undefined undefined

Overview

It was only 2 years ago that a large flock of fanciful electric vehicle (“EV”) players flooded capital markets. With dreams of grabbing a piece of that EV pie – so resolutely dominated, perhaps created – by Tesla (TSLA) over the past decade, capital market moons aligned in what appears to have been an all-out investor cash grab.

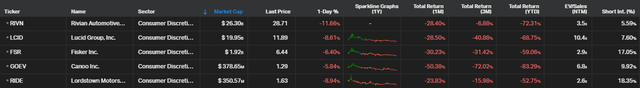

Among them, Lucid Group (LCID), NIO (NIO), Li Auto Inc (LI), Polestar Automotive (PSNY), BYD Company (OTCPK:BYDDF), Rivian Automotive (RIVN), Canoo Inc (GOEV) all unashamedly hoarded into global capital markets raising funds during a period of easy money.

Who could blame them? Everyone wanted to be like Elon, right? SPAC mania facilitated this, along with laissez-faire monetary policy that saw bucket loads of cash flood into financial assets.

So, if the world’s largest EV car maker by volume, BYD Company stands for “Build your dreams,” then the ticker for Lordstown Motors Corp. (NASDAQ:RIDE) may be just as fitting, because it could be argued that is exactly what investors have been taken on.

Lordstown Investor Presentation

The Endurance is presently the only vehicle in Lordstown Motors’ commercial offering.

Making cars is difficult. In fact, the automotive industry is typified as an oligopoly – a few large players with tons of capital to plough into expensive plants, paint shops and assembly lines.

It is a high volume, small-margin, hyper competitive environment where total quality reigns, factory recalls destroy reputations and output dominates. Deep pockets are required, along with sophisticated processes and vendor networks to get the whole thing to work flawlessly.

Now that ultra-loose easy money markets have subsided and weighted costs of capital have skyrocketed, things have gotten much more difficult. For the juniors, such as Lordstown Motors, getting to that critical mass before being upended by excessive cash burn won’t be easy.

Component shortages have resulted in a supply chain squeeze further pressuring volumes as companies try to get that production flywheel raging.

Only a couple of years ago, Lordstown Motors announced 40,000 pre-orders. The company had set itself lofty goals – delivering 100,000 units by 2024. Fast forward to end 2022 and the EV outfit celebrated start of production at its Foxconn EV Ohio Plant. 2 vehicles have been produced and another 500 are expected by the end of the year.

The Ohio EV Junior

Founded in 2019, Lordstown Motors – an Ohio-based firm – started off operations in an old GM legacy plant. The company, which employs ~600 specialists, has since hand-balled off the Lordstown facility in what appears to be a last-ditch attempt to raise cash amid a liquidity crunch exemplified by zero revenues and sizable costs.

The agreement included the sale of the facility for $230 million all-in and a contract manufacturing agreement for the Endurance pick-up truck with Hon Hai Technology Group (Foxconn), the Taiwanese electronics subcontractor.

Lordstown Motors, along with most other EV juniors, have been heaped in red. The Ohio-based firm has also attracted the short-seller crowd, with 18.35% of the stock now out on loan.

This strategic sidestep should raise eyebrows. If the firm no longer owns the capital equipment to produce the units and subcontracts its own production – what is its actual long-term value-add and positioning in this partnership.

The world’s largest automotive manufacturers distinguish themselves by owning the onerous capital equipment to deliver volume. That is what provides the automotive industry with meaningful barriers to entry.

The entire sector has done terribly poorly during 2022. Year-to-date, Lordstown has lost -56.18%

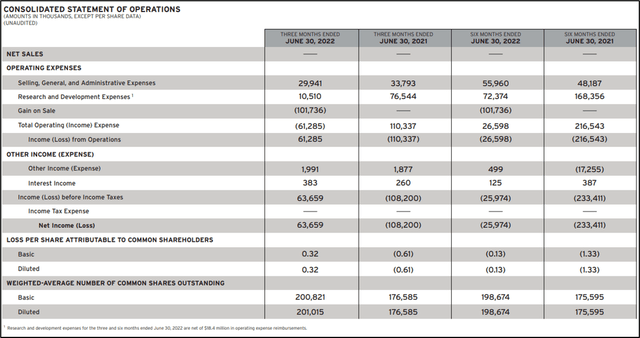

Simplified Income Statement

Lordstown Motors Corporation has not generated any sales since its founding. Standout features in the income statement include a quarter-over-quarter curbing of R&D expenses (from $76.5M in 2Q FY2021 to solely $10.5M in 2Q FY2022). Operating income has been heaped in red, with the firm losing $40.5M in operating income during 2Q FY2022.

Yet the company’s consolidated statement of operations tries to paint possibly a rosier picture by recognizing gain on sale of plant to Foxconn for $101M. This provided for earning before tax numbers of $63.7M.

Had the company not taken a knife to this quarter’s R&D spend, it is likely that net income would have been negative.

