Pgiam/iStock via Getty Images

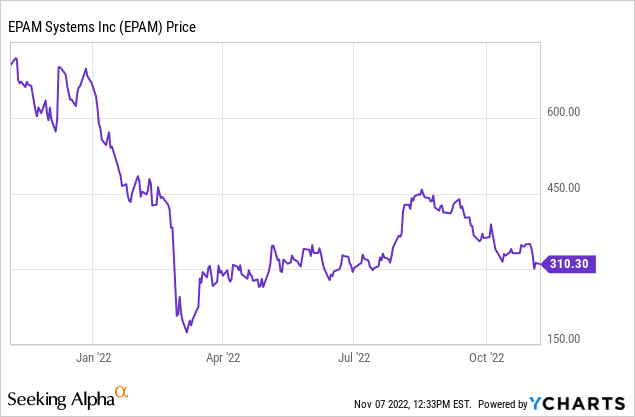

When I first wrote about EPAM Systems (NYSE:EPAM), a software development company in January this year, the Ukrainian conflict had not yet started. However, with a large portion of its workforce (about 40%) located in Ukraine, Belarus, and Russia, the company’s share price suffered considerably as per the chart below due to investors doubting the company’s ability to continue generating sales.

With the business displaying resiliency in the face of a hostile business environment, shares have partially recovered helped by EPAM’s ability to deliver good financial results, and the aim of this thesis is to assess whether this can continue in light of the strong dollar constituting headwinds for U.S. multinationals. At the same time, with the Federal Reserve aggressively tightening monetary policy, there are risks of a global recession too.

I start by providing some insights about the business, especially what explains the company’s continuing success amid adverse economic conditions.

Resilience in Sustaining Operations

There are tons of companies doing software development as the barriers of entry are quite low in this industry with a lot of activities now outsourced to South Asia and other parts of the world. Additionally, large corporations have acquired smaller ones in diverse geographies signifying that there is a lot of competition in IT consulting and related services.

In this respect, with a market cap of $17.93 billion, EPAM has scale, but what really differentiates it is that after 29 years of existence it has managed to keep a “business start-up” approach in helping customers challenged by the pressures of digitalization. This more entrepreneurial mindset helps in proposing customized solutions instead of off-the-shelf ones which may not fit clients’ complex requirements.

Q3 Earnings Call Presentation (seekingalpha.com)

Additionally, as seen above, the “EPAM Continuum”, helps to explain why nine months after the start of hostilities, the business continuity strategy to reposition its employees around the war-ravaged zone has proved resilient.

The situation in Ukraine has indeed become a complex one with the invading force disrupting all business activities in addition to causing loss of life. In this chaotic environment, the company managed to keep the business operational, while beefing up software delivery capability in Central Asia, India, and Latin America. As a matter of fact, the war-impacted regions accounted only for about 30% of software development activities in the third quarter of 2022 (Q3) compared to 40% in Q2.

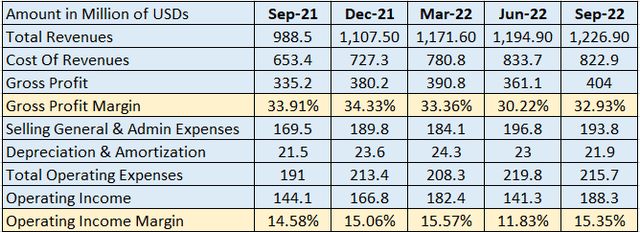

This increase in the staffing budget did help to sustain sales while not unduly increasing operating costs as seen in the table below.

Assessing Profitability

First, EPAM delivered $1.23 billion in revenues for Q3, or a 24% year-over-year growth and a 2.7% progression during the second quarter (Q2) ending in June. Noteworthily, the growth was achieved despite a 4.7% revenue impact due to the Russian exit.

Second, its cost of revenues and operating expenses peaked in Q2 as a result of incurring overheads like transportation and paying overtime to staff located in other countries due to the Ukraine disturbance, but, things normalized in Q3 with both gross and operating margins again increasing, and nearing first quarter numbers as highlighted in the table below.

Quarterly Income Statement (seekingalpha.com)

Looking ahead, in order for profitability to increase there should be more sales, and factors that can help include diversification and the ability to stay competitive. At the same time, the strong dollar constitutes a headwind for U.S companies having global footprints implying that what was previously viewed as a competitive advantage due to geographical diversification has now become an issue. Thus, the company suffered from a 5.7% of forex impact on Q3’s revenues.

