Lululemon (LULU) has been asserting dominance in the women’s market within North America, along with a growing presence in Asia and Europe. The company has boosted its balance sheet recently, with almost $1.5 billion in current cash, equivalents and short-term investments, and has currently no long-term debt. Even with such a strong balance sheet and access to credit, Lululemon’s overexposure to storefront retail and reliance on it for a majority of revenue could cost it in the next two quarters.

Storefront Presence and Market

Lululemon has 491 operating storefronts as of February 2020, with the US and Canada having 368 of those storefronts alone. Of the remaining 123 stores, over half are located in China and Australia (China’s stores are all operating normally minus one location in Wuhan). Twenty of Lulu’s 51 new stores opened during the calendar year were in the US. Although expanding overseas, the company’s North American market presence still accounts for 75% of its storefronts.

Lululemon’s primary customer is women aged 16 to 35, with 70% of revenues coming from women’s apparel. Men’s apparel revenues have risen year-over-year, but the core audience tailored to Lulu’s products remains women. With record unemployment claims the past two weeks, previous unemployment data for February points to the 16-34 age group as having the highest unemployment, with half of all claims falling within. If that trend continued through March and April, the number of unemployed people from 16 to 34 years old could skyrocket, and with no stable income, the demand for expensive, technically nonessential apparel and yoga wear could fall greater than expected.

Cash Cow

Lululemon has emerged from 2019 with a very strong balance sheet, giving it wiggle room to cruise through an elongated crisis. The company generated $212 million in free cash flow in 2019, boosted cash up to $1,093 million, and has just under three times more current assets than current liabilities. Some of those liabilities include lease payments for storefronts, with the company expecting $152 million in minimum lease payments for 2020. Cash reserves can easily cover the next few years of leases, and the company also has zero long-term debt, but access to two different untapped credit lines. Lulu has access to a $150 million committed and unsecured credit line due by 2021 that can be increased by up to $200 million, and to a ¥130 million credit line in China. Should Lulu feel the need to draw on the credit lines before year end (which given the position of its cash and liabilities is low), it should easily be able to repay.

Over-reliance on North American Storefronts

Source: 10-K

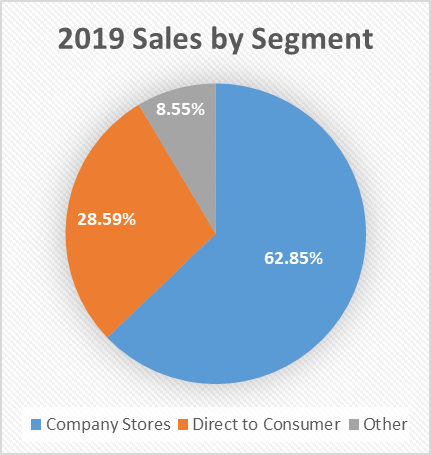

2019 revenues per square foot came in at $1,657 – a very strong figure, given that Lulu’s products fall on the higher end of the price range compared to peers. Yet Lulu generates an eye-popping 62.85% of revenues from storefronts, which are all now closed for the time being (except for 37 in China). Sales direct to consumer through its online website have increased dramatically from 2017 ($577 million to $1,137 million) but still only represent less than a third of total revenue. In addition, Lulu closed its Washington distribution center.

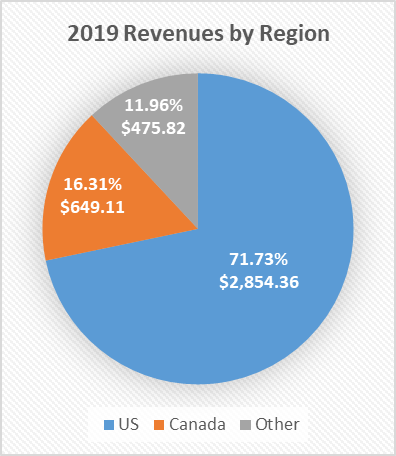

Sales also are dominated by the North American market, where the outbreak has not yet peaked and non-essential business closures could last for another month or two. US sales accounted for 71.73% of total revenues, and Canada 16.31%, giving North America 87.04% of total revenues produced. If stores remained closed though the end of May, revenues for Q1 and Q2 might be quite dry, as Lulu remains so highly concentrated in the US and heavily dependent on foot traffic in storefront to drive its revenue higher.

A Generous Consensus

Average consensus estimates (SA/CNBC) fall at $4.50 to $4.60 for full-year EPS, on ~$4.1 billion in revenue. Given the current North American situation worsening, with deadlines for shelter in place and other social distancing orders extending day by day, the revenue hit that Lululemon will take in the first two quarters should fall short of estimates of $700 million and $860 million, respectively. To put this in perspective, 2019 Q2 came in at $883 million, putting current Q2 estimates just under $25 million short – pretty generous given Lulu’s high dependence on North American storefronts for revenue generation. Full-year EPS figures are consolidated on strong Q4 earnings, and while it’s still to early to predict, a drag in the first two quarters can easily pull full-year EPS down more than the expected $0.40, and more in Q4 holiday revenues are not as strong as expected.

Increasing levels of unemployment claims in the past two weeks is pushing unemployment levels in Lulu’s key target customer group higher (already at half of total unemployment), and stimulus checks only representing about one month of income for a single person has decreased the amount of spending money that this age group has. Although the company might be targeted more to the (upper) middle class and above with prices, consumer behavior has still shifted, and willingness to buy the company’s products could have decreased slightly.

|

FY19 |

FY20 est |

|

|

Revenue |

$3,979.30 |

$3,660.96 |

|

growth |

21.01% |

-8.00% |

|

Cost of Rev |

$1,755.91 |

$1,713.33 |

|

Gross Profit |

$2,223.39 |

$1,947.63 |

|

margin |

55.87% |

53.20% |

|

Operating Expenses |

$1,334.28 |

$1,311.84 |

|

Net Income |

$645.60 |

$550.97 |

|

margin |

16.22% |

15.05% |

|

EPS |

$4.95 |

$4.21 |

Source: 10-K

Assuming an 8% decline in revenues as well as a decrease in margins due to shifting operational dynamics, the company’s full-year EPS can be predicted to fall around $4.20, far below current consensus of $4.50 to $4.60. Revenues for the first two quarters would have to fall short of consensus as well, around $590 million and $770 million at the median. At the current share price, LULU trades at a P/E around 37.6, with a forward P/E of 42, which seems too high for Lulu’s current revenue vulnerability.

Conclusion

Uncertain time frames for the outbreak, increasing unemployment, and store closures are going to have a large effect on Lululemon’s revenues and EPS for the first two quarters. The company has generated great margins on rapidly growing revenue, but its concentration in the US and Canada (generating almost 90% of revenue) and its dependence on storefronts for that revenue (63%) puts the company in a very vulnerable position in the midst of the outbreak. The company trades at 42 times forward earnings currently, but those earnings estimates seem all too generous, as the uncertainty around reopening of stores and malls as well as consumer behavior and spending returning to normal still swirl. Lululemon does have a strong balance sheet and cash position, but the stock does not look fairly valued until around $140.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment