DKosig

Even though humans have been traveling to space for decades now, the space industry has really only begun to develop over the past decade or so. As we move away from government funding and in the direction of private funding for all things space-related outside of research, more and more companies are arising to provide the goods and services necessary to make everything function. One very small player in this market that warrants some attention is Satixfy Communications (NYSE:SATX). As a vertically integrated satellite communications systems provider, the enterprise has a lot of ambition and some bright goals for the future. At the same time, however, profitability is a pressing issue that’s only worsening. And on top of that, shares of the enterprise looked drastically overpriced. So while I am bullish about the space economy in general, I would make the case that Satixfy Communications warrants nothing better than a ‘sell’ rating at this time.

A valuation in the stratosphere

According to the management team at Satixfy Communications, the company operates as a vertically integrated satellite communications systems provider. For more contacts though, we need to dig a bit deeper. For instance, when I say vertically integrated, I mean that the company has its hands in many different aspects of the space economy. What management seems to pride themselves most on are the satellite communications chips that the company produces. In fact, the company goes so far as to say that they are a leader in developing advanced, digital silicon ASIC (application-specific integrated circuit) and RFIC (radio frequency integrated circuit) chips for modems and antennas that can be deployed across the entire satellite communications value chain. These chips enable critical functions for satellite communications systems, including digital onboard processing, beam hopping, and enhanced connectivity needs like positioning, navigation, and timing. These chips are compatible with a wide array of satellite constellations, including LEOs, MEOs, and GEOs.

In addition to the chips that the company produces, it also focuses on the production of satellite communications systems. These systems are really comprised of three primary components. The first is the satellite payload, which is the system integrated to the satellite platform that provides in-space data receiving, processing, and transmitting. The user terminal is the system on the ground or, in some cases, on an aircraft, that’s comprised of an antenna and modem that digitally links to the satellite payload and provides data receiving, processing, and transmitting. And finally, you have the hub, which is the system that enables the network operator to control and manage its communication network and the interaction between the satellite payload and the terminal. To some, this may seem like a rather niche market, but on the satellite communications side alone, the company believes that around 50,000 satellites are planned to be in operation by the end of this decade. This would translate to a total available market size for satellite payloads of between $3 billion and $4 billion, while for user terminals it should be between $5 billion and $6 billion.

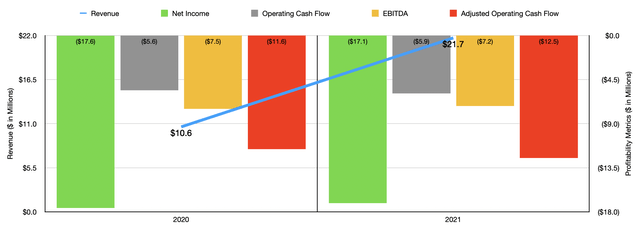

When it comes to fundamental data, Satixfy Communications doesn’t have much. We do have data covering 2020 and 2021 though. During the 2020 fiscal year, sales came in at only $10.6 million. This grew to $21.7 million in 2021, with sales under the development services and pre-production category of the company spiking 86% from $10.3 million to $19.2 million. This increase was driven largely by new engagements for two customers in 2021. And the work in question involves the development of ground equipment that will utilize the company’s modems and chips involving LEO constellations. You would think that a company that saw its revenue roughly double over the course of a year might see profits improve considerably. But you would be wrong. The company went from generating a net loss of $17.6 million to generating a loss of $17.1 million year over year. Operating cash flow went from a negative $5.6 million to a negative $5.9 million, while the figure adjusted for changes in working capital went from negative $11.6 million to negative $12.5 million. Over that same window of time, EBITDA improved modestly, going from a negative $7.5 million to a negative $7.2 million.

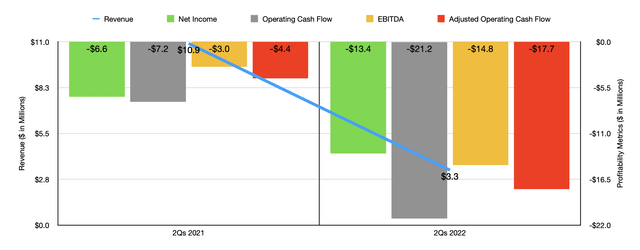

Although the company had a lot going for it from a sales perspective prior to this year, 2022 has been a different animal altogether. In the first two quarters of 2022, the company generated revenue of only $3.3 million. That’s down from the $10.9 million reported the same time last year. According to management, the firm suffered from extended delays in the manufacturing cycle of its third-party manufacturer and related delays in its ability to deliver chips, payloads, and terminals to its customers. Some of this was driven by a strategic decision by management to reduce sales in China because of its regulatory environment and the termination of discussions with a number of potential customers and deferrals of orders under contracts with certain existing customers. Naturally, this would have a big impact on the company’s bottom line. The firm went from generating a net loss of $6.6 million to generating a loss of $13.4 million. Operating cash flow went from negative $7.2 million to negative $21.2 million, while the adjusted figure for this turned from negative $4.4 million to negative $17.7 million. Even EBITDA was slammed, going from a negative $3 million to a negative $14.8 million over the course of a single year.

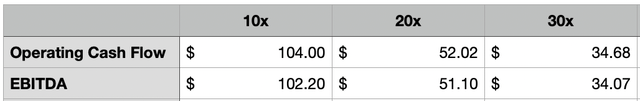

Truth be told, you can’t really value a company like this in the traditional sense. Instead, I would urge you to project out what kind of profitability would be necessary for the business to be fairly valued and then to ask if such a pathway might be reasonable. As you can see in the table above, even if the current value of the company were to warrant cash flow multiples of 30, it would still need to generate cash flow that is well above even the revenue that the business generated last year. Investors who desperately want some of their money in the space economy may think that the rapid growth potential might be worth the lofty price being paid today. But keep in mind that there are other players in the market that have far healthier fundamentals while still being pure plays on space. As an example, you have Iridium Communications (IRDM) an enterprise that operates a constellation of satellites of its own. Using data from when I last wrote about the company in October of this year, it was trading at a price to free cash flow multiple of 20.2, a price to adjusted operating cash flow multiple of 17.7, and an EV to EBITDA multiple of 17.1. Though not exactly cheap, it definitely beats out what Satixfy Communications is doing and it comes with a stability in revenue and cash flows that Satixfy Communications can almost certainly never achieve.

Takeaway

At this point in time, I understand why investors want to be involved in the space economy. There truly is a lot of opportunity there in the long run. At the same time, however, I don’t believe that Satixfy Communications is a great way to play it. We can’t even make the case that the company is continuing to grow based on recent financial data. Add on top of this the fact that cash flows are nowhere near what they would need to be in order for the enterprise to be at least fairly valued, and I would make the case that this is a solid ‘sell’ candidate at this time.

Be the first to comment