Sorry, my piece on MGIC Investment Corp. (NYSE:MTG) a week ago wasn’t all it should have been. I could let it slide, but I decided to do my homework. And after doing it, I conclude the same – MGIC and its peer private mortgage insurers are remarkably cheap stocks in all but a full-scale depression. While I am all-powerful in my own mind, I will admit that I can’t guarantee no depression. With that said, let’s get to my updated argument.

MGIC’s current stock price assumes pretty close to another ’08

My valuation model sums MGIC’s three parts:

- Net cash

- New business origination capacity

- The value of the existing insurance in force

Here are my new assumptions and evidence:

$13.50 per share in net cash value. This number doesn’t change. The majority of MGIC’s cash is invested in corporate bonds; government debt is nearly all the rest. 99.8% of those corporate bonds are investment grade, and 76% are A or better. Could there be a couple of clinkers in the bunch? Sure, but lower interest rates increased the portfolio’s value. So $13.50 is solid.

$5.50 per share in new business value. In my last piece, I left this value as a question mark. Lazy. I went back and checked how much value MGIC added by originating new business in the years following the ’08 housing crisis. A few years of adding $0.25 that ramped up to $1.00 or more a share recently. $5.50 per share in value for the whole effort is on the conservative side, in my opinion.

That’s $18.50 per share in value so far. With the stock sitting at less than $7, Mr. Market implicitly values MGIC’s $222 billion of insurance in force at ($11.50) per share. How does that compare to MGIC’s losses from the housing bust?

MGIC paid out nearly $16 billion in claims since 2008 due to ’08 and prior business. MGIC has about the same insurance in force today as it did back at the end of ’07, so let’s call $16 billion of claims payments a “100% of an ’08”. So what percent of an ’08 is Mr. Market assuming, after matching the pace of claims payments to the ’08 experience and reasonably forecasting premiums, less operating expenses?

I come up with 65% of an ’08. I believe that it is a significantly high ratio, based on these four differences from ’08:

- The housing and home mortgage markets are in far better shape.

- Underwriting standards are dramatically better.

- MGIC has reinsured far more of its risk.

- Public policy appears far more proactive.

Net/net, even 30% of an ’08 would be surprising even in a serious recession. At 30%, MGIC’s stock is worth $17 per share. That’s up 150% from the current price. 15% of an ’08 brings the potential gain to 200%. But you be the judge.

The housing and home mortgage markets are in far better shape

First – and crucially – the supply/demand situation is far better. This chart tracks the amount of vacant housing (owned and rental) compared to a normal 3.5% vacancy rate:

Source: U.S. Census Bureau

In ’08 there were 2 million excess homes, and today there is a 750,000 shortage. The import of this is home prices have to fall a lot less in a recession to clear the market.

Relative home prices are lower. Home prices compared to consumer disposable incomes reached 240% in ’07, by far a record. Today they are 180%. More downside protection.

Mortgage debt service is at a record low. A decade of very low mortgage rates has driven mortgage payments as a percent of disposable consumer incomes down to 4.1%, from a long-term average of 5.5% and an ’07 peak of 7%. You may be getting the idea – more downside protection!

Underwriting standards are dramatically better

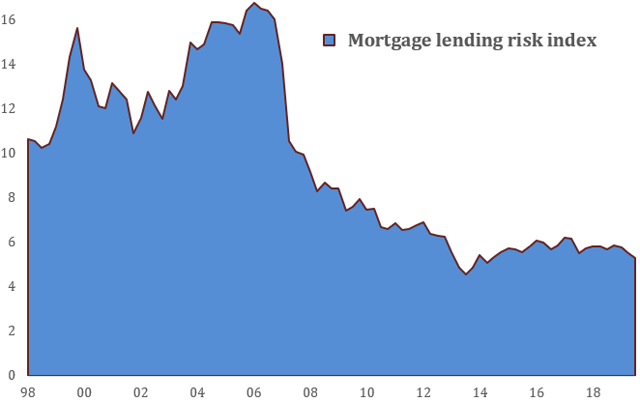

The underwriting differences between 2007 and today are stark and myriad. I’ll lead with a summary of national mortgage lending standards. The picture I now gaze at for five minutes each night before sleep:

Source: Urban Institute

MGIC’s difference in lending standards in the years leading up to ’08 are starkly different from the past decade. Examples:

FICO scores: Scores less than 660 were 27% of MGIC’s insurance book going into ’08. Today – 7%.

No/low documentation of incomes and assets were about 15% of new business during ’05-’07. Today they are 0%.

Debt payments as a percent of incomes greater than 45% were 38% of ’05-’07 new business. The past three years they were 14%.

Very low downpayments of less than 5% were 38% of ’05-’07 new business. The past three years – 15%.

Investor loans (non-owner occupied) were 3% of ’05-’07 new business. Today – 0%.

In total, 43% of MGIC’s claims payments since ’08 were for loan types it hasn’t made in a decade!

MGIC has reinsured far more of its risk

MGIC and its mortgage insurer peers have two vehicles with which to shift some of their risks to others. One is a “quota share” policy, where the reinsurer takes a percentage of any loss, typically about 30%. The other is an “excess of loss” policy, today in the form of insurance-linked notes, or ILNs. A common structure today is for MGIC to take losses up to 2¼% of insurance in force, the ILN then takes up to 5%, and MGIC has the rest. Excellent recession protection.

In 2007, MGIC had essentially no quota insurance. It did have a form of excess loss insurance to cover up to $630 million of paid claims. It subsequently collected nearly all that amount. Today 79% of MGIC’s book is covered by quota share reinsurance. And its ILNs cover another $532 million of potential losses.

In a disaster scenario, how much could reinsurance compensate MGIC? Well, its regulators give MGIC $1¼ billion of capital credit for its reinsurance, so something north of that amount. And math says that if 79% of MGIC’s insurance has quota share absorbing 30% of losses, MGIC would collect $3¾ billion in an ’08 $16 billion loss scenario.

Public policy appears far more proactive

The federal government’s main response to the ’08 housing bust was HARP, a loan refinance program. It did not go into operation until March 2009, fully two years after the first serious cracks in mortgage quality arose. And subsidies to consumers and businesses were relatively modest (mostly TARP to support the banking system and a payroll tax cut).

Now government officials are tripping over themselves to promise subsidies, with a $1-2 trillion cost being bandied about. Already, Fannie Mae and Freddie Mac, and some banks, have announced forbearance on missed mortgage payments.

Summing up

Each of these protections will significantly reduce MGIC’s losses in even a serious recession. Yes, some things will go wrong. Sadly, I expect that MGIC’s stock buyback program will be put on hold. Loss reserve additions will make for ugly looking Q1 and probably Q2 EPS reports. The mortgage insurers may have to pay some of the cost of Fannie and Freddie’s mortgage forbearance programs. But another ’08? No.

Disclosure: I am/we are long MTG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment