Vertigo3d/E+ via Getty Images

The dominant macroeconomic theme at the moment is inflation. This is due to a combination of a labor shortage, the Russo-Ukrainian war and the accompanying sanctions, lingering COVID-19 headwinds which continue to deal major disruptions to the global supply chain, and the full impacts of the massive government stimulus payouts during the height of the pandemic just now being felt as consumers are increasingly resuming normalized economic activities and spending their extra cash.

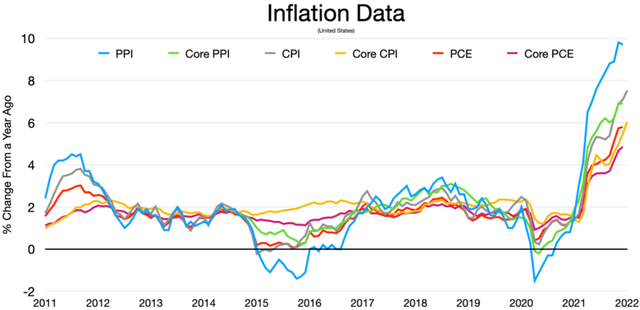

US Inflation Data ((Wikipedia))

In fact, inflation has become so alarming that even prominent Keynesian economists are sounding the alarm and urging policymakers to change course immediately to better tackle the problem.

In the meantime, it looks like inflation will get worse before it gets better, so investors would likely be prudent to ensure their portfolios are hedged appropriately.

Real Estate Is A Proven Inflation Hedge

Real estate has proven to be a reliable inflation hedge and could potentially be a great fit during these challenging economic times.

First of all, inflation – especially given the labor shortage we are seeing today – tends to push up wages, which in turn increases consumer buying power for real estate. Furthermore, the rising cost of commodities and raw materials due to inflation and supply chain challenges means that the replacement cost of all buildings is increasing.

Add to that the fact the mortgage rates remain near historic lows, and there is a case to be made for sustained strong real estate demand that should enable it to keep pace nicely with inflation.

As Cambridge’s Real Estate Finance professor Colin Lizieri said:

To the extent that wages capture inflation, there’s a clear link between house prices and inflation.

We are definitely seeing that today. However, investing in rental residential properties today might not be the best option given that valuations are very rich. In fact, the Federal Reserve Bank of Dallas just recently stated:

Our evidence points to abnormal U.S. housing market behavior for the first time since the boom of the early 2000s…the U.S. housing market has been showing signs of exuberance for more than five consecutive quarters through third quarter 2021.

However, commercial real estate and farmland appear to be better alternatives in the real estate space. Thus far, commercial real estate has not seen nearly the bubble-like appreciation in prices that housing has seen. As a result, it offers greater value potential and less downside risk in the event of a real estate market downturn.

A commercial real estate sector we particularly like at the moment is high quality mission-critical logistics and industrial real estate. This is because the supply chain challenges mean that well-located warehouses and industrial facilities are more valuable than ever.

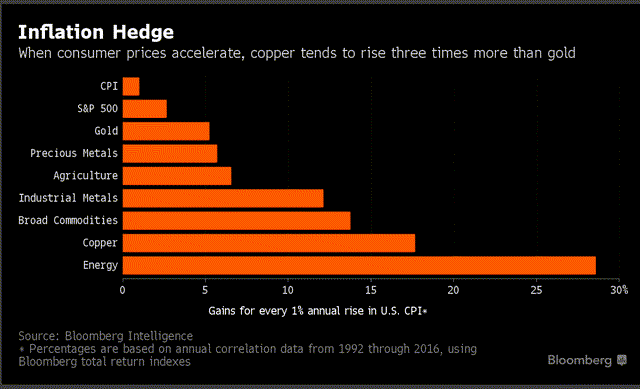

Meanwhile, farmland also has a lot going for it as agriculture is one of the most reliable inflation hedges around and the price of agricultural products is soaring at the moment due to the Russo-Ukrainian war since both countries export a lot of agricultural products.

Agriculture As An Inflation Hedge (Bloomberg)

As a result, we think that investing in high quality logistics, industrial, and farmland real estate are some of the best ways to hedge against inflation at the moment. In order to gain sufficient diversification and to avoid the headaches involved with asset management, we especially like to gain such exposure via the following two REITs (VNQ):

#1. W. P. Carey (NYSE:WPC)

In addition to the fact that roughly half of its rental revenue comes from mission critical logistics and industrial real estate (which as we mentioned previously, benefits from the current supply chain headwinds) that is secured with multi-decade triple net lease contracts, we think WPC is poised to benefit from rising inflation for the following reasons:

First, ~37% of its rental revenue comes from Europe and a few other non-U.S. geographies. This gives it exposure to lower interest rates that it can arbitrage against the high inflation/rising rate environment in the U.S.

