Michael Fitzsimmons

I last wrote you about Lockheed Martin Corp (NYSE:LMT) in October 2021. At the time, I had just initiated a new position in LMT. This article is an update. My original contribution, “Lockheed Martin: Why It’s Become a New Position in My Portfolio,” may be found here.

Investment Thesis

My investment thesis for owning LMT shares hasn’t changed much:

Lockheed Martin stock likely remains a solid investment for long-term investors seeking both growing income and capital appreciation. The business is well-managed, owns a strong franchise, possesses a sound balance sheet, earns its profits in cash, and is shareholder-friendly.

Using routine valuation methodologies, shares appear fairly valued. Currently, shares do not appear to be trading at a significant discount or premium.

Over the past decade, Lockheed has, on average, grown operating earnings and operating cash flow by low double-digits a year. Historically, the business tends to be recession resistant.

LMT investors have enjoyed dividend increases for 20 consecutive years. Today, the stock yields ~2.6 percent. In recent years, the payout has risen over 9 percent annually, and the current yield is higher than other large Aerospace and Defense stocks.

Business Update

Since I first initiated a position, Lockheed management reported earnings four times. While I track a number of financial and operational metrics, I’ve listed several specifics below that I believe LMT investors may find especially helpful when seeking to evaluate management performance:

-

Revenue

-

Segment Operating Margin

-

Free Cash Flow

-

Return-on-Invested-Capital

Let’s break these down one-by-one.

Revenue

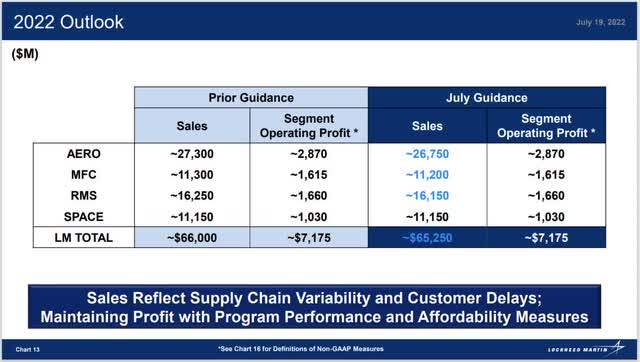

Over the past four quarters, revenue averaged about $16 billion. For the full year 2022, management guides to $65.3 billion. Doing some arithmetic indicates management expects top-line acceleration during the second half of this year. That’s a positive. Nonetheless, presuming management meets its forecast, full-year 2022 sales will be down slightly from 2021.

During the 2Q earnings call, management explained the soft revenue is a result of supply-chain disruptions, inflation, and customer delays.

Lockheed Martin 2Q 2022 earnings presentation

Additional Detail: F-35 Aircraft Program Delay

The F-35 aircraft program (Lots 15 to17) is really the core issue affecting 2022 sales. It’s integral to the 2Q 2022 earnings “miss” and revised full-year guidance.

Lockheed had been authorized to begin production work on Lots 15 to 17, but the company’s costs began to exceed the contract value and available funding in the second quarter of 2022. As a result, F-35 program sales and cash flow became impaired. In addition, the company had approximately $1 billion in potential termination liability exposure to third parties related to Lots 15 to 17.

Recently, the company reached an agreement in principle with the U.S. Government on an amended F-35 Lots 15 to 17 production contract. There is not yet a definitive agreement. Lockheed Martin expects to recover certain sales and costs incurred upon receiving revised contractual authorization and funding on the F-35 production contract. Such contractual authorization is expected to occur sometime during the third quarter of 2022.

However, until a final agreement is reached, or the U.S. Government otherwise provides additional contractual authorization and funding, the company’s financial results will continue to be negatively impacted. Such impact may be material. As part of the LRIP Lots 15-17 production contract, the U.S. Government reduced the acquisition quantities based on budget availability. While the company expects the LRIP Lots 15-17 contract to support its long-term objective to produce 156 aircraft a year, COVID-19 and other impacts experienced by the F-35 enterprise have required it to modify its near-term production plan.

I believe Lockheed will resolve its F-35 contract issue successfully. If so, current events are likely to fade into the positive, long-term prognosis for the company.

