Michael Fitzsimmons

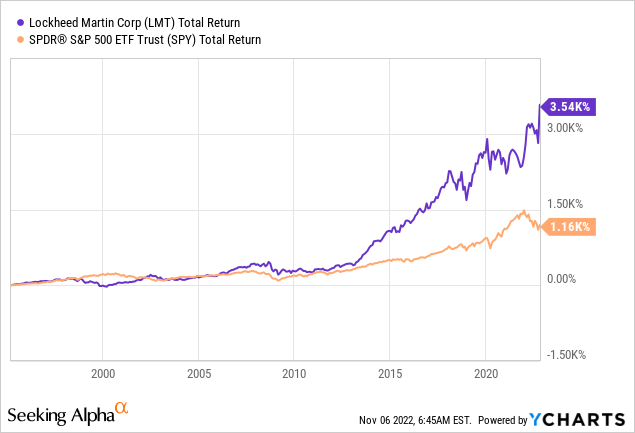

Lockheed Martin (NYSE:LMT) is an American defense and aerospace company that has had an outstanding trajectory of value creation ever since its foundation. The company has beaten all major American indices due to the quality of its business and the systematic creation of value thanks to generating a consistent return on capital over its cost of capital. Factors such as the company’s solid balance sheet, strong cash flow generation and the active policy of shareholder remuneration have helped the company increase its value much more than the average market’s growth.

An a priori discussion can help us understand the attractive business economics of this niche market.

- High entry barriers (in terms of costs): The military sector has high entry barriers due to existing regulations and the high investment required to compete with the main players in the market. This prevents disruption and allows a small number of companies to thrive in a lucrative market.

- Military spending is not going to go down: military spending tends to grow in all countries, although in the recent past a pacifist rhetoric has prevailed. Due to the Russian invasion of Ukraine, many countries have understood that the best way to keep the peace is to prepare for war. As the Romans used to say: si vis pacem para bellum. The US (the main client of military contractors) will continue to demand their services in the fight for technological superiority against China and other old rivals such as Russia.

- Manufacturer of unique assets: Lockheed products are difficult to replace, since there is no other manufacturer so specialized in the niche markets of aeronautics and missile systems. Lockheed then enjoys a lasting competitive advantage that significantly reduces the terminal value risk of future cash flows.

Business segments and business culture

Within Lockheed Martin we can find different business units that operate in one specific niche: aerospace industry. The four different segments that comprise Lockheed’s business are:

- Aeronautics: Historically, the aeronautics segment has been focused on providing all kind of devices for the United States Air Force. Currently, the main program within this category is the F-35, which generates 27% of the company’s total sales. The company is focused on accelerating the pace of deliveries this year (once problems in avionics supply chains have been definitely solved) and earning recurring maintenance revenue over the whole lifetime of the aircrafts. There are other devices that also contribute to the generation of income in this segment, such as the F-16 and F-22 programs, as well as the C-130 Hercules transport aircraft.

- Missiles and Fire Control: This business segment is responsible for the development of the famous Patriot anti-missile system, as well as other lesser-known programs, among which are the Apache or hypersonic missile programs. Currently this part of the company corresponds to 17% of Lockheed’s consolidated sales.

- Rotary and Mission Systems: Although it is not included in the aeronautics segment, Lockheed is also engaged in the manufacturing of helicopters for the US Army. The main program focuses on Sikorsky devices (the Marine One has been manufactured by Lockheed), as well as other types of detection systems and sensors. This segment generates 25% of Lockheed’s revenue.

- Space: Within Lockheed’s space program, we can find satellite production, transportation system development, and space defense systems. An important part of the program consists of classified files, which limits our knowledge of this part of the company. It represents 18% of the company’s total sales.

Regarding the company’s strategy, it is important to note that Lockheed does not intend to radically change its business, but instead has the will to continue operating in the niches that make up the bulk of its operations. One should not change what already works.

As well as focusing on developing leading products in its niche, Lockheed combines this with an active shareholder remuneration policy. In the words of CEO James Taiclet:

I’d like to conclude today by, again, reinforcing what Jay just talked about: our commitment to delivering long-term, attractive and reliable total returns to shareholders, underpinned by our strong cash generation and our robust balance sheet as well as delivering on these 21st century solutions to meet the challenges that our customers are facing in global security right now.