Second, 60% of its ABR is actually linked to CPI. As management emphasized on a recent earnings call:

Higher inflation had a positive impact on our same-store growth during the third quarter, especially for leases tied to uncapped CPI. However, it is really just the start, with the bulk of the impact occurring over the next few quarters…With inflation picking up in recent months, we expect leases tied to inflation to drive rent growth, and strongly outpace the 2.3% average fixed rent bump we saw for the third quarter. Inflation began to flow through to rents during the third quarter, although on a relatively small portion of our portfolio. Leases with CPI-linked rent increases, they went through scheduled rent adjustments during the quarter, experienced rent increases averaging 3.3%. The vast majority of CPI-linked leases, that did not bump during the third quarter, are scheduled to do so over the next 9 months, adding about 100 basis points to our same-store rent growth based on current inflation forecasts.

In contrast, peer blue chip net lease REIT Realty Income (O) only has 30% of its ABR linked to inflation. This means that WPC has essentially twice the inflation protection that O does.

Third, O and many other triple net lease REITs like National Retail Properties (NNN) and STORE Capital (STOR) own a much smaller percentage of industrial and logistics properties than WPC, and instead own a lot more retail businesses that are being hurt by inflation and supply chain difficulties. This positions WPC to see more resilient revenues through a prolonged high-inflation environment, thereby making it a lower risk investment proposition.

Fourth, given the strong demand for industrial and logistics assets at the moment as well as its impressive geographic diversification, WPC has a very robust growth pipeline. In 2021, it acquired ~$2 billion in new properties on attractive cap rate, lease duration, and rent escalation terms and is poised to put up another strong growth year in 2022 as well. This should also enable it to weather inflation well since its strong AFFO per share growth (6.1% in 2021) should flow through to stronger dividend per share growth in the next year or two and will thereby help to sustain investor purchasing power.

Fifth, WPC’s large size (over $22 billion enterprise value) gives it considerable economies of scale and combines with its low CapEx/labor-light business model to mitigate impacts of material and labor cost inflation. As a result, its G&A cost of 6.2% compares favorably to many REITs as well as the typical 8% property management fee for rental properties.

Finally, despite its strong performance over the past year that has outpaced its peers in the triple net lease sector, WPC remains undervalued. The company’s EV/EBITDA ratio is 18.05x which is below its 3-year average of 18.65x. When adding to that its improved growth profile, rock solid investment grade profile, conservatively positioned portfolio, and dividend yield of 5.2% that remains well above interest rates, WPC looks like a very attractive risk-adjusted inflation-proof real estate income investment.

#2. Farmland Partners (NYSE:FPI)

As we already mentioned, farmland is also a proven inflation hedge. Our favorite publicly-traded REIT in the space at the moment is FPI. It is broadly diversified across over 160,000 high-quality row crop U.S. farmland acres in 16 states. This gives it considerable economies of scale and diversification benefits to investors that they would not be able to enjoy if they invested in farmland on their own.

On top of that FPI’s scale enables it to enhance investor return with access to fairly inexpensive capital and has a pretty sound balance sheet at present with ~60% equity and ~40% debt.

In addition to offering a broadly diversified and professionally managed portfolio of farmland that currently trades roughly in-line with consensus NAV estimates, FPI also is just now growing an asset management business that could lead to an explosion in growth for the REIT.

If it can successfully become a one-stop-shop for farmland investing that includes offering private fund asset management services, property management services, and auction & brokerage services on top of its buy-and-hold farmland portfolio, the company will effectively become a leveraged bet on the value and demand for farmland. In a highly inflationary environment combined with a global food shortage, this bodes as an extremely bullish outlook for FPI.

It also means that FPI is essentially trading at fair value for its underlying farmland and investors are buying the asset management business for free.

With so much demand for agricultural products – including farmland – at the moment, FPI’s asset management business could see massive growth, making it a potentially powerful growth driver for the business. In fact, in 2021 FPI’s first private fund was launched and it quickly reached $53 million in fee-bearing assets under management and now they have acquired Murray Wise Associates to further enhance the asset management business.

While the upside potential is clear here, the main risk is the ongoing costly lawsuit against a short-seller, which has proven to be a drain on the company’s resources. Additionally, the company does not generate much dividend coverage at the moment, so if the sector experiences a sudden downturn in combination with rising interest rates and the asset management business fails to take off, the dividend could be cut.

Investor Takeaway

With inflation clearly headed higher for the foreseeable future, investors would be prudent to examine ways to hedge against it. While real estate has proven to be an effective hedge in the past, investors should be careful about which sector they invest in as some real estate sectors are currently trading at bubble-like valuations without commensurate tailwinds to justify the valuations.

We think that reasonably priced CPI-linked logistics real estate and farmland are two of the best opportunities in real estate today and WPC and FPI are the best risk-adjusted ways to invest in them.

Be the first to comment