Segment Operating Margin

Lockheed Martin reports Segment Operating Margins for each of its four segments: Aerospace, Missiles/Fire Control, Rotary and Mission Systems, and Space. Nomenclature non withstanding, Segment Operating Margin is simply Lockheed management’s way to express EBIT margins after excluding unallocated /corporate items.

Over the past few years, Lockheed consolidated Segment Operating Margins were reported as follows:

2019: 10.6 percent

2020: 10.8 percent

2021: 11.0 percent

Despite an outlook for a year-over-year 2.6 percent sales decline, management still guides 2022 segment margins to be 11.0 percent. Through the first half of the year, Segment Operating Margin was 11.0 percent.

Free Cash Flow

When current CEO Jim Taiclet took the new role, he stated Lockheed Martin would run for cash. Front and center, management reports cash flow and free cash flow clearly.

For the full-year 2021, Lockheed recorded $6.03 billion free cash flow: or ~$22 per share. This compared favorably with FY $22.48 EPS. It demonstrates Lockheed earns its profits in cash.

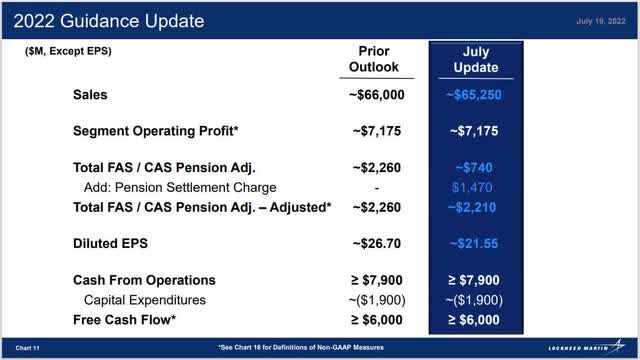

Current 2022 FCF guidance calls out ~$6 billion, on par with last year.

Lockheed Martin 2Q 2022 earnings presentation

At mid-year, Lockheed reported $2.74 billion free cash flow. FY 2022 cash flow is tracked for success.

Return-on-Invested-Capital

Return-on-Invested Capital can be a useful tool to help evaluate management effectiveness. There are several ways to calculate the metric. Generally, I utilize a simple formula seeking to obtain a conservative perspective:

RoIC = EBIT / Total Assets less Current Liabilities less Cash

This is “kitchen sink” approach; but it serves its purpose.

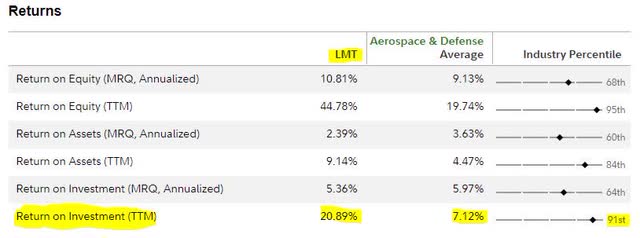

RoIC is best considered when compared to a company’s WACC and benchmarked against similarly situated peers.

For FY 2021, utilizing the aforementioned RoIC methodology, Lockheed Martin registered 28% return-on-invested-capital. This compares reasonably well with the more recent 2022 six-month 23% RoIC.

Currently, Lockheed Martin has ~6% WACC.

Please find below a table comparing LMT’s half-year RoIC with several peers:

Lockheed Martin Corp — Return on Invested Capital versus Peers

|

1H 2022 RoIC |

|

|

Lockheed Martin |

23% |

|

Raytheon (RTX) |

4% |

|

Northrop Grumman (NOC) |

12% |

|

General Dynamics (GD) |

11% |

|

L3Harris Technologies (LHX) |

7% |

Underlying data found on investor websites and calculated by author

Lockheed Martin has a higher RoIC than peers and covers its WACC easily. This indicates management is creating shareholder value. Indeed, the average return-on-invested-capital for the Aerospace & Defense industry is about 7 percent. LMT returns are among the top industry performers. See the chart from fidelity.com below.

Note that Lockheed’s listed RoI is 21 percent versus the 23 percent I calculated in the table above. This is not at issue. First, Fidelity Investments is computing RoI over 12 months versus my 6-month time frame. Second, as noted earlier, the formula for RoI can vary; Fidelity Investments may not utilize precisely the same formula I expressed.

