JHVEPhoto/iStock Editorial via Getty Images

Introduction

As a dividend growth investor, I am constantly looking for additional dividend growth opportunities for my portfolio of ~70 dividend growth companies. While I am looking for possible additions of new positions, I am also adding to my existing positions whenever I believe a specific company is attractively valued, and its growth trajectory makes it attractive.

A year ago I analyzed Lowe’s (NYSE:LOW) and found it to be an attractive dividend growth company. Since then the share price has increased substantially only to decline by 20% in the past several months. In this article, I will look again into Lowe’s, and try to determine how attractive the company is following the stock price decline.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same methodology to make it easier for me to compare analyzed stocks. I will look into the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

According to Seeking Alpha’s company overview, Lowe’s operates as a home improvement retailer in the United States, Canada, and Mexico. The company offers a line of products for construction, maintenance, repair, remodeling, and decorating. It provides home improvement products in various categories, such as appliances, decor, paint, hardware, millwork, lawn and garden, lighting, lumber and building materials, flooring, kitchens and bath, rough plumbing and electrical, seasonal and outdoor living, and tools.

Wikipedia

Fundamentals

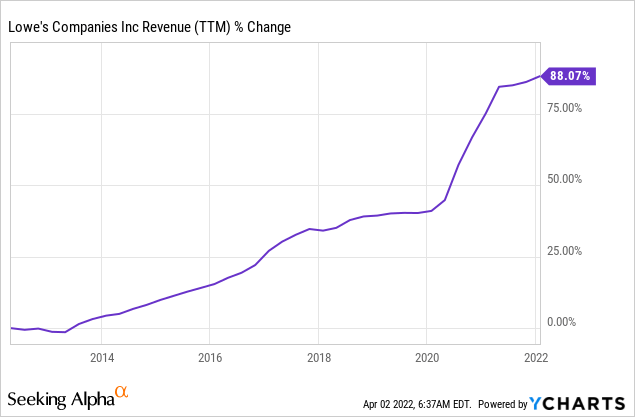

Revenues have almost doubled over the past decade implying a mid-single digits growth rate. Lowe’s is increasing revenues mostly organically by increasing same-store sales, opening new stores, and offering its private label products and other products in online channels. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Lowe’s to keep growing sales at an annual rate of ~3% in the medium term.

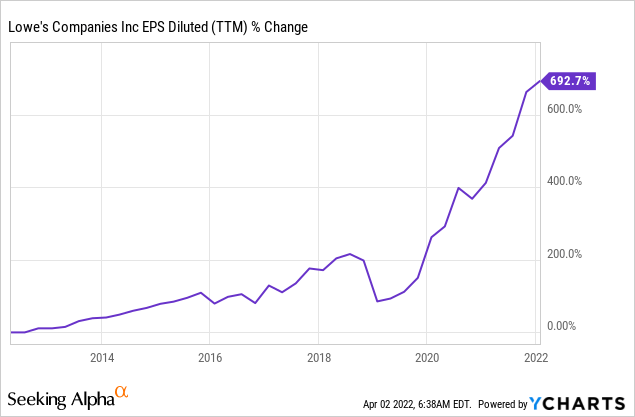

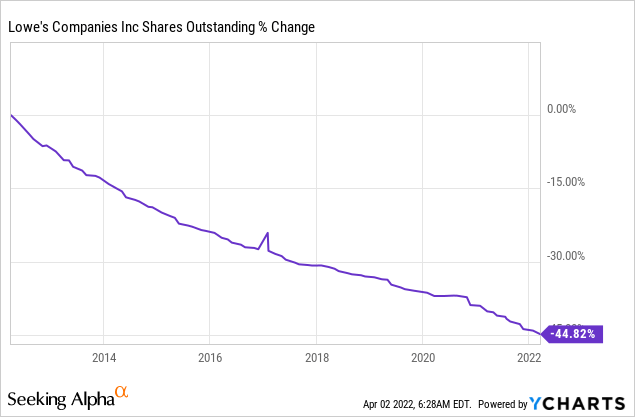

The EPS (earnings per share) over the same period has grown at a much faster pace. The EPS growth was fueled by the sales growth, the massive and aggressive buyback plans, and the improvement in margins. The company has become much leaner and more efficient, and margins have improved as operating margins almost doubled in the last decade. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Lowe’s to keep growing EPS at an annual rate of ~12% in the medium term.

