Scott Olson

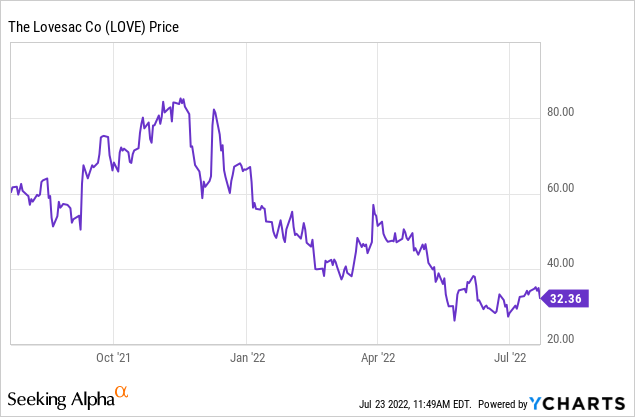

This year has done a lot of damage to growth stocks, and news of persistent inflation and waning consumer confidence hasn’t really done any favors for the consumer goods sector either. Lovesac (NASDAQ:LOVE), a maker of eclectic furniture that is known for its modularity (customers can mix and match between different items to create their personalized furniture set), has been a major casualty of this weakened sentiment.

Year to date, this one-time high-flying growth stock has shed 50% of its value. In my view, investors have sold the stock off primarily on expectations of a macro slowdown and on waning faith for growth stocks in general, rather than due to Lovesac’s own fundamentals. It’s a good time, in my view, for us to re-assess the bull case for Lovesac.

Lovesac is a rare consumer stock that is performing admirably well

Since I last wrote on Lovesac in February, the stock has only continued to tumble (from the low $40s at the time) while at the same time releasing a succession of earnings beats. I’m watching Lovesac’s valuation, especially its new low P/E ratio, and I remain quite bullish on the stock’s prospects to outperform the S&P 500 should a broader market rally take hold later this year.

One key reason why I remain enthused on Lovesac is that its story has diverged from other growth furniture competitors like Wayfair (W). Now, Wayfair saw a huge boost in revenue in 2020 (thanks to the COVID trend of moving away from the city and into the suburbs, Wayfair saw a large one-time spike in furniture orders), but that growth quickly subsided and Wayfair saw negative comps in 2021 and 2022. This is not true, however, of Lovesac. The company has continued to aggressively push for growth – and it’s not just the addition of new stores that have boosted its revenue, either. E-commerce sales continue to grow, and same-store sales (excluding the contribution of new locations) are also up healthily.

For investors newer to the stock, here are the key reasons why I am bullish on Lovesac:

- Growing nicely even at scale. Even on a same-store basis, excluding the growth driven by store expansions, Lovesac is growing at a ~40% y/y pace. Analysts are expecting 27% y/y growth for Lovesac in FY23 (corresponding to most of calendar 2022), though Lovesac has a trend of “beating and raising” – growth expectations for FY22 started out closer to the mid-30s and ended up just shy of 50% y/y.

- Willingness to spend on home improvement and comfort. Furniture companies, home-improvement stores, and other home-related companies were all big winners from the pandemic, due not only to the volume of moves but also due to a higher propensity to spend for comfort. Looking longer term, this benefits higher-end furniture makers like Lovesac, whose typical Sectionals sofas run in the upper mid-tier $2,000-$3,000 range.

- Impressive profitability despite macro headwinds. Lovesac’s problems are shared with other consumer products companies – China tariffs and higher freight costs. Yet despite this, the company’s 50%+ gross margins are high for a consumer products manufacturer, and its ability to generate positive adjusted EBITDA and GAAP net income sets it apart from other small caps.

- Omni-channel expert. Lovesac’s fleet of retail stores are now all open in some capacity, and we expect Lovesac to continue its retail expansion strategy in 2022. These small-format stores are a great way for Lovesac to spread its brand and drive more traffic online.

- Possibility of tariffs cancellation. As a consumer products company that is primarily sourced out of China, Lovesac is heavily impacted by the Trump tariffs on products imported from China, hurting gross margins by about nine points. According to a news report in early July, the Biden administration is considering rolling back some tariffs at a modest pace. Given the heavy impact of these tariffs on Lovesac’s bottom line, news of any follow-through in this legislation could produce a sharp burst for the stock.

Valuation checkup

Next, let’s talk valuation. For the current fiscal year (FY23, the year ending for Lovesac in January 2023), Wall Street analysts are expecting Lovesac to produce 27% y/y revenue growth and hit $2.96 in pro forma EPS (3% y/y earnings growth, indexing behind revenue growth due to the gross margin impact of this year’s logistics squeeze). The outlook next year (FY24) is rosy, calling for 22% y/y revenue growth and $4.12 in pro forma EPS (39% y/y earnings growth; consensus data from Yahoo Finance).

