alexsl/iStock Unreleased via Getty Images

It’s no secret that shares of Meta Platforms, Inc. (NASDAQ:META) and Snap, Inc. (NYSE:SNAP) have plummeted in recent months, mirroring a broader pullback in tech. Unfortunately, the headwinds that these particular companies face goes deeper than the greater macroeconomic trends plaguing the market right now. Meta’s slowing user growth and Snap’s lack of profitability are certainly contributing factors to each company’s recent outsized loss in market value. However, the common threat that both companies face is Apple’s (AAPL) updated privacy settings for iPhone, which significantly limits the effectiveness of ad targeting. Seeing as advertising revenue is the main component of each company’s income, the market reaction is understandable. And while they have shared a similar selloff, I believe the future looks very different for these two companies, and opportunity is ripe to profit on the spread. I will illustrate below why Meta Platforms is on to greener pastures, and why Snap is heading in the wrong direction.

META vs. SNAP Price Return (Seeking Alpha)

Meta Valuation

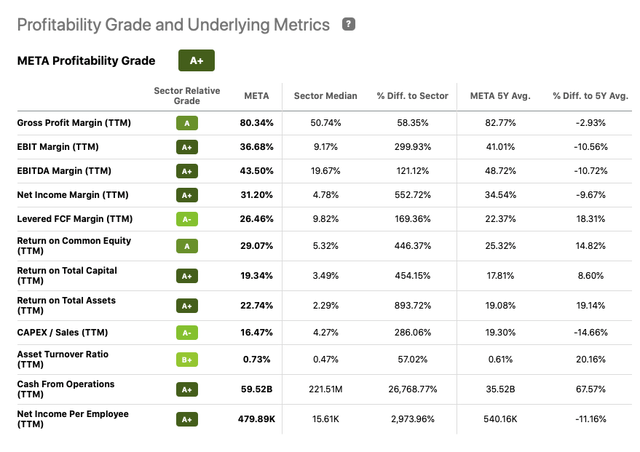

Even before share prices started falling tremendously towards the end of 2021, Meta was trading at very attractive P/E ratios compared to other big tech companies. They have only gotten cheaper to own since. Despite their impressive profitability margins (80% TTM Gross Profit Margin, and 44% TTM EBITDA Margin), Meta trades for a modest 12.1x TTM earnings in a sector where they outpace competitors in both metrics. Put differently, Meta rakes in 58% more Gross Profit and 121% more EBITDA than their competitors, yet trades 27% cheaper than them on a TTM P/E basis. Operational efficiency becomes exponentially more important as we enter into a recessionary environment, and Meta is poised to weather the storm.

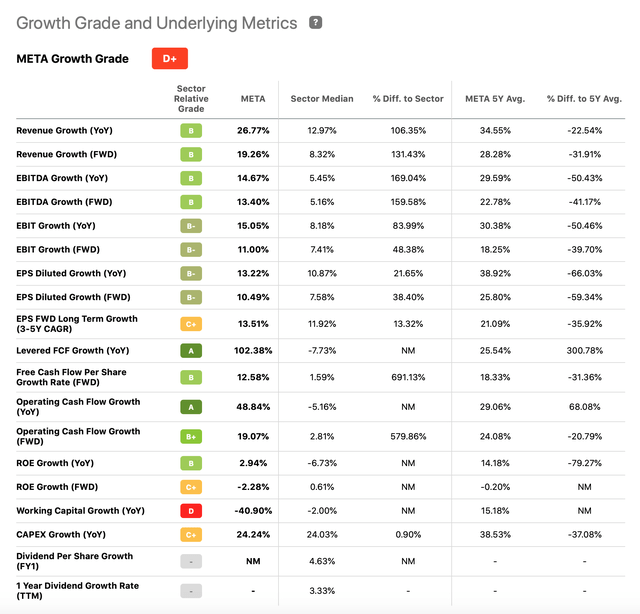

It is clear how undervalued they are from a profitability standpoint, but what about from a growth perspective? Even with stagnation concerns surrounding Meta, Forward EBITDA growth comes in at 13.4% compared to the sectors 5.5% average. Likewise, Seeking Alpha lists their Long Term EPS Growth to be 13.3% higher than the sector average. Take a look at the grades below.