Lordstown Motors Investor Presentation

Consolidated Statement of Operations – Lordstown Motors.

Stock based compensation, which is conveniently brushed over in the firm’s generic financial statements, was $19.5M over the last 12 months. That’s possibly a difficult pill to swallow for investors swimming in losses.

Simplified Balance Sheet

The $235M currently carried in current assets provides the company with some form of capital runway to cover costs before unit sales get off the ground.

A large part of this has been raised from SPAC proceeds following its merger with DiamondPeak Holdings along with recourse to share issuances. At the current run rate, that’s possibly enough to cover the firm’s operating expenses for a couple of years without another cash call.

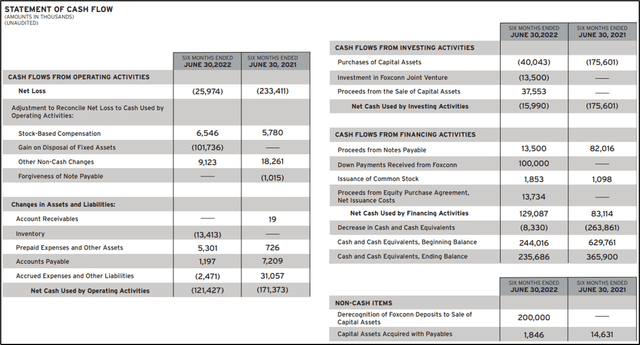

Simplified Cash Flow Statement

The EV junior continues to post negative cash flow from operations, irrespective of cash inflows from its Taiwanese electronics partner. Capital expenditure ($18.1M) was offset to a certain extent by plant, property & equipment sales ($37.6M).

Issuance of common stock figured as a means of capital financing, with the firm generating proceeds of $15.1M. Free cash flow for 2Q FY 2022 was -$70.5M.

Lordstown Investor Presentation

Statement of Cash Flows 6 months ended June 30, 2022 – Lordstown Motors.

The company posts a market cap of $350 million, including $235M in cash and short-term investments. Putting this into perspective, only a couple of years ago, the company was posting an enterprise value of $3.7 billion.

Debt remains very manageable but a pathway to profitability appears some ways away, given current production run rates versus initial plans.

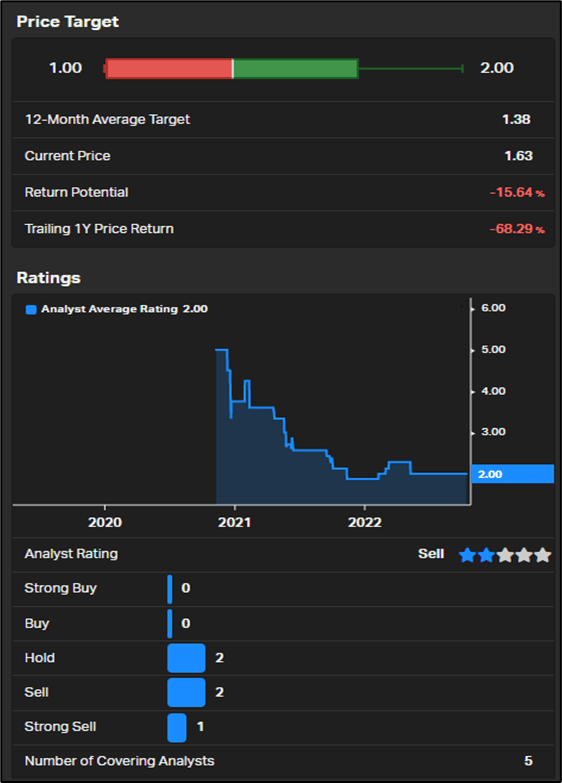

Unfortunately, it also appears the analyst community has lost patience with the Ohio-based EV outfit, with 3 of 5 analysts providing coverage pushing either sell or strong sell ratings.

Mid-range consensus sits at $1.38, which is presently -15.64% lower than spot prices.

Koyfin

Analyst consensus – target price Lordstown Motors.

Key Takeaways

- Lordstown Motors – an Ohio based EV junior that was the product of SPAC mania – a period where blank check companies pitched fanciful sales projections, numbers, and total addressable markets to investors flush with cash.

- Numerous promises have fallen by the wayside, and the company has struggled to find sources of cash for survival, ultimately divesting its prized Lordstown assembly plant to Hong Hai Technology Group ((Foxconn)).

- That divestment includes a subcontract manufacturing agreement which makes the company’s strategic relevance increasingly dubious.

- The rush for EV dominance has created a range of fledgling industries and outliers gearing up to be part of a global oligopoly. Yet, the auto industry is reputed for its big barriers to entry with players requiring deep pockets for survival.

- Accordingly, it is unlikely Lordstown Motors Corp. survives in its current form, particularly during a period of extensive economic decline, recession, and a reversal in the consumer discretionary sector.

Be the first to comment