landbysea

Note:

I have covered Transocean (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

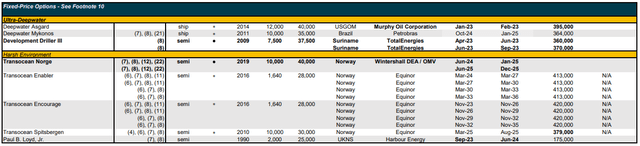

After the close of Thursday’s session, leading offshore driller Transocean released a new fleet status report which contained a number of impressive contract awards:

- Drillship Deepwater Conqueror was awarded a two-year contract by an undisclosed customer in the U.S. Gulf of Mexico at $440,000 per day which is expected to commence in March 2023.

- Drillship Deepwater Asgard secured a one-well contract with Murphy Oil (MUR) in the U.S. Gulf of Mexico at $395,000 per day plus a one-well option followed by a one-year contract with an undisclosed customer at a dayrate of $440,000.

- Drillship Petrobras 10000 was awarded a 5.8-year-contract by Petrobras (PBR) offshore Brazil at $399,000 per day escalating annually to $462,000 per day.

- Semi-submersible rig Development Driller III secured a one-well contract with TotalEnergies (TTE) offshore Suriname at a day rate of $345,000 plus two one-well options.

- Harsh environment semi-submersible rig Transocean Norge was awarded a 17-well contract offshore Norway by Wintershall DEA and OMV at dayrates between $350,000 and $430,000. Please note that the majority of the work remains subject to regulatory approvals.

- Customer Reliance exercised a one-well option for the drillship Dirubhai Deepwater KG1.

- Harbour Energy (OTCPK:HBRIY) exercised two 100-day options in the U.K. part of the North Sea for the 5th generation harsh environment semi-submersible rig Paul B Loyd, Jr. at a dayrate of $175,000.

- Equinor (EQNR) exercised a one-well option offshore Norway for the harsh environment semi-submersible rig Transocean Spitsbergen at $316,000 per day.

In aggregate, these awards added approximately $1.6 billion in gross backlog. After accounting for Transocean’s revenue recognition over the past three months, backlog increased by almost 15% sequentially to $7.1 billion.

That said, the strong fleet status report doesn’t really come as a surprise as all important contract awards had been previously reported by the company.

Investors should also remember the fact that the company only owns 33% of the Transocean Norge which results in substantially reduced margin contribution as Transocean is required to bareboat charter the asset from the rig-owning entity.

Moreover, the harsh environment semi-submersible rig Transocean Equinox has been returned to the company ahead of its scheduled contract end and is now sitting idle but customer Equinor will partially compensate Transocean with a reduced dayrate until contract end.

Remember, the Transocean Equinox is the first of four purpose-built semi-submersible rigs (“CAT-D” rigs) chartered to Equinor with the remaining units scheduled to roll off contract between June 2023 and March 2024.

Originally, Equinor held priced options for all CAT-D rigs but last week’s fleet status report no longer lists options for the Transocean Endurance, which is the next CAT-D rig to roll off contract.

As both units have been working in the Troll field, I already suspected the Transocean Endurance joining the fate of Transocean Equinox next year.

As the CAT-D rigs accounted for 30% of the company’s revenues and an even higher percentage of Adjusted EBITDA last year and the Norwegian market expected to remain weak for another couple of quarters, Equinor’s apparent decision to not extend the Transocean Endurance’s contract is another disappointing setback for Transocean. I would estimate the annualized cash flow hit from an idle CAT-D rig at well above $100 million.

While there might be opportunities for the rigs to secure work in the U.K. part of the North Sea next year, rates are unlikely to be anywhere close to current levels.

Lastly, the harsh environment semi-submersible rig Deepwater Nautilus has recently finished its contract and is now sitting idle, too.

Bottom Line

The recovery in the offshore drilling markets continues to gain traction as evidenced by an impressive 15% sequential backlog increase for Transocean.

Unfortunately, the company’s ongoing struggles to avoid debt covenant violations are likely to remain an overhang on the shares for the time being.

Meanwhile, competitors like Noble Corporation (NE), Valaris (VAL), Seadrill (SDRL) and Diamond Offshore (DO) continue to enjoy the benefits of having emerged from chapter 11 with sufficient liquidity and very low debt levels, while Transocean’s incorporation in Switzerland likely prevented the company from going this avenue.

That said, with the industry recovery unlikely to abate anytime soon, I would expect the rising tide to literally lift all rigs and Transocean to resolve its current issues in due time.

Starting in 2024, I would expect the company to benefit from substantially reduced capex requirements and further increased day rate levels, which should finally result in the company generating substantial amounts of free cash flow.

Analysts have also become more positive on Transocean in recent weeks including a double-upgrade by Barclays earlier this month.

While I prefer to stay with my short-term trading approach for now, speculative investors should consider scaling into the shares on weakness.

Be the first to comment