Seeking Alpha Profitability Grade (Seeking Alpha) Seeking Alpha Growth Grade (Seeking Alpha)

Seeking Alpha gives Meta a “D+” grade for growth, even though they are near or above the sector median in every category except Working Capital. After taking a closer look, it is clear why this metric is so far off from the rest. Over the past twelve months, Meta has repurchased $55.5B in common stock, which is likely a move to combat its falling share price. However, shares continue to slip. And because of this, their current assets have fallen 26.6% in the trailing twelve months since 1Q 2022. Meanwhile, Current Liabilities have increased by 41.8% over the same period, due largely to legal accruals from dragged-out anti-trust lawsuits. This taxing combination has led to compressed working capital over the past year. However, Meta has not let this steer them off course from financing capital expenditures and investing in growth. They are currently trading at a 58% discount to their 52-week high, a bargain by any means.

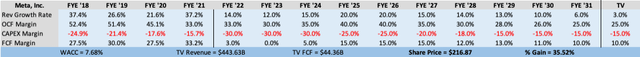

Looking at Meta through the lens of a DCF model solidifies my beliefs. I projected their Revenue, Operating Cash Flows, and Capital Expenditures ten year into the future and into perpetuity to arrive at a conservative valuation. Whereas Revenue growth has averaged 46% across the past ten years, I set the next ten to average only 14%. Likewise, Free Cash Flow Margin (which is OCF Margin minus Capex Margin) has averaged 32% over the last ten years, and I reduced the next ten to 7%.

Meta DCF (Data from Seeking Alpha)

In my model, advertising hurdles and slowing user growth cause Meta’s sales to stagnate over the next couple of years, before ancillary revenue lines like Quest VR and native commerce products begin to gain traction toward the middle of the decade, ultimately growing at 2% into perpetuity. Even with these conservative estimates, Meta’s fair value share price is $216.87, a 35.52% premium to July 1st closing.

Snap Valuation

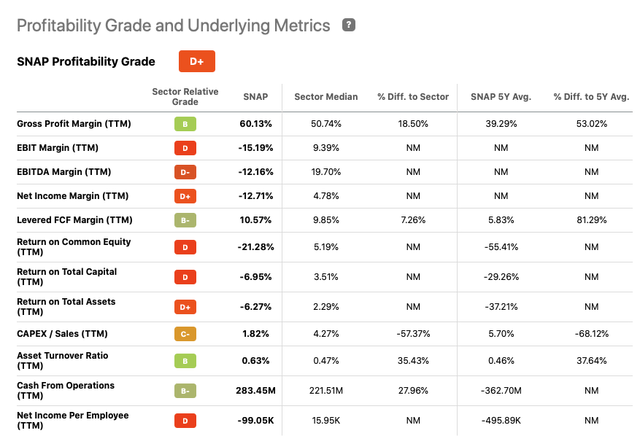

Snap, on the other hand, has their own host of concerns. Many investors view them in a similarly undervalued light to Meta, however the problems go much deeper. Admittedly, Snap does beat the sector average Gross Profit Margin by about 18%, however they have yet to record positive EBITDA, reporting a -12% TTM EBITDA Margin. Forward P/E does not look good either, where they trade at 58.2x projected 2022 earnings. Compare this with the sector median 17.0x, and they look very expensive. For such an unprofitable company facing significant headwinds, it is no wonder why Seeking Alpha gives Snap an “F” Valuation Grade.

Revenue growth is the one thing Snap has going for it, with 56% YoY growth compared to the sector median 13%. However, this is expected to fall to 39% in 2022 and even more significantly in the coming years, as data privacy constraints and macroeconomic headwinds stifle their sole source of revenue. Take a look at the grades below.

