Anna Bliokh/iStock via Getty Images

In the information economy, electronic devices serve as the foundation of almost everything we do. This includes communication, as well as various other activities like sensing, measurement taking, and so much more. One company dedicated to producing some of the components that go into these final products is Lumentum Holdings (NASDAQ:LITE). Despite experiencing a bit of mixed results because of the COVID-19 pandemic, this enterprise has done incredibly well over the years. Its current 2023 fiscal year in particular is slated to be particularly positive. Add on top of this the fact that shares of the company look attractively priced, both on an absolute basis and relative to similar firms, and I do believe that it makes for an appropriate ‘buy’ prospect at this time.

A niche player in electronic devices

The management team at Lumentum Holdings describes the company as an industry-leading provider of optical and photonic products dedicated to servicing customers that act as OEMs (original equipment manufacturers). These OEMs often use the products that Lumentum Holdings creates for the production of their own products that ultimately address end market applications. One example provided by the company involves its fiber optic components that network equipment manufacturers assemble into communications networking systems. These systems, in turn, are then sold to network service providers, operators, or other enterprises that have their own networks. Another example involves the company’s laser products. These are often incorporated into the tools that its customers produce, products that are then used for manufacturing processes. Likewise, the 3D sensing components that the company produces include diode lasers that are sold to manufacturers of consumer electronics products for mobile, personal computing, gaming, and other related activities.

To best understand Lumentum Holdings, we should dig into the two key operating segments that it has. The first of these is referred to as the OpComms segment. This particular unit of the company is, by far, the largest of the two, accounting for 93% of the firm’s revenue and for 93.5% of its profits. Its focus is on customers in the telecommunications, data communications, and consumer and industrial markets. The firm sells a wide variety of different products under this category, including those that are useful for the transmission and transport of video, audio, data, and more across fiber optic cables. The segment is also responsible for the production of diode laser products, with the laser light sources the company produces being integrated into 3D sensing cameras for various applications. These applications can include biometric identification, computational photography, virtual and augmented reality, and so much more. It is worth noting that the single largest customer in this segment in 2021 was Apple (AAPL), a firm that accounted for 30.2% of the company’s overall revenue.

The other segment the company has is remarkably smaller, accounting for just 7% of revenue and 6.5% of profits last year. This is the Lasers segment. According to management, the products that it sells through this segment serve customers across a wide variety of markets and applications, ranging from sheet metal processing to general manufacturing to biotechnology, and so much more. Specific OEM applications include diode-pumped solid-state, fiber, diode, and gas lasers. It also produces high-powered and ultrafast lasers for the industrial and scientific markets. And on top of that, the segment sells various components and subsystems that range in output all the way from watts to kilowatts and that include different wavelengths like ultraviolet, visible, and infrared.

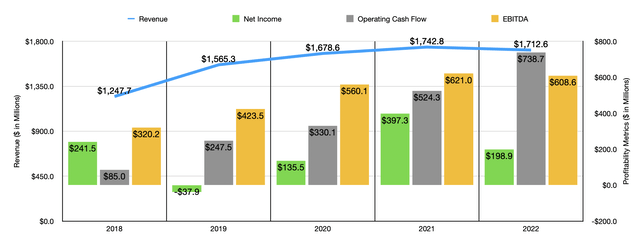

Over the past few years, management has done a really good job growing the company’s top and bottom lines. Revenue rose from $1.25 billion in the company’s 2018 fiscal year to $1.74 billion by the end of its 2021 fiscal year. Then, for the 2022 fiscal year, sales dropped slightly to $1.71 billion. This drop in sales came even as the Lasers segment of the company reported a 59% rise in revenue. It was impacted by a 6.3% decline in the OpComms segment. However, this decline is expected to be short-lived. That’s because, for its 2023 fiscal year, management is forecasting revenue of between $2.10 billion and $2.25 billion. This should be driven in large part by the company’s acquisition of NeoPhotonics, a purchase that was completed just after the end of the firm’s 2022 fiscal year. The transaction price for it came out to $918 million in all.

