Helioscribe/iStock via Getty Images

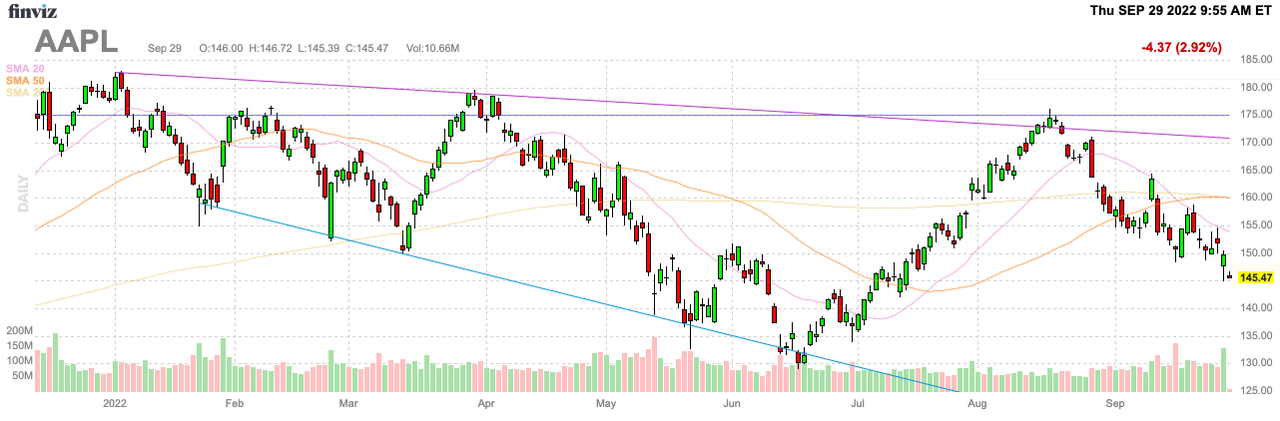

After a year of warnings, the market is finally catching on to the valuation issues with Apple (NASDAQ:AAPL). The tech giant is running into questionable demand scenarios for the new iPhone 14 and analysts are actually cutting EPS estimates previously set up for limited growth anyway. My investment thesis remains bearish on the stock still priced for exceptional growth that isn’t going to occur in this recessionary environment.

Source: FinViz

iPhone 14 Demand Slows

In no huge surprise, market rumors now have Apple struggling to match iPhone unit sales from last year. Bloomberg reports have the tech giant slowing production to the same 90 million units target for the iPhone 13, primarily due to a sluggish start in China where comparable sales are down 11% from last year.

Another issue is the mix shift to the Pro versions causing disruption with the original production schedules. Wedbush analyst Dan Ives suggests a full 85% of the iPhone 14 sales are now Pro models.

As highlighted in the previous research, consumer reviews were questioning the value in purchasing the iPhone 14 Plus for $899 when the Pro models started only $100 higher. Some reviewers promoted consumers buying a new or refurbished iPhone 13 Plus instead for a $200 discount due to the lack of a new chip in the iPhone 14 base phones.

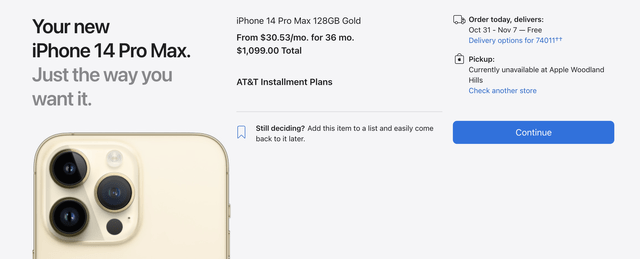

The problem with so many consumers shifting to the Pro Max model is the lack of original supplies hampering sales. The Apple website currently lists the estimated delivery date for the gold iPhone 14 Pro Max has slipped from mid-October until early November now.

Source: Apple.com

The tech giant faces the problem of sales for the Pro models pushed out past the prime holiday quarter. Consumers might end up opting for lower priced iPhones more readily available.

Lowered Estimates

The market appears somewhat shocked by the EPS cut issued by BoA analyst Wamsi Mohan, but the bearish call should be a huge warning to investors. Previously, the analyst had a bullish $185 target on the stock and cut the price to $160.

Wamsi cut the FY23 EPS target to only $5.87 on revenues of $379 billion. Analysts were up at $6.46 per share with FY22 EPS estimates now at $6.10.

The BoA analyst is now forecasting FY23 earnings to slip from the consensus estimates for the fiscal year closing here in September. Wamsi sees the App Store revenues trending down to flat with a FY23 revenue target for Services at only $85 billion.

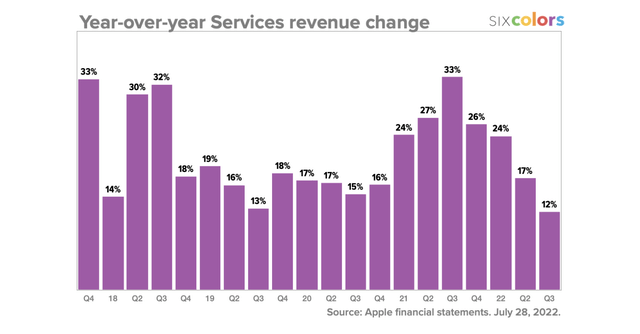

Services revenues were the linchpin of the growth story for Apple. Even if iPhone sales were flat and Apple could generate an increased ASP, the company could previously rely on Services revenue growth to boost overall revenues in excess of any weak iPhone sales.

The biggest issue was the clear sales pulled forward in FY21 followed now by recessionary and currency headwinds. Apple Services were growing at a ~15% clip in FY20 before the huge boost in FY21 led to a FQ3’21 peak of 33% growth.

Source: sixcolors

Apple has seen Services revenues stall just below $20 billion in quarterly sales. The BoA analyst has sales reaching $85 billion in FY23 for minimal growth of 5% max from current quarterly sales in the $19.5 billion range.

Our view has long held that the stock should be worth no more than $100 to $120. Analysts were only forecasting 5% to 6% EPS growth over the next few years warranting no more than a 15x forward P/E multiple.

Source: Seeking Alpha

If one takes the consensus FY23 EPS target of $6.47, the stock would only trade at $97 on 15x these estimates. The lowered BoA estimate questions the 15x multiple with earnings set to fall next fiscal year to only $5.87.

On those numbers, the market might have a very difficult time justifying such a multiple on falling numbers. What tricks investors is that analysts pick price targets that don’t match the actual estimates.

Wamsi cut the price target by $25 to $160 suggesting over 10% upside from the initial trading at $143. Analysts are notorious for maintaining price targets based on where the stock currently trades, not where the analysis would lead a logical conclusion.

Apple likely doesn’t dip below $100 with investors expecting a bounce back in FY24 numbers combined with “hope” the new AR/VR device drives sales and ushers in a new promising product category. The Apple Car could develop into a more legitimate story by the end of next year to support the stock. Regardless, Apple is likely to stall for years with the current analyst EPS targets still estimating the stock trades at 20x FY25 EPS targets.

Takeaway

The key investor takeaway is that the market and analyst community is finally catching on to Apple facing a few tough years with difficult comps. The stock now faces the legitimate concern of the tech giant reporting a year where reported sales and EPS falls YoY.

Investors must not fall for the trap of buying the dips just because the stock already trades down $40 from the highs or the promise of a $160 price target. Apple can’t justify a price above $120, much less even $100.

Be the first to comment