arild lilleboe

Offshore Market Looks Promising

Oceaneering International’s (NYSE:OII) thrust on offshore energy will benefit immensely in the current environment because offshore energy is considered a cleaner and more reliable source. I already discussed this before in my previous article. With the legacy subsea robotics business, demand is springing in niche areas like remote supervisory control. Also, a higher requirement for national security-related services from government-focused businesses will likely increase under the volatile geopolitical setup.

The Offshore Projects Group’s performance can come under pressure in Q4. Despite losing cash in the year’s first nine months, the company plans to generate positive FCF in FY2022. However, in the near term, lower ROV days on hire and a seasonal decline in vessel-based days can affect the Subsea Robotics business. The stock is reasonably valued compared to its peers. Given the medium-term trend, I would suggest investors “hold” the stock.

The Outlook And Forecast

Oceaneering International’s Filings

OII’s management, in the Q3 earnings call, expressed optimism for a continued recovery in 2023 after a solid performance in Q3 2022. The expectations are pinned primarily on offshore energy and the offshore renewable market growth because offshore energy is considered a cleaner and more reliable source. The mobile robotics business, too, is potentially a strong growth candidate. The management also sees mild growth opportunities in the aerospace and defense segment. Its subsea robotics business can demand rising in niche operations like remote supervisory control.

Demand for national security-related services from government-focused businesses in the offshore renewables market can lead to improved operating performance. In FY2023, the company expects to generate $260 million to $310 million of EBITDA, which would be 25% higher than the revised guidance for FY2022. Over the medium-to-long term, on top of the core areas of Subsea Robotics and Offshore Projects Group, the management believes it can leverage its core robotics expertise into the new energy and mobile robotics market to sustain growth.

Subsea Robotics Segment Outlook

Oceaneering International’s Filings

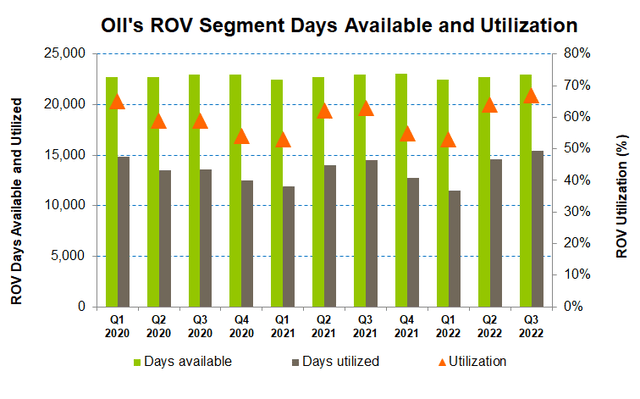

In Q4 2022, lower ROV days on hire and a seasonal decline in vessel-based days can reduce the segment operating results. So, revenue and operating profitability can decline marginally in Q4 compared to Q3. ROV utilization can stick at the mid-70% range. So, the EBITDA margin can also remain unchanged at the 30% range in Q4. However, survey activity suggests a revival in the near-to-medium term.

During Q3, revenues in this segment increased by 8% quarter-over-quarter. With higher activity levels for ROV, new contract pricing and utilization efficiencies led to a revenue rise in Q3. The segment received a robust order intake of $300 million in Q3. These contracts were primarily for remotely operated vehicle services for subsea equipment support, intervention and construction, and autonomous underwater vehicle services.

Manufactured Products Segment: Performance And Outlook

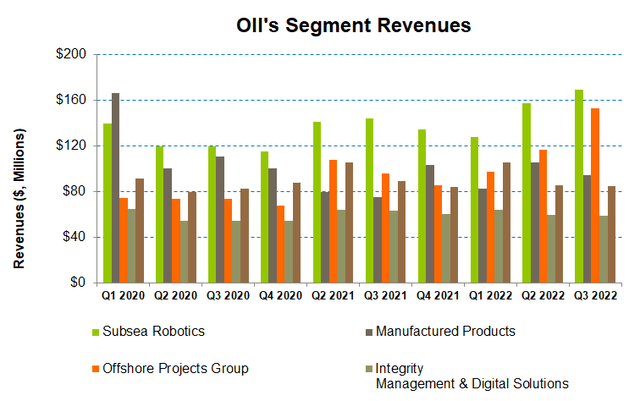

In contrast to the SSR segment, the Manufactured segment’s revenues declined by 11% in Q3 2022 compared to Q2. However, the backlog on September 30 increased, while its book-to-bill ratio advanced past 1.1x. The segment operating margin turned from a loss to a profit (expanded by 600 basis points) in Q3.

