Robert Way

Investment thesis

Year to date, Luckin Coffee Inc. (OTCPK:LKNCY) has outperformed S&P Index (SPY), Global X MSCI China Consumer Discretionary ETF (CHIQ) and Starbucks Corp. (SBUX) by a large margin despite the COVID lockdowns, economic headwinds in China and global market selloff (see chart below).

LKNCY vs SPY, CHIQ and SBUX

Stock Performance (Bloomberg)

This trend should continue to be positively supported by its improving underlying fundamentals going forward. Our analysis of its new store opening data from April to mid-July suggested that LKNCY has maintained a robust pace of new store opening across China (averaging 6 new stores per day), totally undeterred by the draconian COVID lockdowns and slowing consumer spending in China.

Our investment thesis remains unchanged that LKNCY’s stock price could have 3x to 5x upside from its level in April and an eventual relisting onto the main exchange will most likely trigger the move. For more details about the thesis, please see our earlier writeup dated April 9th, 2022 “Luckin Coffee: Relisting Or Delisting“. This writeup will focus only on the new store opening data during the second quarter.

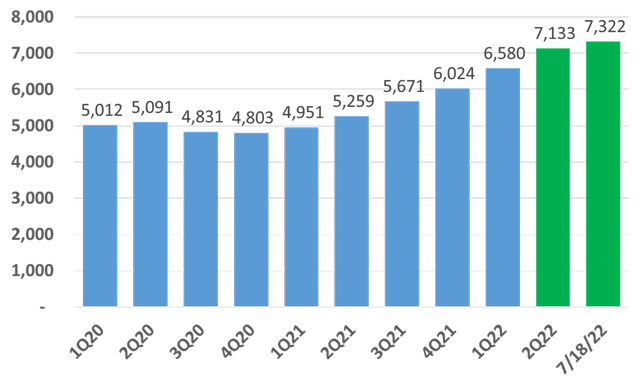

LKNCY is solidly the largest coffee chain in China

Every Monday LKNCY releases an update on its new store openings via its WeChat official channel which typically includes the number and location of the new stores opened during the previous week. According to those data, LKNCY has a total of 7,322 stores across China as of July 18, 2022, up more than 11% from end of 1Q22. This store count makes LKNCY solidly the largest coffee chain in China. To keep that store count in perspective, Starbucks, the second-largest coffee chain in China, has 5,654 stores in China as of April 3, 2022.

Quarterly Store Count Since 2020

Store Count (Company Data, Company Filings and Official WeChat Channel)

COVID impact on new store openings was limited

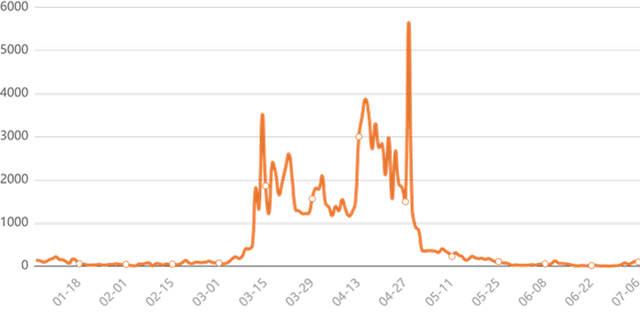

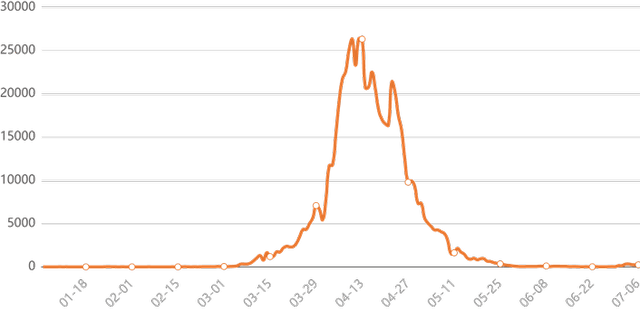

The large waves of COVID outbreak (see charts below) during the second quarter of 2022 had caused partial or full lockdown of multiple major cities in China, including first-tier cities such as Shanghai, Shenzhen and Beijing which are all core markets for LKNCY.

Daily New Confirmed COVID Cases in China

Daily New Asymptomatic COVID Cases in China

The situation certainly created quite some unexpected headwind on the company’s top line. In the first quarter earnings press release dated May 24th, 2022, LKNCY had warned about the potential negative impact of COVID lockdowns on its existing stores:

As a result, the Company’s temporary store closures gradually increased during the first quarter of 2022, with March being the most impacted. The Company experienced around 700 daily store closures on average during March 2022. Starting from April 2022, there was a nearly complete lockdown in Shanghai, resulting in a further increase of average daily store closures. For the period between April 1, 2022 and the day prior to this earnings release, the daily average number of temporary store closures was around 950.