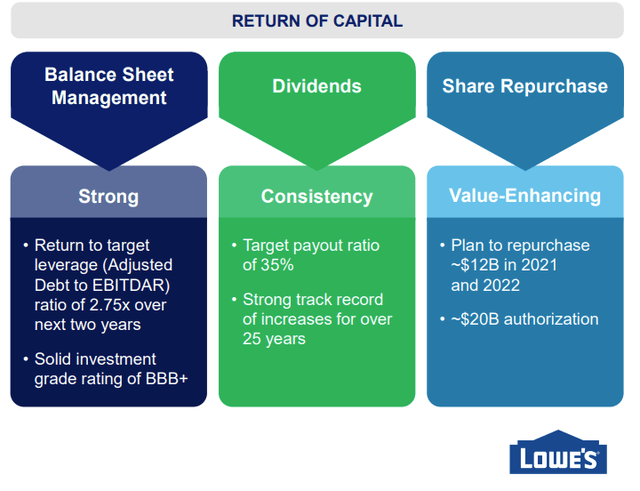

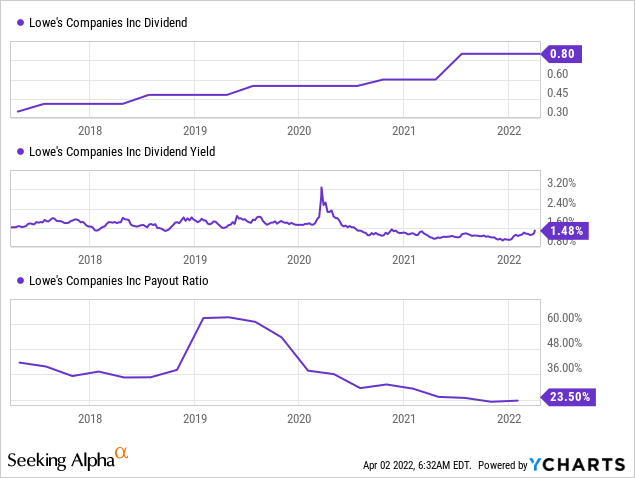

The company is a dividend king which means it has raised its dividend for over 50 years. The company’s dividend yield stands at 1.5% at the moment, and the dividend is extremely safe with a payout ratio below 25%. The company expects to maintain a 35% dividend payout ratio over the long term. Therefore, investors should expect a significant dividend increase in the dividend increase coming May 2022. Another 20%+ increase should not be ruled out as the company is growing fast, and the current payout is far from the target the company set.

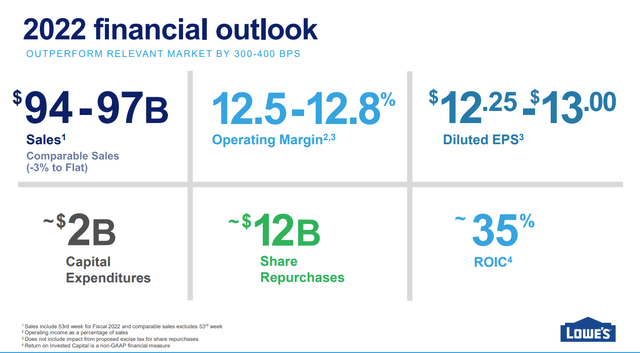

December’s outlook

in addition to the ever-growing dividend, the company is also aggressively buying its shares to increase shareholder returns and support EPS growth. Over the last decade, the company has decreased the number of shares outstanding by almost 50%, and that alone contributed to almost doubling the EPS. The company expects to buy back additional shares worth $12B in 2022, equaling almost 10% of its market cap at the current price.

