Bet_Noire/iStock via Getty Images

Over the past several weeks, the price of crude oil, both WTI (CL1:COM) and Brent, is once again on the rise even with fields brimming with opportunities. Over the past several weeks, inventories in all petroleum products were further stretched. Attempts from government are having little effect in keeping at bay the dogs unless it authorizes and actively supports new drilling and production.

The White House Oily Trick

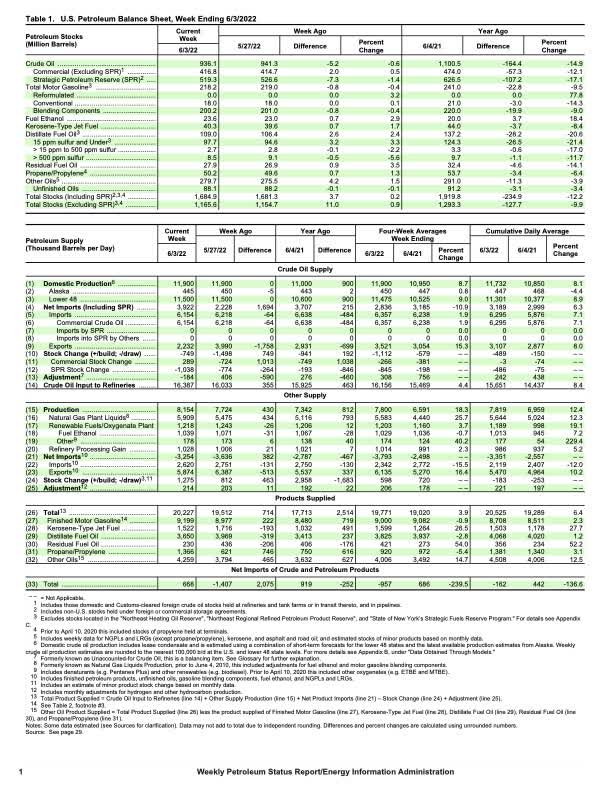

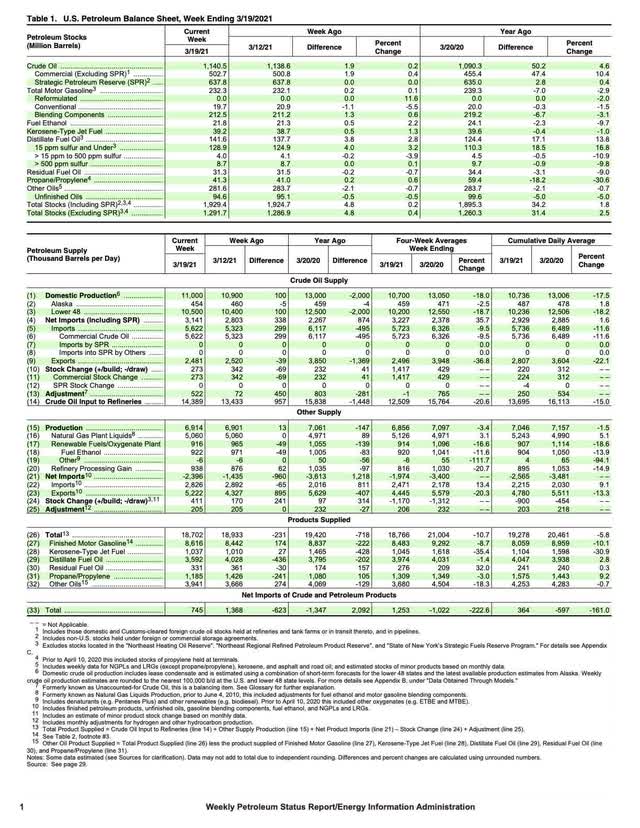

Some weeks ago, the Federal Government decided to release an excess of the SPR crude hoping to lower prices by headlining, there is enough oil. The trick is nothing but a trick. Two EIA charts follow. The first is dated 3/19/2022, about the time frame the tricky trick began.

Total crude stored on March 19th equaled 1140 million barrels. Crude production equaled 11000 million barrels per day. Gasoline inventories equaled 232 million barrels and domestic fuel oil inventory equaled 142 million. The next chart from the week of June 3rd follows.