Snap Profitability Grade (Seeking Alpha)

It is also important to note FYE 2021 saw their first year of positive Free Cash Flow, however, red flags are raised when you dissect this. Over $1.09B of stock based compensation was issued in 2021, continuing the trend of a 21% per year average increase over the past three years. This huge amount gets added back to Free Cash Flow, as it is a non-cash item. However, when it is revealed that over 12.8M shares were sold by insiders over the past twelve months, compared to roughly 1.4M bought, it is clear what is happening. Snap leadership is paying themselves by issuing new shares, then turning around and dumping them onto the open market. Ultimately, the method by which Snap is reporting excess cash flow comes at the expense of diluting shareholders and increasing sell pressure to their own stock.

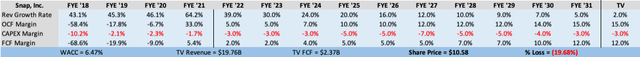

After building out a DCF model for Snap, the issues and concerns became more visible. Just like for Meta, I projected Snap’s Revenue, Operating Cash Flows, and Capital Expenditures ten years into the future and into perpetuity to arrive at a valuation. Whereas Revenue growth has averaged 60% since IPO, I set the next ten years to average 17.%. Likewise, Free Cash Flow Margin has averaged -38% since IPO, but I continued their 2021 positive trend across the next ten years to average 6%.

Snap DCF (Data from Seeking Alpha)

In my model, Snap’s sales growth trickles over the next decade, as their sole source of revenue becomes less effective. The lack of user data analytics will cause their product to be less engaging and therefore lose users. They will grow revenue at a modest 2% into perpetuity, and become more operationally efficient behind other lines of business like Augmented Reality. It is important to note that my model also captures the vital common share dilution that will continue to occur as Snap issues more stock based compensation each year. Whereas common shares have been diluted at an average 7.3% per year over the last four years, my model projects a 5.7% average across the next ten, tapering off in the later years. Something my model does not project is the effect of the combined sell pressure that accompanies this increasing stock based compensation, which can only be negative, and also highlights leaderships lack of confidence in the company. All things considered, Snap’s fair value share price is $10.58, a 19.68% discount to July 1st closing.

Risks

There are notable risks associated with both Meta and Snap. Below, I will speak on each and illustrate why Meta’s are far less worrisome, and why Snap’s might be worse than we think.

Meta

Apple’s updated privacy settings: This was last year’s big news, which sparked the massive decline in share value. Investors were rightfully worried when Founder and CEO Mark Zuckerberg said it will likely cut $10B out of Meta’s 2022 earnings. But in the same breath, Zuckerberg ensured the company will be able to weather the storm. He went on to explain how this problem might be a blessing in disguise if more businesses, who rely on Meta for ads, decide to sell products directly through the company’s native commerce applications – Facebook Shops and Instagram Shops. Native commerce makes shopping easier for the consumer and improves the user experience. On the same hand, it allows merchants to ditch the middle-man and sell directly to Meta’s massive user base. This mutually beneficial ecosystem not only proliferates advertising, but also yields Meta up to 5% per transaction, a healthy margin for a flourishing business segment. Meta’s nascent commerce platforms already saw 250M active users last year, and the number is only growing.

Revenue Growth is slowing: Panic struck the market when Meta’s 1Q2022 earnings call revealed the company missed street revenue estimates by $319.4M. This shock qualified the Apple privacy concerns, and disrupted income predictions. It is the characterization of an obstacle that Meta’s seasoned leadership has proven they are ready to take on, as they have done so many times before. As Zuckerberg said, the company is taking on the challenge by shifting focus toward growing other existing revenue lines like native commerce and VR.

Anti-trust lawsuits: The controversy which caused Meta, and many of their peers, so much time and expense over the past few years might have just been solved by Apple. The issue of continuing legal battles is now largely mitigated by the iPhone maker’s recent privacy settings, which stops non-consensual user data collection by third party applications. The result hurts small businesses who rely on advertising to sell products and keep apps free, while Apple charges 30% on anything sold via the App Store, but that’s a separate argument.

