWGAY), and Prada (OTCPK:PRDSY). Depending on how you view it, you could arguably include things such as Ferrari (RACE) and others as well.

However, in the end, I will take a firm stance that none of these companies shares the diversified and mature appeal of LVMH. Since my first article, my stake in LVMH has grown to by far the largest of these peers.

In the end, this is one of the very, very few companies where I see a long-term premium of around 20-33X P/E as valid.

As things stand, the market is offering us the ADR at a multiple of 16.3x. Even only to a 17-18x P/E, that’s an upside of double digits based on current more negative forecasts for the ADR.

LVMH Valuation/Upside. (F.A.S.T Graphs)

My own estimate is significantly higher. I forecast LVMH to a PT of €760/share, giving me a 17%+ upside to the native. In terms of analysts, 32 follow the company with a price target range of €595 on the low end to €910 on the high end, with an average PT of €775. 27 out of 32 analysts are either at a “Buy” or similar rating.

These trends, recent results, and targets/expectations should explain to you why I’m positive enough about the company to add shares to my portfolio on a near-weekly basis.

Remember what I said in my first article on this business?

I consider this a “safe” long-term investment. Sometimes, investors will ask me what my “no-brainer” companies are. Those companies I would own forever, where I could just buy millions worth of stock, and then never check it again, confident in management and returns.

That list currently has 29 stocks.

LVMH is one of them.

This is a stance I still hold, to this day. The following qualities make LVMH, what I view, a must-own investment.

- Portfolio Quality

- Product desirability

- Projected Earnings Growth

- Asset resilience

- Through-Cyclic business model resilience

- Forward-thinking business model, combining the best of the new with appealing old.

- Superb management

- Institution-like long-term safety

I will argue with you that very, very few companies manage to tick all of these boxes – but LVMH is indeed one of them.

So, for that reason, my stake is now 2.3%. I’m targeting a full 5%.

It’s been a chaotic year so far for many of us. Many tech-oriented (or even non-tech) portfolios are significantly in the blood-red for the year. My own portfolio is oriented around value investing and diversification in dividend-paying quality stocks.

While I do have positions firmly in the red – I will never argue that this is not the case – my overall portfolio is nonetheless in the green for the year, and my non-native portfolio (including LVMH and focusing on USD/EUR/CAD/GBP) is up 16.5% thus far as of Friday the 28th.

This is not to boast, but to illustrate the strength of value investing coupled with dividends. Every month so far has been record-setting in terms of fresh payouts.

I expect this to continue.

Thank you for reading.

Be the first to comment