EIA Weekly Report

Total crude stored equaled 936. Total production increased from 11000 to 11900 million barrels per day. Gasoline inventories came in at 216 million barrels with domestic fuel oil equaling 100 million. The next table shows how negatively the energy balance is.

| Crude Balances (millions of barrels unless otherwise noted) | Storage WTI | Storage Gasoline | Storage Fuel Oil | Production (millions of barrels per day) |

| March 19th | 1140 | 242 | 142 | 11.0 |

| June 3rd | 936 | 216 | 100 | 11.9 |

| Net Differences * | 200 (2.4 mb/dy) | 25 | 40 | 0.8 |

* Rounded

The crude balance continues extremely negative. In the past roughly 100 days, crude storage dropped by 200 million barrels or 2 million per day. Gasoline and diesel inventories drifted lower also. An average production of 11500 million barrels per day means that crude production must increase to 13.5 or so million barrels per day going forward to balance. The peak production shortly before March 2020 equaled 13 million, still slightly less than what is needed to balance usage.

Coming Increases in Crude Production

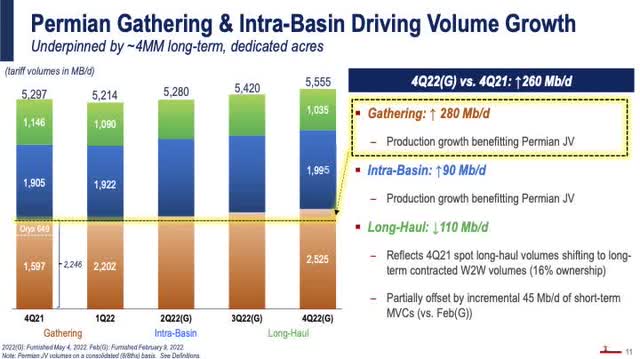

When assessing possible production increases, pipeline companies such as NuStar Energy (NS) and Plains All American (PAA) stated in previous conferences that production especially from the Permian will increase. The question becomes when and how much? Both companies are heavily involved in the sweet spot shale production region, the Permian Basin. NuStar management at its last conference stated while referring to the Permian Basin:

“What I would tell you is those supply chain issues, I think, will get sorted out but it’s probably a longer-term thing than the end of 2022. So I think you could see an effect maybe in the fourth quarter, but most of the effects would be in 2023. And what I’m talking about is effects above and beyond the 10% that we’re predicting. And so some kind of a move on our system from 560, 570 into the — well, into the 600s would be in 2023.”

From Plains quarterly slides shown below, management basically predicts the same for Permian.

Plains believes that growth from the Permian is coming this year, but very slowly. Management also noted in its comments that other places of production will slowly grow through 2022. Backing up future growth, Willie Chiang, Plains’ CEO, stated:

“As I stated earlier, we believe the Permian will be critical to meeting increased global oil demand. . . Our February outlook for production reflected growth of roughly 600,000 barrels per day per year, over the next several years, increasing to 7 million barrels by 2025.”

Crude production in the States will increase, but the bigger increases begin in the latter part of 2022. At current usage rates, real inventories will fall another 200 million barrels through the summer leaving crude dangerous low.

Goldman Sachs stepped in with its own prediction:

“High oil and gasoline prices will need to rise even higher this summer to incentivize new production and discourage consumption, . . . is now forecasting Brent crude oil prices will average $140 a barrel between July and September, up from its prior call of $125 a barrel.”

The Bank added that price spikes are likely needed to quench demand.

Minimal spare capacity exists in the world for help in bailing out the United States. This limitation brings with it a gravity of risk from hurricane-induced disruption or political unrest in places such as Libya. By the way, Libya’s history is one or more off-line incidents per year. World spare capacity at this point is estimated at 1 million per day or one percent of total world demand.

Experts commented with differing opinions on the direction of prices. One states a case for $65 per barrel if Europe abandons its commitments for ban Russian oil. Another makes a case that $100 per barrel is a floor. We find ourselves questioning the $65 case, which is based on significant spare capacity being brought online in an expedient time frame. Recently, crude prices dropped approximately $15 from believed demand extinction from a coming recession. We believe that this is more likely a buying opportunity than a real trend.

Crude oil shortages are likely with us for a significant period of time and could provide investors with opportunities with any market weakness.