Other Important Observations

Order Backlog

In conjunction with the 2Q earnings release, management communicated Lockheed had a $135 billion backlog. This is on par with the mid-year 2021 backlog. It also totaled $135 billion. Management indicated they expected the backlog to increase by the end of this year.

The “Four Growth Pillars”

Despite 2022 shaping up to be a bit of a down year, management remains constructive on the future. They expect the company to resume earnings growth in 2023. Lockheed’s “four pillars” remain intact. These include growing:

-

Programs of record

-

Classified activities

-

Hypersonics

-

New business awards

Employee Pension Contract Purchased

In June 2022, the company purchased group annuity contracts to transfer $4.3 billion of gross defined benefit pension obligations and related plan assets to an insurance company. The group annuity contracts were purchased using assets from Lockheed Martin’s master retirement trust and no additional funding contribution was required. In connection with this transaction, the company recognized a noncash, non-operating settlement charge of $1.5 billion (or $4.33 per share, after-tax). When the company reported 2Q 2022 earnings, the accounting loss startled some investors. Reading past the headlines, the aforementioned explained what appeared to be big EPS “miss,” and apparent reduction in full-year guidance. Actually, management didn’t reduce the underlying operating earnings.

Stock Valuation

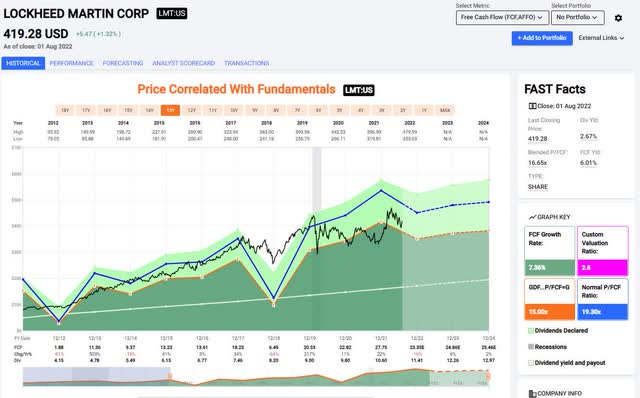

When I last wrote you, LMT stock traded around $350 to $360 a share. Lockheed common appeared to be an undervalued security. Since then, shares have appreciated about 20 percent sans dividends.

Currently, the stock no longer appears to be in the bargain bin. A recent bid is close to my current $430 to $440 Fair Value Estimate.

I arrived at this valuation by reviewing current year price-to-operating earnings and price-to-free cash flow.

Two FAST Graphs help illustrate my opinion:

Lockheed Martin price-and-earnings (Fastgraphs.com) Lockheed Martin price-and-free cash flow (Fastgraphs.com)

For both charts, I selected a post-Great Recession time frame. In addition, I elected to base my FVE upon the current fiscal year. This is a conservative approach. Lockheed may be considered a growth-and-income stock; performing a valuation exercise by looking out to 2023 earnings and cash flow would be acceptable.

Based FVE on 2022 expectations, I believe LMT stock has an indifference point between $430 and $440 a share. Looking ahead to 2023 Street forecasts, the fair value estimate may be between $460 to $470 per share.

Share prices may be bolstered by a shareholder-friendly management team. The current dividend yield is 2.6 percent. The dividend payout has been increased for 20 consecutive years. The string should continue in 2022. In addition, the board of directors continue to authorize stock repurchases. Over the past year, Lockheed’s total diluted shares outstanding have been reduced by 4 percent.

Conclusion

Lockheed Martin stock remains a solid, long-term dividend growth investment. The essence of my October 2021 investment thesis remains intact.

Company fundamentals are experiencing near-term bumpiness due to supply chain issues, inflationary pressure, and customer delays (primarily related to the F-35 aircraft government contract Lots 15 to 17). Despite the current circumstances, margins, returns and 2022 free cash flow expectations remain robust.

Current common stock prices no longer reflect the significant discount I noted in October 2021. However, new investors seeking to accumulate shares may consider opening a small position, then monitoring the stock for a chance to buy more on short-term weakness.

Please do your own careful due diligence before making any investment decision. This article is not a recommendation to buy or sell any stock. Good luck with all your 2022 investments.

Be the first to comment