While the Company is encouraged by recent government initiatives to introduce measures to support the local economy and has recently seen a partial re-opening in Shanghai, the Company anticipates that its operations will continue to be negatively affected by pandemic-related market pressures for the foreseeable future. The extent of these impacts is difficult to predict given the nature of the COVID-19 pandemic and the severity of the effects on the global economy.”

Based on the analysis of store opening data, new store openings were also negatively impacted by COVID outbreak, especially in April, however, the hit was temporary and very limited and the pace of store opening was seemingly undeterred at all.

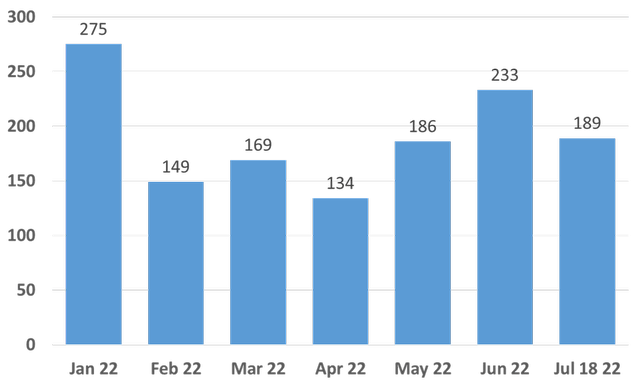

The following chart summarizes the new store openings trend by month, which shows that new openings in April declined by 20% due to COVID but immediately bounced back 39% in May and grew another 25% in June. During the first 18 days of July, the new openings had reached 189, highly likely to post another sequential growth.

Monthly New Store Openings

Monthly Store Opening (Company Data, Company Official WeChat Channel)

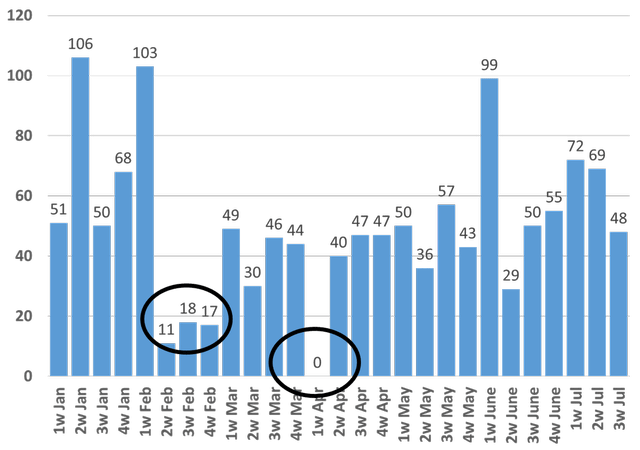

If charting the new store opening data by week (see below), we observed the similar trends. During the first 27 weeks in 2022, the new store openings dropped significantly (below 20 per week) only twice (in black circles). The first time happened during mid of February, i.e., Chinese New Year holiday, which is quite understandable as people tend to reduce their workload to celebrate the single most important holiday in China. The second time happened in the first week of April. LKNCY did not publish its weekly store opening updates on WeChat channel that week, so we assumed the new store opening was zero. One possible explanation for this might be that the new store openings were postponed due to unexpected Shanghai lockdown starting end of March. Regardless of what really happened, the store opening update was published again since the second week of April.

Weekly New Store Openings

Weekly Store Opening (Company Data, Company Official WeChat Channel)

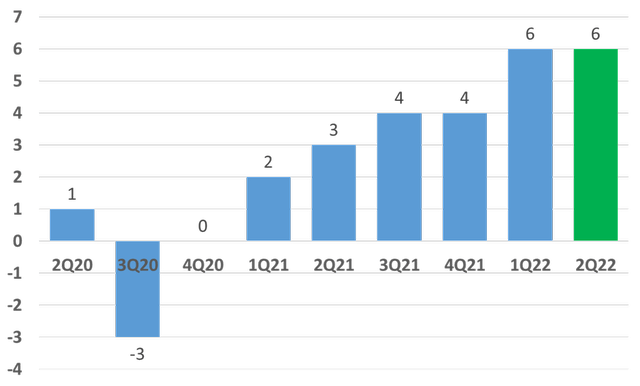

A more important data point to assess the COVID impact is the average new store openings per day, i.e., the pace of opening. As illustrated in the chart below, the pace of new store opening has accelerated from 2 per day at the beginning of 2021 to 6 per day in both the first and second quarter of 2022. It is worth mentioning that the pace in 2Q22 was achieved against all the severe COVID outbreaks across China.