VR does not work out: Meta has funneled the majority of a steadily increasing Capex figure on the Virtual Reality segment of their business. The Quest 2 continues to increase sales in 2022, despite United States discretionary spending beginning to slow. The good thing is, the potential of the Metaverse does not seem to be priced into the company’s value. Therefore, the investor is getting free optionality here.

Snap

Risk of losing market share: The broader social media market is already dominated by Meta. Snap’s application is a one-trick pony that has less functionality than their competitors large host of product offerings. Snap also has far fewer daily active users than Meta (322M vs. 2.87B). Because of these facts, they are always playing catch-up. Additionally, the new app Tik-Tok has exploded onto the scene within the past year and recently overtook Snapchat as the top social media platform used by teens, the age group Snap once had an unrelenting hold on. Qualitatively, this might foreshadow a large contradiction with their optimistic growth projections.

Apple’s Updated Privacy Settings: As is with Meta and every other social media platform, Apple’s updated privacy settings have caused large amounts of vital user data to be cut off at the source, making digital advertising far less effective. Although this is a problem effecting both Meta and Snap, Snap is far less equipped to pivot to native commerce applications like Meta is doing, which might be the only way over the hurdle.

Snap’s nonvoting shares: When Snap issued their IPO in 2017, the shares they sold held no voting rights. This was the first time no-vote shares had been issued at IPO since 1940. It is a move to ensure founders Evan Spiegel and Bobby Murphy retain 88.5% voting power. Ultimately, the entire fate of the company lies in two individuals hands, which is a massive risk in itself.

Oncoming Debt Burdens: After taking a look at Snap’s most recent 10-Q, investors can see a breakout of the company’s convertible notes. Debt for 2023 and 2024 is not listed, but it appears the net carrying amount for 2025 Debt is $282.1M. However, 2026 Debt ramps up to $832.8M, then $1.14B in 2027. Debt in 2028, the farthest note maturities out, top off at $1.48B. These increasingly hefty debt burdens will surely take their toll over the next few years, and will require servicing at the expense of company cash flows.

Long/Short Pair Trade

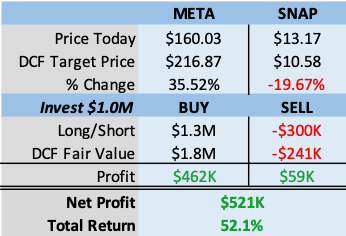

Given each company’s trading multiples and the DCF values I arrived at in my models, a perfect Long/Short Pair Trade opportunity has been presented. Meta’s DCF valuation yields a 35.52% increase from current market value, which would price them at 16.4x TTM earnings, still under the sector average of 17.1x. Snap’s DCF yields a 19.68% decline from current market value, which would price them 12.2x closer to Forward Earnings, where they already trade exceptionally high. Seeing as Meta’s gains will be larger than Snap’s losses, I recommend employing a conservative 130/30 Long/Short strategy (where long exposure is 130% of AUM and short exposure is 30%). This will yield 52.1% overall, given the DCF values. One of the only risks with taking on additional Snap short exposure is the fact that they currently trade at a mere 16% of their 52-week high. Because of this, it would not be unlikely for them to experience a short term rebound. However, I do not believe Snap can outrun their problems in the long term, and share price will surely reflect that. Take a look below at the details of the trade, assuming a $1.0M investment.

Long/Short: 130/30 (Data from Seeking Alpha & DCF)

The Case Is Clear

The case is clear for why Meta Platforms is undervalued in today’s market, and why investors should reconsider holding onto Snap. Meta has a stellar track-record of profitability and operational efficiency, which are qualities investors can rely upon, especially as the market prepares for a recession. They also continue to effectively support ancillary business lines, which will pick up the slack created by Apple. Despite headwinds, the path has been laid out for Meta to emerge from this slump, as they have done many times throughout their iconic history. If only the same could be said for Snap, who continue to be plagued with challenging problems. The company’s lack of consistent earnings will likely become exponentially exposed in the months/years ahead. And despite growth optimism, many indicators point to an overdue plateau in terms of both users and sales. The valuations of both companies have shared a similar fall over the past year, but for all the reasons listed above, only one will revert course and regain shareholder value.

Be the first to comment