December’s outlook

Valuation

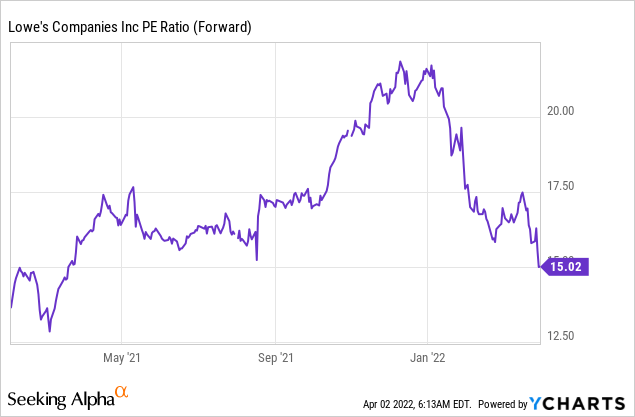

The company is trading for a P/E (price to earnings) ratio of 15 when taking into account the 2022 consensus of analysts for EPS. The valuation which has been significantly higher just three months ago declined as the company improved its outlook and the share price declined. Paying 15 times earnings for a company that is growing at a double digits pace is attractive in my opinion.

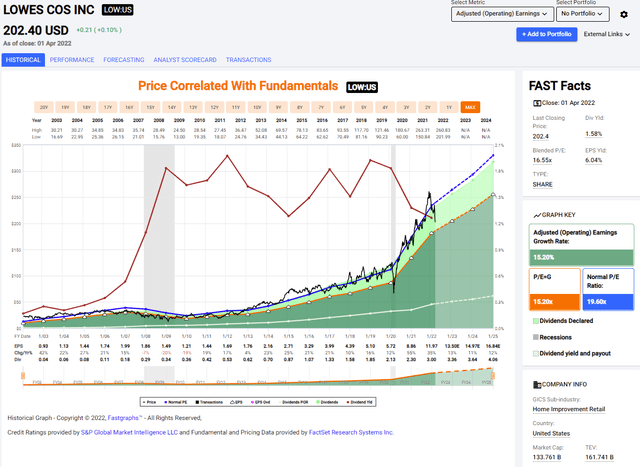

The graph below from Fastgraphs.com emphasizes that Lowe’s is attractively valued at the moment. Historically, Lowe’s has been following the blue line very closely. Therefore, the current situation where the stock is trading significantly below its average valuation makes it attractive. The company’s growth rate forecasted for the medium term is just a little slower than the company’s average growth rate. Thus, I believe that at the current valuation Lowe’s is attractively valued.

Fastgraphs

To conclude, Lowe’s is right now at the sweet spot of strong fundamentals, combined with what I believe to be an attractive valuation. Lowe’s is growing sales and EPS, thus fueling dividend payments and buybacks. It’s trading for a valuation that is lower than its historical valuation despite the growth rate being impressive.

Opportunities

The trend of remote work is here to stay even in the post-pandemic era. If last year there was a higher uncertainty regarding this trend, it becomes obvious that people will continue to work remotely when possible for several days a week. It brings more focus to the home, and remodeling the house to fit the new needs is essential. Moreover, as people spend more time at home, they show more interest in designing and modeling it.

With the extension of remote work for some employees, we’re expecting a permanent step up in the repair and maintenance cycle. And as a reminder, 50% of the homes in the U.S. are over 40 years old and will continue to require investments for upkeep, and approximately two-thirds of Lowe’s as annual sales are generated from repair and maintenance activity.

(Marvin Ellison – Chairman and CEO, Q4 earnings call)

Omnichannel is another growth opportunity for Lowe’s. The company is investing in its online presence, and it is essential for several reasons. First, its peers are investing in online and omnichannel capabilities which are translated into better service. Moreover, it allows the company to be leaner in the long term as it requires less manpower to fulfill every order, and it will allow Lowe’s to improve margins.