Average New Store Openings per Day

Store Opening Per Day (Company Data, Company Filing)

New stores openings are in “full coverage” mode

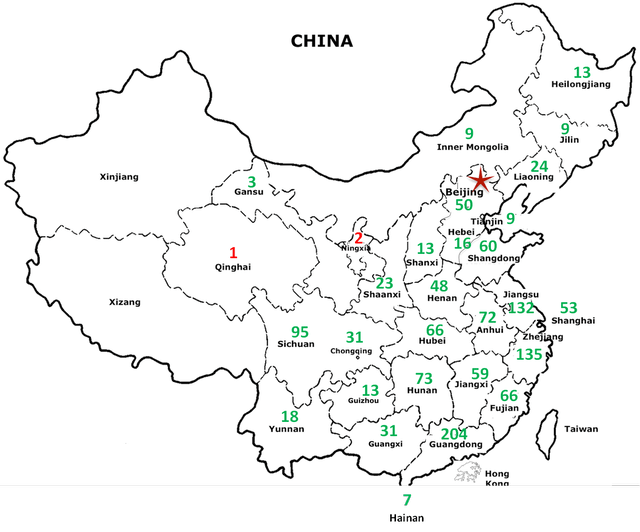

We repeated our exercise of showing the new store count by province on a map of China (see below) by aggregating the weekly store opening data from the first week of 2022 to July 18th, 2022. One key observation from this updated map is that during 2Q 2022 LKNCY has continued successfully its “full coverage” strategy by opening more new stores in almost every province though with a growing focus on the lower-tier cities. One good example is that the company had its debut in both Ningxia and Qinghai (store count highlighted in red), two provinces that have long been under-served by all the coffee chains due to the remoteness. As of July 18, 2022, LKNCY has opened its stores in all provinces of Mainland China except Xinjiang and Tibet.

New Stores Openings in 2Q 2022

Map of China (Company Data, Company WeChat Official Channel)

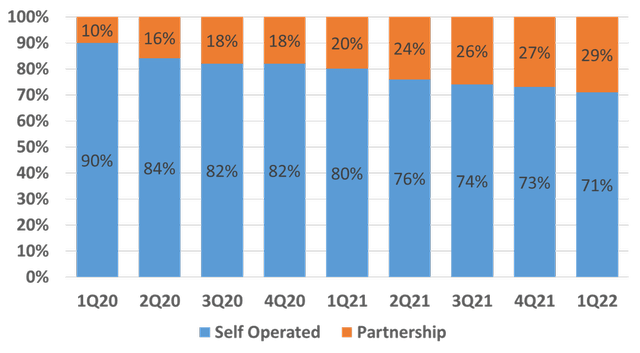

Consistent with what we observed on the new store map, LKNCY’s partnership stores (i.e., the franchised stores) continued to take an increasingly higher share in the total store mix per the operating data in the company’s 1Q22 earnings release dated May 24th, 2022. The partnership stores are typically located outside the more saturated first and second-tier cities. LKNCY seeks to leverage its partnership store network to tap the new markets in the third and fourth tier cities while minimizing the capital outlay. Partnership stores have increased from 10% of the total stores in 1Q 2020 to 29% in 1Q 2022, i.e., almost 3X in two years (see chart below).

Partnership Stores as % of Total Stores

Key Risks

1) COVID uncertainties in China. China has been strictly enforcing zero COVID policies which could still cause temporary store closings for LKNCY going forward. It is also difficult to predict the length and magnitude of the financial impacts. As we pointed out before, one natural mitigation for LKNCY is that a majority of its revenue is from pickup stores or via delivery platforms such as Meituan or its own app. As long as any future potential lockdown does not ban customer pickup or third-party delivery, LKNCY could still generate fair amount of revenues.

2) An economic downturn in China. During 2Q22, China GDP only expanded 0.4% as the COVID outbreak posed mounting challenges to the economy, especially to the consumer spending. The economic status would most likely cause the government to provide additional stimulation into the economy. LKNCY should be able to benefit from the government boost. Also, it has lower pricing point vs its competitors which could serve as another natural hedge when consumers become more cautious on spending during a downturn.

3) New store opening data are not from the company’s SEC filings. The new store opening data are from LKNCY’s weekly updates in its WeChat channel, not from the company’s SEC filing or official press release. For the most accurate operating statistics, please wait for the company’s second quarter earnings release which should be out sometime in August.

Conclusion

LKNCY’s weekly data from April to mid-July suggested that COVID had only limited impact on its robust pace of new store openings across China, averaging 6 new stores per day during the first half of 2022. With total store count over 7,322 as of mid-July, LKNCY is currently the largest coffee chain in China, surpassing Starbucks China by at least 1,000 stores. Our investment thesis remains unchanged that a relisting on the main exchange will eventually unlock more upside of the stock despite the recent outperformance. More for details on the thesis, please read our earlier writeup dated April 9, 2022.

Be the first to comment