As revenue has risen in recent years, profitability has mostly followed suit. Net income, to be clear, has been quite volatile, ranging from a low point of negative $37.9 million to a high point of $397.3 million over the past five years. In 2022, net profits came out to $198.9 million. Other profitability metrics have been more consistent. Operating cash flow, for instance, rose consistently year after year, climbing from $85 million in 2018 to $738.7 million last year. Almost as consistent was EBITDA, a metric that increased from $320.2 million in 2018 to $621 million in 2021 before dropping slightly to $608.6 million last year. Interestingly, the profitability issues the company experienced came even as the gross margins for it rose from 44.9% to 46%. The problem, then, came from a couple of different factors. For starters, selling, general, and administrative costs rose even at a time when revenue fell. As a percent of sales, this metric increased from 13.9% to 15.5%, while research and development costs increased from 12.3% of sales to 12.9%. But most importantly was the fact that the company received a $207.5 million merger termination fee during its 2021 fiscal year any move that temporarily pushed profitability up unnaturally. Despite the decline in profitability for the business, management did, earlier this year, announce a $1 billion share buyback program. That’s a great way to return value to shareholders. And on top of that, the company expects to eventually achieve $50 million in cost savings associated with its aforementioned acquisition. But that will take up to 24 months from the closing of the purchase.

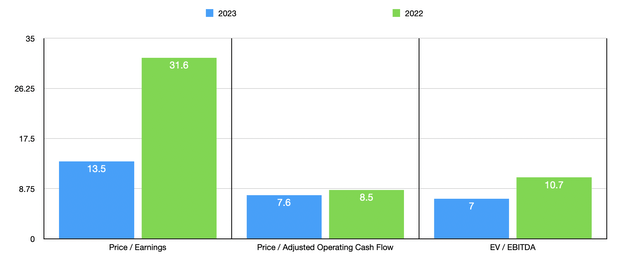

When it comes to the 2023 fiscal year, management expects earnings per share of between $6 and $7. At the midpoint, this translates to net income of $464.8 million. The company has not provided any guidance regarding other profitability metrics, except to say that its operating margins should be between 24% and 26%. Running the numbers, I was able to do a rough estimate for operating cash flow for the 2023 fiscal year of around $827.7 million, while my estimate for EBITDA came out to $933.7 million. Using these figures, I calculated that the company is trading at a forward price to earnings multiple of 13.5. These numbers are all lower than what the data look like if we were to use the 2022 results for the business. The forward price to operating cash flow multiple is 7.6, and the EV to EBITDA multiple should be 7. As a note, the enterprise value of the company involved a scenario where I stripped out the $918 million from the company’s cash position to cover the acquisition that was made following the end of the fiscal year. I also assumed that convertible notes will remain debt for the foreseeable future.

As part of my analysis, I also compared the company to five other firms. On a price-to-earnings basis, these companies ranged from a low of 18.6 to a high of 232.8. Three of the four companies that had a positive multiple were cheaper than Lumentum Holdings. Using the price to operating cash flow approach, the range was between 5.9 and 99.8, with only one of the five companies cheaper than our prospect. And when it came to the EV to EBITDA approach, the range was between 12.7 and 53.7. In this scenario, our target is the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Lumentum Holdings | 31.6 | 8.5 | 10.7 |

| Ciena Corporation (CIEN) | 20.4 | 22.2 | 13.8 |

| Calix (CALX) | 18.6 | 99.8 | 53.7 |

| Viavi Solutions (VIAV) | 232.8 | 20.0 | 14.4 |

| Juniper Networks (JNPR) | 25.2 | 53.6 | 15.1 |

| Viasat (VSAT) | N/A | 5.9 | 12.7 |

Takeaway

Factoring all the data into the equation, Lumentum Holdings strikes me as an interesting company that will likely continue to do well for itself. Assuming current performance holds, the business does look quite cheap and that includes relative to some other firms that are similar to it. Because of this, I have decided to rate the enterprise a ‘buy’, reflecting my belief that it would likely outperform the market for the foreseeable future.

Be the first to comment