Cost of Refining

The cost of crude is only half the story. Refining costs have exploded, created by long periods of weak investment and the divestment of marginal refining during 2020. We are including a simple table on Gulf Coast 2-1-1 crack spreads self-derived to illustrate the enormous spike.

| GC 2-1-1 | April | May | June TD |

| Spreads | $38 | $52 | $60 |

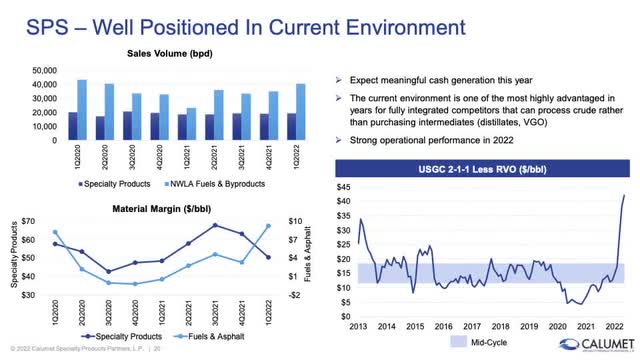

Next, we added a slide from Calumet Specialty Products’ (CLMT) Barclay’s Conference dated May of 2022. On the right side of the slide, management included verification for the high crack spreads. Since the middle of 2020, crack spreads jumped from the middle nought to the $40-$60s, a 10-fold increase.

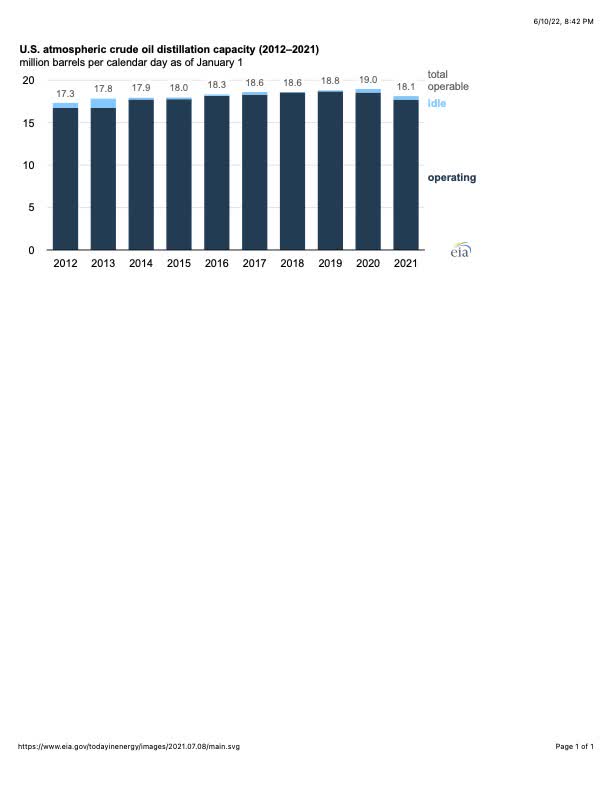

The EIA reports refining capacities in one of its reports. The following figure shows refining capacity over the past 10 years.

EIA Energy

In 2021, the report removed the following refineries from the total U.S. operable capacity:

- The Philadelphia Energy Solutions refinery in Philadelphia, Pennsylvania: 335,000 b/cd

- The Shell refinery in Convent, Louisiana: 211,146 b/cd

- The Tesoro (Marathon) refinery in Martinez, California: 161,000 b/cd

- The HollyFrontier refinery in Cheyenne, Wyoming: 48,000 b/cd

- The Western Refining refinery in Gallup, New Mexico: 27,000 b/cd

- The Dakota Prairie refinery in Dickinson, North Dakota: 19,000 b/cd

HollyFrontier, Marathon and Convent refineries are either being converted to renewable operations or plans are in place to do so. The future of Gallup is unknown. In trying to quench refined product prices, the White House reportedly contacted refiners hoping to restart idled assets. It appears that Convent or Gallup might be the only candidates. With a significant length of time to restart idled units, hope for relief can only come from overseas imports. We don’t expect much relief from high spreads.

Investment Opportunities Continue

Positive investment opportunities continue, especially with distribution/transportation companies or startups. Both, crude and product production are lagging real demand and are likely to do so for significant periods of time. With Permian Basin investment rapidly expanding its production, opportunities such as Occidental (OXY), Devon (DVN) Chevron (CVX), Shell (SHEL) remain possibilities. In our view, a startupRND/speciality, Calumet Specialty Products (CLMT), is still our favorite. Its business model consists of premium specialty, captive refining in both Montana and Louisiana and a renewable operation coming online in the next 3 months. The value of Calumet at $11 represents a possible steal compared with its possibilities.

The world energy markets are stretched, but risk still exists from wars or economic shutdowns experienced in 2020. But even oil, oil all around, the assets to produce crude or products is stretched and will continue to be so for a long period of time. We are investing primarily in income-producing stocks with the exception of Calumet.

Be the first to comment