This proposal is realistic, since the solid cash flow generated by the company more than covers the necessary capital expenditures to maintain operations (and even expand them), as well as to remunerate shareholders via dividends and share buybacks.

In addition, there is a business culture that encourages managers to create an efficient cost structure since part of their salary is linked to cash flow generation objectives and the maintenance of high rates of return on invested capital.

Future Outlook

I believe it is important to assess whether Lockheed Martin will be able to maintain its competitive advantages and therefore will continue to produce cash flows in the years to come. The company, along with the entire defense sector, has strong tailwinds from the growing trend of increased military spending in most countries of the world.

Over the last few years, investment in defense systems has increased at rates of 5%, and there is nothing that currently indicates that this trend will reverse in the long term. Countries will need deterrent capabilities, and the United States (along with its allies) will increase its military budgets to combat major threats to the Western world.

Another point that especially favors Lockheed Martin is that the increase in spending is not focused on troops, but on technological capacity, which today gives superiority on the battlefield. That is why Lockheed, whose products are of high quality and difficult to replicate, will achieve more recurring income in the coming years.

Financials and valuation

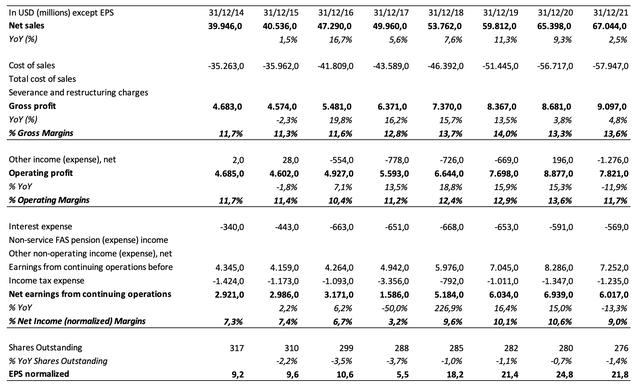

Taking a look at the evolution of Lockheed’s financial statements over the last seven years, we see a company that has been able to increase sales over time while maintaining the level of operating margins in values within the 11%-12% range. It is remarkable – unlike what we see today in some technological companies – the commitment that the company has with having a disciplined cost structure that does not grow as fast as the rate of increase in revenue.

Although the company’s total profits have grown at not particularly high rates, it is noteworthy that the EPS has grown due to the positive effect of the share repurchases, which are systematically executed by the company.

LMT Income Statement (Own Models)

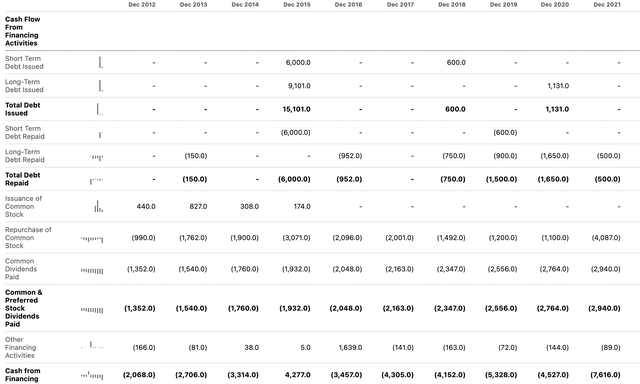

Taking a closer look at the statement of cash flows makes us realize that, despite operating in the industrial sector (which may seem capital-intensive at first glance), has few capital expenditures. This fact, combined with the stability of operating cash flows, means that the company can constantly remunerate shareholders. This is done thanks to the combination of a growing dividend and a buyback program both sustained, and sustainable, over time. For the past several years, the share count has been reducing at a rate of 2% per annum. In addition to this commitment to generating value for shareholders, they tend to be quite good with the timing of repurchases, which certifies their quality as capital allocators.