The management is excited about the mobility solutions businesses to push the top line in the near-to-medium term. In Q4, the management expects the operating margin to remain unchanged in the “mid-single-digit” range. Revenue may increase, expects the company, due primarily to the product sale in the entertainment business.

Non-Energy Business: Performance And Outlook

OII’s Offshore Projects Group segment saw the steepest revenue rise (31% up). Increased intervention and installation work in the Gulf of Mexico drove sales in Q3. The adjusted operating margin, however, contracted by 200 basis points following an adverse service mix. In Q4, the top line and operating margin can decline marginally compared to Q3.

The company’s Integrity Management and Digital Solutions segments are unlikely to see any significant change in the operating performance trend. The absence of pre-contract cost recovery can affect the segment profit adversely in Q4.

Debt And Cash Flows

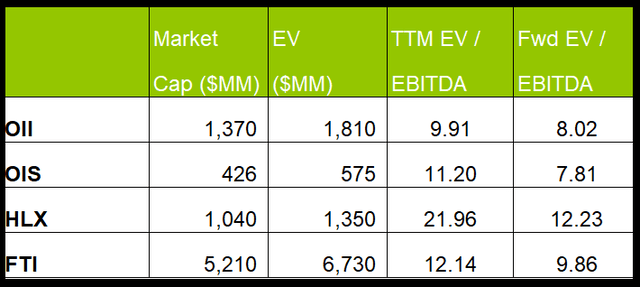

OII’s debt-to-equity (1.47x) is much higher than the peers’ (OIS, HLX, FTI) average of 0.28x. On September 30, 2022, its liquidity was ~$643 million (excluding working capital).

OII’s cash flow from operations turned negative in 9M 2022 related to adverse changes in the timing of project milestones and customer payments. So, its free cash flow (or FCF) went significantly negative in the past year. As I discussed in my previous article, it has maintained its position regarding generating positive FCF ($25 million and $75 million) in FY2022.

Analyst Rating And Relative Valuation

According to data provided by Seeking Alpha, three sell-side analysts rated OII a “buy” in the past 90 days (including “Strong Buy”), while four of the analysts rated it a “hold.” None of the analysts rated it a “sell.” The consensus target price is $14.9, suggesting a 9% upside at the current price.

OII’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA multiple suggests higher EBITDA in the next four quarters. It also indicates that its EBITDA will rise less steeply than its peers in the next year. The company’s EV/EBITDA multiple (9.9x) is lower than its peers’ (OIS, HLX, and FTI) average. So, its relative valuation is reasonable at the current level.

Why Do I Maintain My Call On OII?

In my previous article, I expressed confidence over the industry recovery, although concerns over the ADTech business and the rising concerns over cash flows remained. Regarding OII’s drivers, I wrote:

Oceaneering International’s offshore energy business benefits from favorable seasonal activity in ROV and increased survey and tooling services. High quotation activity in the energy businesses can translate into robust bookings. The company should also benefit from increased ROV utilization and a rise in aerospace and defense businesses.

The most notable value driver after Q3 includes a $300 million subsea robotics contract. It also sees growth opportunities in the aerospace and defense segment from government agencies. The industry’s recovery rate accelerated, despite growing concerns in the economy. The balance sheet remains leveraged, and cash flows turn negative. I continue to take a call of a “hold” on the stock.

What’s The Take On OII?

In Q4, Oceaneering International will likely witness increased activity and improved operating performance in many of its segments, except the Offshore Projects Group. It will leverage its core robotics expertise into mobile robotics markets and clean energy, which will set its business on a growth path in the medium term.

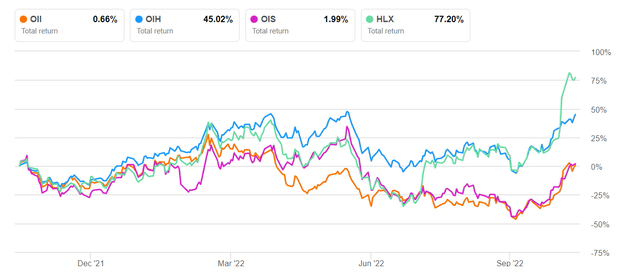

The Offshore Projects Group’s performance, on the other hand, can come under pressure in Q4. Plus, ROV days on hire can decrease in the Subsea Robotics segment in Q4. So, the stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. The company plans to generate positive FCF in FY2022, which can strengthen further in 2023. I would suggest a “hold” on the stock for the short-to-medium term.

Be the first to comment