Spencer Platt

I am neither gloating that I purchased those market hedges nor am I particularly relieved. They are just part of a strategic approach. Here was my logic in not following the masses up or down on Friday:

There is a greater likelihood of more bad news afoot these days than there is likely to be good news. No institutional money manager who wants to keep their job is going to hold all their positions over a full three days when the nuclear facility at Zaporizhzhia could be accidentally screwed up by the Russians (their recent track record at not screwing up is not exceptional). Or China could attack Taiwan (which would be really stupid but then Xi Jinping really, really wants to be re-elected this fall). Or the voices that Fed chair Powell hears might tell him 0.75% is just not enough; let’s make it 1.25%!

We cannot make investing decisions for our future based upon getting excited when the market rises intraday and despondent when it falls. I have done more trading this year than at any time in my entire career, thanks to placing stop orders to protect on the downside. I hate this much trading. And I am pleased to report that, if I am correct about this bear cycle, we are closer to its end than we may suspect.

This kind of volatility is a hallmark of bear cycles that do not want to be finished with us just yet. But if history is any guide, one of two things are most likely to happen. (1) The markets will continue to drip down, toying with investor emotions for an insufferably long time of up, down, up, down. Or (2) it will have a really scary (but likely shorter) stretch that shakes the confidence of even the crypto-owners and the meme stock buyers into selling.

The point is that you must have discipline in times like these. Mine is to try to buy when I see good opportunities within the context of the bear cycle and to place stop orders soon thereafter because I have no idea what “could” happen just around the corner. This requires a huge investment of my time and attention. I would much rather be able to see the beginning of a bull cycle where I can buy good quality companies and funds and then go kayaking, hiking, bicycling or, in another couple months or so, skiing, without having to check the market all the time.

To that end, I can see a few good longer-term signs that may be harbingers of better times.

- US companies are leaner and meaner than they have been in some time. 2nd quarter profits were better than almost all expectations.

- We are adding to the labor force at a steady rate. So far in 2022, companies added jobs at a 3.7% annualized pace. This lowers wage inflation, job-hopping and couch surfing rather than working.

- While consumers “say” they are feeling very afraid (consumer sentiment has dropped to an all-time low this year), consumer spending is rising at an annualized 10.7%.

- Inflation is likely to subside even without the heavy hand of the Fed. Demographically, many retirees or soon-to-be-retirees mean fewer big-ticket purchases for that age cohort. And business productivity is once again rising as new technologies continue to provide cheaper prices on many fronts.

- As a percent of total household debt (mostly for a mortgage), Americans held about 25% of their assets in cash and cash equivalents back in the early 1970s. After that, this cushion declined all the way down to about 3% at the beginning of the Great Recession. It has been steadily climbing back since then and is today right back around 25%. That translates into a lot of dough-re-mi on the sidelines, ready to invest when the current foreboding and malaise begin to lift.

- Most of us of a certain age look at today’s P/E ratios and presume stocks are still too expensive. We are looking at a long period of time, like 40 years or so until about 1990, when trailing P/Es hovered around 14 on average. Now we are seeing that number up around 20 and it looks scary as heck! But wait a minute. The 1990s were the first full flowering of technology that has affected every facet of our economy. If we are willing to pay a higher P/E for a clearer path to future growth, whether tech firms or simply all those benefiting from tech, who is to say that 20x earnings is not now a more rational view? Maybe there is simply more growth in the average company than there was in previous times.

All this and a $4 still won’t buy you a gallon of gas or its human corollary, a cup of decent coffee at Starbucks. But doing the research and analysis required to determine the most favorable sectors at any given time and then selecting the best instruments (stocks, bonds, preferreds, funds, ETFs, etc.) to own within those sectors still makes sense. It beats rushing into a FOMO buying frenzy whenever the market is moving up and slip-sliding into defeatist frustration when it declines.

The Numbers For The Just-Past Week Ending on September 2, 2022

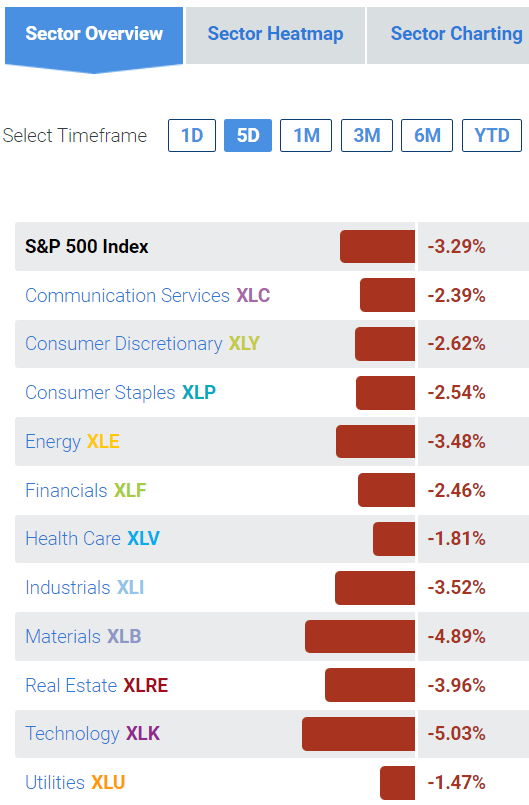

Sector Tracker

The only sectors deviating much from the mean on the downside were the 5.03% decline in Energy and the 4.89% decline in Materials. The not-great-but-down-least sectors were two of the usual suspects during bear cycles. Utilities were down “just” 1.47% and Health Care was down “just” 1.81%.

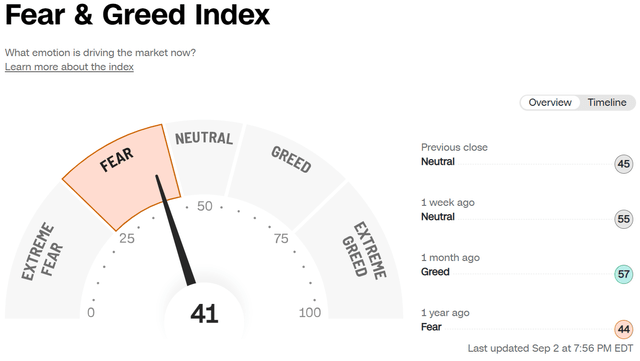

Fear and Greed Index – Investor Sentiment | CNN

The CNN Fear & Greed Index slipped quite a bit from 1 month ago, when greed ruled the day and fear was pushed into the background. If you are a devotee of this index, you became somewhat wary when it shot all the way to Greed back then. If it declines into Extreme Fear, you may well find another upswell to buy into. (Just be willing to use those stop orders!)

Buys and Sells

Nothing new to see here. I am happy to stay, for now, with my 40% cash position in the Investors Edge Growth & Value Portfolio. Adding the 2 market hedges I just purchased last week takes that, effectively, even higher.

The Energy sector remains my largest sector allocation, comprised of both company shares and ETFs, at 11%. My best call there was to buy Equinor (EQNR) a little over two years ago. It is now up 202%. My worst is the just purchased last month First Trust Natural Gas ETF (FCG), down 2.2%.

My smallest sector choice is Communication Services, where I hold a grand total of 0%.

My largest single holding, as befits my current cautious approach, is the Fidelity MSCI Utilities Index ETF (FUTY) in the Utilities sector. FUTY is now 5.1% of the total portfolio.

Have a safe remainder of this 3-day weekend!

Be the first to comment