If we take these consensus estimates at face value, Lovesac’s valuation sits at:

- 10.9x FY23 P/E

- 7.9x FY24 P/E

Needless to say, this is a massive discount to the broader market and quite a cheap multiple for a company currently growing revenue north of >50% y/y. The discount is a reflection of the fact that investors largely don’t believe in Lovesac’s ability to meet these consensus targets, but I’d say trust the numbers and the trends that the company has already published rather than project macro concerns into the future.

Q1 recap

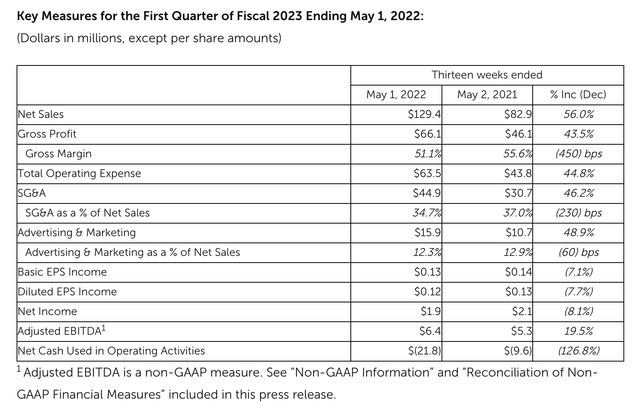

Let’s now discuss Lovesac’s latest Q1 results in greater detail. The Q1 earnings summary is shown below:

Lovesac Q1 results (Lovesac Q1 earnings release)

Lovesac’s revenue in Q1 grew at an incredible 56% y/y pace to $129.4 million, beating Wall Street’s expectations of $114.8 million (+38% y/y) by a massive eighteen-point margin. Note that the company has heavily emphasized reducing promotional discounting to mitigate the impacts of the current inflationary environment, so the fact that Lovesac was able to achieve this level of growth without significant consumer incentives is quite impressive.

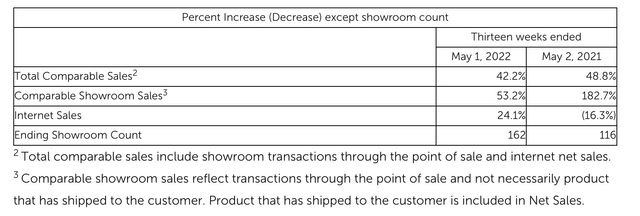

As previously mentioned, sales growth was boosted not only by store count expansion, but by an increase in same-store sales as well. You’ll see in the chart below that Lovesac ended Q1 with 162 total stores in its fleet.

Lovesac comparable store sales (Lovesac Q1 earnings release)

E-commerce also continues to thrive with 24% y/y growth – again, this invokes a compare versus Wayfair, which saw e-commerce revenue decline post-pandemic. Management also mentioned that its partnership with Costco (COST) has also been extremely fruitful, with the company achieving successful “roadshows” on Costco.com.

Lovesac has not been immune to challenging supply chain conditions, but it has navigated well through them. Per CEO Shawn Nelson’s prepared remarks on the Q1 earnings call:

Then regarding supply chain update. In Q1, we continued to benefit from our diversified supply chain and inventory strategies, which enabled us to not only over deliver net sales in quarter one but also exit the quarter in a strong planned inventory position with quarter ending in-stocks in the high 90s an expected strong position heading into quarter two with our evergreen inventory.

Our delivery times customers continue to be best-in-class in our category, and we remain committed to this performance. As we look to quarter two, we expect continued operational progress despite ongoing headwinds in the global supply chain. Our active strategy to manage inventory and our diversified sourcing has enabled stronger and consistent supply performance thus far, and we will continue to manage through the current environment while delivering our expected margins.

We’re also happy about the progress we are making as we continue to mitigate some of the tariffs in China and ramp up North American production, both of which will create and strengthen redundancy to ensure our industry-leading in-stock position.”

Lower promotions, as previously mentioned, helped to offset raw materials inflation, but higher logistics costs were the main driver behind pushing gross margins down 450bps to 51.1% (still impressive for a consumer products company). The company was able to partially compensate for this gross margin hit by reducing selling, general and administrative expenses by 230bps as a percentage of revenue.

Overall, adjusted EBITDA still grew 20% y/y to $6.4 million, while pro forma EPS was relatively flat at $0.12 and came in well ahead of Wall Street’s expectations for a -$0.25 loss. These results demonstrate that even amid tough supply chain conditions and inflationary pressure, Lovesac remains a highly profitable business.

Key takeaways

Handsome profitability, robust growth, and so far, a demonstrated resiliency to tough macro conditions – these are the key highlights for Lovesac that the market seems to be ignoring at the moment. I’d gladly take the opportunity to invest in this overlooked name at just a <8x P/E ratio against next year’s expected earnings.

Be the first to comment