Furthermore, economic slowdowns due to high inflation prompted corporations to reduce capital expenditure and instead prioritize their free cash flows. Also, the financial results of Microsoft (NASDAQ:MSFT) show that there may have been a reduction in the pace at which companies are moving their workloads to the cloud.

Assessing the Ability to Navigate Challenges Ahead

In these circumstances, it is important to assess factors like exposure to the conflict zone, sector diversification, and the appeal of EPAM’s solutions in a high-inflation environment.

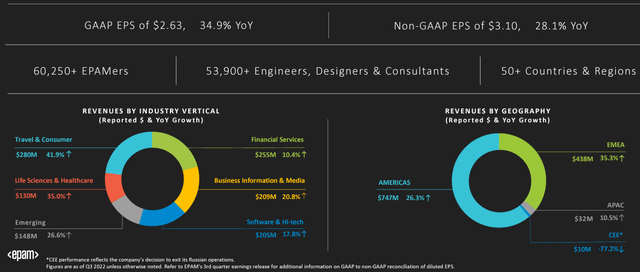

First, looking at geographical diversification, the Americas region generated the bulk or 61% of Q3’s revenues and grew by 27.7% on a constant currency basis. The second region, EMEA or Europe, Middle East, and Africa represented 36% of sales and grew by 50.3% again on a constant currency basis, partly explained by acquisitions in addition to organic growth. About 3% of overall sales came from the Asia Pacific region. More important, revenues from CEE or Central and Eastern Europe constituted only 1% of revenues, after contracting by 80.2%, thereby showing reduced dependence on that part of the world.

Q3 Earnings Call Presentation with the actual percentage increase in sales (seekingalpha.com)

Moreover, there is also industry-level diversification as pictured above with Travel and Consumer growing by nearly 42% as a result of profiting from a pickup in travel followed by Life Sciences and Healthcare at 35% as people prioritize health with Covid acting somewhat like an eye opener.

Next, looking at the IT industry, the corporate aim of digital transformation has shifted from one focusing exclusively on the growth of the business to a more balanced one including cost savings. Thus, EPAM’s solutions can actually act as a deflation enabler to help companies offset higher wage expenses through productivity gains.

Looking at the competition, the company faces economic cyclicality risks due to softening of demand which could result in a shrinking of its market share. Here, the fact that it was able not only to maintain but increment market share during its period of maximum weakness in Q2 shows that it possesses some competitive advantages.

Valuations and Key Takeaways

Looking forward, EPAM expects $1.22 billion to $1.23 billion of sales for the fourth quarter or a 15% growth on a constant currency basis. This is after factoring in 1% of inorganic growth and -5% of negative impact from the ramp-down of Russian operations. For fiscal 2022, the total estimated revenues come to $4.2 billion, or a 28.3% rise over 2021.

However, this may prove to be a difficult target to reach in view of ”signs of moderation in demand due to delays in decision-making” as certain clients adopt caution in view of shifting demand in their end markets. Moreover, the company should continue to suffer from a strong dollar as the Fed continues to hike interest rates, with sector diversification likely to help to offset some of the losses.

As for valuations, this is no opportunistic buy with a GAAP price-to-earnings multiple of 46x being above the sector median by a whopping 114.17%, and with the value strategy prevailing, the stock could suffer further from further volatility.

Furthermore, EPAM’s gross margins of 33.14% remain lower than the median for the IT sector by more than 34%. This is mainly because of the lower utilization rate of its software development team, mostly because of Ukraine-related disturbances, and is likely to remain so with the conflict continuing to last. In fact, utilization rates may fall further due to an escalation of the conflict leaving the city of Kyiv and other locations in Ukraine without power for a prolonged period of time.

Lower utilization rates are likely to be partly offset by a favorable exchange rate differential as most of EPAM’s employees are located in countries other than the U.S. and are paid in local currencies. However, this is not sufficient to have a meaningful impact on gross margins.

In these circumstances, it is better to wait for fourth-quarter results as there is a possibility that the stock becomes volatile due to developments in Ukraine. Also, for shareholders, EPAM is a hold due to its healthy balance sheet. In this respect, it had a debt of only $197.3 million in Q3 against a cash balance of $1.49 billion. This is due to strong cash flow from operations of $252 million for Q3 compared to only $206 million in the same period of 2021.

Finally, this thesis has shed light on EPAM’s operational resiliency and ability to grow revenues in a profitable manner. The company also exhibits good sector diversification. However, it should continue to suffer from a strong dollar, the ability of its software production team to deliver optimally after power outages throughout Ukraine, and uncertainties related to a global economic slowdown. Its high valuations could also add to volatility as investors select lower-valued stocks which pay dividends amid the rotation from growth to value.

Be the first to comment