Sjo/E+ via Getty Images

Since our initial coverage of LSB Industries (NYSE:LXU), we had a few criticisms from the Seeking Alpha investor community. However, LSB stock price performance was in line with our expectations, and the company declined by almost 30% compared to the return of the S&P 500 of -6.13%. In September 2022, we were still not convinced, and our neutral case recap was based on the fact that 1) commodities prices were still trading at all-time record highs, 2) and more importantly, after having analyzed LSB’s secondary offer, we were pretty skeptical about the investment timing, and 3) almost all chemical companies were de-rated, and we thought there was better upside in other sectors.

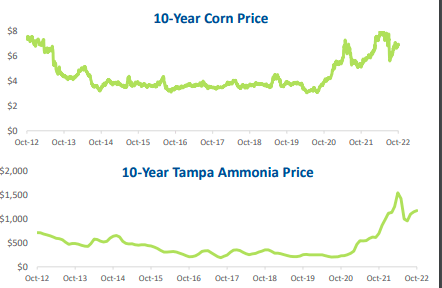

Mare Evidence Lab’s Previous Publication

Despite the fact that LSB had a positive pricing delta (Q3 results as well as half-year numbers confirmed that), our thesis was based on the fact that the company’s main products were starting to show some negative price development, and then LSB’s profit could not sustain this trend for long. On a positive note, we also reported that, based on the company’s geographical footprint, it was less exposed to natural gas cost evolution; however, higher logistic costs and supply chain constraints were not doing any favors to the US company to export in Continental Europe.

Q3 results simply confirm our expectations. Very briefly, the company reported:

- Top-line sales were up by 45% on a yearly basis thanks to higher selling prices; however, volume declined;

- EBITDA reached $50 million versus the $38 million recorded in the same quarter last year. As already mentioned, this is due to the fact that LSB has 3/4 of its sale agreements at a spot price contract;

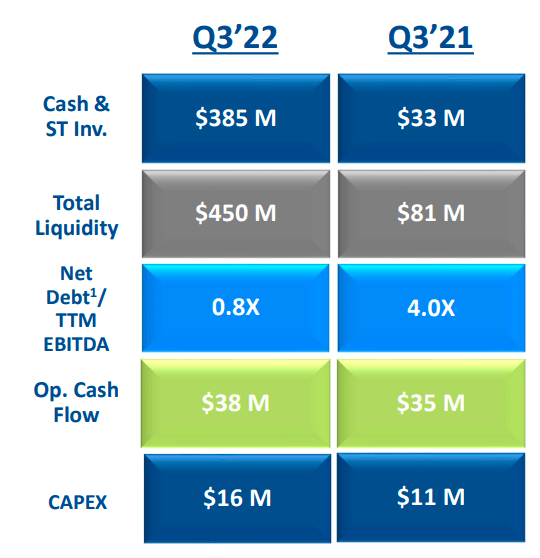

- The company continued to deleverage with total liquidity of roughly $450 million and a net debt/EBITDA of 0.8x.

LSB Industries Q3 Financials in a Snap (LSB Industries Q3 Results Presentation)

Our Take and Conclusion

What are our main key takeaways now?

- On the Macro level, the Russian invasion was a key supportive catalyst for LSB, and it clearly exacerbated the commodities global supply chain.

- Still related to point 1) high EU natural gas prices further decreased nitrogen production. Even if we were pricing in a positive short-term upside for LSB, this might translate into a medium-term opportunity.

- Nitric acid and industrial product demand remained stable over the period (in Q3, looking at LSB’s volume loss was just -$6 million and was also due to scheduled maintenance at the El Dorado and Pryor facilities).

- Here at the lab, we now believe that fertilizer prices will be higher for longer. We decided to overweight Corteva (from neutral to buy) and also Yara International (from sell to neutral).

- Going into the details, despite two important turnarounds in Q3, the company was cash positive.

- We can also make a case for an asset replacement cost opportunity. It seems that LSB might be an ideal acquisition target for a larger chemical company with a focus on ammonia/nitrogen production. Natural gas costs might further consolidate the chemical sector.

- In a position of strength, the company is working on capacity expansion and inorganic M&A. This is also coupled with an opportunity in low carbon ammonia production (you can have a look at our recent Air Product and Chemical publication).

- In Q3, LSB repurchased $90 million worth of stock at an average stock price of $13 per share. The company announced an additional buyback authorization for a total consideration of $75 million in the last quarter. This provides a margin of safety that we like to see.

- Thanks to the company’s deleveraging, interest expenses were cut by three times compared to a year ago.

-

Regarding the valuation, LSB is trading at an EV/EBITDA of 4.25x (LTM) compared to a historical valuation of a double-digit number. Again, looking at the forward P/E estimates, the company is trading at around 5x; however, LSB is uniquely positioned to benefit from the above positive trends. Based on an EV-to-EBITDA multiple of 6x, we decided to overweight the company at a buy target, and we derive a price of $16.50 per share with an implied upside of 20% at today’s price.

Ammonia and Corn Price Evolution (LSB Industries November Investor Update)

Be the first to comment