bjdlzx

Berry Corporation (NASDAQ:BRY) looks pretty undervalued ahead of Q2 2022 earnings. Since I last looked at Berry in May, commodity prices have come down a bit (with 2022 and 2023 Brent strip several dollars lower now), but Berry’s stock has fallen 22%.

This appears to be an overreaction to me, especially since I expect Berry to announce a significantly higher variable dividend for Q2 2022 than the $0.13 per share variable dividend that it announced for Q1 2022.

Berry may also announce a negative revision to its operating expense guidance for 2022, but I believe that Berry is worth around $12 per share in a long-term $75 Brent environment even after factoring that in. This is around 40% higher than Berry’s current share price.

Berry appears to have the ability to offer a near-25% yield (over the next year) at its current share price along with the potential for significant capital appreciation.

Notes On Operations

Berry is an upstream company with operations in California (accounting for 80+% of total production) and Utah. Berry’s California production is 100% oil and is fully located in Kern County. The importance of the oil industry to Kern County helps protect producers a bit from California regulations (through local support), although the California regulatory environment still a major issue. Berry has identified over 30 years’ worth of potential drilling inventory, but it is uncertain how much of that it will be allowed to drill in the future.

Working Capital And Discretionary Cash Flow

Berry only reported generating $17 million in discretionary cash flow in Q1 2022. Berry’s discretionary cash flow was negatively affected by $37 million in working capital changes. If there was no change to working capital (between Q1 2022 and Q4 2021), Berry’s variable dividend for Q1 2022 would have been higher by approximately $0.25 per share.

Berry’s variable dividend based on Q1 2022 ended up being $0.13 per share, so without working capital changes, Berry could have declared a variable dividend in the $0.35 to $0.40 range.

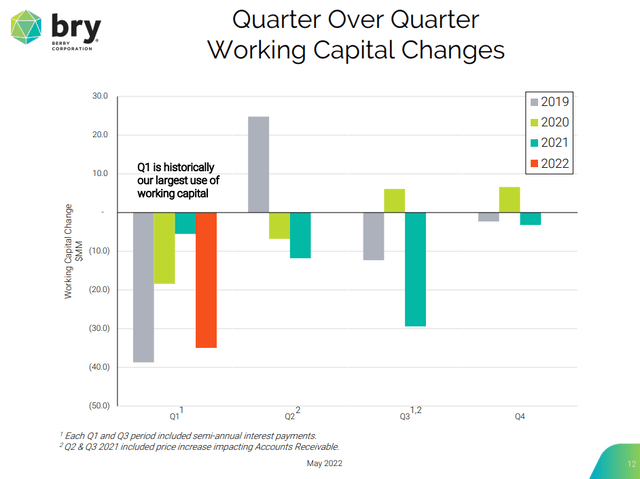

Berry’s Working Capital Changes (bry.com)

Berry noted that working capital changes have historically had the largest negative impact on cash flow from operations in Q1. This is partly due to the timing of Berry’s note interest payments in Q1 and Q3. All else being equal, Berry’s variable dividends for Q2 and Q4 will be close to $0.10 per share higher than its variable dividends for Q1 and Q3 due to the impact of changes in accrued interest on working capital.

Berry’s discretionary cash flow should be significantly improved in Q2 2022 due to a combination of higher commodity prices, seasonality in working capital and increased production (including a full quarter of contribution from its Antelope Creek acquisition).

Guidance For Operating Expenses

I believe that there is a high chance that Berry comes out with a negative revision to its operating cost guidance for 2022. It reported operating expenses in Q1 2022 that were several dollars above its full-year guidance range. Berry kept its full-year guidance range at $20 to $22 per BOE and said it was still comfortable with that guidance on its Q1 2022 earnings call. It did indicate that it would potentially reassess things after seeing how its energy operating costs were in Q2 2022.

Berry has hedges and pipeline capacity access (particularly from May onwards) to help mitigate rising energy costs, but I still think it will be hard to keep its operating costs within its original guidance.

Valuation And Yield

I am maintaining my estimate of Berry’s value at $12 per share in a long-term $75 Brent oil environment. Although Brent is currently around $100, I prefer to value oil and gas companies based on more conservative long-term prices. The oil market remains in backwardation, with 2025 Brent futures currently around $80 and 2028 Brent futures edging below $75.

I’ve modeled Berry’s operating costs at around $24 per BOE with high energy costs and inflation serving to push up this number. Further increases in operating costs may trim Berry’s estimated value. At $26.50 per BOE in operating costs, Berry’s estimated value will go down by $1 to $11 per share in a long-term $75 Brent oil environment.

In addition to capital appreciation, Berry should be able to offer a significant yield. Excluding the effect working capital changes (which tend to even out over time) Berry’s variable dividend (related to 2022) results should be in the $0.45 to $0.50 per share per quarter based on current strip prices. Berry also has a $0.06 per share quarterly fixed dividend.

Conclusion

While California regulations may prevent Berry from taking full advantage of its drilling inventory, it still is able to generate a large amount of near-term cash flow at current strip prices. With Berry’s share price at around $8.50, its yield may be near 25% with $100 Brent.

Rising operating costs are a bit of a concern, but the oil price environment is more important to Berry’s outlook. A 3% increase in oil prices would offset a roughly 10% increase in operating costs in terms of its effect on Berry’s unhedged cash flow.

Overall, I believe that Berry offers substantial upside (between its dividend and capital gains) at its current share price in a long-term $75 Brent oil environment.

Be the first to comment