LMT Cash Flow Statements (Seeking Alpha)

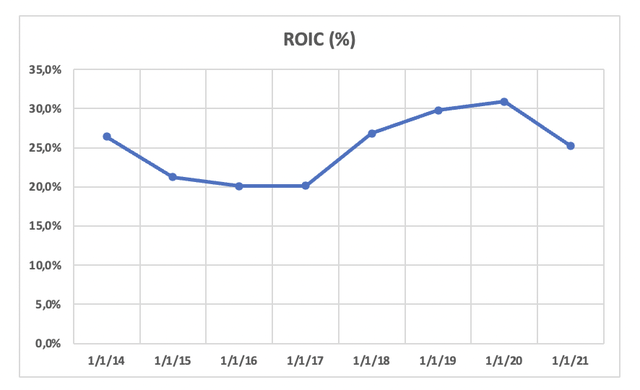

It is also worth mentioning that the return on invested capital has remained above 20% over the last 7 years. Bearing in mind that Lockheed compounds value at rates of 20-25% and is financed at rates of 3-4% (and the cost of equity is around 5%), we see that the creation of net value can fluctuate at rates of 10-15%, which has been the historical value generation rate achieved by the company in the long run.

The company’s leverage is also low. Currently the interest on the debt paid by the company is 15 times lower than the cash flow it generates, so Lockheed’s financial viability is not compromised in the short term thanks to the high cash flow generated.

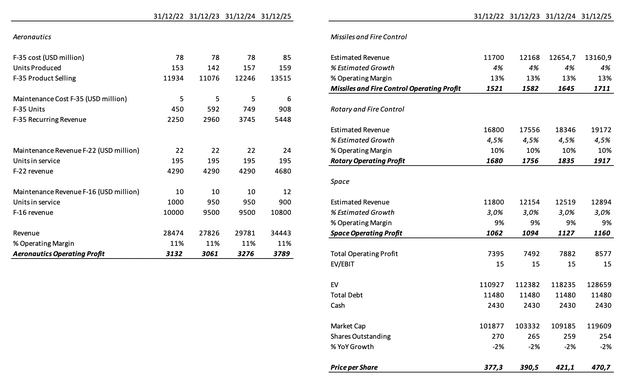

To assess the valuation correctly, we will use some KPIs of the business to estimate how will the future cash flows of the company look like.

Using KPIs in a company with classified information is somewhat complex, although it is possible to make certain sales estimates for some segments in which information is publicly available.

We will use KPIs to model revenues in the Aeronautics segment and for the remaining segments we will estimate growths of between 3 and 5% with the historical operating margins. If we also assume that the company will repurchase shares at a rate of 2% per year, the following scenario for the coming 3-4 years arises.

LMT Valuation using KPIs (Own Models)

The recent increases of Lockheed Martin’s stock price have put in price that the delivery program of the F-35 will be accelerated (to replace other ships somewhat more in disuse) and that the company will be able to increase the pace of profit generation from 2024 onwards. All of this, combined with Lockheed’s buyback program, indicates that the company’s approximate value is at $470 per share, close to the current trading price.

It is true that although a three-year valuation does not invite one to be particularly optimistic about the expected return, Lockheed is a company that may be able to generate value in the long term because its return on capital is systematically higher than its cost over time.

On top of all this, I don’t think Lockheed is in the maturity phase (it would be a risk to terminal value), due to the favorable tailwinds that exist in the defense sector in the long term. That is why Lockheed can be an interesting option for a long-term investor who expects returns of 10% per year with a low level of volatility.

Risks and conclusions

Lockheed Martin is an extraordinary company in the aeronautical sector, although it comes with a series of risks that need to be discussed.

- First of all, Lockheed Martin is a company that operates in a highly regulated sector, which always adds an extra point of complication to any investment thesis. However, this can have a double reading: although it depends on a single client for its survival, it is also guaranteed that there will be no new competitors that can steal market share.

- Second, the company’s sales mix is not overly diversified, which always adds some risk to Lockheed’s terminal value. Reliance on a particular type of product can mean that cash flows are compromised if Lockheed services are terminated.

- And finally, the current valuation could be a risk in the medium term, since the market is discounting the improvement in the company’s efficiency and the high capital return programs for shareholders. However, in the long term, the positive spread between the returns on capital and the cost of capital should make the company progressively increase in value.

Lockheed Martin is a business with unit economics that protect it from competition and that reduce the risk of terminal value going to zero. In addition, the company has a strong balance sheet and a sustainable pace of cash flow generation that will be backed by the increasing amount of money that will be dedicated to investing in defense policies in the years to come.

Be the first to comment