Nilanka Sampath/iStock via Getty Images

Thesis

After an impressive bull market following the Covid-19 pandemic crash, in late 2021 markets entered a new phase of uncertainty and turmoil. The technology sector has experienced a correction with many, previously high-flying, aggressively valued stocks mounting sizable losses. As the market rotates toward value stocks, there is one area of the Technology sector that can offer opportunities in the value direction. Hardware manufacturers like Logitech (NASDAQ:LOGI), which is the subject of this analysis trade at cheap valuations and offer decent growth potential and profitability.

Logitech has seen its stock price decrease by 33% over the last year despite posting tremendous results for the 2021 fiscal year. While growth prospects are not going to create the hype many investors previously looked for, LOGI might still present an interesting investing opportunity and is as such examined in this analysis.

The Industry

The Technology Hardware, Storage & Peripherals Industry falls into the Information Technology Sector and includes manufacturers of phones, computers, servers, computer parts, and peripherals. According to a recently published market research report by thebusinessresearchcompany.com, the worldwide computer hardware market is expected to grow from $1,13T in 2021 to $1,22T in 2022 at a 7.6% YoY rate. As a primary growth driver, the report lists resurging sales, affected by the global Covid-19 pandemic and the supply chain disruptions that still obstruct business operations across a wide range of companies. By 2026 the industry is expected to grow at a 6.6% CAGR, reaching $1.58T.

Financial Snapshot

In 2021 Logitech recorded the 8th consecutive fiscal year of revenue growth, with sales increasing at an impressive 74% YoY rate, to reach $5.25B. Cash from operations reached an all-time high level of $1.46B, while the 2022 outlook was also raised. Strong demand for remote work-related equipment was the prime growth driver paired with growth in the gaming and content creation industries.

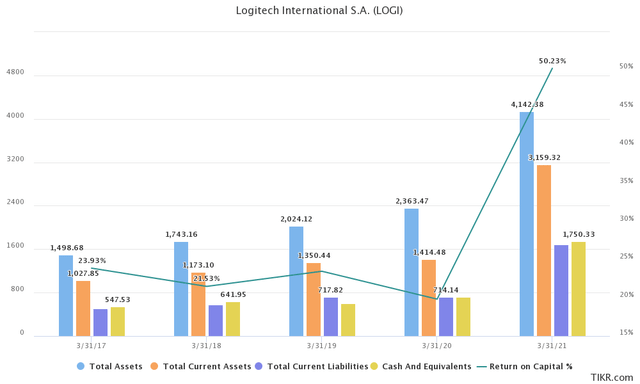

Logitech’s balance sheet points to a financially healthy company. Total assets are consistently growing, while the company’s cash balance, also increasing, is now amounting to $1.7B or 14% of Logitech’s market cap. The company maintains no long-term debt balance, significantly enhancing its overall viability, while liquidity is also strong, with a current ratio of 2.05x and a quick ratio of 1.46x. Returns on capital have been consistently impressive, over 20%, with 2021 marking a significant increase.

Logitech pays a 1.32% dividend yield almost identical to the S&P 500’s yield. Income distributions have grown at a 5-year 10.5% CAGR, while a 17% payout ratio indicates adequate safety. The company’s share count has remained static over the last decade.

Relative Valuation

The hardware and peripherals industry is often viewed as one of the few more conservative, value segments of the Technology sector. Companies generally carry lower valuation multiples, while growth prospects are not nearly as high as those in the rest of the sector. Hardware companies also display lower profit margins, compared to their software counterparts, while offering, however, much more attractive dividend yields.

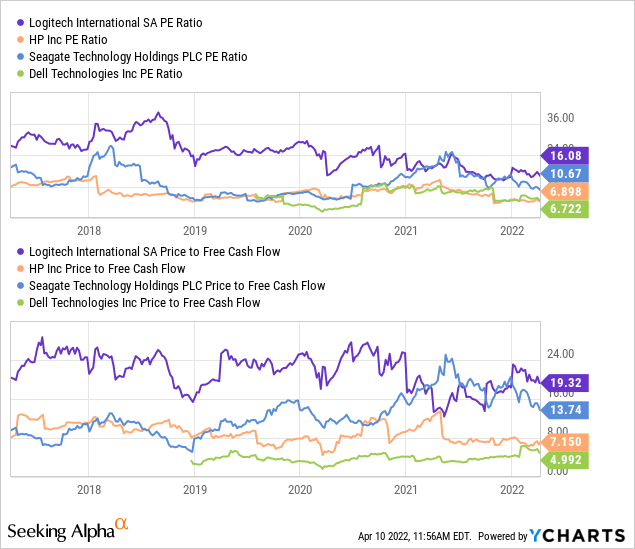

In order to take a closer look at Logitech’s valuation, P/E and P/FCF multiples are examined across a group of mature, established companies that operate in the Technology Hardware industry. While the group selected for this first comparison is not exhaustive, it lists some of the largest and most widely-respected firms in the industry. HP (HPQ), Dell Technologies (DELL), and Seagate (STX) were selected. Just by looking at the multiples mentioned before, it becomes apparent that Logitech is more expensive by comparison, carrying a 16x P/E and a 19x P/FCF ratio.

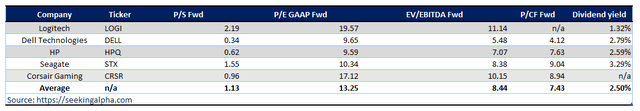

To put things in a clearer perspective, a more detailed presentation of valuation metrics across a wider group of companies in the technology hardware industry is summarized below. Logitech is the most expensive stock of the group across all different valuation multiples. It also offers the lowest dividend yield, at 1.32%, excluding Corsair Gaming (CRSR) which offers no dividend. With an average P/E of 13.25x and EV/EBITDA of 8.44x across all 5 companies, Logitech’s respective multiples of 19.57x and 11.14x definitely put the company in the overvalued category.

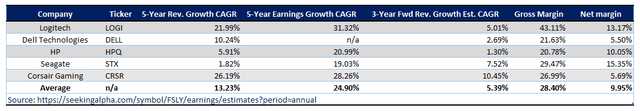

Continuing on the analysis, it is important to look into growth performance, both past and expected, to determine whether the valuation premium Logitech carries, compared to its peers can be justified. LOGI has recorded the second-highest 5-year revenue growth (21.99% CAGR) and the highest 5-year earnings growth record (31.32% CAGR). While past performance has been rather impressive, for the next few years analysts forecast a slowdown in growth, placing the Logitech in the middle of the pack in terms of growth prospects. Expected to grow at a CAGR of 5.01% revenue is expected to reach $6.10B for the fiscal year ending in March 2024.

One area of relative strength for Logitech is clearly its profitability capacity. Consistently reporting gross profit margins above 35% over the last few years, the company has stayed ahead of the competition, hinting at strong product demand, business and operating model efficiency as well as good cost management. Net margins for Logitech also lead the pack at around 13.17%, when the entire group averages just below 10%.

Final Thoughts

After all things are considered, Logitech’s healthy financial outlook, profitability, and financial performance render the company attractive to more value-oriented investors, still looking for opportunities within the technology sector. One thing that should be said, however, is that the company is somewhat more expensively valued than its peers, a concern that could be overlooked, however, when someone considers its superior profitability, low leverage, and moderately attractive growth prospects.

Be the first to comment