Moving to Lowes.com, as Marvin mentioned, we delivered sales growth of 11.5% in the quarter and 147% on a two-year basis in the fourth quarter. We are focused on further enhancing our omnichannel capabilities in 2022 across three key areas, expanding our online assortment, enhancing the user experience, and improving fulfillment.

(Bill Boltz – Executive VP, Merchandising, Q4 earnings call)

The company is also expanding its business with professionals. If historically, the company was focused on the DYI segment, it has created a one-stop-shop for professionals as well, thus creating a whole new business. In 2022, the company expects that 25% of its revenues will come from professionals who buy their materials at Lowe’s.

Our Total Home Strategy continues to gain momentum as we grow our share wallet with both PRO and DIY as they increasingly rely on Lowe’s as a one-stop solution for all of their project needs. And looking at our results this quarter, I’m particularly encouraged that our growth was broad-based and balanced across product categories, both DIY and Pro, both online and in-store.

(Marvin Ellison – Chairman and CEO, Q4 earnings call)

Risks

Lowe’s is in a highly competitive landscape. The company is a retailer, and it competes with other retailers both with physical stores as well as with online stores. Its size and expertise help it compete efficiently, but on the other hand, it still lacks an online presence compared to large retailers like Walmart (WMT) and Target (TGT). Lowe’s is well-positioned to compete using its edges, but it would need to constantly invest and evolve.

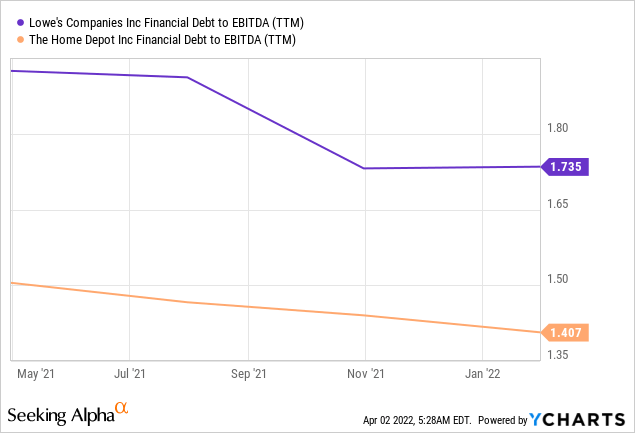

The second risk is inflation. Inflation has reached a decade high at almost 8%. Lowe’s just like other retailers will face price increases from its suppliers. Due to the company’s competitive landscape, it may struggle to increase prices accordingly. Home Depot (HD) for example enjoys a lower debt/EBITDA ratio and can leverage itself more if a price war starts.

The higher inflation is forcing the central banks to increase the interest rates. It may hinder the growth of Lowe’s in the short and medium-term. Consumers use credit for home improvement and higher rates mean that credit is more expensive. If the higher rates lead to a recession, then growth will slow even further as the economy is adjusting, and housing prices may be affected as well impacting the willingness of consumers to invest in remodeling. Still, for 2022, the company expects decent demand despite rates being higher.

But keep in mind rates are increasing off historic lows. Home equity has increased due to rising home prices and consumer savings are about $2.5 trillion higher than pre-pandemic levels, positioning consumers for continued residential investments. Given all these factors, we are expecting another strong year of demand in the Home Improvement market.

(Marvin Ellison – Chairman and CEO, Q4 earnings call)

Conclusions

Lowe’s is a dividend aristocrat that is about to announce its 60th annual dividend increase in a row. The company has generated growing sales and earnings consistently and rewarded shareholders with dividends and buybacks. The company is traded for what I believe is an attractive valuation with a forward P/E of 15.

In addition, the company also enjoys good growth opportunities as the need for houses is growing and increasing wages allow consumers to upgrade their homes. The risks of inflation and rate hikes may slow down growth, but they are mostly temporary, and in the long-term the current valuation makes Lowe’s a BUY.

Be the first to comment